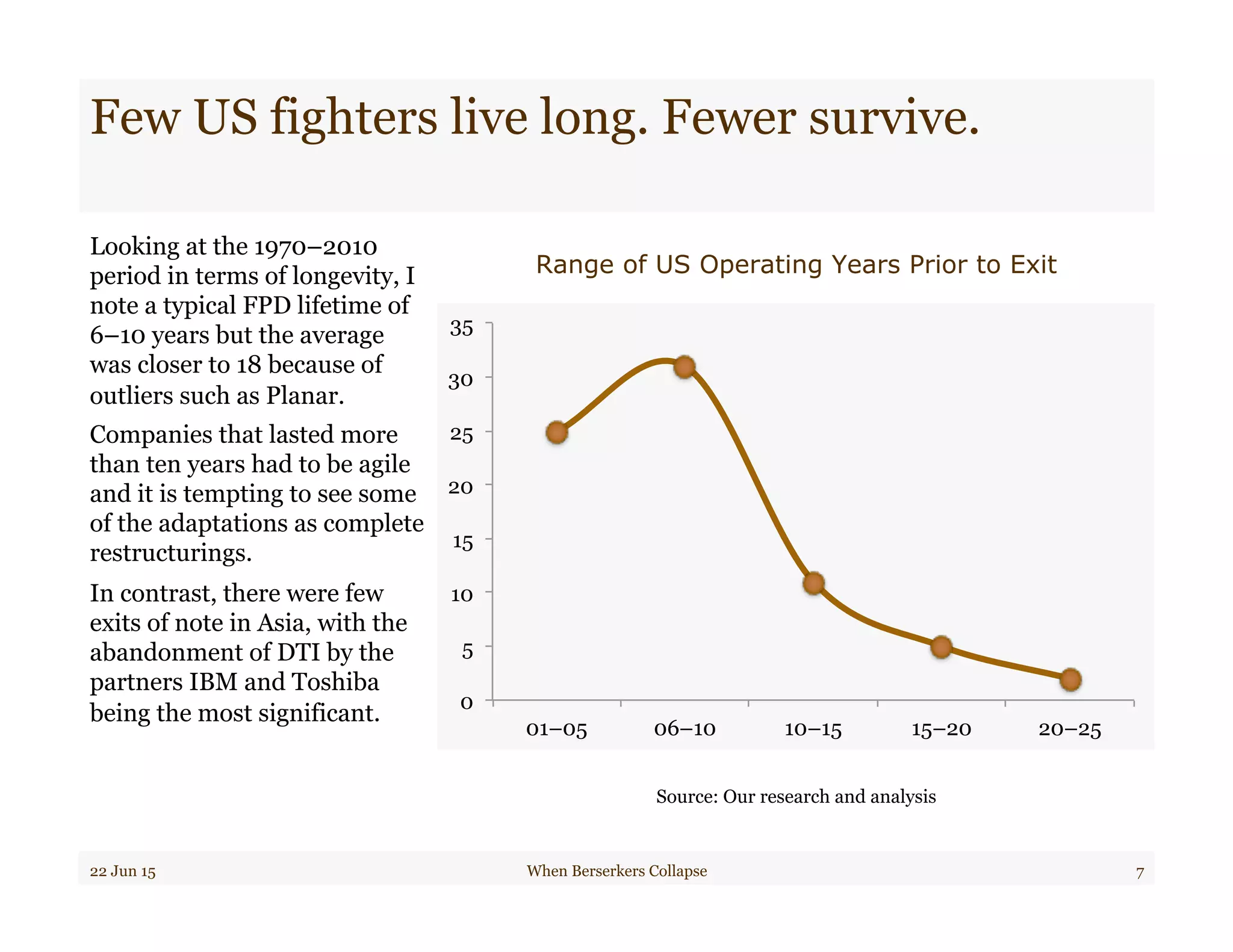

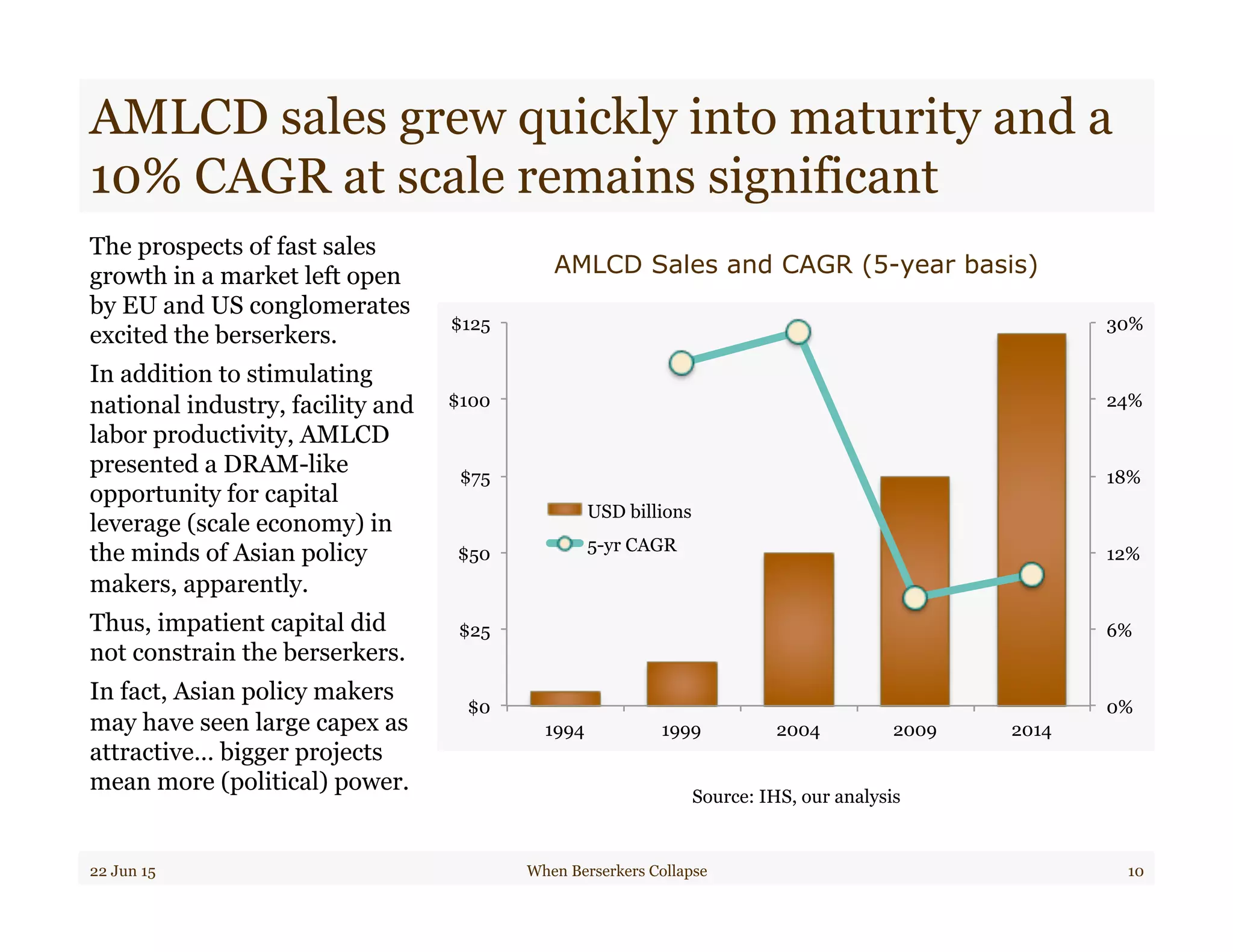

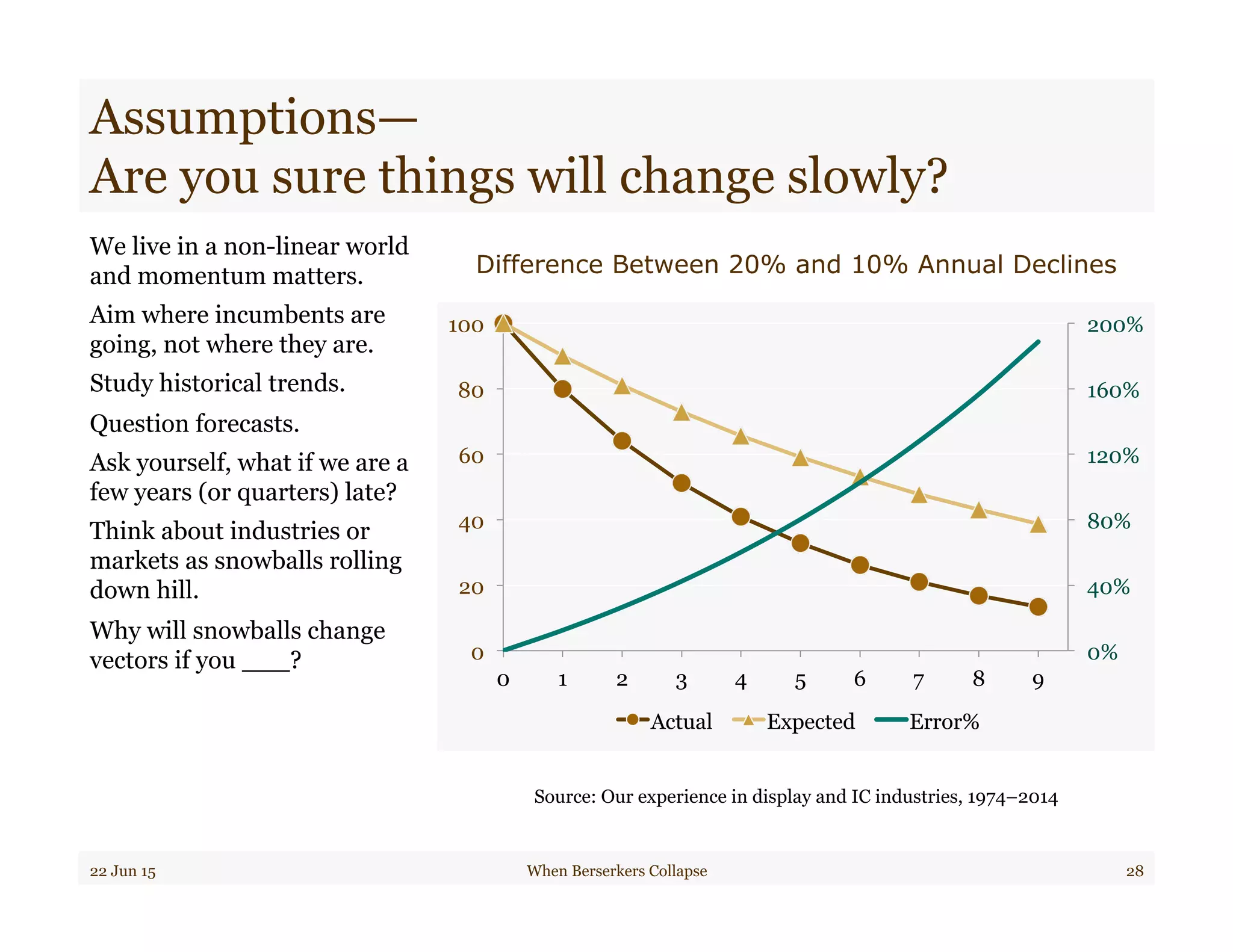

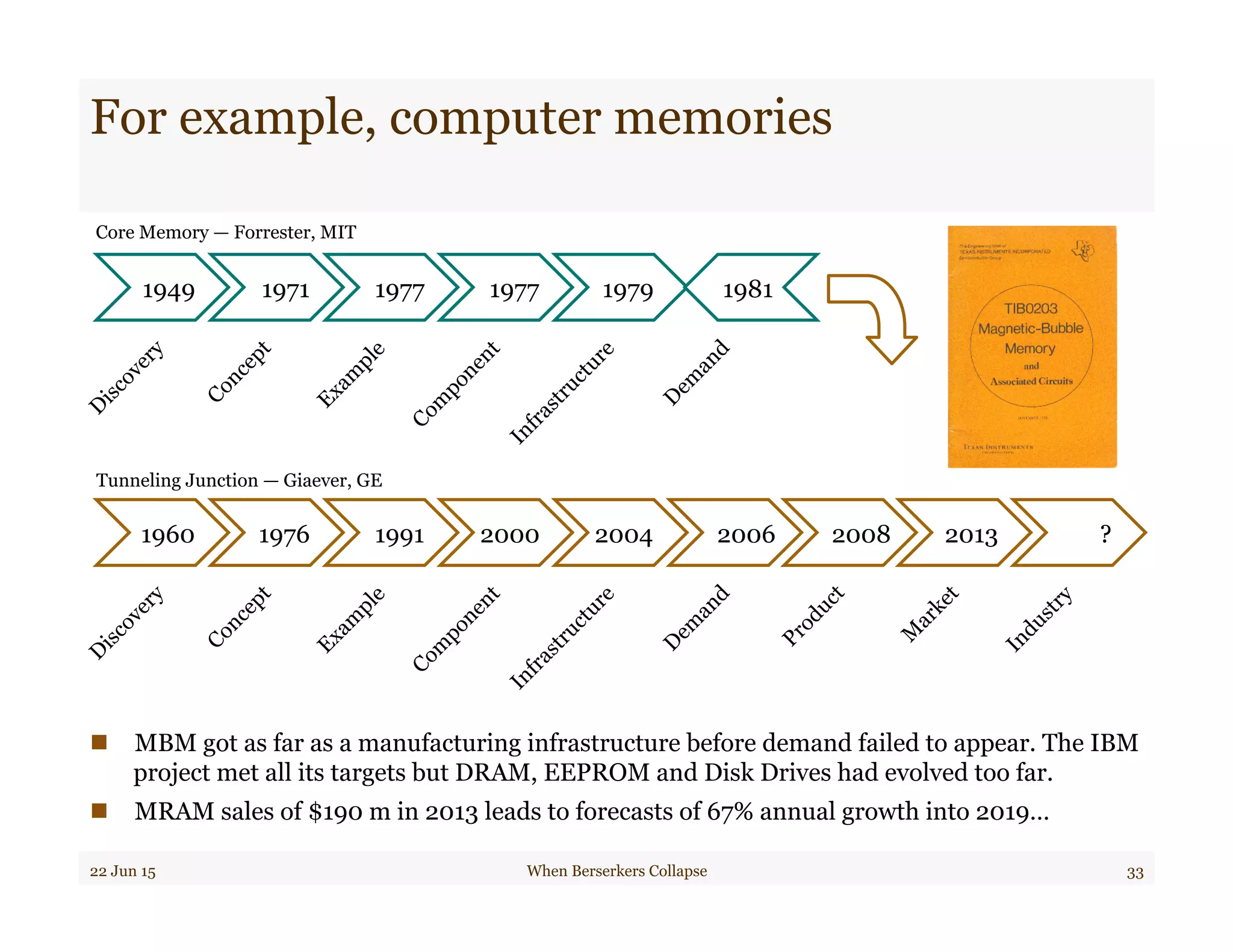

