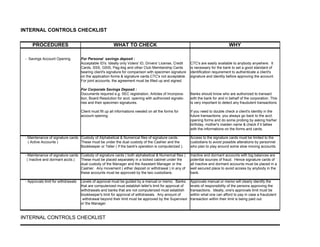

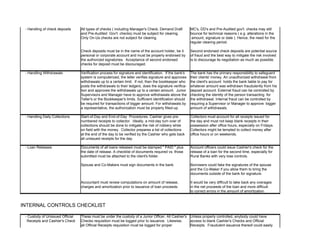

This internal controls checklist summarizes procedures that a bank should follow to properly manage accounts, transactions, and protect against fraud. Key points include:

- Requiring proper identification for account openings and maintaining signature cards in secure storage.

- Establishing approval limits for tellers, bookkeepers, and managers for withdrawals and other transactions.

- Ensuring proper verification and endorsement of check deposits and following clearing periods.

- Having collectors account for all receipts issued and turn over daily collections to mitigate robbery risks.

- Reviewing loan release documents and amounts to prevent duplicate issuances or errors.

- Maintaining custody over unissued receipts and checks and logging all requisitions for proper accounting