DLF's Strategic Analysis and SBU Breakdown

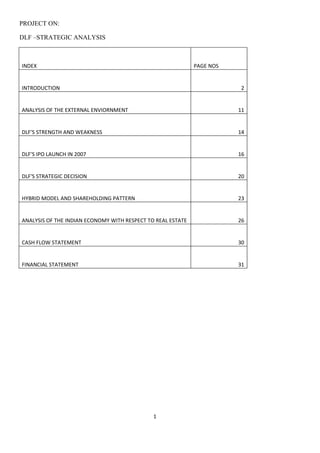

- 1. PROJECT ON: DLF –STRATEGIC ANALYSIS INDEX PAGE NOS INTRODUCTION 2 ANALYSIS OF THE EXTERNAL ENVIORNMENT 11 DLF'S STRENGTH AND WEAKNESS 14 DLF'S IPO LAUNCH IN 2007 16 DLF'S STRATEGIC DECISION 20 HYBRID MODEL AND SHAREHOLDING PATTERN 23 ANALYSIS OF THE INDIAN ECONOMY WITH RESPECT TO REAL ESTATE 26 CASH FLOW STATEMENT 30 FINANCIAL STATEMENT 31 1

- 2. INTRODUCTION The DLF Group, is India's largest real estate company in terms of revenues, earnings, market capitalization and developable area. It has a 62-year track record of sustained growth, customer satisfaction, and innovation. The group has over 231 msf of completed development and 423 msf of planned projects, and has pan India presence across 32 cities. DLF's primary business is development of residential, commercial and retail properties. The company has a unique business model with earnings arising from development and rentals. Its exposure across businesses, segments and geographies, mitigates any down-cycles in the market. DLF has also forayed into the infrastructure, SEZ and hotel businesses. The business of DLF is organized on a SBU basis. The Homes SBU caters to 3 segments of the residential market - Super Luxury, Luxury and Mid-Income. The product offering involves a wide range of products including condominiums, duplexes, row houses and apartments of varying sizes. DLF has 214 msf of developed area under homes and residential plots. Currently, DLF has more than 319 msf of land resource targeted towards residential business. The Office SBU took DLF across the country, predicated on the customer demand for office space at different geographic locations. Nearly 17 msf of ongoing projects forms a strong portfolio for DLF offices. The Retail Mall's and Commercial Complexes SBU is a major thrust area for DLF. Currently, DLF is actively creating new shopping and entertainment spaces all over the country. The company has 12 msf of retail projects and commercial complexes under construction. DLF Hotels has also entered into a JV with Hilton to set up a chain of business hotels and service apartments across India. DLF holds 74% and Hilton holds 26% equity in the JV. DLF has a strong management team running independent businesses, though complementing each other in cases of opportunities of mixed land use. DLF's mission is to build a world-class real estate development company with the highest standards of professionalism, ethics and customer service and to thereby contribute to and benefit from the growth of the Indian economy. DLF’s SBU 2

- 3. RETAIL OFFICE COMMERCIAL HOTELS HOMES RESIDENTIAL SPACE GROUPS Vision, Mission & Values DLF Vision To contribute significantly to building the new India and become the world’s most valuable real estate company. DLF Mission To build world-class real-estate concepts across six business lines with the highest standards of professionalism, ethics, quality and customer service DLF Values • Sustained efforts to enhance customer value and quality • Ethical and professional service • Compliance and respect for all community, environmental and legal requirements. DLF's Presence 3

- 4. The following map illustrates the locations of our developments, projects and lands across India, as of November 30, 2006: 4

- 5. Corporate Governance Code of Conduct 1. Introduction DLF Limited and its subsidiaries (‘hereinafter referred to as the ‘Company’) is a leading professionally managed Company emerging as the one of the foremost enterprise in real estate development. It has over 60 years of experience, an established brand name, a highly experienced, qualified and motivated management team with a high reputation for project execution. The formation and management of many subsidiary and partnership companies is considered necessary in real estate development to ensure effective governance in dealing with legal and commercial requirements. The Company’s philosophy on Corporate Governance is built on a rich legacy of fair, transparent and effective governance. This includes respect for human values, individual dignity and adherence to honest, ethical and professional conduct. This enables customers and all stake holders to be partners in the Company’s growth and prosperity. The Company’s Code of Conduct not only ensures compliance with the Company Law, the provisions of the listing agreement with Stock Exchanges and other laws, but goes beyond to ensure exemplary Corporate Governance. Accordingly, the Board of Directors of DLF Limited have adopted the following code that details the following: • Guidance on ethical standards of conduct on various matters including conflict of interest, acceptance of positions of responsibilities, treatment of business opportunities etc.; • Responsibility to comply with Insider trading regulations and applicable laws and regulations; and • Procedure for annual affirmations to the Code of Conduct by Directors and the Senior management. 2. Objective This code of conduct document has been created in furtherance of the Company’s commitment to building a strong culture of corporate governance by promoting the importance of ethical conduct and transparency in the conduct of its operations. This code lays down the standards of conduct that shall apply to its Directors and all Employees of the Company and shall come into force with effect from 21st day of March, 2007. 3. Definitions The definitions of some of the key terms used in this Code are given below i. “Director” means any Executive, Non-Executive, Nominee or Alternate Director of the Company. ii. “Employee” means any employee or officer of the Company. iii. “Relative” means ‘relative’ as defined in Section 2(41) and Section 6 read with schedule 1A of the Companies Act, 1956. iv. “Senior Management” means personnel of the Company who are members of its Core Management team excluding the Board of Directors and shall include all personnel above the level of Vice-President and all function heads. 4. Applicability This Code is applicable to the following: 5

