The document outlines instructions for a cybersecurity research paper focusing on the TJX security breach incident, requiring a minimum of five authoritative sources. It details the vulnerabilities that led to the breach, including inadequate wireless security, improper data storage practices, and failure to encrypt customer data. Additionally, the paper emphasizes the lessons learned for auditors and retailers regarding data protection and compliance with industry standards.

![encrypted, or the hackers stole the encryp-

tion key. In either case, industry standards

were not maintained hy TJX. PCI Data

Sectirity Standard 3.4 i-et]uires that at min-

imum, the customer's "primary account

number" (i.e.. the customer's card number)

be "rendered unreadable.'' Furtheniiore. PCI

Data Security Standards 3.5 and 3.6

nitjuire merchants to pnMect tlie encryption

keys used for protecting customer data from

disclosure and misuse.

How the TJX Breach Affects

Audit Practices

At firNt. the TJX fiasco appears to offer an

object lesson for retailers" IT departments,

rather tkui auditors. After all, aistomeni' cred-

it card numbeis are not the retailer's asset to

protect; rather, the sales transaction itself is

what accounting intentai controls have tradi-

tionally sought to secure. With the atlvent of

Statement on Auditing Standaitl (SAS) 109,

UnderstíUKÜng ¡Iw Entity and ¡ts Envimntnent

and Assessing the Risks of Material

Misstatemctu. internal control clearly

extends beyond protecting one's own assets.

SAS 109 requires auditors to "audit die

business, and not just the books'" when

evaluating the risks of a client's financial

statements containing a material misstate-

ment. Specifically, SAS 109 requires an

understanding of: 1 ) the entity and its envi-

ronment: 2) the entity's intemal control](https://image.slidesharecdn.com/cybersecurityresearchpaperinstructionsselectaresearchtopic-221114172946-00562589/85/Cybersecurity-Research-Paper-instructionsSelect-a-research-topic-docx-5-320.jpg)

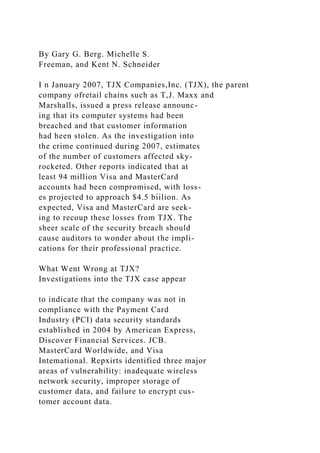

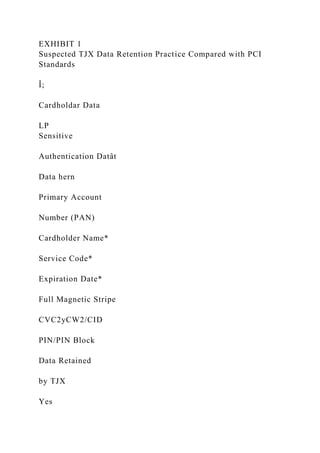

![Yes

Yes

Yes

Yes

Yes

Yes

PCI Retention

Standards

Yes

Yes

Yes

Yes

No

No

No

* Must be protected if stored in conjunction with PAN.

[. t Sensitive authenticaton data must not be stored after

authorization (even if encrypted].

EXHIBIT 2](https://image.slidesharecdn.com/cybersecurityresearchpaperinstructionsselectaresearchtopic-221114172946-00562589/85/Cybersecurity-Research-Paper-instructionsSelect-a-research-topic-docx-12-320.jpg)

![Differentiate yourself from other financial planners:

only a CPA can become a PFS

Access marketing tools to promote yourself and

increase new business

Receive media training and opportunities to participate

in public relations activities

Network with other thought leaders in the industry

:AICPA:

Menlion ptonio code RHX

Questions?

e-mail [email protected]

ISO Certified

AUGUST 2008 / THE CPA JOURNAL 37](https://image.slidesharecdn.com/cybersecurityresearchpaperinstructionsselectaresearchtopic-221114172946-00562589/85/Cybersecurity-Research-Paper-instructionsSelect-a-research-topic-docx-20-320.jpg)