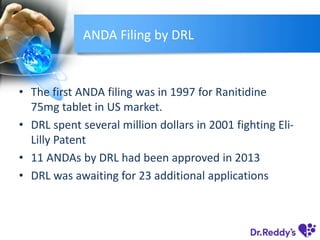

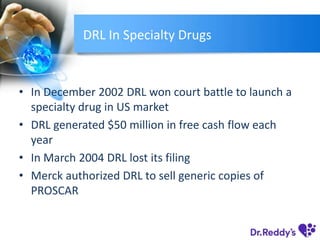

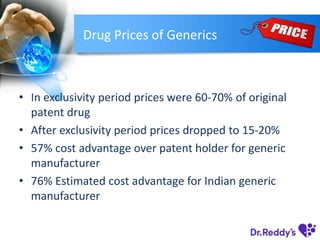

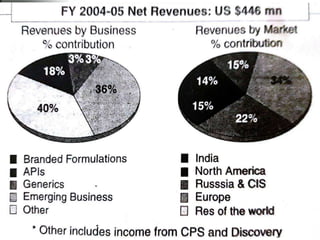

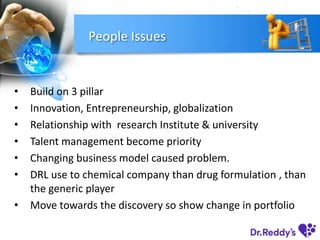

Dr. Reddy's Laboratories (DRL), founded in 1984, has evolved into a leading generic drug company through product diversification, international expansion, and drug discovery capabilities. The company has seen significant growth from manufacturing active pharmaceutical ingredients to developing branded generics and specialty drugs, while also facing challenges in maintaining profitability. With strategic acquisitions and a strong focus on research, DRL aims to strengthen its position in the global pharmaceutical market, especially in light of upcoming patent expirations and a growing generics market in Europe.