- 6. a. All Employees of the Company including Senior Management; and b. All Directors of the Company. This Code does not address every possible form of unacceptable conduct and it is expected that the Directors and the Employee shall apply their sound judgment to comply with the principles set forth in the Code. 5. Standards of Conduct The Directors and employees shall conduct the Company's business in an efficient and transparent manner in meeting its obligations towards the shareholders and other stakeholders. The Directors and employees shall not be involved in any activity that would have any adverse effect on the objectives of the Company or against national interest. The following elucidates the Company’s position on the manner of conduct of the Company’s business and transactions: a) Compliance with applicable laws DLF requires that its employees and Directors strictly comply with the applicable laws and regulations in the conduct of its business, both in letter and spirit. If the ethical standards set forth in this policy are more rigorous than the applicable laws and regulations, then the standards of the DLF Code of Conduct shall prevail. b) Conflict of Interest Conflicts of interest may appear where on account of either on undertaking or in the act of influencing a business transaction, relationship, or an activity, the Director or Employee is in a position to derive a personal benefit for himself or for a relative or a related party (as described in the Companies Act, 1956). It includes instances where the independent judgment of such a Director or Employee to work towards the best interests of the Company may be or perceived to be impaired. In case of an Employee, where such conflict appears at any time or is in existence at the time of the implementation of this policy, such Employee shall forthwith make a disclosure in writing to the Chief Executive (Corporate Affairs), who in turn shall compile such disclosures for review by the Corporate Governance Committee. Upon review by the Corporate Governance Committee, the Employee may be directed to avoid/resolve the conflict or to take such remedial action as is deemed suitable by the Corporate Governance Committee. A Director shall disclose any potential conflicts of interests to the Board of Directors or any Committee thereof and abstain from participating in the decision making or in influencing the decision on the areas resulting in the potential conflict of interest in accordance with the applicable rules under the Companies Act. In addition, the Director shall provide on a periodic basis, such disclosure as is required by the Board of Directors or any Committee thereof. c) Business opportunities The Directors and Employees are hereby prohibited from taking for themselves personally, any opportunities that are discovered through the use of Company’s property, information or position, unless the opportunity is disclosed fully in writing to the Corporate Governance Committee and the Corporate Governance Committee authorizes the said Director or the Employee to pursue such opportunity. 6

- 7. The Directors and Employees are also prohibited from competing directly with the business of the Company. d) Acceptance of Employment / Position of responsibility Employees are expected to devote their total attention to the business interests of the Company. Prior approval of the Corporate Governance Committee must be sought in writing prior to accepting any position of employment or responsibility (such as Directorship etc.) outside the Company. Directors other than Non-Executive and Independent Directors are required to obtain the express approval of the Corporate Governance Committee prior to accepting any Directorship outside the Company. e) Insider Trading and fraudulent & unfair practices in the securities market A Director or the Employees and their relatives shall not derive any benefit or assist others to derive any benefit from the access to and possession of information about the Company, which is not in the public domain and thus constitutes insider information. They shall also ensure compliance with SEBI (Prohibition of Insider Trading) Regulations, 1992 as also other regulations as may become applicable to them from time to time in addition to the Company’s Policy for Prevention of Insider Trading. The Company also prohibits its Directors and Employees in undertaking any fraudulent or unfair trade practice in connection with the securities of the Company. f) Financial reporting and disclosures The Company is committed to ensuring that its financial statements and reporting: i. Does not contain any untrue statement; ii. Does not omit any material fact or has contents that might be misleading; and iii. Strives to present a true and fair view of the Company's affairs in compliance with the prevailing Accounting Standards and applicable laws and regulations. The Directors and Employees shall ensure that there shall be no willful omission of any Company transactions from the books and financial records and all required information shall be provided to the Auditors. g) Health, Safety and Environment The Company strives to provide a safe and healthy working environment and comply, in the conduct of its business affairs, with all regulations regarding the preservation of the environment of the territory it operates in. The Company is committed to prevent the wasteful use of natural resources and minimize any hazardous impact of the development, use and disposal of any of the intermediaries or direct materials used in its product and service offerings on the ecological environment. h) Protection of the Company’s Assets The Companies Assets shall be protected from theft, loss, damage or misuse and shall not be employed 7

