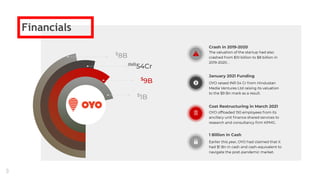

OYO Rooms is an Indian startup valued at $9 billion that provides affordable hotel accommodation. It raised $54 crore in funding in January 2021 but saw its valuation drop from $10 billion to $8 billion in 2019-2020. In March 2021, OYO laid off 150 employees from a subsidiary. The company claims to have $1 billion in cash reserves. Scenario planning identified uncertainties around increasing hotel operating costs and regulations. Risks for OYO include litigation costs, lack of luxury options, and social media scrutiny. It faces competition from other hotel aggregators and direct competitors. OYO aims to expand globally and implement more tech innovations by 2030.