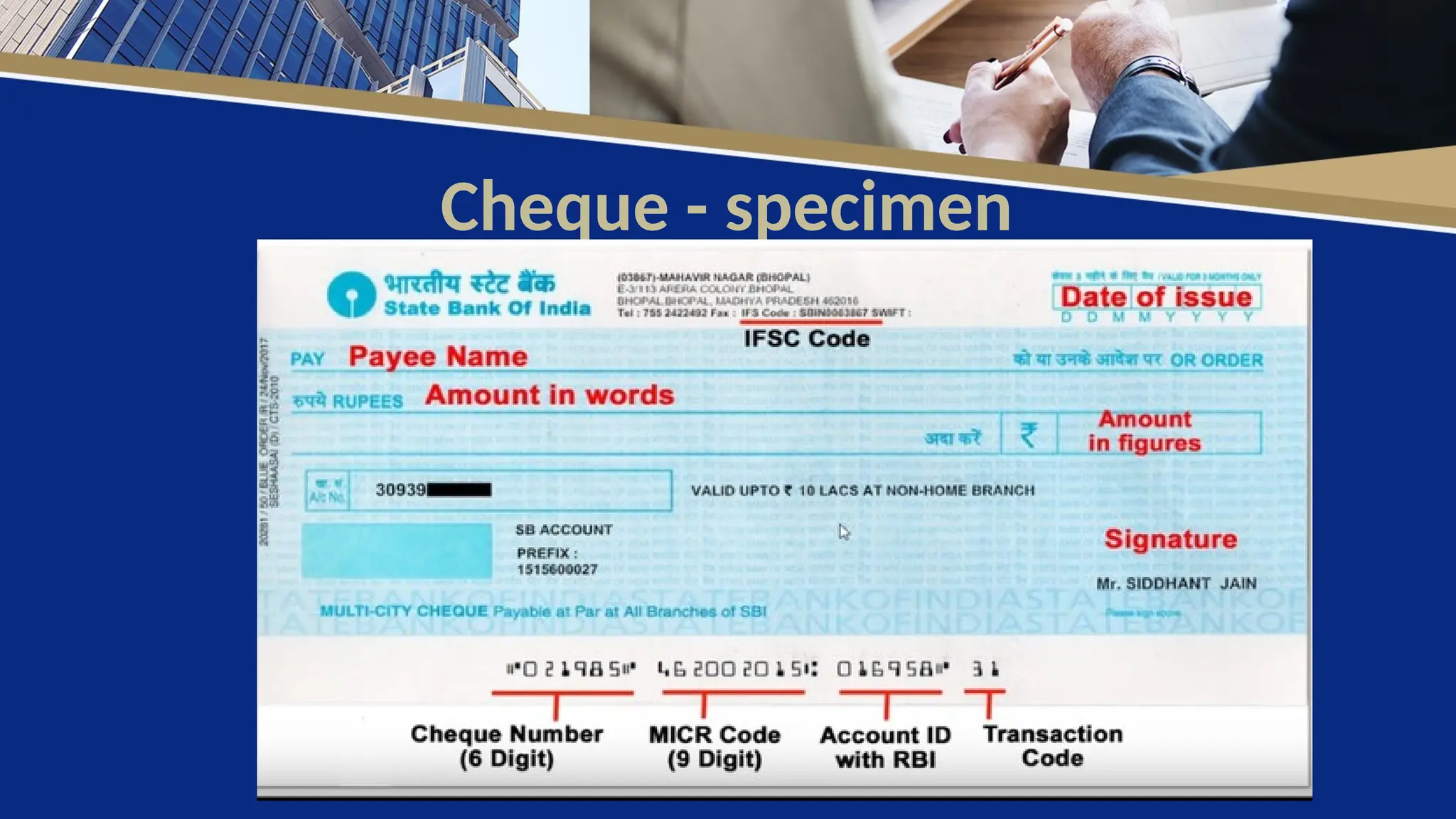