- 8. for conducting any illegal activity or for purpose other than of conducting the business of the Company. The Directors and the Employees shall not use the Company’s tangible assets such as equipment and machinery, systems, facilities, materials etc. or intangible assets such as proprietary information, relationships with customers and suppliers, etc. for their personal benefit or for the benefit of a related party. i) Competition DLF is committed to a fair and competitive free market system. The Directors and Employees of the Company are prohibited to take any action that are anti-competitive or otherwise contrary to laws that govern competitive practices in the marketplace. j) Public Representation It may be necessary to communicate information relating to the Company, its operations and performance to its stake-holders, media, stock-exchanges etc. In all its public appearance with respect to disclosing any information in relation to the Company’s activities or performance to any public constituency such as the Media, financial community etc, the Company shall be represented only by duly authorized personnel. This policy establishes that matters relating to public representation of the Company shall be handled by the Chairman or Vice-Chairman or the Managing Director or the Head of Corporate Communications department (or such person to whom the Head of Corporate Communications has delegated his authority) or such persons as are authorized by the Board of Directors or the Chairman. In addition, the Chief Financial Officer is duly authorized to make suitable public representation in relation to financial matters. Where a Director or an Employee seeks to publish a book, article or manuscript containing reference to the Company or its business/processes, such person should obtain prior approval of the Corporate Governance Committee. The Committee may grant such approval on terms and conditions that it may deem fit such as pre-review/changes to such publication by the Committee, inclusion of disclaimers etc. k) Confidentiality of Information Any information concerning the Company’s business, its customers, suppliers, etc. to which the Directors or the employees have access or which is possessed by the Directors and the employees, must be considered privileged and confidential and should be held in confidence at all times, and should not be disclosed to any person, unless 1. Authorized by the Board; or 2. The same is part of the public domain at the time of disclosure; or 3. It is required to be disclosed in accordance with applicable laws l) Gifts and Donations The Company, its Directors and Employees shall neither receive nor offer or make directly/indirectly any illegal payments, gifts, donations or any benefits which are intended to obtain business or unethical favours. However, the Directors or Employees may receive such nominal gifts which are customary in nature or are associated with festivals. m) Electronic Usage Electronic resources provided to the Directors and Employees by the Company should only be used for the conduct of the Company’s business. The Company prohibits any uses which are illegal or infringe on the privacy of a person or result in the transmission of inappropriate messages. The Company also reserves the right to monitor electronic usage and files on the system as and when deemed necessary. 8

- 9. n) Fair treatment of Employees, Working Environment and Child Labour DLF is committed to recruiting, employing and promoting employees on the sole basis of the qualifications and the abilities needed for the work to be performed, without regard to race, age, sex, caste, national origin or any other non-relevant category. DLF is furthermore committed to providing a working environment that is free from unlawful harassment and prohibits any sexual harassment and harassment based on race, age, national origin, caste, medical condition, childbirth or related condition, physical or mental disability or any other form of harassment that is unlawful. Where the employee has been unlawfully harassed, he/she should submit a complaint to the Chief Executive (Corporate Affairs). Where an employee feels that he/she has been sexually harassed, he/she shall submit a complaint to the ‘Officer’ designated for receiving these complaints. It is DLF’s policy to offer to its employees a safe and healthy workplace. DLF is against all forms of exploitation of children and believes in abiding by the laws and applicable regulations for prevention of child labour. 6. Consequences of non-compliance with the Code The matters covered in this Code are of the utmost importance to the Company, its stockholders and its business partners, and are essential to the Company's ability to conduct its business in accordance with its stated values. We expect all of our Directors and Employees to adhere to these rules in carrying out their duties for the Company. The Company will take appropriate action against Director or the Employee whose actions are found to violate these policies or any other policy of the Company. 7. Consultation and reporting In case of any doubts/clarifications in relation to the application of the Code of Conduct, Employees are requested to consult in writing with the Chief Executive (Corporate Affairs) in the Company. Where Chief Executive (Corporate Affairs) in the Company or the Directors need any clarifications in relation to the application of the Code of Conduct, they should consult in writing with the Corporate Governance Committee. Where any Director or Employee notes an act inconsistent with the principles set forth in the Code of Conduct, he should report the same to the Chief Executive (Corporate Affairs) in the Company. Chief Executive (Corporate Affairs) in turn is required to compile all such instances in a report along with suitable recommendation on the action required to the Corporate Governance Committee. Such report should be presented at least on a quarterly basis or sooner, depending on the nature of the complaint. Alternatively, the Director or Employee may use the Whistle-Blower mechanism provided by the Company to report any instances of violation of the Code of Conduct. 8. Amendments and waivers The Code may be amended or modified by the Board after due consultation with the Corporate Governance Committee. Any waiver of any provision of this Code for a Director or the Employee must be approved in writing by the Company's Board of Directors. 9. Acknowledgement and annual affirmation Directors and Senior Management personnel shall acknowledge the receipt of this Code indicating that they have received, read and understood, and agreed to comply with the Code and send the same to the 9

- 10. Chief Executive (Corporate Affairs). New Directors will submit such an acknowledgment at the time when their Directorship begins and in case of other Management personnel when they assume the responsibility of Senior Management personnel. All the Directors and the Senior Management personnel to whom the Code applies shall, within 10 days of close of every financial year affirm compliance with the Code indicating their continued understanding of and compliance with the Code. The duly signed Annual Compliance Declaration shall be forwarded to the Chief Executive (Corporate Affairs). ANALYSIS OF EXTERNAL ENVIORNMENT ASSESSMENT OF CHANGES IN THE ENVIORNMENT ANALYSIS OF REAL ESTATE SECTOR 10

- 11. Real estate is one of the fastest growing sectors in India. Market analysis pegs returns from realty in India at an average of 14% annually with a tremendous upsurge in commercial real estate on account of the Indian BPO boom. Lease rentals have been picking up steadily and there is a gaping demand for quality infrastructure. A significant demand is also likely to be generated as the outsourcing boom moves into the manufacturing sector. Further, the housing sector has been growing at an average of 34% annually, while the hospitality industry witnessed a growth of 10-15% last year. Apart from the huge demand, India also scores on the construction front. A Mckinsey report reveals that the average profit from construction in India is 18%, which is double the profitability for a construction project undertaken in the US. The importance of the Real Estate sector, as an engine of the nation’s growth, can be gauged from the fact that it is the second largest employer next only to agriculture and its size is close to US $ 12 billion and grows at about 30% per annum. Five per cent of the country’s GDP is contributed by the housing sector. In the next three or four or five years this contribution to the GDP is expected to rise to 6%. The Real Estate industry has significant linkages with several other sectors of the economy and over 250 associated industries. One Rupee invested in this sector results in 78 paise being added to the GDP of the State. A unit increase in expenditure in this sector has a multiplier effect and the capacity to generate income as high as five times. If the economy grows at the rate of 10% the housing sector has the capacity to grow at 14% and generate 3.2 million new jobs over a decade. The relaxed FDI rules implemented by India last year has invited more foreign investors and real estate sector in India is seemingly the most lucrative ground at present. Private equity players are considering big investments, banks are giving loans to builders, and financial institutions are floating real estate funds. Indian property market is immensely promising and most sought after for a wide variety of reasons. FACTORS THAT EFFECTED REAL ESTATE SECTOR DURING RECCESION Real estate sector is second to only the agriculture sector where employment generation is concerned. This can be further proved by the fact that the real estate sector contributes a good 5% towards the country’s gross domestic product (GDP). However, recent financial crisis followed by economic 11

