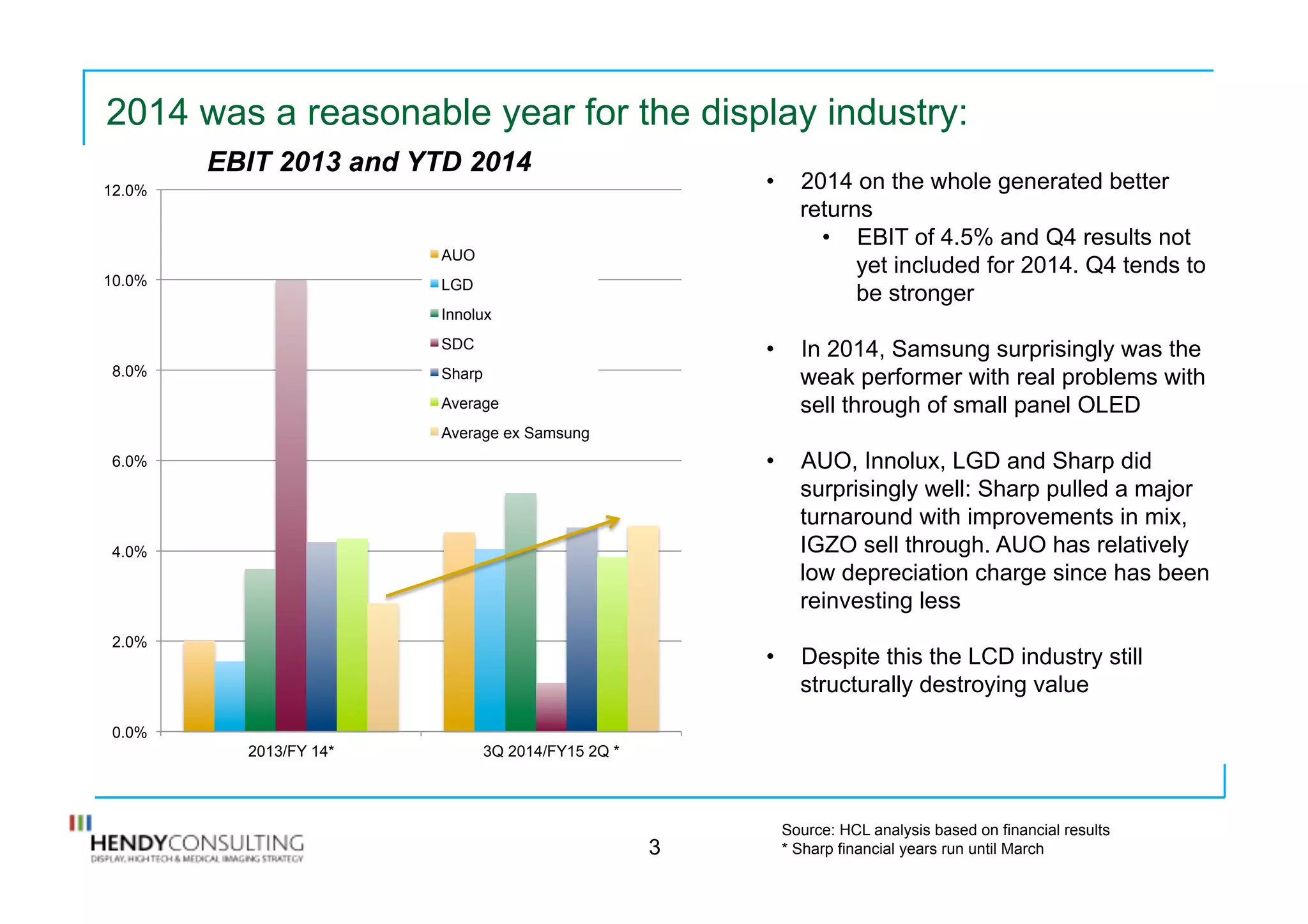

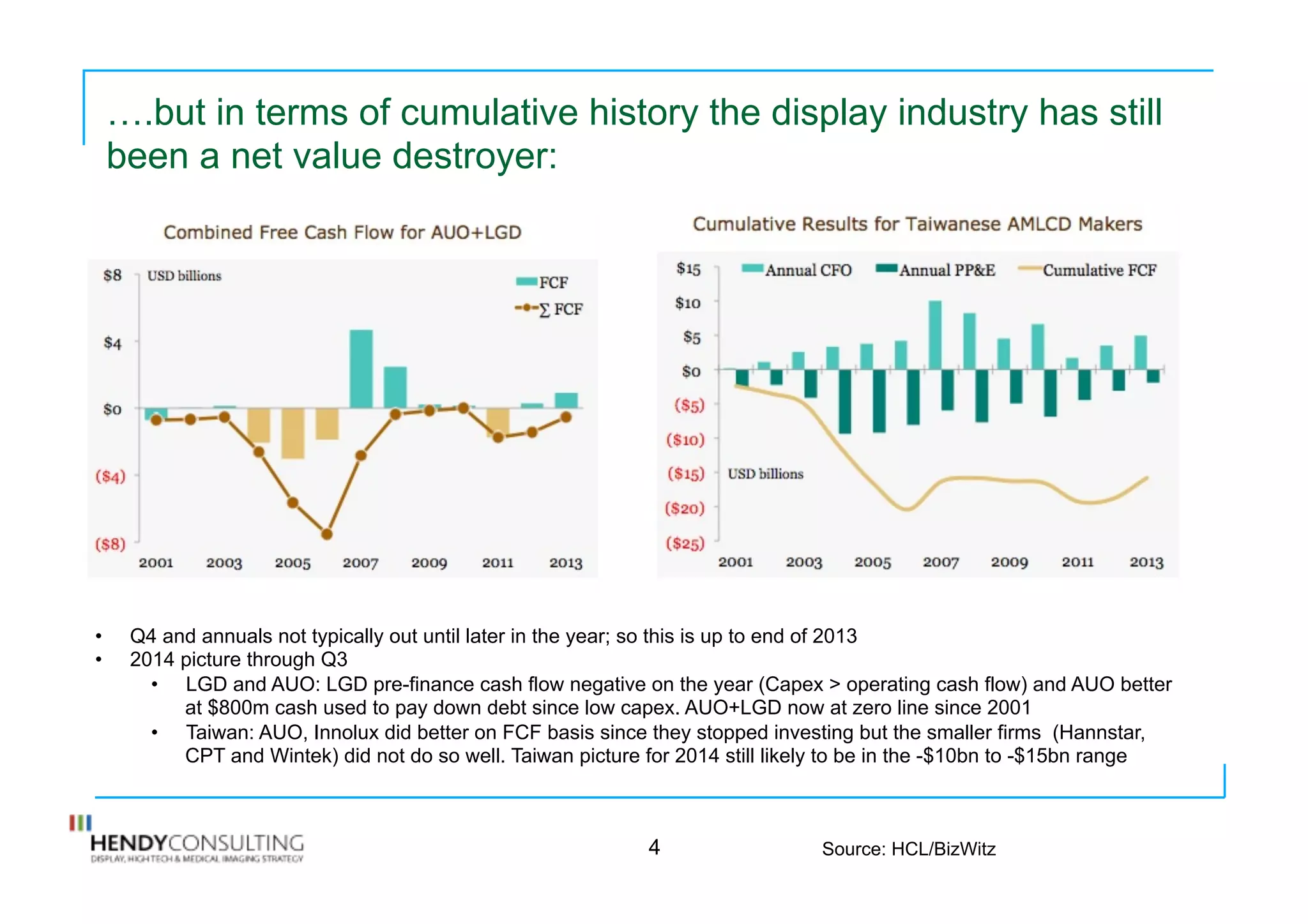

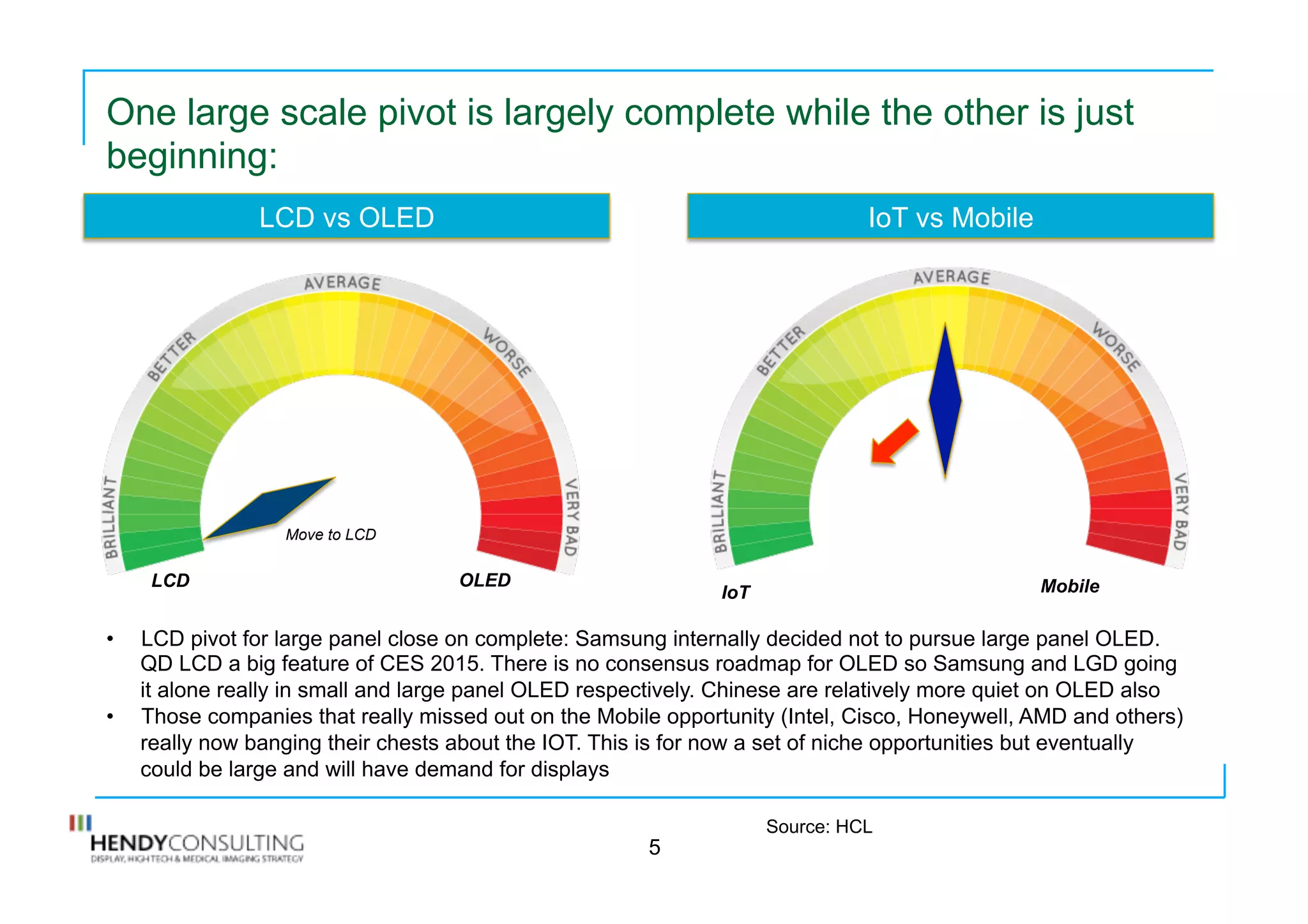

