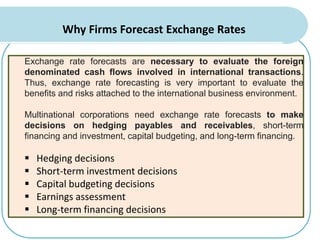

The document outlines the importance of forecasting exchange rates for multinational corporations, emphasizing its role in various financial decision-making processes such as hedging, capital budgeting, and investment. It details three primary forecasting techniques: technical, fundamental, and market-based forecasting, each with its own strengths and limitations. Additionally, it discusses market efficiency in relation to exchange rates and presents methods for forecasting currency volatility.