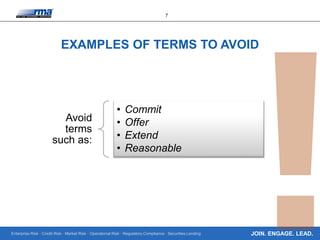

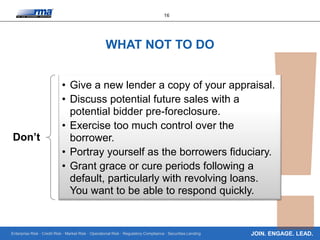

The document discusses critical risk management principles in the context of banking, particularly focusing on securities lending and the importance of careful documentation and communication. It highlights the enforceability of contractual promises, the significance of due diligence, and precautions to prevent misunderstandings and legal issues. The document emphasizes proactive measures to mitigate risks before problems arise, especially in the context of potential borrower bankruptcies.