- 12. slowdown have placed huge strain on this sector. While all sectors of the economy were under tremendous pressure, demand in the real estate industry was the lowest. This was largely as majority of the homes were taken on loan and an unexpected rise in the interest rate had its obvious impact. According to KP Singh, Chairman, DLF, "If there is a lack in demand, the projects eventually close down. There is a lack in demand because most people take mortgage loans. In fact, currently the interest rate is at 11–12 per cent, which should actually not exceed seven per cent. This also leads to higher EMIs." Also, the credit freeze stemming from the collapse of Lehman Brothers prompted investors and speculators to withdraw investments from this sector. Property developers, who raised funds through external sources, were left stranded with minimal cash flows and huge debt obligations surfacing in the near term. There are several factors that have influenced the real estate sector's performance. Some of these factors include the unemployment rate, income level, FDI investment, rise in the number of young working population, and easy availability of home loans. With this industry being one of the primary contributors to the GDP over the past few years, it is indeed interesting to note the performance of companies in this sector during the economic slow down. The sectoral ranking, based on consolidated revenues, revealed that top three companies within the sector had retained their positions from the previous year. There have been major changes in the list of market leaders as compared to last year. Out of the 10 companies in the previous year, only four retained their position among India's top 500 companies. The current challenging economy along with the sluggish demand had a significant impact on the top-line of most of the realty developers in the country. Some of the companies that witnessed a substantial dip in revenues include Omaxe, Ajmera Realty, Parsvnath Developers, Ansal Properties & Infrastructure, JMC Projects and Indiabulls Real Estate. Collectively, no developer could sustain the revenues base recorded in FY’08. DLF, Unitech and Housing Development & Infrastructure (HDIL), though witnessed >20% fall in revenues, maintained their first, second, and third positions respectively in the ET sectoral list. This means, the negative impact of the financial crisis affected all top real estate companies equally. Sobha Developers climbed up three positions to number four, despite a 58% decline in revenues. Its steady climb was primarily due to a sharp fall in revenues of other developers. Overall average revenues for these developers fell by 28% from the previous year. According to Sanjay Chandra, managing director of Unitech, “We have changed our strategy from maximisation of realisation to that of volumes in order to improve operational cash flows.” A closer look into the financials elucidate that developers faced stiff margin pressure, resulting from the drop in real estate prices. Real estate prices have been sky rocketing for several years and a sharp correction has been long overdue. Average net margins of the four developers slipped by a colossal 890 bps to 39.7%. This indicates that the companies faced higher liquidity pressure which consequently led them to unwind inventories at lower rates. The companies which have huge land bank and are primarily funded through external sources have been wiped out of the market and are yet recovering from losses incurred. 12

- 13. Valuations of the companies have bottomed out. The BSE realty index is trading at a Price/Book value of 2.69x this year as compared to 21.11x in 2007 and 13.36x in 2008. Players like Unitech and DLF have lost more than 75% of their values. DLF, which debuted the market in July 2007 entered the bear phase and remained below its issue price. Recently, the markets have seen immense recovery with the realty index gaining 88% from its previous low in 2008. The relaxed FDI regulation has invited several players to invest in the real estate market. Various private players are considering investment in the sector as banks are now readily giving loans due to a rise in the consumer confidence index. By 2010, it is expected that nearly 150 million square feet of office space across urban India would be utilised by the IT sector. The retail industry is also likely to utilise an additional 220 million sq ft by next year. According to the Tenth Five-Year-Plan, there is a shortage of 22.4 million dwelling units. Thus, over the next 10-15 years, 80 to 90 million residential units will have to be constructed with a majority of them catering to middle- and lower-income groups. This will create immense opportunities for real estate companies. “Now that property prices have dropped and the risk of job layoffs has diminished, the service class is likely to actively participate in property absorption, leading to a strong recovery in residential demand,” says Suman Memani, associate vice president, Religare Capital Markets. In conclusion, with early signs of recovery currently reflected by the drop in unemployment rate, easing liquidity and aggressive government initiatives to pull back the sector, increased activity in the real estate sector should be expected. DLF’S STRENGTH AND WEAKNESS STRENGTH 13