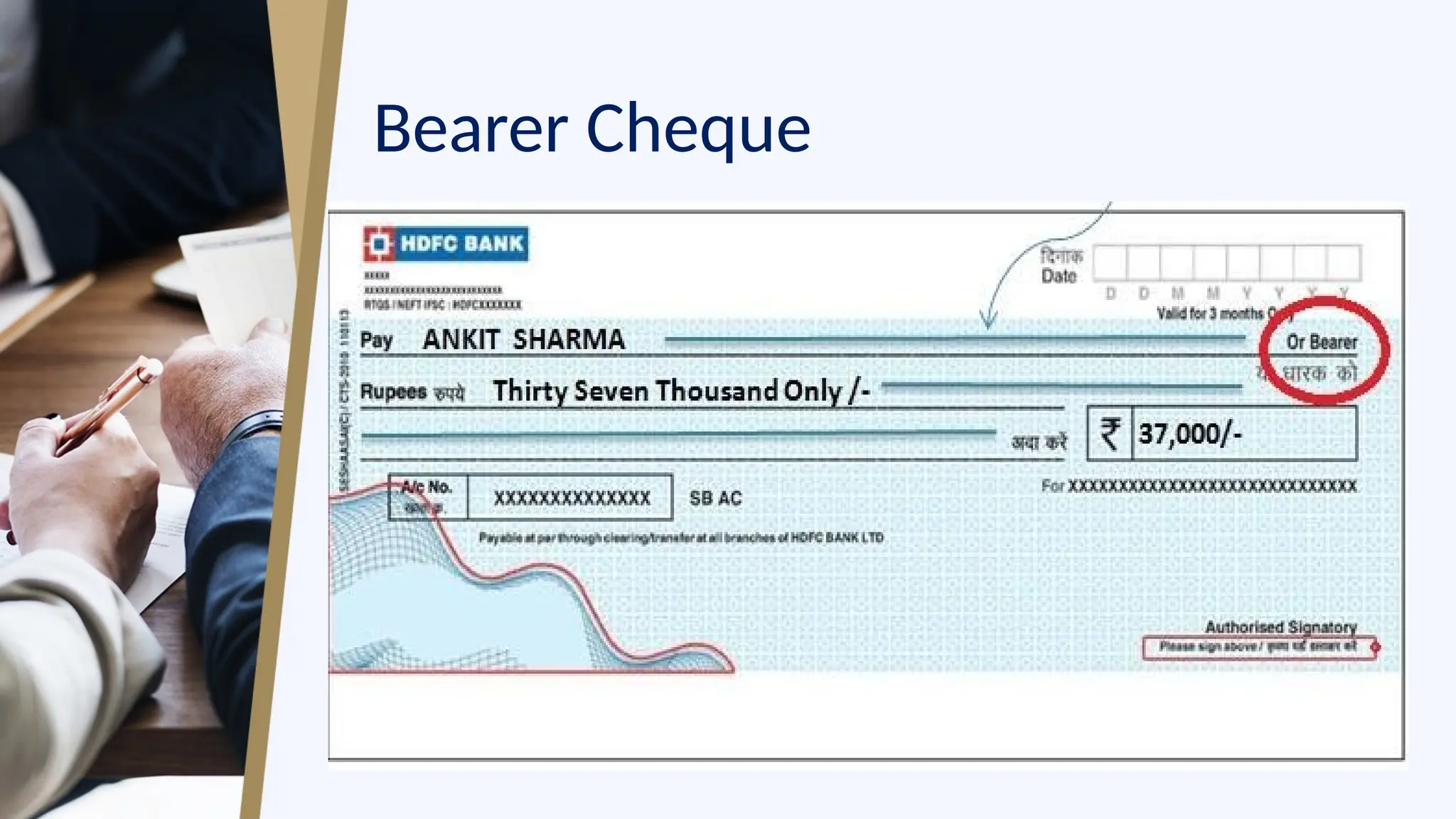

