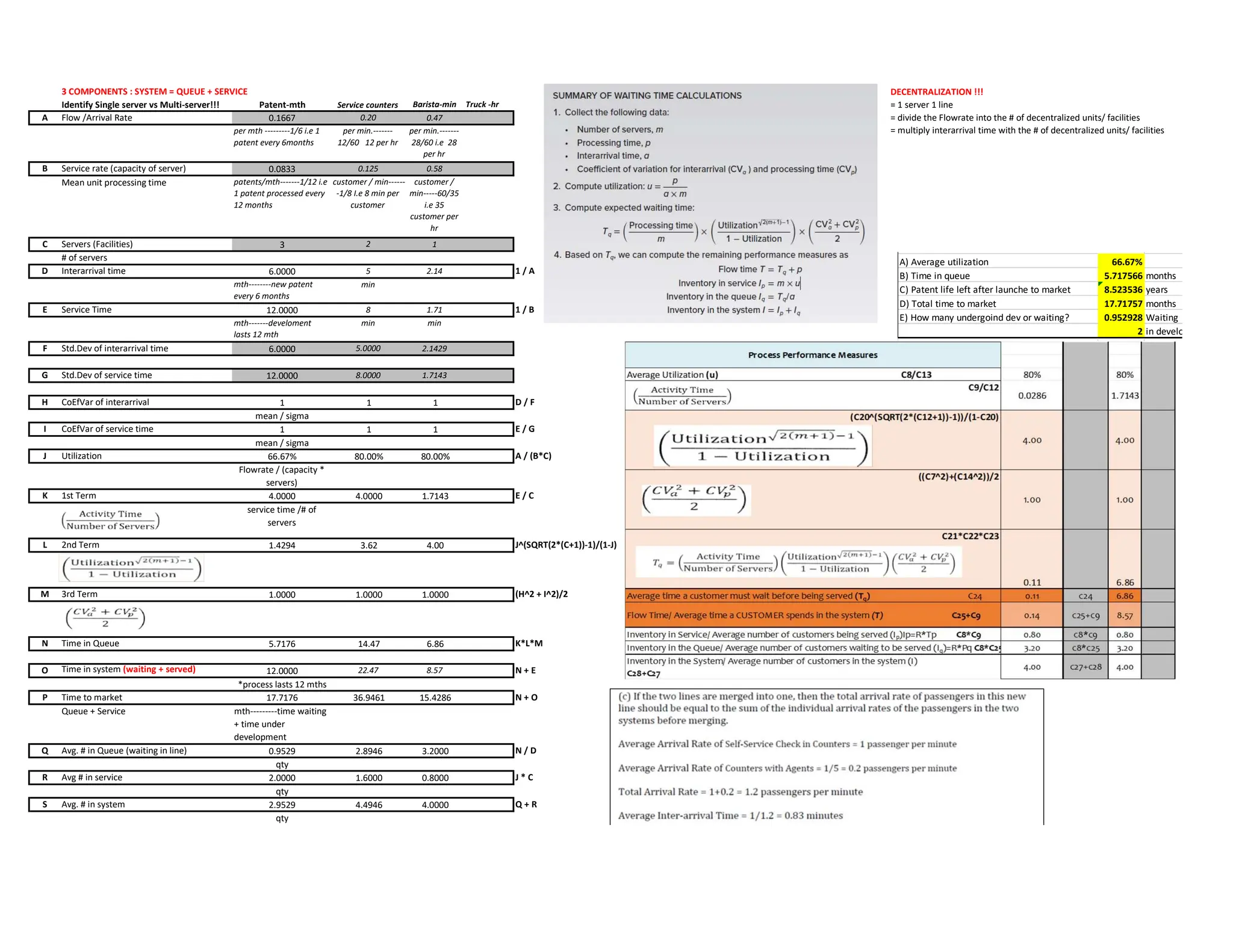

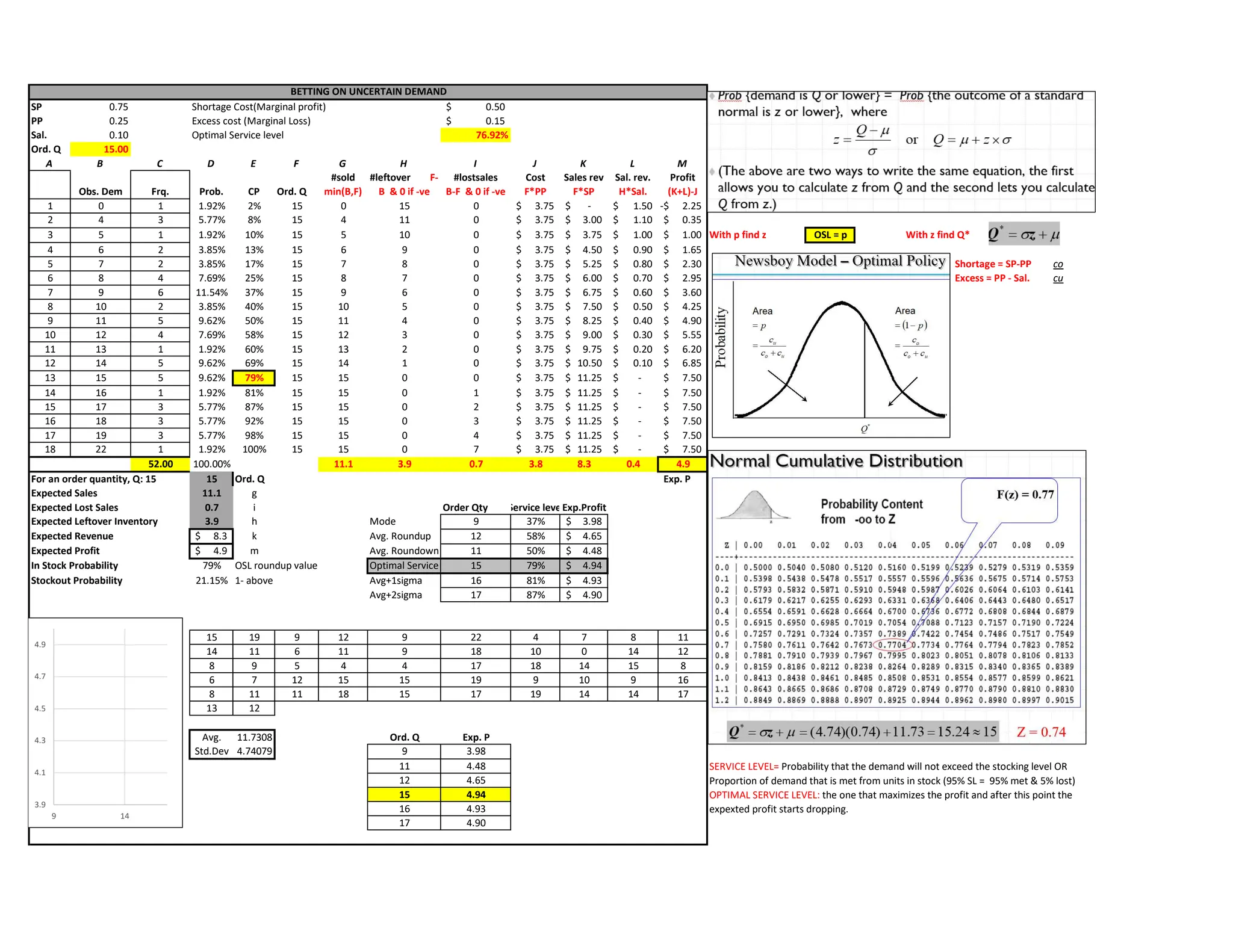

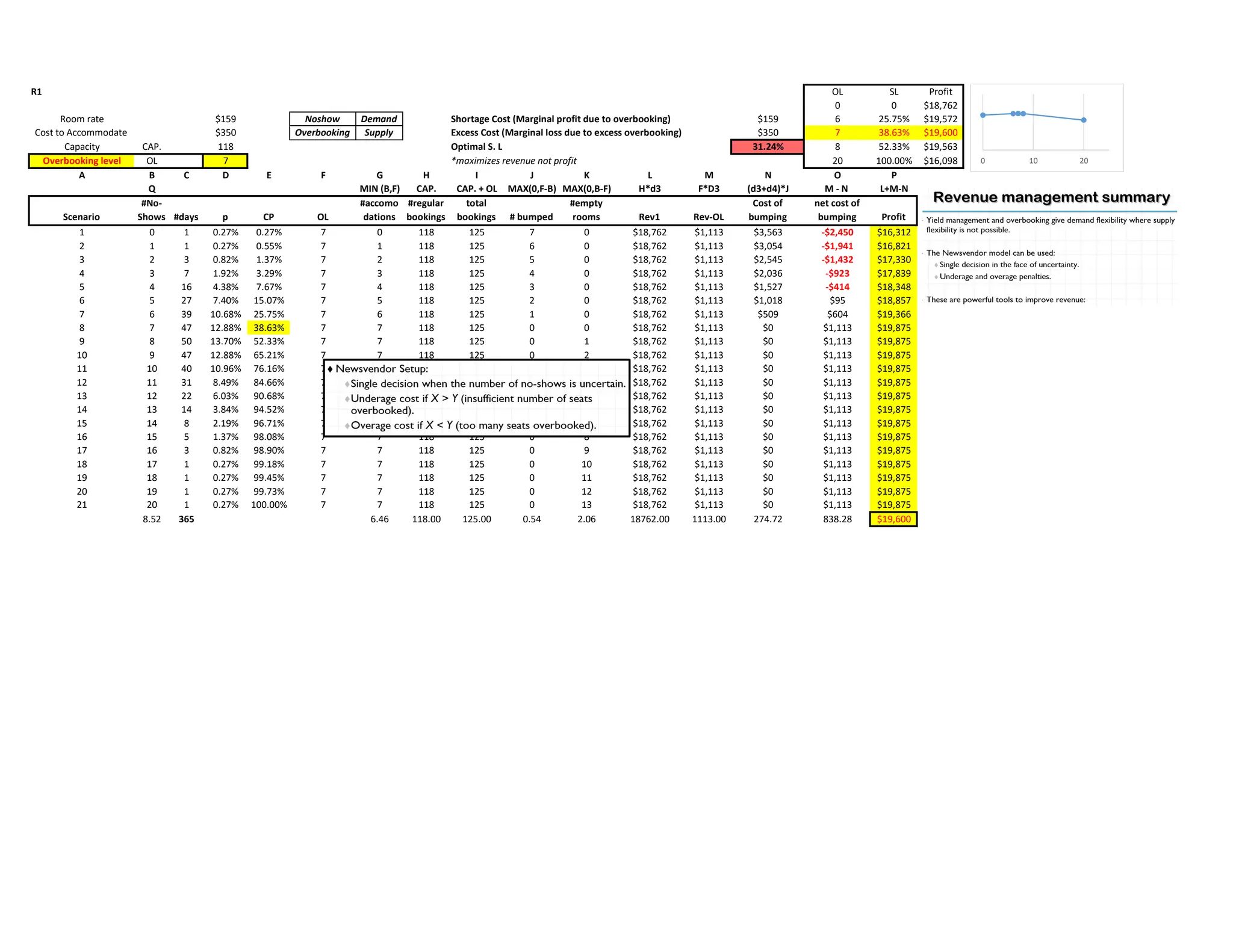

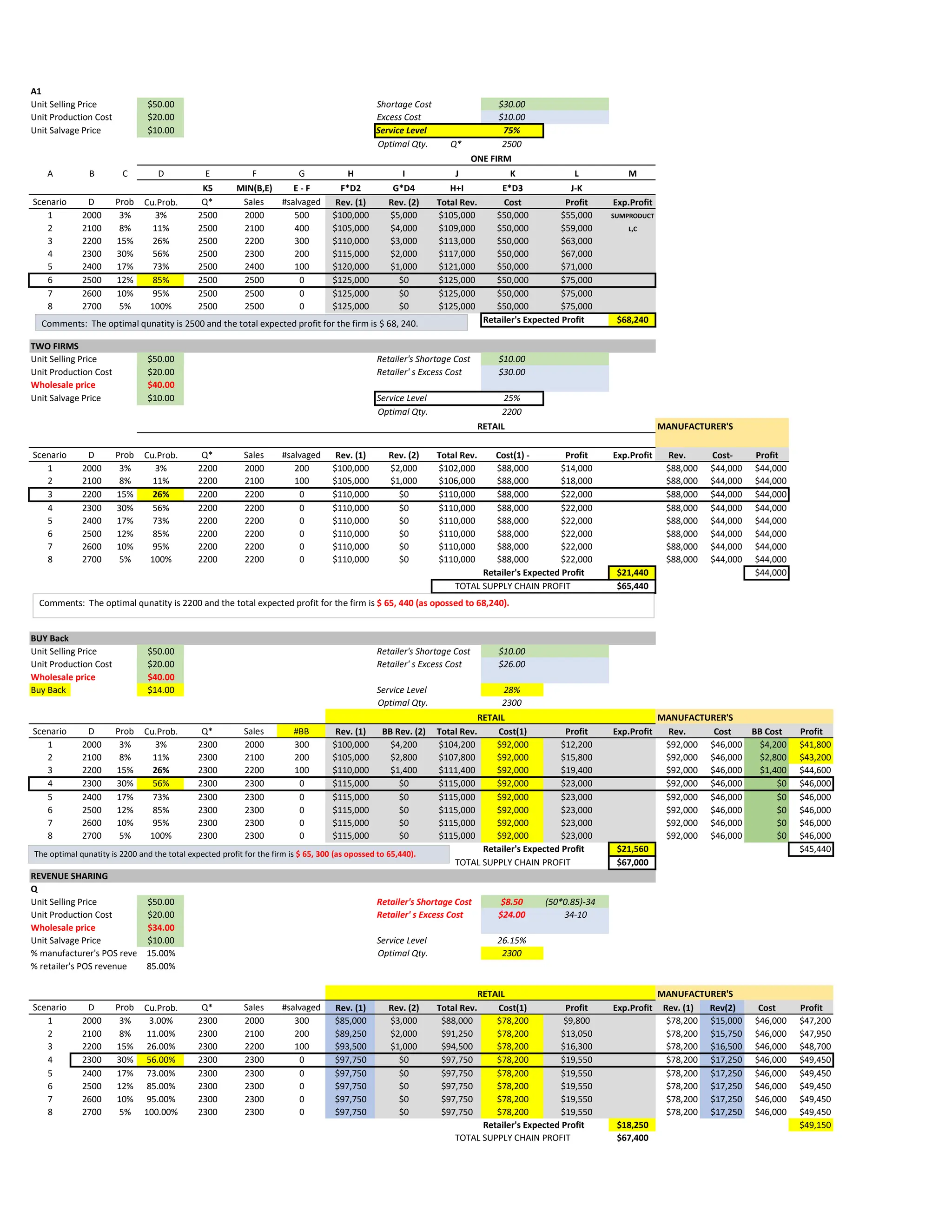

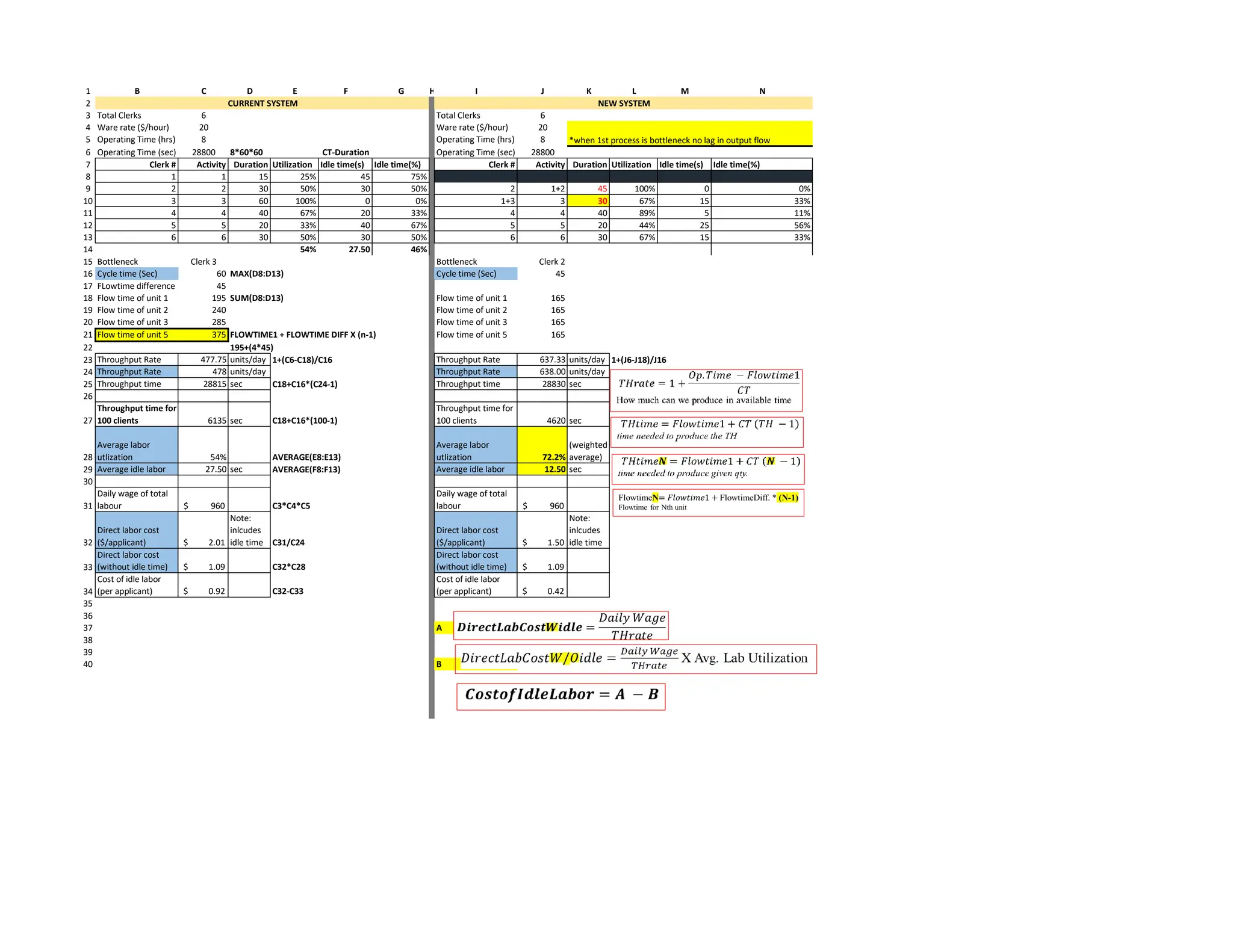

The document provides a detailed analysis of labor utilization, bottlenecks, throughput rates, and cost calculations for a production system involving clerks and various operations. It includes comparisons between current and new systems in terms of