- 14. • Uniquely positioned in emerging, profitable segments: • DLF has a sizable presence across several key cities (Delhi NCR, Mumbai, Bangalore, Chennai, Kolkata, Chandigarh, Goa etc) and clear market leadership position in commercial, retail, and lifestyle/premium • apartments. These segments are highly profitable and have significant entry barriers. The estimated market share at ~16% in commercial offices and ~8% in retail space absorption in India over the next 2 years. • Better placed to face the macro challenges: • Commercial, retail, luxury and premium housing account for 67% of DLF's estimated Gross • Asset Value (GAV). Middle income housing segment accounts for just 24% of DLF’s GAV (56% of the development area). This segment is more susceptible to emerging macro concerns and challenges, and thus even 50% lower absorption v/s estimates would impact GAV by ~11% • DLF huge land bank • DLF’s current land bank stands at 13,055 acres (addition of 2,800 acres since filing of RHP) and total developable area at 612m sq ft (addition of 43m sq ft). Recent land bank addition of ~2,800 acres has been done at Rs19.3b (average cost of Rs230/sq ft, assuming FSI of 1x). For DLF, land cost stands at Rs154b, i.e. an average of Rs252/sq ft, which provides competitive advantages. • Large companies such as DLF, which have holding power, are best positioned to take large bets by acquiring large tracts of contiguous land, which could create value through ‘land bank ageing’ and ‘integrated development’. It is believed that this strategy will generate better returns, which would lead to continuous upgrade in NAVs and allow for higher asset turnover. • Successful implementation of monetization strategies will lead to lower capital costs and create conditions for building integrated property business models, comprising property development, re-development, acquisitions, divestitures, leasing and management WEAKNESSES DLF due to its predominant positioning in the commercial office, retail and premium apartment segments is relatively less vulnerable to the emerging macro challenges. We believe that a significant part of the concerns pertaining to the sector are getting compounded in middle income housing segment, which is more sensitive to prices and higher interest rates. 14

- 15. Macroeconomic risks: Any weaker-than-expected GDP growth for the domestic economy could negatively affect sentiment of buyers, leading to elusive demand, which could render sales and earnings estimates for DLF unrealizable. Also, any further tightening measures and policy changes by the government (with regard to mortgage applications and approvals, project financing, and property pre-sales) to curb speculation and overinvestment could adversely affect the bottom lines and cash flows of property developers and sentiment of home buyers Real risk of decline in property prices, and concentration in Gurgaon: Conservatively, we have assumed ‘NO’ price increase in the NCR region for apartments during FY08-17 and for commercial and retail during FY08-FY12. From FY13, we have assumed a price CAGR of 5% in commercial and retail space in NCR. Other than NCR we have assumed stagnant prices for all projects and all verticals (residential, commercial and retail) for FY08 and FY09. Given the sharp acceleration in real estate prices over the past three years, there exists a real probability of a price correction in certain pockets. Also, NCR region still accounts for 42% of the development area for the company, thus exposing it to significant price movements in the region. DLF’S COMPETITORS India Bulls HDIL Ackruti City Omaxe Group Unitech 15

- 16. New rivals Bombay Dyeing, Golden Tobacco and Century Textiles. There has been a precedent with groups like Tata, Mahindra and Godrej having turned developers. The Tata group has Tata Housing and Tata Realty while Mahindra’s venture is called Mahindra Lifespace Developers. Godrej’s venture goes by the name of Godrej Properties. A prominent case is that of Bombay Dyeing, a well known player in the textile business. While it has entered the real estate business, it does not have a separate company in place. DLF’S IPO LAUNCH IN 2007 The future grand plan after the IPO launch: DLF has outlined a three-pronged growth strategy: 1} Strengthening its pan-India presence, 2} Building up land reserves at strategic locations, and 3}Leveraging its real estate capabilities in related areas be it special economic zones or hospitality. The company will primarily be a developer and sell its properties retaining limited assets to be leased out. The money raised through the IPO would go towards buying more land (Rs 3,500 crore -- Rs 35 billion), developing existing projects and repayment of loans. 16

- 17. Going by the scale of development done so far, DLF is the largest real estate player in the country with land reserves of 10,255 acres or about 574 million square feet (msf) of developmental area. Of this, 171 msf is located in or near developed urban areas while 404 msf is urbanisable. "About 90 per cent of the total land bank is available as large contiguous plots enabling large integrated development", says, chief executive officer Rajiv Singh. After being centered around Delhi for many years, the company now has a nation-wide presence across 31cities and towns. It has developed 29 msf of residential, commercial and retail projects and integrated townships spread over 3,000 acres in Gurgaon so far. Currently, some 44 msf of development is under progress and projects involving 524 acres is planned over the next few years. The company intends to focus on its core competence while partnering with leading global players such as Nakheel (SEZs), Laing O'Rourke (construction), ESP (engineering and design), Feedback Ventures (project management) for better execution. Right from acquiring low cost land to creating a full fledged township to realise the true potential of the land, DLF has amply demonstrated its success in Gurgaon. One key advantage is that DLF's average cost of acquisition of land is fairly low at around Rs 274 per sf which will enable it sit out the cycles and not indulge in distress sale ever. Some key determinants of profitability for real estate companies apart from the land cost, is the developer's land acquisition and aggregation skills, relationship with the state authorities and reputation -- on all these DLF scores highly. And with its unquestionable capabilities as a successful developer, DLF seems best placed to capitalise on the booming real estate market, which is expected to grow at 20 per cent-plus annually from the current size of $40-45 billion. Even more, the national capital region, where the company has over 50 per cent of its land holdings, is among the fastest growing markets in the country. Apart from the boom in retail malls and residential owning to rising disposable income, there are several new vistas opening up for developers which DLF is planning to tap -- for instance, SEZs which offer opportunities to create integrated townships, hotels and serviced apartments, multiplexes, airports and the list goes on. According to a newly devised strategy, the company would, instead of leasing out commercial projects, indulge in outright sale to potential buyers including DAL. This model rests on the ground that DAL would be able to garner low cost capital by tapping the alternative investment market overseas and pay a higher capitalization rate for DLF's properties resulting in faster growth in revenues and better margins too. Thus DLF wanted to apply cost differentiation leadership strategy where through economies of scale they reduce the cost and achieve differentiation in each of its strategic business units. 17