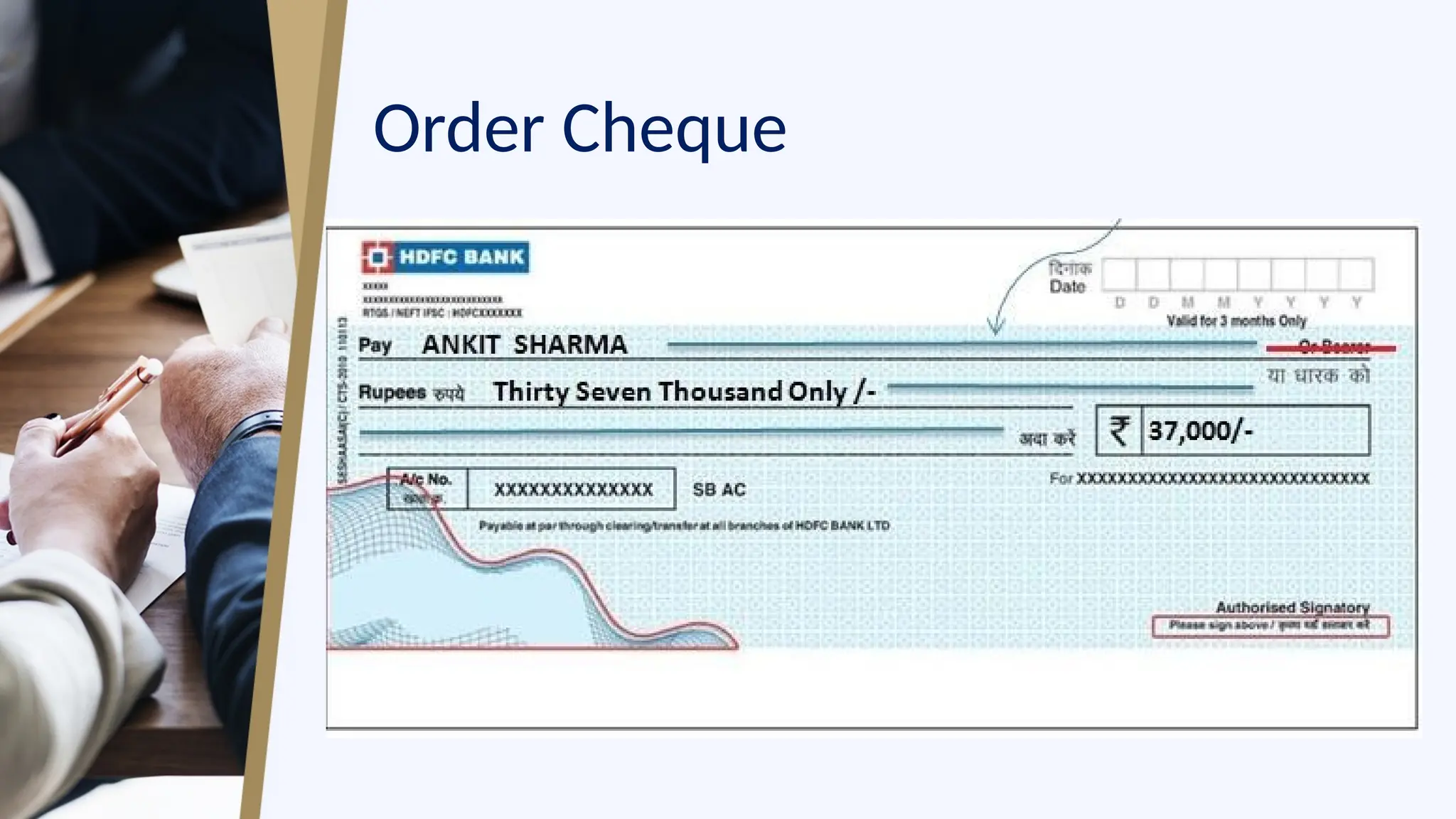