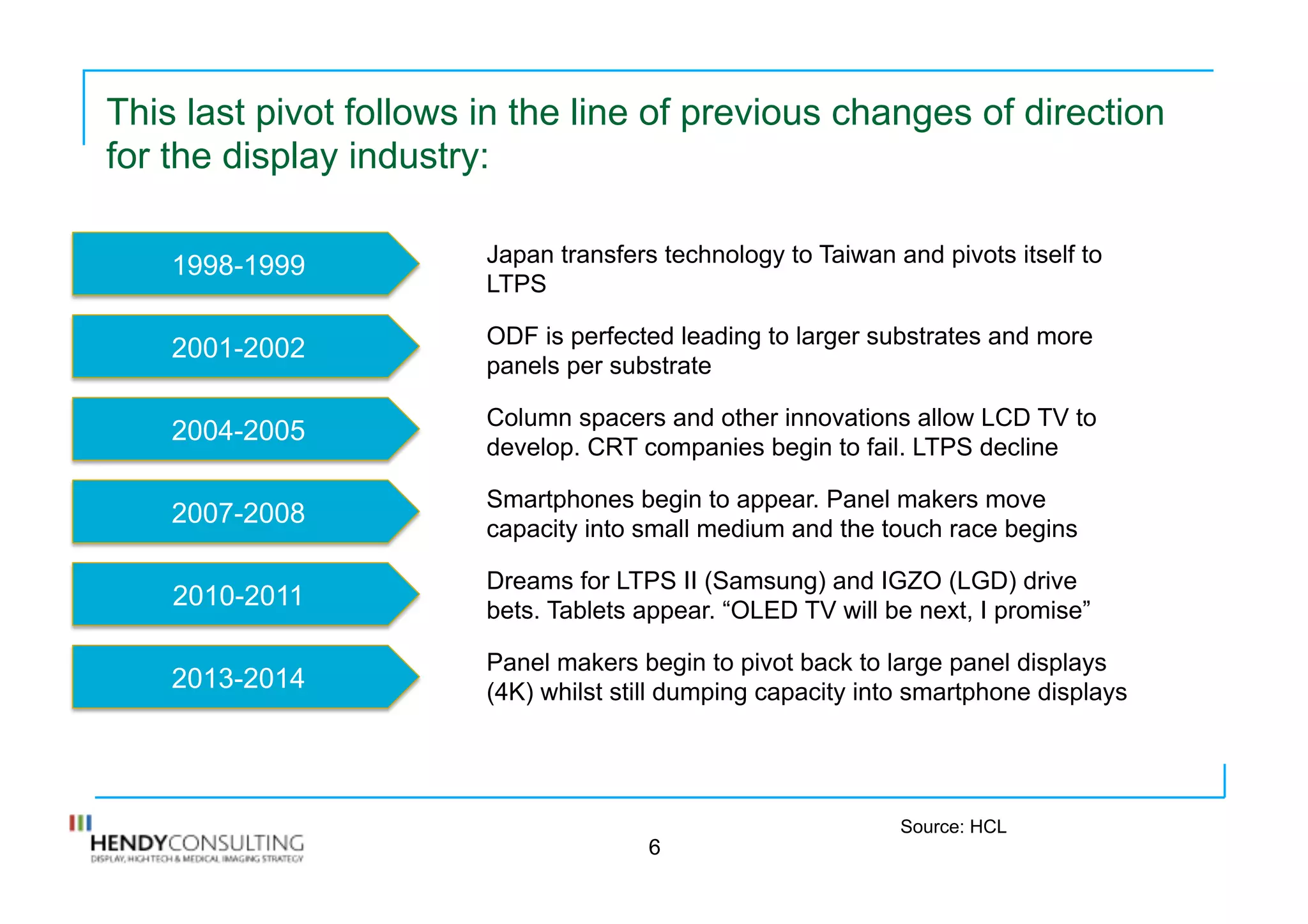

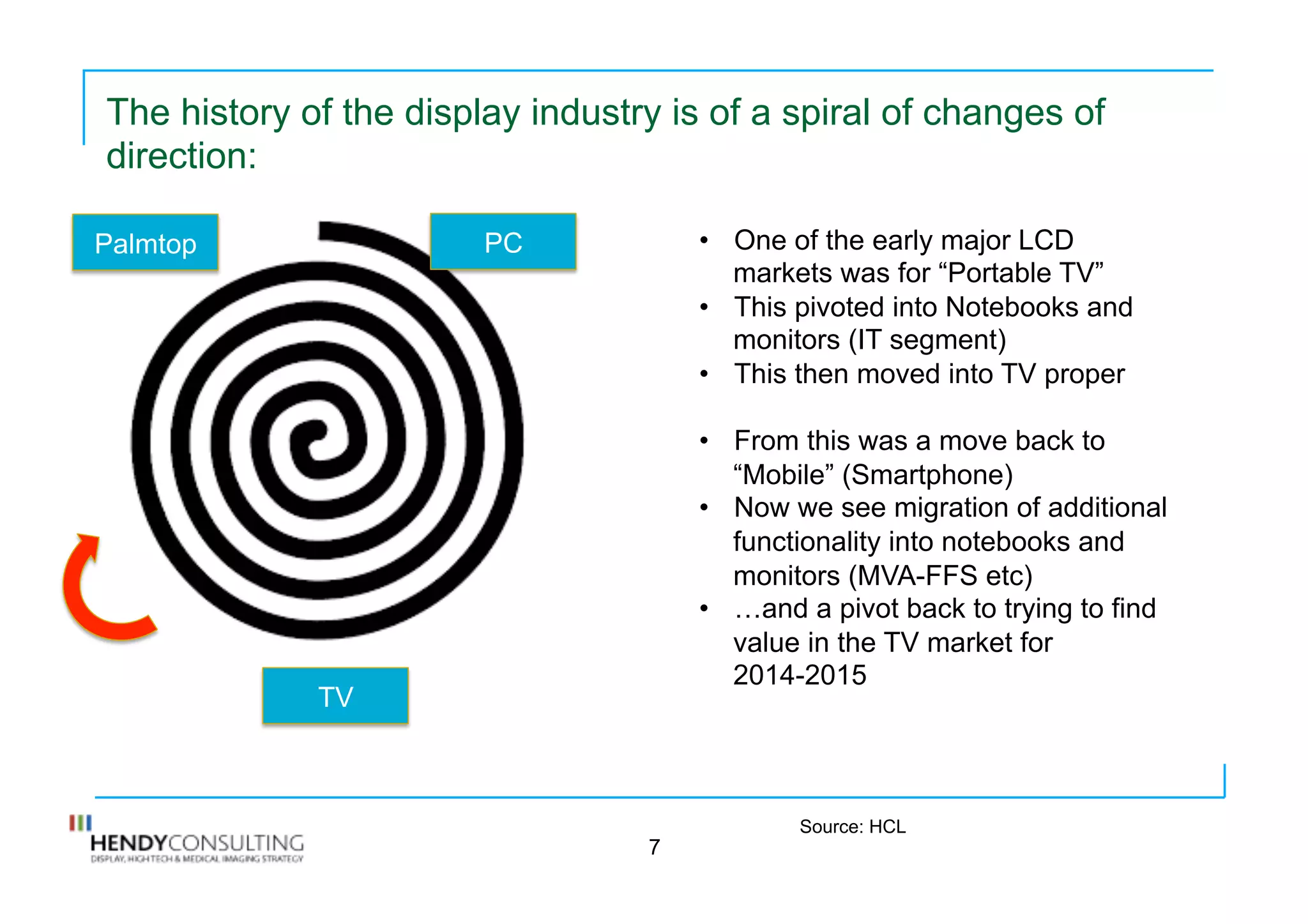

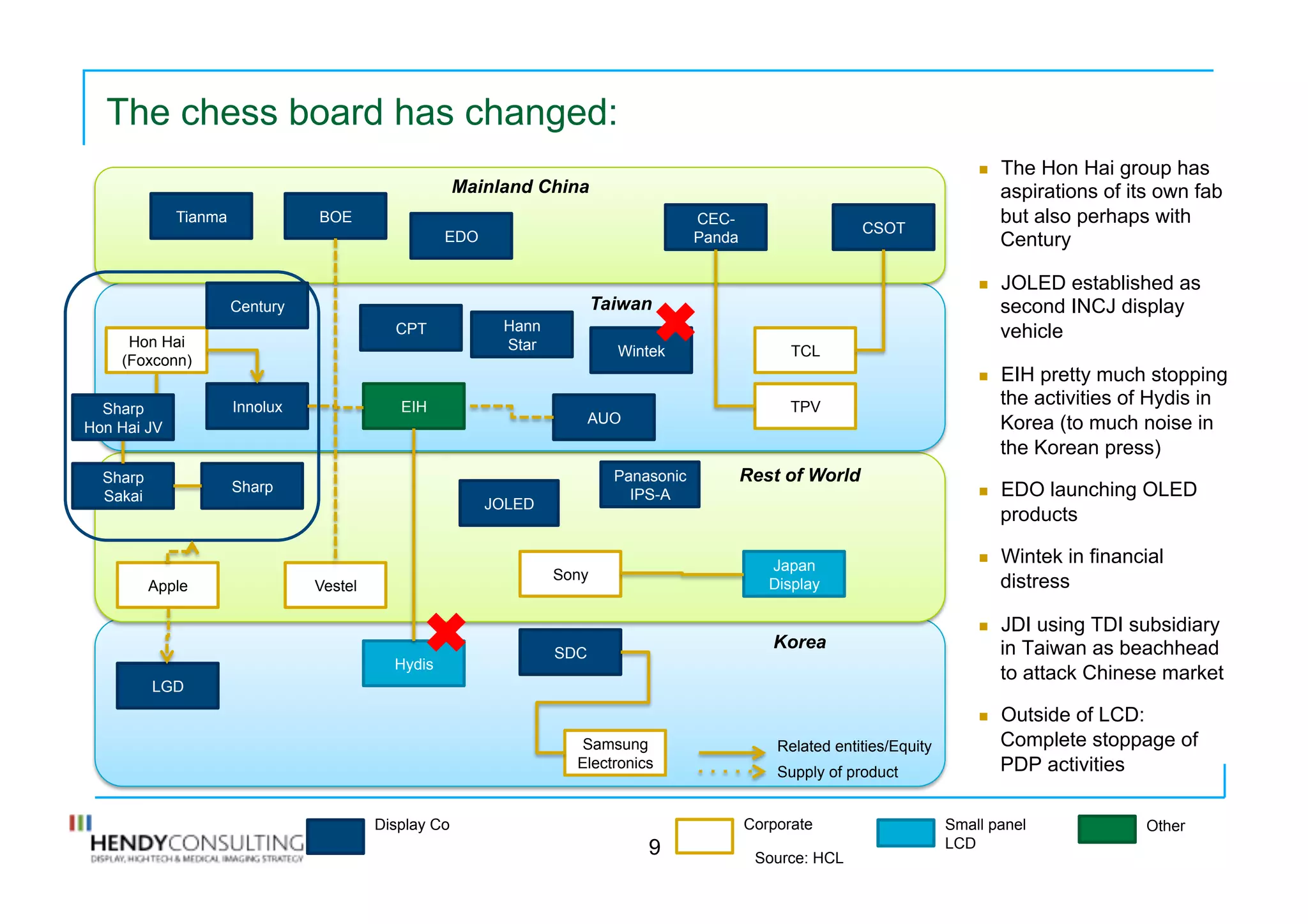