- 18. KEY ELEMENTS OF ITS EXISTING BUSINESS STRATEGY Brand reputation  DLF has a 60-year history of service excellence. Since it was founded in 1946, it has been responsible for the development of 21 urban colonies aggregating 5,816 acres, as well as an entire integrated 3,000- acre township - DLF City. DLF reputation for providing prompt payment to landowners upon the acquisition of its land, developing and completing projects in a timely manner and conducting its business with transparency has created a relationship of trust with its customers and suppliers. The company retains internationally and nationally renowned architectural, construction and consulting firms for all its projects. Extensive land reserves are the most important resource for a real estate developer. As of April 30, 2006, DLF land reserves under development aggregated 1,372 acres representing approximately 102 18

- 19. million square feet of developed area or area available for development and it has made partial payments to acquire a further 2,893 acres in various regions across India. It is estimated that it will be able to develop over 118 million square feet of saleable or rentable area. The Company benefits from economies of scale and is able to purchase large plots of land from multiple sellers, thus enabling it to aggregate land at lower prices. The company has the ability to anticipate market trends and, in some cases, to influence the direction of such trends provides it with opportunities to acquire strategic locations of their choice. DLF is one of the first developers to foresee the need for townships on the outskirts of fast growing cities and is credited with the growth of Gurgaon. The company is one of the early developers to focus on developing theme-based projects such as The Magnolias in DLF City. The Company has an experienced, highly qualified and dedicated management team, most of whom have over 20 years experience in their respective fields. DLF encourages responsibility, autonomy and innovation among its employees with an attractive compensation package DLF’S SOME STRATEGIC DECISIONS DLF Laing O’Rourke (India): DLF Laing O’Rourke (India) Ltd is a joint venture between DLF, Laing O’Rourke Plc and LOR Holdings Ltd. According to the agreement, the JV company would carry out development activities in 19

- 20. identified DLF projects for a built up space of 50m sq ft over five years with minimum of 6m sq ft each calendar year. Laing O’Rourke will issue a corporate guarantee in favor of DLF to secure the JV company’s performance under the projects. Joint venture with Hilton: DLF has entered into a joint venture with Hilton International for development and ownership of a chain of hotels and serviced apartments in India. DLF will hold 74% and Hilton will hold 26% of the equity share capital of the JV company, which would develop and own 50-75 hotels and serviced apartments with an equity investment of US$550m over the next five to seven years.The hotels and serviced apartments would be managed and operated by Hilton’s subsidiaries. DLF has agreed not to develop and manage any hotels or serviced apartments that target the same market segment as of the JV company. Joint venture with WSP Group: The JV company has been established to provide engineering and design consultancy and project management services for DLF’s real estate plans. Both DLF and WSP Group have equal shareholding in the JV company and have identical rights and privileges. The JV company will provide consulting services to DLF for an initial 18 months after which the JV company can target new clients in India as agreed by the parties. WSP is permitted to provide independent services to its current as well as new clients. Acquisition of stake in Feedback Ventures: Necia Builders and Developers Pvt Ltd, a subsidiary of DLF, has acquired a 19% stake in Feedback Ventures at Rs72.5/ share. Feedback Ventures provides consulting, engineering, project management and development services for infrastructure projects in India. MoU with Nakheel: DLF has signed an MoU with Nakheel LLC, a leading property developer in UAE, to develop real estate projects in India through a 50:50 JV company. The initial two projects of the JV company would be 20,000 acres SEZ each in NCR and South Maharashtra and/or Goa. Joint venture with Prudential Insurance: 20

- 21. DLF has entered into a joint venture with Prudential Insurance to undertake life insurance business in India. DLF would hold 74% and Prudential would hold 26% of the equity share capital. DLF’s 30% equity share capital and Prudential's entire shareholding would be locked in for seven years. Remaining shareholding of DLF would be locked in for 10 years. After the lock-in period, if any shareholder intends to transfer the shares, first offer should be made to the non-selling shareholder. No transfer of share is permitted to the competitor. Joint venture with MG Group: DLF has entered into a 50:50 joint venture with MG group for real estate development. The board shall consist of 4-12 members. Each party is entitled to appoint one half of the board. A non-executive chairman would be nominated by DLF. Joint venture with HSIIDC: DLF has entered into a joint venture with HSIIDC for developing two SEZ projects. A SPV would be created in the form of a limited company to implement the project. Shareholding pattern is 90% in favor of DLF and 10% in favor of HSIIDC. The equity holding of DLF in the SPV cannot fall below 51% and HSIIDC cannot increase it above 26%. In the event of initial public offering, DLF would contribute its share for the lock-in period of three years and shares held by HSIIDC would be locked in for one year. HSIIDC has the right to sell its shares and DLF has the first right to purchase it at market price. On DLF’s refusal, HSIIDC would have right to offer the shares to the public. Memorandum of Co-operation with Fraport AG Frankfurt Airport Services: DLF has signed a MoC with Fraport AG Frankfurt Airport Services Worldwide to establish DLF Fraport SPV. The SPV would focus on development and management of certain airport projects in India. The shareholding of each party shall be mutually agreed such that each of parties shall hold not less than 26% in the management company. DLF in talks with AT&T for mobile services 21

