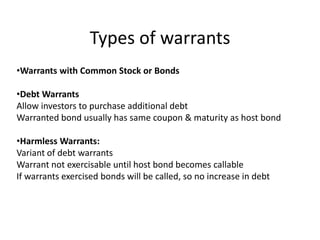

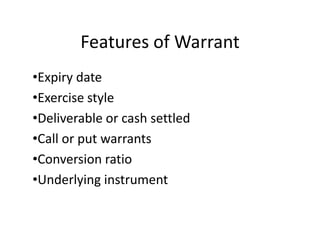

Warrants give holders the right to purchase shares of common stock from a company at a fixed price for a specified period of time. They are often issued with bonds. There are different types of warrants including those attached to common stock or bonds, debt warrants, and put warrants. Convertible bonds can be exchanged for a fixed number of shares and have characteristics of both debt and equity securities. Call options give the right to purchase shares at a specified price within a set time, while warrants are issued by companies to raise capital.