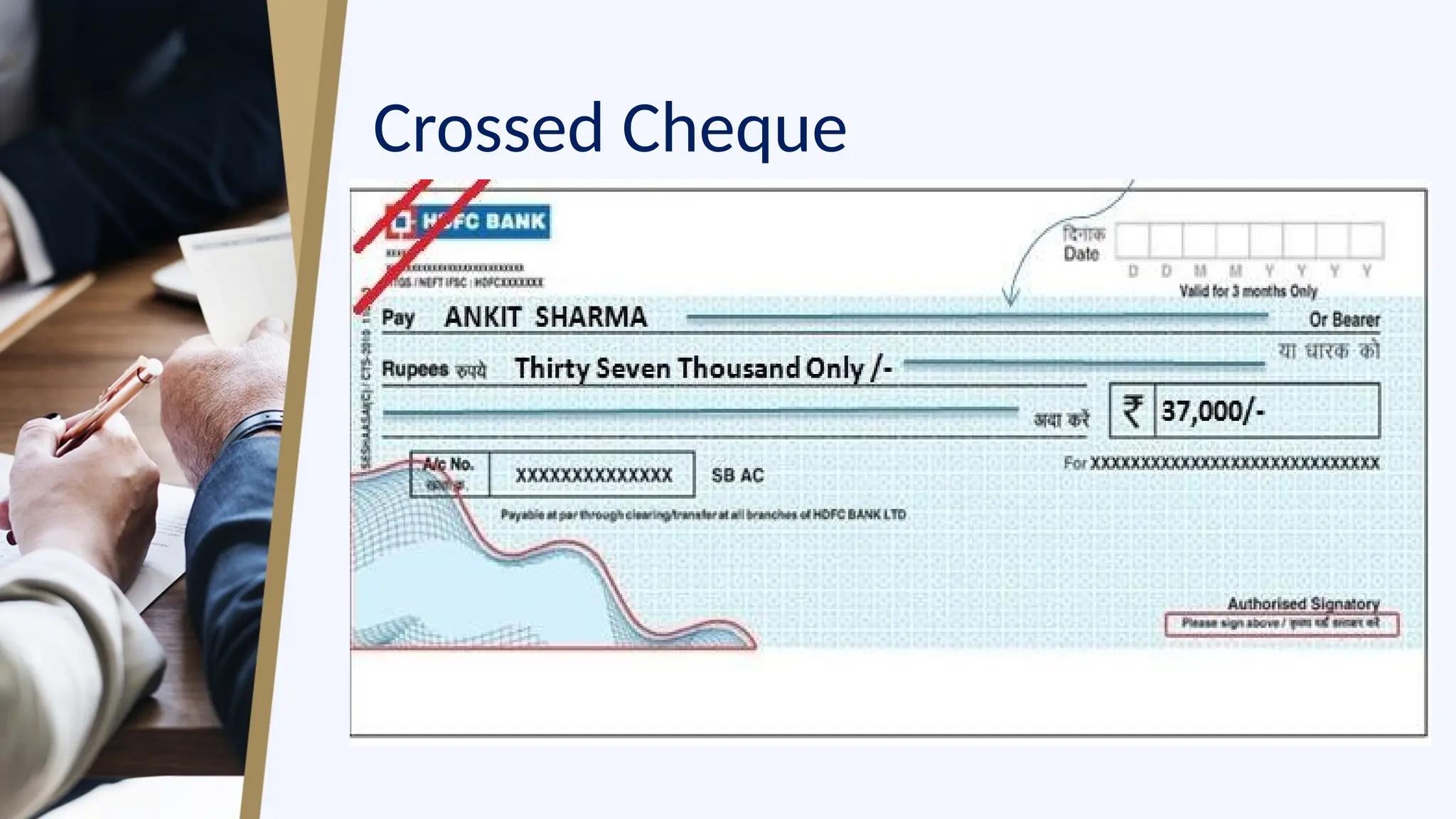

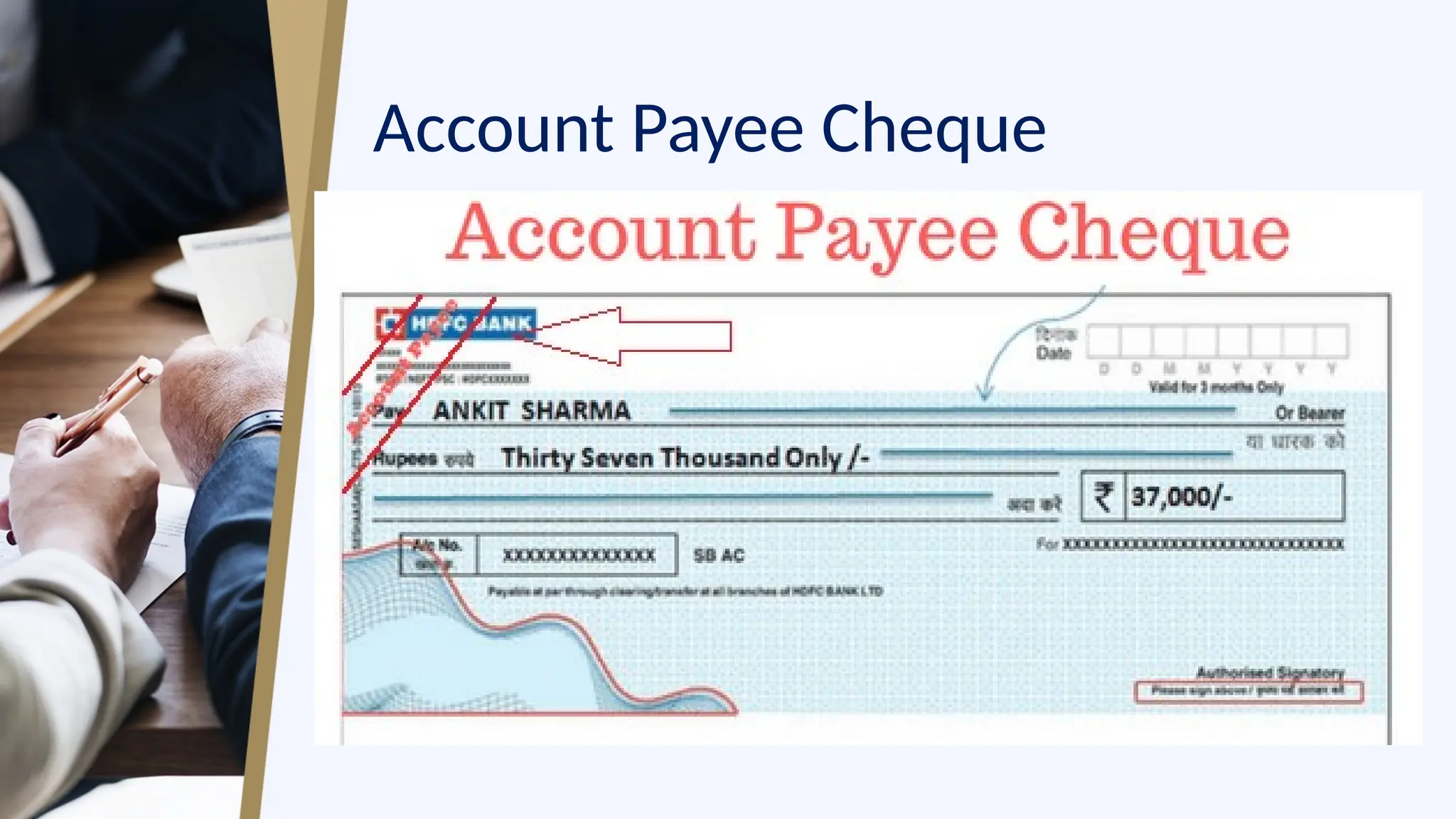

