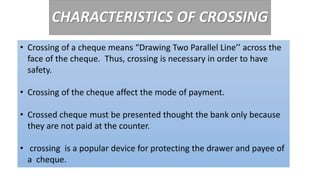

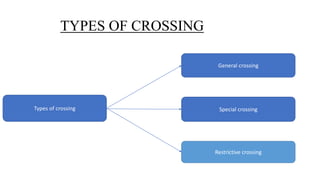

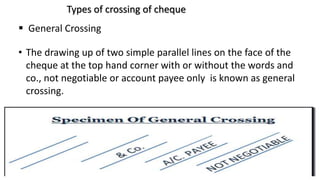

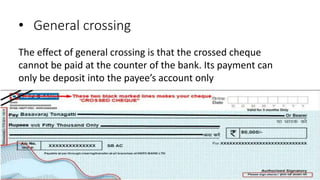

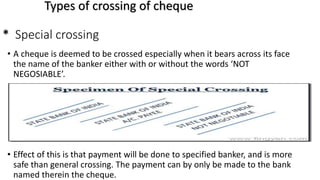

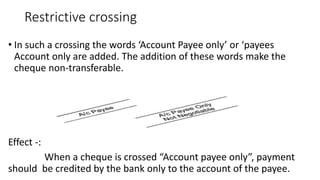

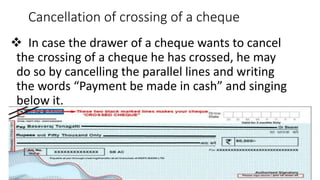

The document discusses different types of crossing that can be done on a cheque, including general crossing, special crossing, and restrictive crossing. General crossing involves drawing two parallel lines on the cheque and prevents it from being cashed over the counter. Special crossing names a specific bank for payment and is more secure than general crossing. Restrictive crossing adds words like "account payee only" making the cheque non-transferable and ensuring payment is credited only to the payee's account. The drawer, holder, or banker can cross a cheque depending on circumstances. Crossing can be cancelled by the drawer writing "payment be made in cash" and signing.