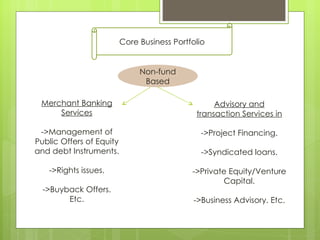

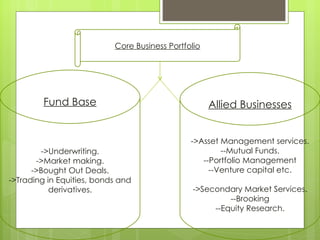

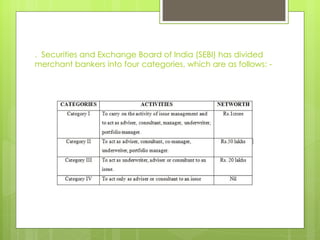

The document discusses merchant banking in India. It defines merchant banking as arranging loans for companies and dealing in international finance, stocks, and launching new companies, without providing normal banking services to the public. It notes that merchant banking originated in Italy and France and later spread to the UK and US. In India, merchant banking became popular in 1983-84 and was first initiated by Grindlays Bank in 1969, providing public issue management and financial consulting. The functions of merchant banking include corporate counseling, portfolio management, venture capital financing, mergers and acquisitions, project counseling, and underwriting. SEBI classifies merchant bankers into four categories in India.