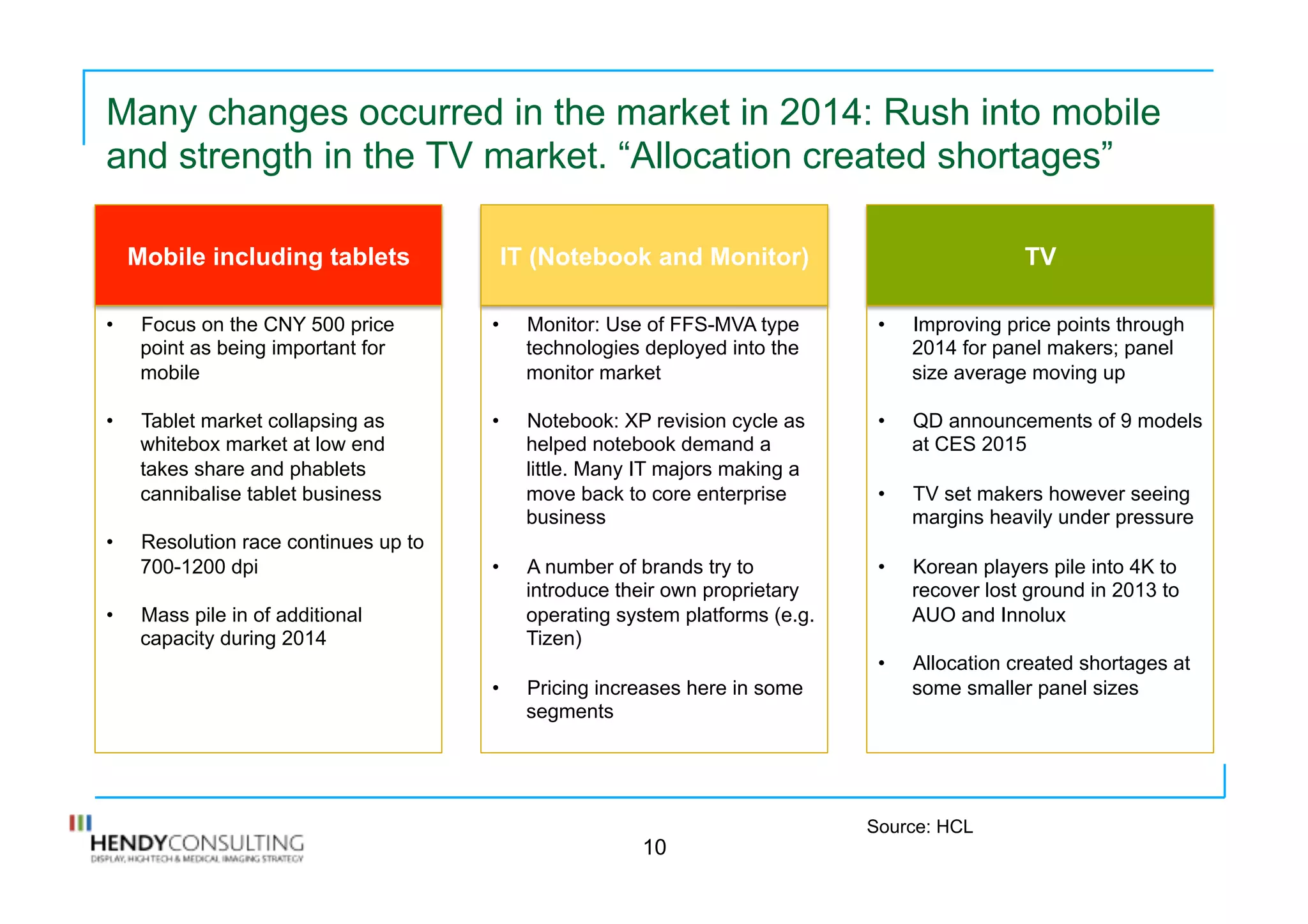

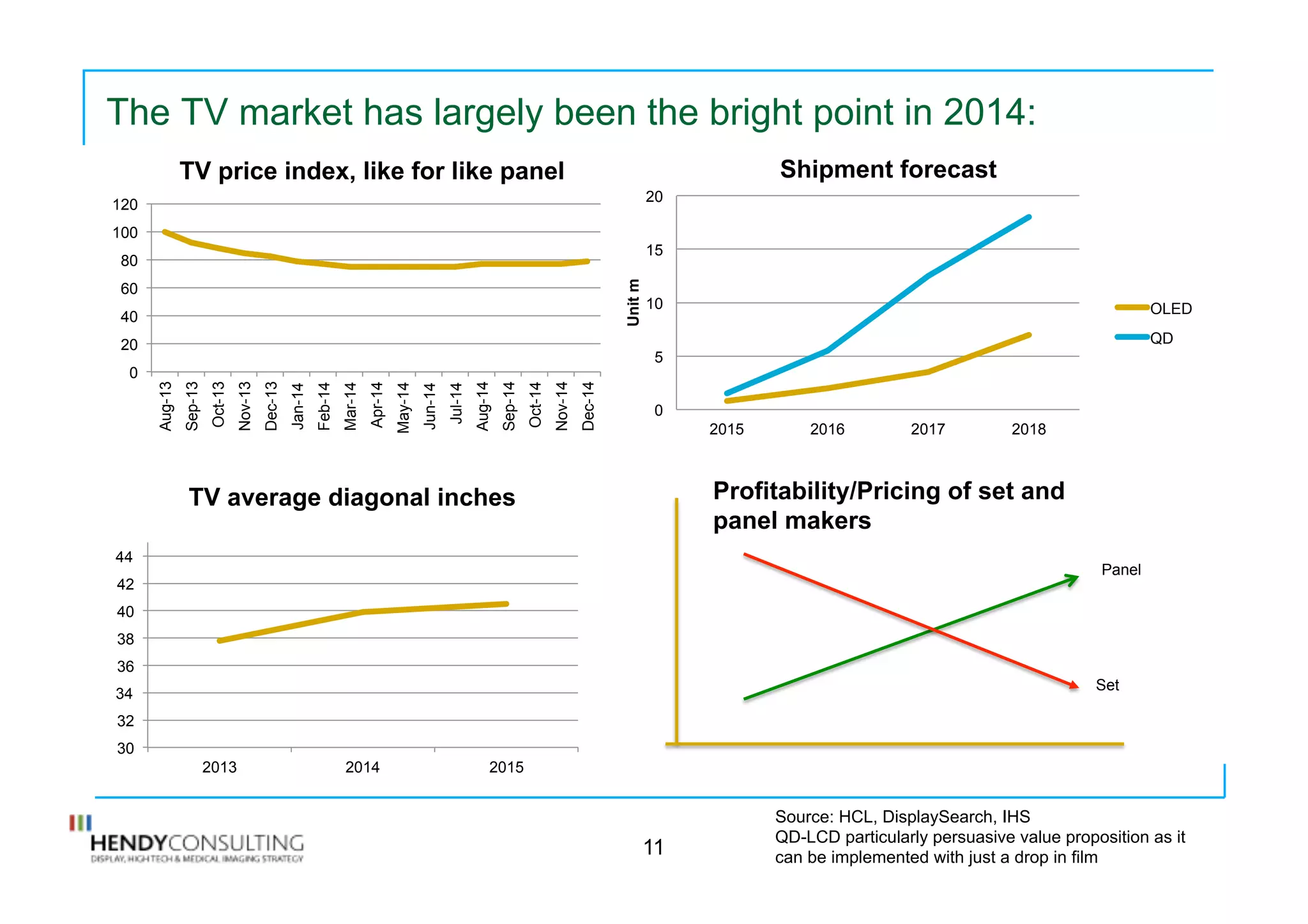

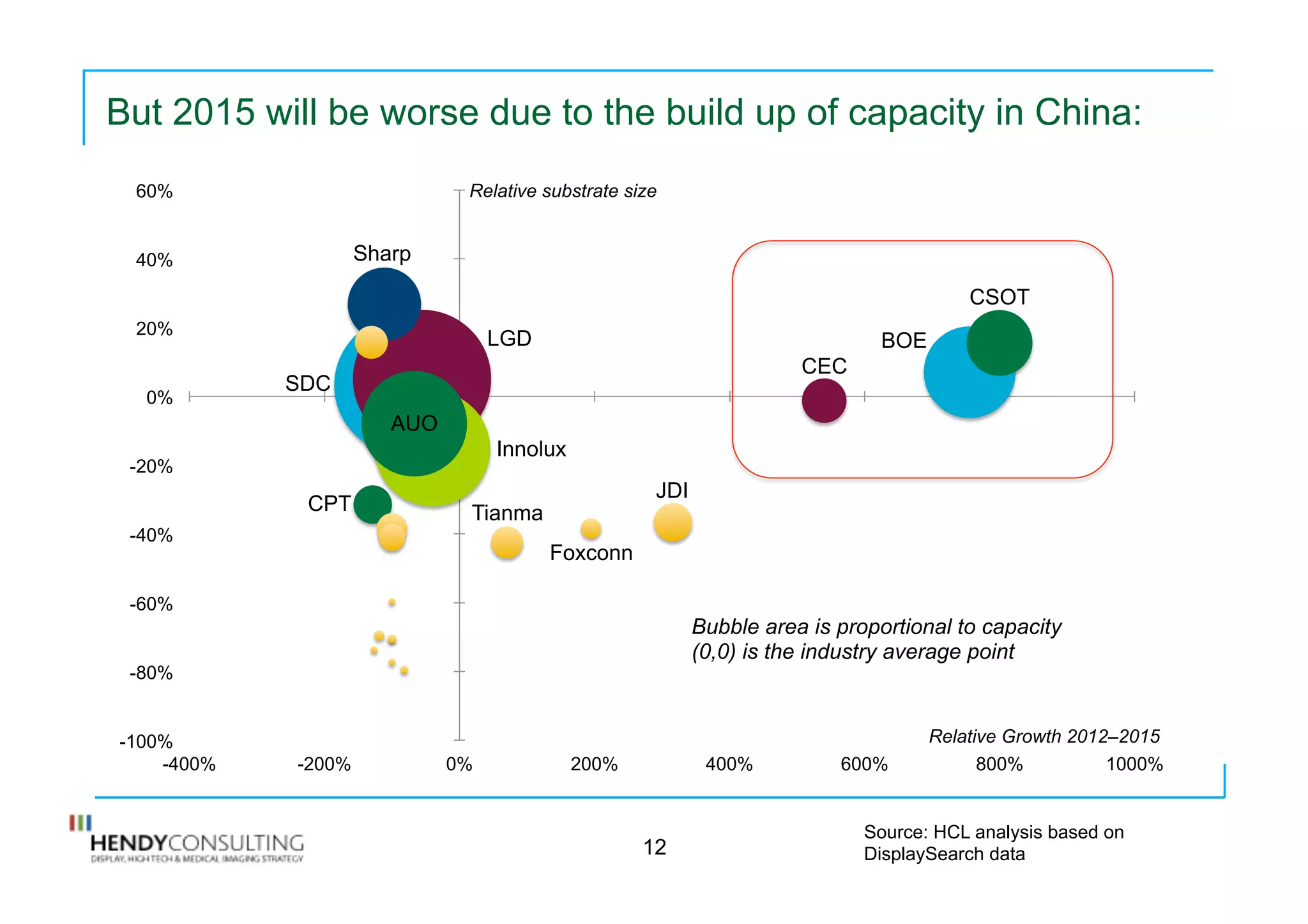