- 22. Real estate major DLF Ltd is talking to US telecom giant AT&T as a strategic partner to roll out pan- India mobile services. AT&T has also applied for a universal access service licence (UASL), which allows operators to offer services in both GSM and CDMA technology, with the Mahindra & Mahindra group, for 22 circles. The US company, however, has stipulated that it wants a majority equity stake in the mobile venture. This will be AT&T’s second coming in India after it exited Idea Cellular a few years ago. DLF had also applied for a pan-India licence on its own and without a foreign partner. A senior DLF executive said: “We are in talks with various international telecom operators; all the big operators will approach us.” Sources close to the development, however, confirmed that DLF has been approached by AT&T. An AT&T India spokesperson said: “We do not comment on market rumours or speculation.” Insiders also said DLF is talking to other international telecom majors apart from AT&T. With over 300 Indian companies applying for pan-India UASLs, the race is on to get international partners with experience in the telecom sector as strategic partners. This is because the industry expects the government to offer only two or three licences in each circle. Hybrid business model DLF has a hybrid business model, which is a blend of ‘sale and lease’. It is estimated DLF’s rental income to increase from Rs6b in FY08 to Rs43b by FY12, comprising an asset base of 46m sq ft in the commercial and retail verticals. The rental stream would enable the company a steady income source and also provide monetization opportunities, leading to a long-term, self -sustaining growth phase. 22

- 23. SHAREHOLDING PATTERN: NO. OF SHARES % OF TOTAL PROMOTERS 1502823120 88.26% INSTITUTION 124231366 7.30% GENERAL PUBLIC 75657427 4.44% GRAND TOTAL 1702711913 100% CHANGE IN TOTAL INCOME QoQ: 23

- 24. CHANGE IN OPERATING INCOME QoQ: CHANGE IN NET PROFIT QoQ: 24

- 25. RATIO: 30/09/07 31/12/07 31/03/08 30/06/08 30/09/08 EPS 4.50185 3.558407 3.75022 4.117167 3.752981 OPM 63.51832 52.03052 50.83347 68.86187 72.49094 NPM 59.77961 33.42675 36.35313 46.92742 46.88816 INTEREST COVERAGE 13.90027 7.221565 4.851037 5.495604 5.100798 EPS is showing declining trend in the last five quarter. OPM has declined earlier from 63% to 52% but later got recovered. Same trend was also witnessed in the NPM earlier shown a decline but later shown a recovery. Interest coverage has shown consistent decline. It has declined from 13 to 5 in just five quarte 25

- 26. Analysis of the Indian economy with Respect to Real Estate Sector According to the United Nations Population Fund (UNFPA),India is getting urbanised at a faster rate than the rest of the world and by 2030 more than 40.7 per cent of the country’s population would be living in urban areas. Presently, more than 28.7 per cent of India’s area is urban as against the global average of 48.7 per cent. However, the growth rate of urban areas was 2.3 per cent in 2005, as against the world average of 2 per cent. The urban population of India was estimated to stand at 316 million in 2005 and is the second largest in the world after China. It is estimated to reach 590 million by the year 2030 retaining its second position. India’s cities have been the driving force in shaping India’s socio-economic profile. Urban areas which constitute only 28.7 per cent of the population, have been a major contributor to the GDP with a major share of industry and almost the entire services sector concentrated in the urban agglomerations. During the last sixty years, post independence the population of India has grown two and a half times, whereas urban India has grown by nearly five times. According to Census of India 2001 estimates, 30 per cent of the total population of India would be living in urban areas by 2011. The number of cities with one million plus population is further expected to double from 35 in 2001 to 70 by 2025. India’s ‘Mega-Cities’ of Mumbai and Delhi would be the world’s 2nd and 3rd largest cities by 2015. With a rapid influx of migrants in these cities there is a corresponding increase in the demand for space. Rapid urbanisation is fostering real estate growth in India. Increasing number of households The growing popularity of nuclear families in India has decreased the average household (HH) size in the country, leading to an increase in the number of households in the country. The average HH size in India has declined from 5.4 persons per HH in 1981 to 5.1 persons per HH in 2001. In 2001, there were roughly 192 million HH in India, about 40 million more than those in 1991. 26

- 27. Growing number of first-time home buyers India has a much younger population compared to mostother economies. Currently the population in the working age group (16-65 years) is about 700 million representing about 64 per cent of the total population. India is expected to emerge as the highest contributor to the global work force by 2010. Given that a majority of the population would still be young the per capita income generation capability of India would continue to remain robust. With the average age of home buyers declining fast the young working population would further push demand for housing units higher. First-time home buyer numbers have multiplied over the years and the median age of home buyers has reduced from 38 years in the early 1990s to about 28 years today. Increasing income levels: The per capita disposable income has grown manifold in the past one decade. The current annual per capita disposable income stands at around US$ 693 and is further expected to grow by 8-13 per cent in the next five years. Robust economic growth, particularly in the services sector has led to an increase in income levels in the country. Several studies have indicated that salaries in India have been increasing by an average of 10-15 per cent on a year on- year basis. This has increased the affordability of homes in spite of higher property prices and has further created more discerning buyers Affordability of housing: As per estimates from the National Council of Applied Economic Research (NCAER) the proportion of HH in the top five income brackets (>US$ 11,651 per annum) has increased from 0.6 per cent in 1996 to 2.4 per cent in 2006 and is likely to increase further to 4.5 per cent by 2010. Also, the number of HH in the top four income brackets (>US$ 23000 per annum) is expected to grow at a CAGR of over 20 per cent till 2010. Thus, housing is expected to become increasingly affordable especially in the mid- market and premium segments. 27