process efficiencies, labor costs, and inventory management strategies. Multiple decision parameters, such as optimal order quantities and inventory levels, are evaluated, alongside recommendations for process improvement.

![#of Samples above UCL mean

10%

No. samples Time Frame of analysis changes:

Sample size Sample size n

Standard Deviation Number of samples

Estimated standard Dev

A2

D3 Z

D4 2-sigma 68.30%

4-sigma 95.50%

6-sigma 99.70%

1.4 sigma

Sigma Level: [(USL – Process Mean) / Standard Deviation] =>

Sigma Level: [(LSL – Process Mean) / Standard Deviation]

X-bar Chart

Detects shift

Does not reveal increase

R-chart

Does not detect shift

Reveals increase

WHEN, Cp >1, the tolerance range is greater than the process range and hence the process is capable of being within the design specification.

RECOMMENDATIONS, Try out different upper specification = 9, 10.5 minutes, 11 minutes, and 11.5 minutes and compute the process capability ratio and

recommend one of them

Minimum of these two

ranges

sample

of

average

the

of

multiple

a

minus

mean

grand

ranges

sample

of

average

the

of

multiple

a

plus

mean

grand

R

ranges

sample

of

average

2

2

R

A

x

LCL

R

A

x

UCL

R

ranges

sample

of

average

the

of

multiple

A

ranges

sample

of

average

the

of

multiple

A

3

4

R

D

LCL

R

D

UCL

population

in the

defective

fraction

the

is

before

as

,

)

1

(

LCL

p

z

n

p

p

where

z

p

z

p

UCL

p

p

p

PROBABILITY OF A UNIT FALLING BELOW LCL AND ABOVE UCL

LSL 100 USL 98

Mean 95.6 Mean 95.6

Estimated standard Dev 2.3 Estimated standard Dev 2.3

Probability 97.21% Probability 14.84%

NORM.DIST(LCL,MEAN,ESTI,1) 1-NORM.DIST(USL,MEAN,ESTI,1)](https://image.slidesharecdn.com/amerged-240628040306-eb97c697/75/Formulae-for-business-process-management-4-2048.jpg)