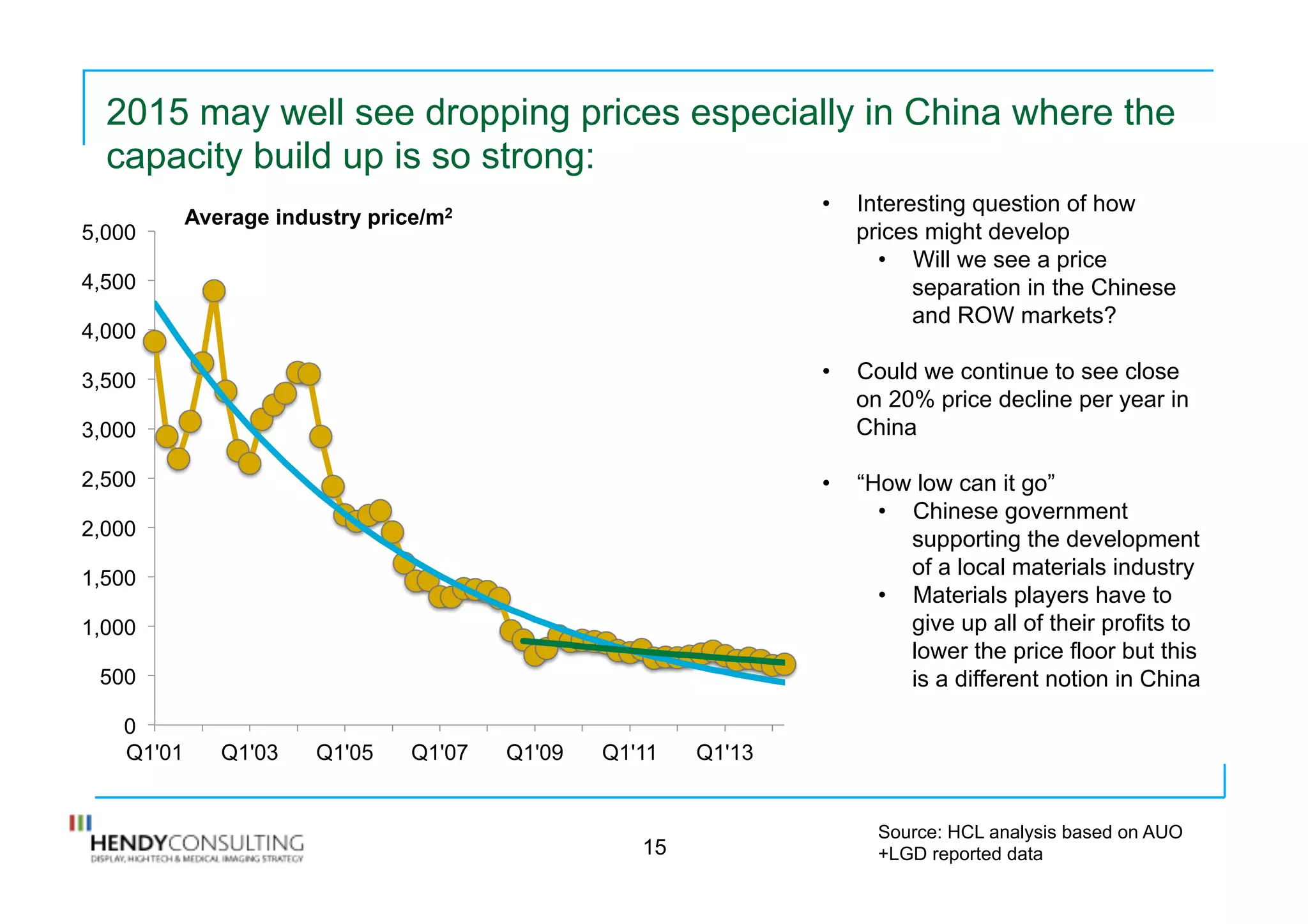

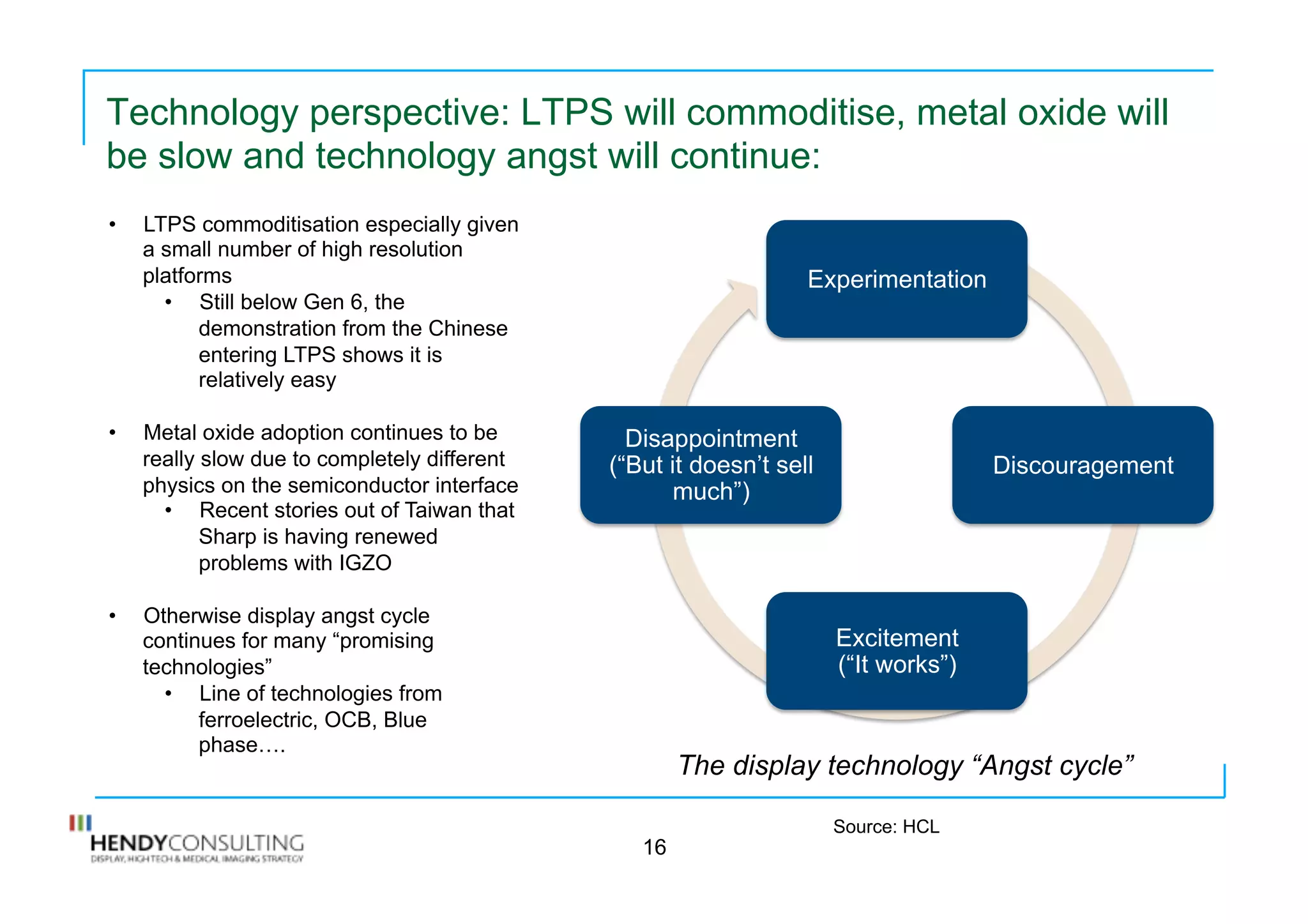

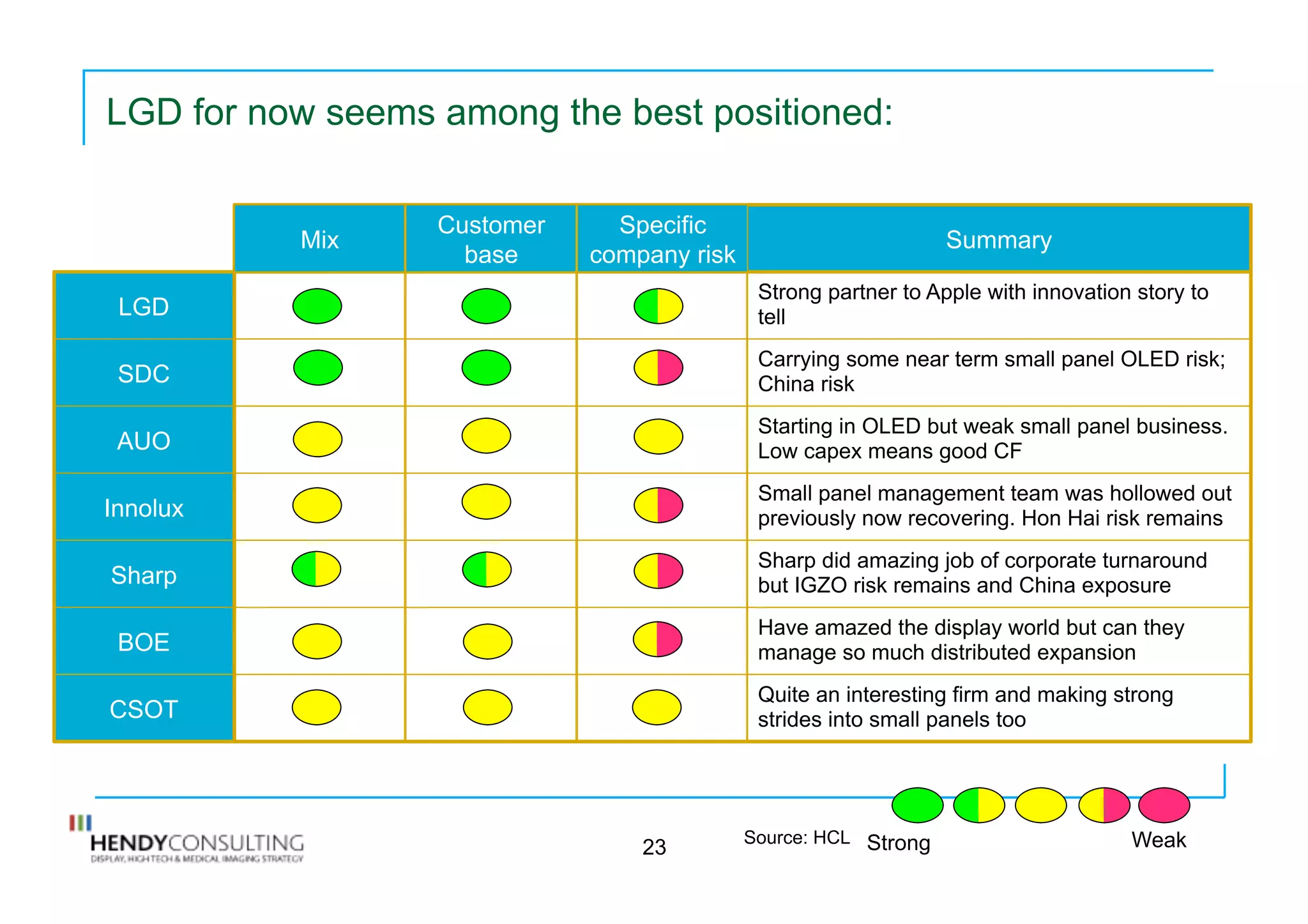