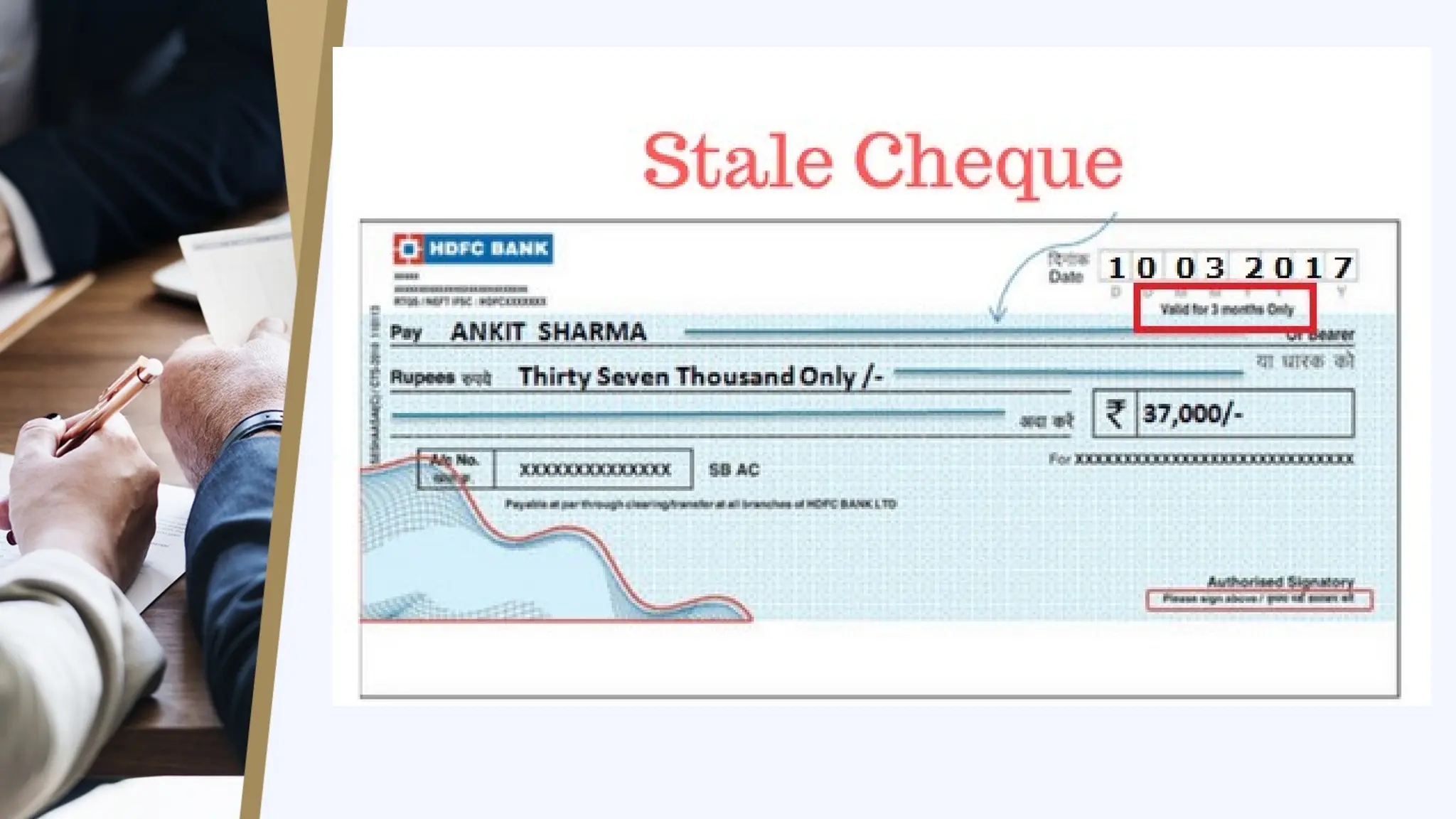