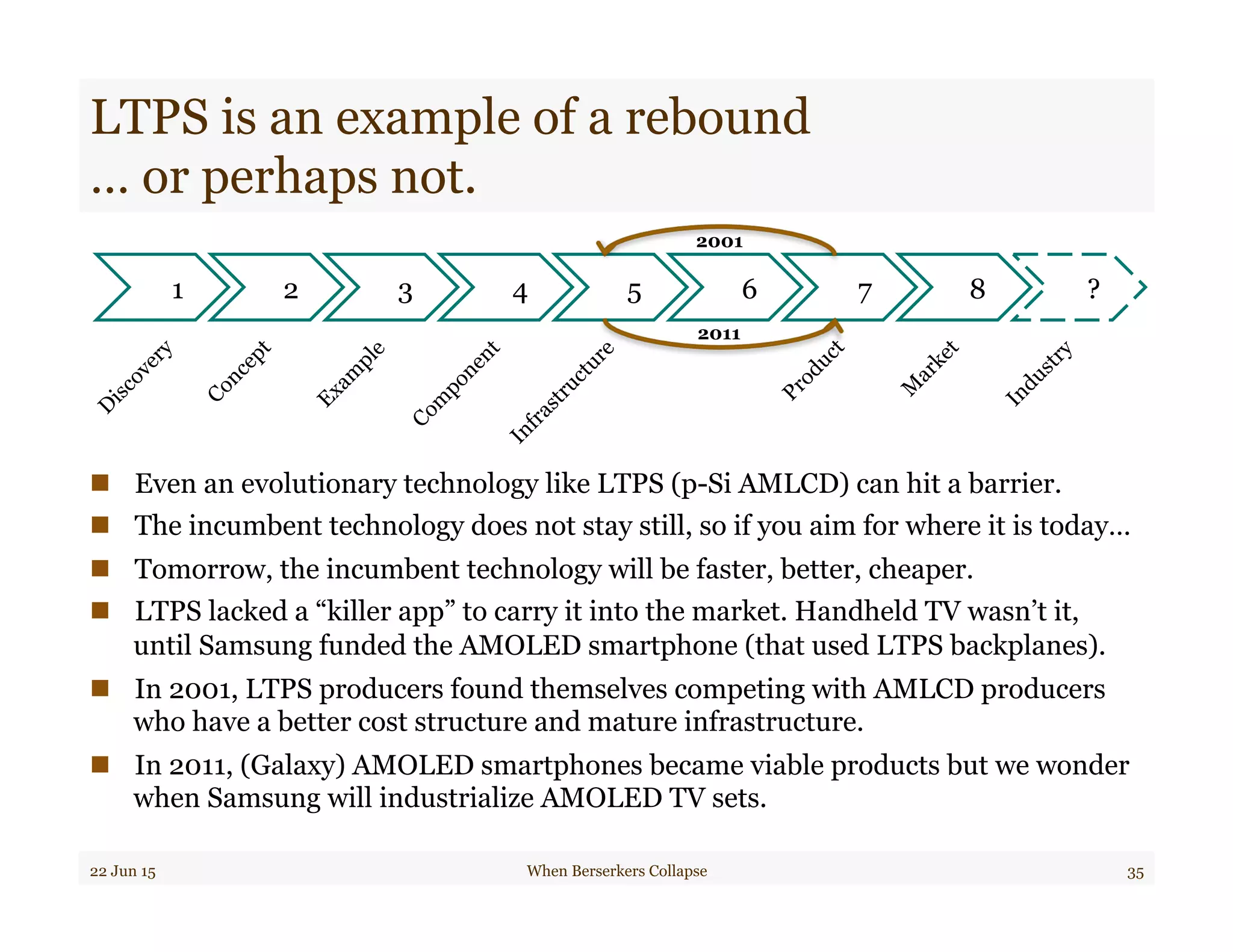

The document discusses the rise and fall of companies in the flat panel display (FPD) industry, comparing the relentless expansion of Asian manufacturers, referred to as 'berserkers', to the historical challenges faced by U.S. firms. It highlights the failures of U.S. policy and market strategies that prioritized personal computing over panel manufacturing, allowing Asian competitors to dominate through aggressive investments. The document concludes by warning that current industry leaders may face similar capital exhaustion, potentially paving the way for new challengers in the future.