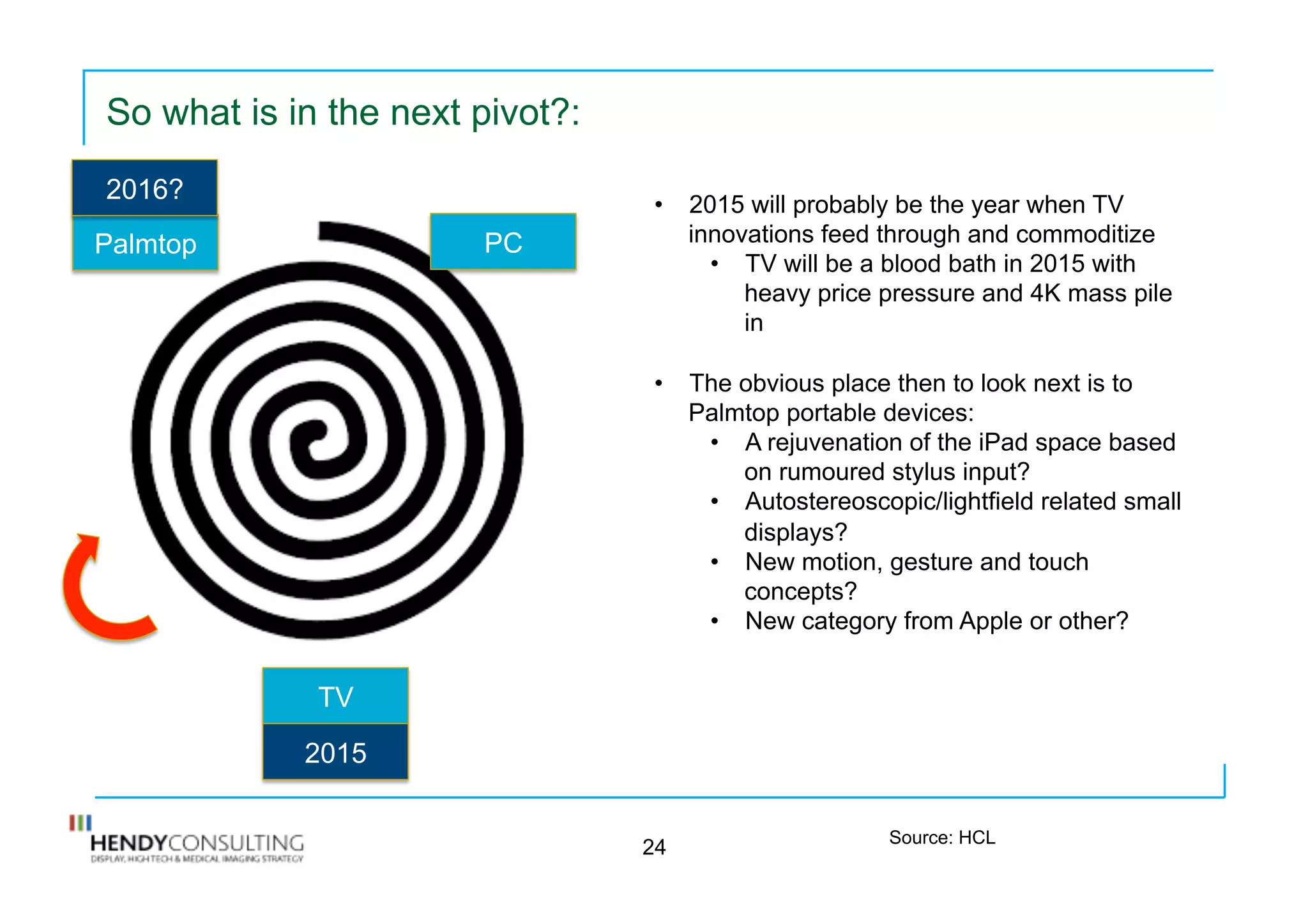

This document provides an overview and analysis of the display industry in 2014 and projections for 2015. It summarizes that 2014 was a reasonable year for profits but the industry has historically destroyed value. It also notes that the pivot to LCD displays is largely complete while the pivot to OLED displays for mobile is just beginning. The document predicts that 2015 will be a tough year with price pressures in China where significant new capacity is being added.