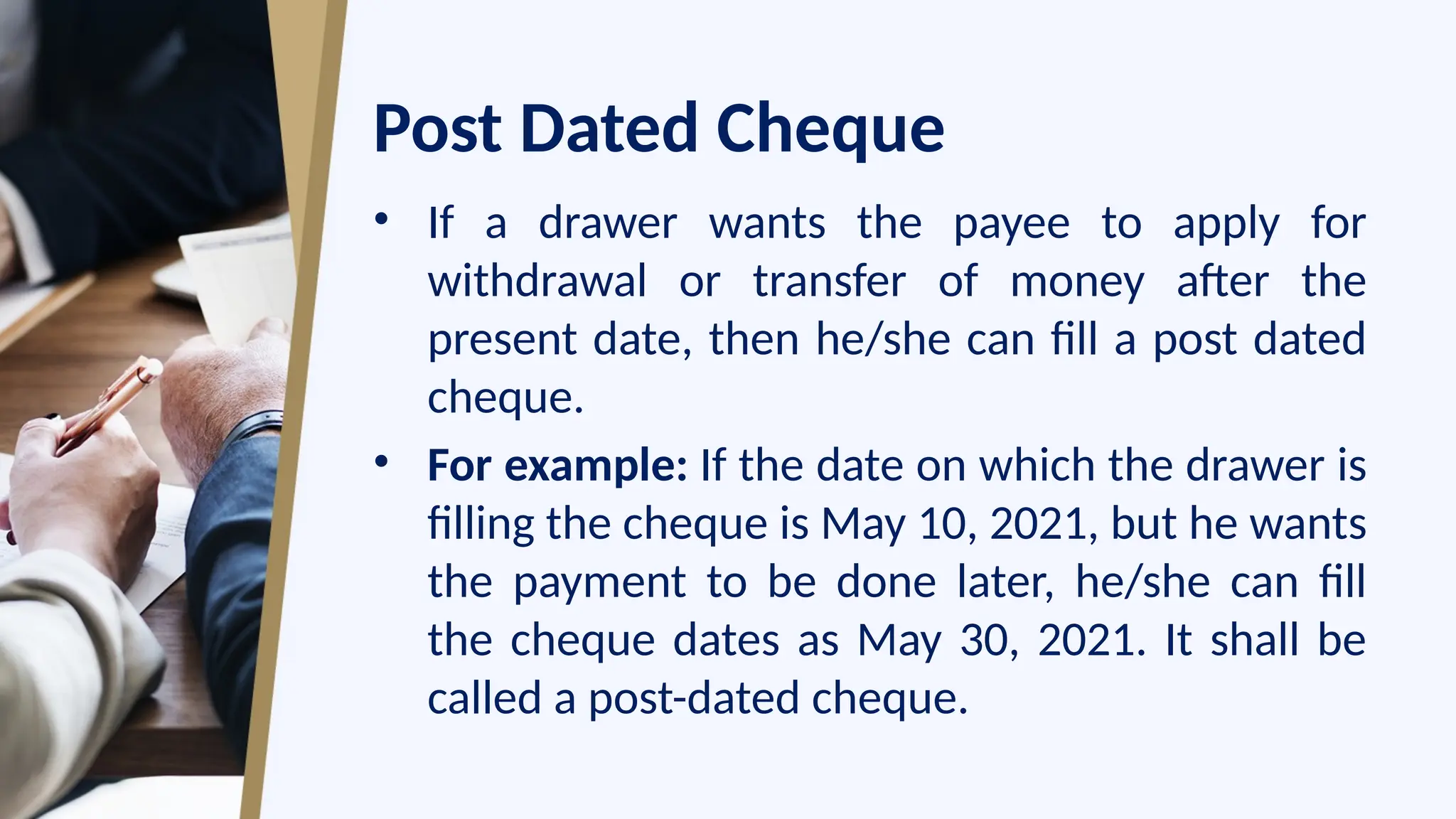

