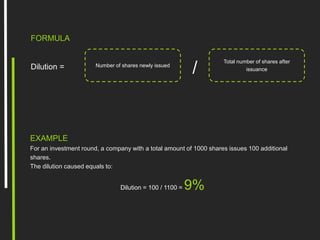

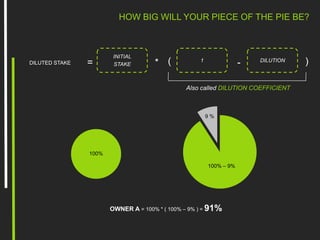

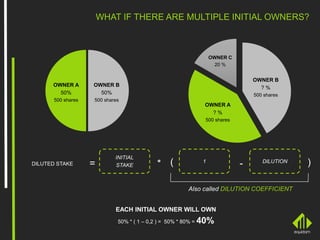

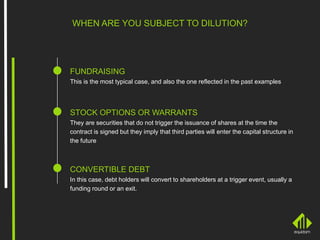

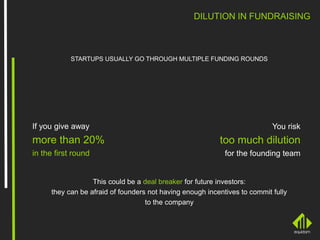

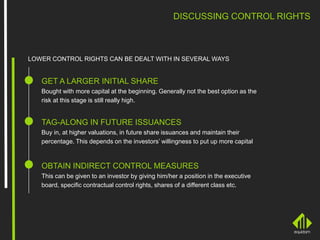

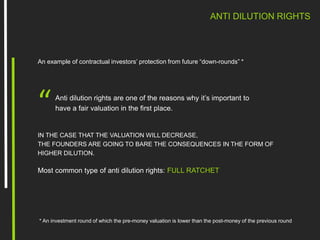

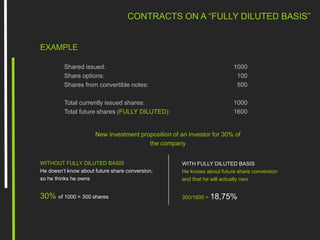

The document explains the concept of dilution for startup owners, highlighting its impact on ownership percentages and the importance of considering it during investment rounds. It covers situations leading to dilution, such as fundraising and issuance of stock options, and emphasizes how founders must negotiate to protect their shares. Additionally, the text discusses anti-dilution rights and the need for clear contractual terms regarding dilution to avoid misrepresentations of company ownership.