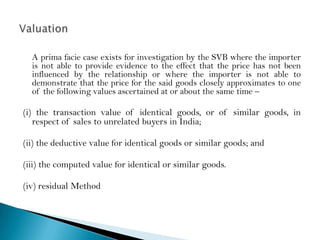

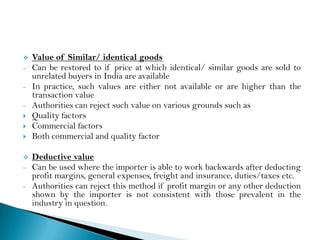

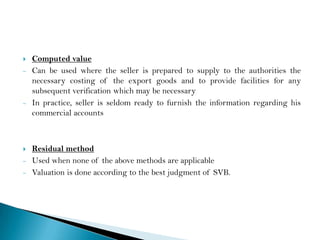

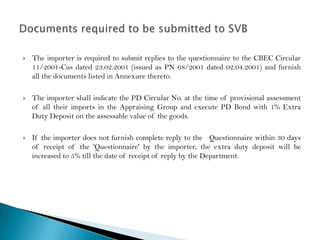

The Special Valuation Branch (SVB) investigates import transactions between related parties to determine if the relationship influenced the invoice price. Importers related to their supplier per the Customs Valuation Rules must register with SVB. SVB examines factors like identical goods prices, deductive value, computed value, or residual method to determine the proper assessable value. Importers must submit documents responding to SVB questionnaires, and assessments are provisional until SVB makes a final ruling, which generally lasts 3 years before renewal is required.