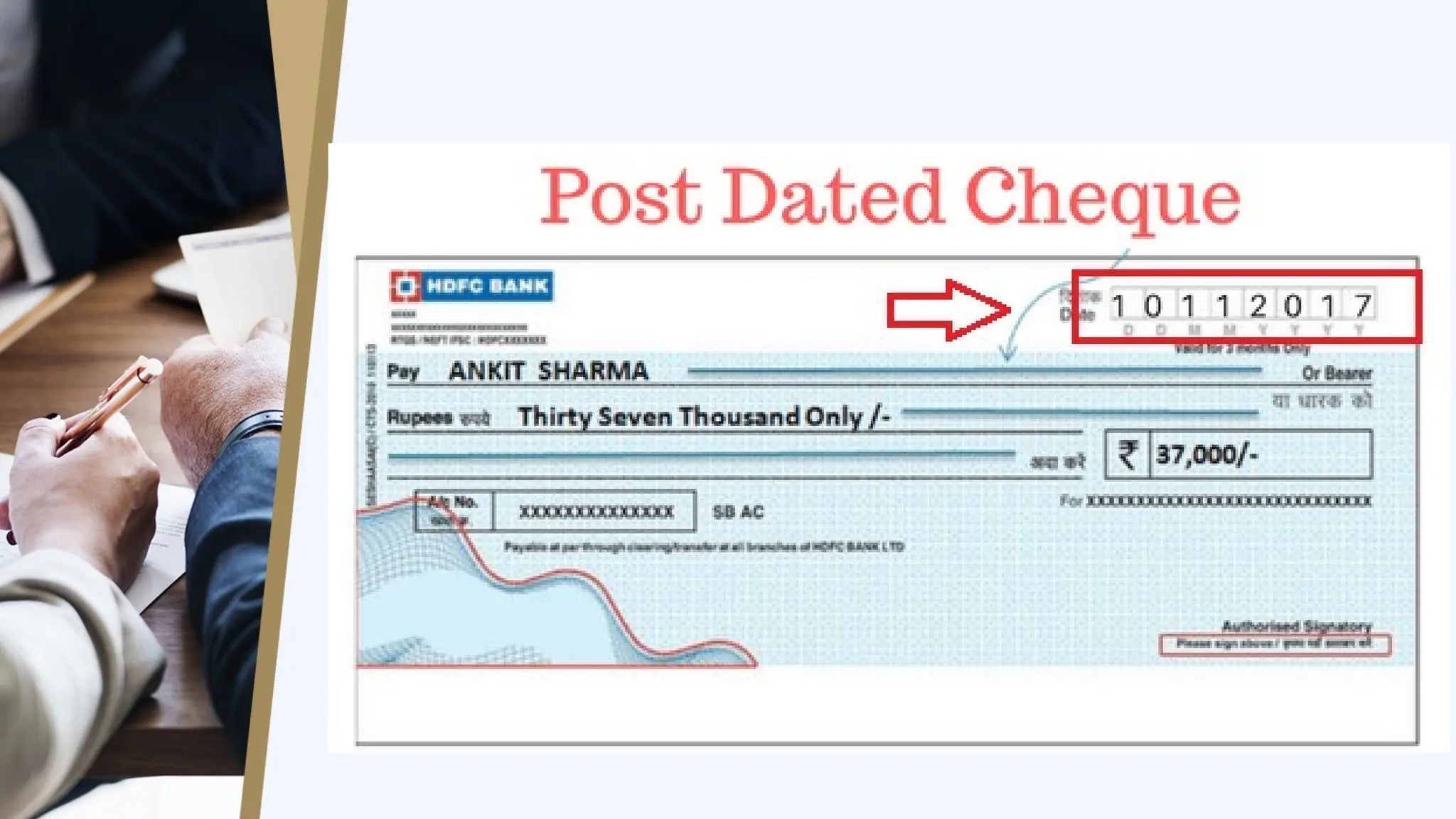