- 28. Retail Real Estate: The Indian retail industry is witnessing a structural change with individual small format stores making way for large format shopping malls and hyper-markets. On the policy front, the partial relaxation in FDI regulation (51 per cent FDI in single brand retailing) has provided a boost to the retail segment. Presently the top seven cities of India account for a dominant share in mall space. The total organised retail space absorbed for the year 2006-07 in the top seven cities was around 19 million sq. ft. The following chart depicts the absorption scenario of organised retail space for the year 2006-07. National Capital Region (NCR), one of India’s most affluent urban centres, dominates the absorption scenario followed by Mumbai and Kolkata. Bengaluru is also emerging as a major retail hub owing to its cosmopolitan character Special Economic Zones (SEZ): Following the success of China in boosting manufacturing exports, India has adopted the SEZ model albeit with private participation to provide world class infrastructure to boost its industrial export performance. With the fiscal benefits extended to IT Parks expected to end in 2009 several upcoming and proposed SEZs are expected to provide the next generation impetus to the IT commercial office space development in the country. Offering significant fiscal benefits, SEZs are being preferred by the IT/ITES and other services sectors. IT/ITES sector accounts for more than 50 per cent of the approved or notified SEZs. 2006-07.Till date under the new SEZ policy, formal approvals have been granted to 366 SEZ proposals out of which 142 have already been notified as SEZs as on 30th August, 2007. In addition, around 176 proposals have been granted in-principle approvals. In terms of industry focus, Information Technology (IT) and Information Technology Enabled Services (ITeS)/ Electronics/Hardware sector witnessed the maximum number of approvals followed by Bio-technology, Engineering etc. With respect to type of SEZs, almost 90 per cent of the SEZs approved, were sector specific followed by multi-product (5 per cent), multi-services (2 per cent) and FTWZ (1 per cent). 28

- 29. Geographically, the maximum number of approvals were bagged by the State of Maharashtra (75) followed by Andhra Pradesh (61), Tamil Nadu (53) and Karnataka (36). In a recent move the Government has withdrawn the freeze on new approvals however at the same time the rules have been tightened by capping the land size to a maximum of 5,000 hectares in case of a multi-product SEZ Rea l Estate Opportunities: • Health Cities: Large scale integrated development • Hospitals: combining the services of a hospital and a Hotel Low-cost Budget Housing: As per the Working Committee of the 11th Plan (2007-12) the total shortage of dwelling units at the beginning of Eleventh Plan Period i.e. 2007 was 24.7 million. As per the estimates by National Housing Bank (NHB), going forward, the gap of housing unit shortage would further widen to about 45 million units during the Eleventh Plan (2007 – 2012) period E&Y estimates that more than 70 per cent of the shortage of dwelling units is for middle and low income brackets. Rea l Estate Opportunities • Slum-rehabilitation • Mass housing. CASH FLOW STATEMENT 29

- 30. Y/E MARCH 2006 2007 2008 2009 2010E PBT before Extraordinary Items 3,595 25,495 71,370 92,196 110,974 Add : Depreciation 361 571 828 1,090 1,380 Interest 1,685 3,076 1,575 0 0 Less : Direct Taxes Paid 1,668 6,058 11,807 21,012 30,951 (Inc)/Dec in WC -16,545 -67,432 10,738 117,642 24,551 CF from Operations -12,572 -44,348 72,704 189,917 105,954 (Inc)/Dec in FA -7,194 -25,400 -65,817 -29,546 -39,884 (Pur)/Sale of Investments -7,900 6,193 0 0 0 CF from Investments -15,094 -19,207 -65,817 -29,546 -39,884 (Inc)/Dec in Networth -767 13,044 76,072 -6,819 -6,819 (Inc)/Dec in Debt 31,644 58,008 -64,328 -35,000 0 Less : Interest Paid 1,685 3,076 1,575 0 0 Dividend Paid 0 2,216 13,580 16,230 18,245 CF from Fin. Activity 29,192 65,760 -3,411 -58,049 -25,065 Inc/Dec of Cash 1,526 2,205 3,476 102,321 41,005 Add: Beginning Balance 424 1,950 4,155 7,631 109,952 Closing Balance 1,950 4,155 7,631 109,952 150,957 BALANCE SHEET 30

- 31. Y/E MARCH 2006 2007 2008 2009 2010E Equity Capital 379 3,059 3,408 3,408 3,408 Preference Capital 0 9,498 0 0 0 Reserves 9,123 27,115 158,506 206,644 261,606 Net Worth 9,502 39,672 161,914 210,052 265,014 Loans 41,320 99,328 35,000 0 0 Capital Employed 50,967 139,279 196,914 210,052 265,014 Goodwill 8,489 8,935 8,935 8,935 8,935 Gross Fixed Assets 13,023 17,787 38,118 69,840 99,793 Less: Depreciation 1,891 2,412 3,240 4,330 5,710 Net Fixed Assets 11,132 15,375 34,878 65,510 94,083 Capital WIP 5,911 26,497 71,983 69,806 79,738 Investments 8,300 2,107 2,107 2,107 2,107 Curr. Assets 35,604 128,794 149,346 159,542 185,831 Inventory 16,409 57,006 40,342 23,752 9,329 Debtors 6,580 15,195 14,669 14,956 16,523 Cash & Bank Balance 1,950 4,155 7,631 109,955 150,964 Loans & Advances 10,642 52,371 86,703 10,879 9,014 Current Liab. & Prov. 18,469 42,429 61,400 86,914 96,745 Net Current Assets 17,135 86,365 87,946 72,628 89,086 Application of Funds 50,967 139,279 196,914 210,052 265,014 31