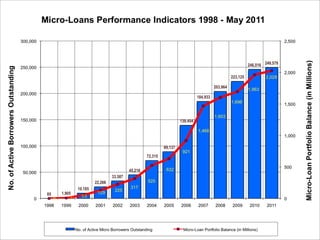

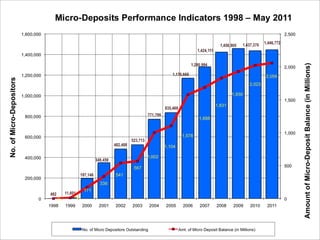

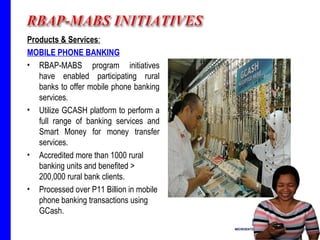

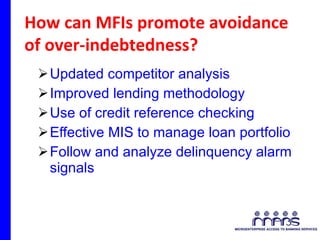

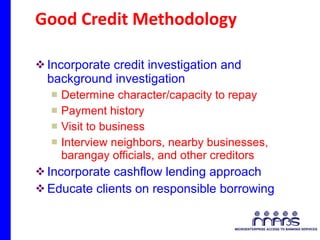

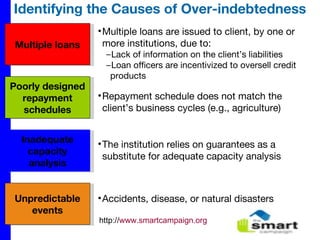

The RBAP-MABS program provides technical assistance and training to rural banks in the Philippines, enabling them to offer a variety of financial services to microenterprise clients. Key achievements as of May 2011 include servicing over 868,000 borrowers and facilitating significant agricultural and housing microfinance initiatives. The program also emphasizes preventing over-indebtedness through improved lending methodologies and client education on responsible borrowing.