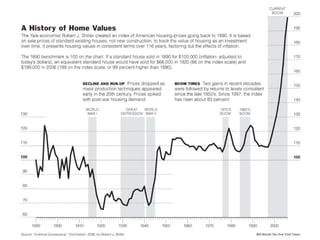

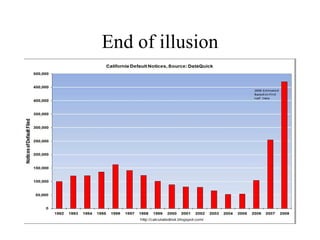

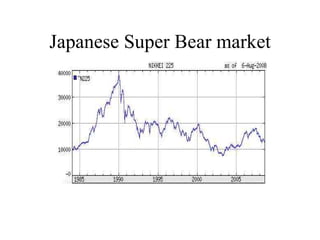

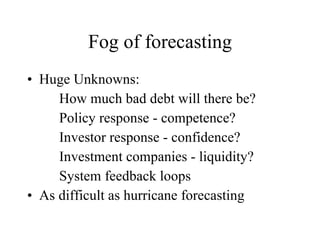

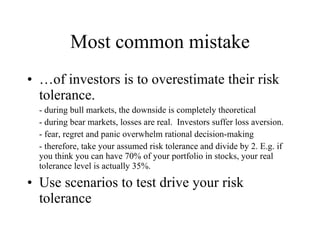

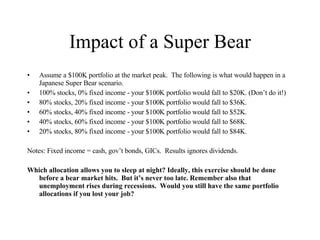

The document discusses the origins and impacts of the credit crunch crisis that began in the late 1990s, highlighting the housing market's bubble and the subsequent financial failures of major institutions. It examines the effects of falling real estate prices, rising unemployment, and increasing default rates, as well as the ramifications for both the U.S. and global economies. Additionally, it offers insights on investment strategies and risk tolerance during bear markets, emphasizing the importance of preparation and cautious decision-making.