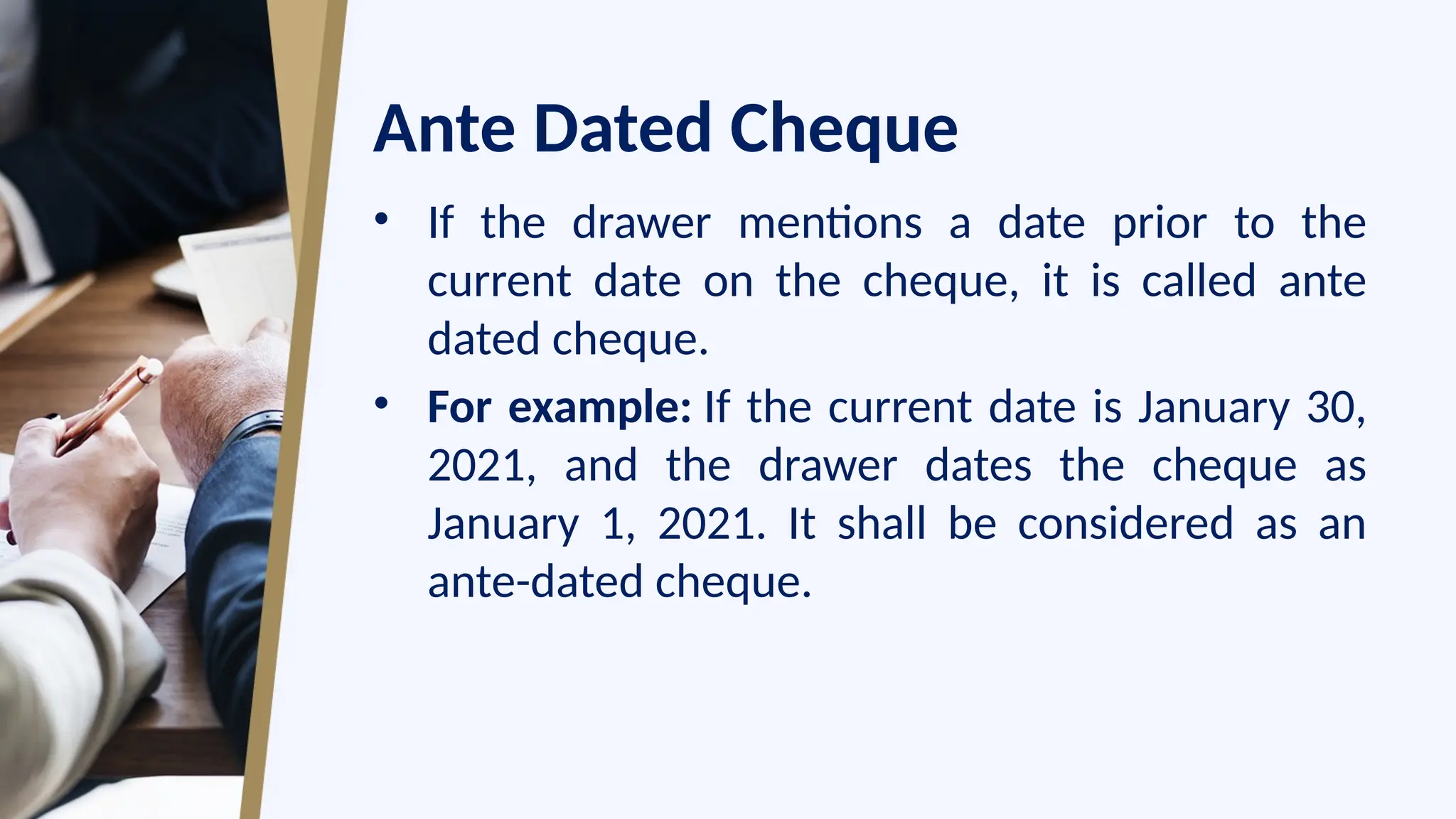

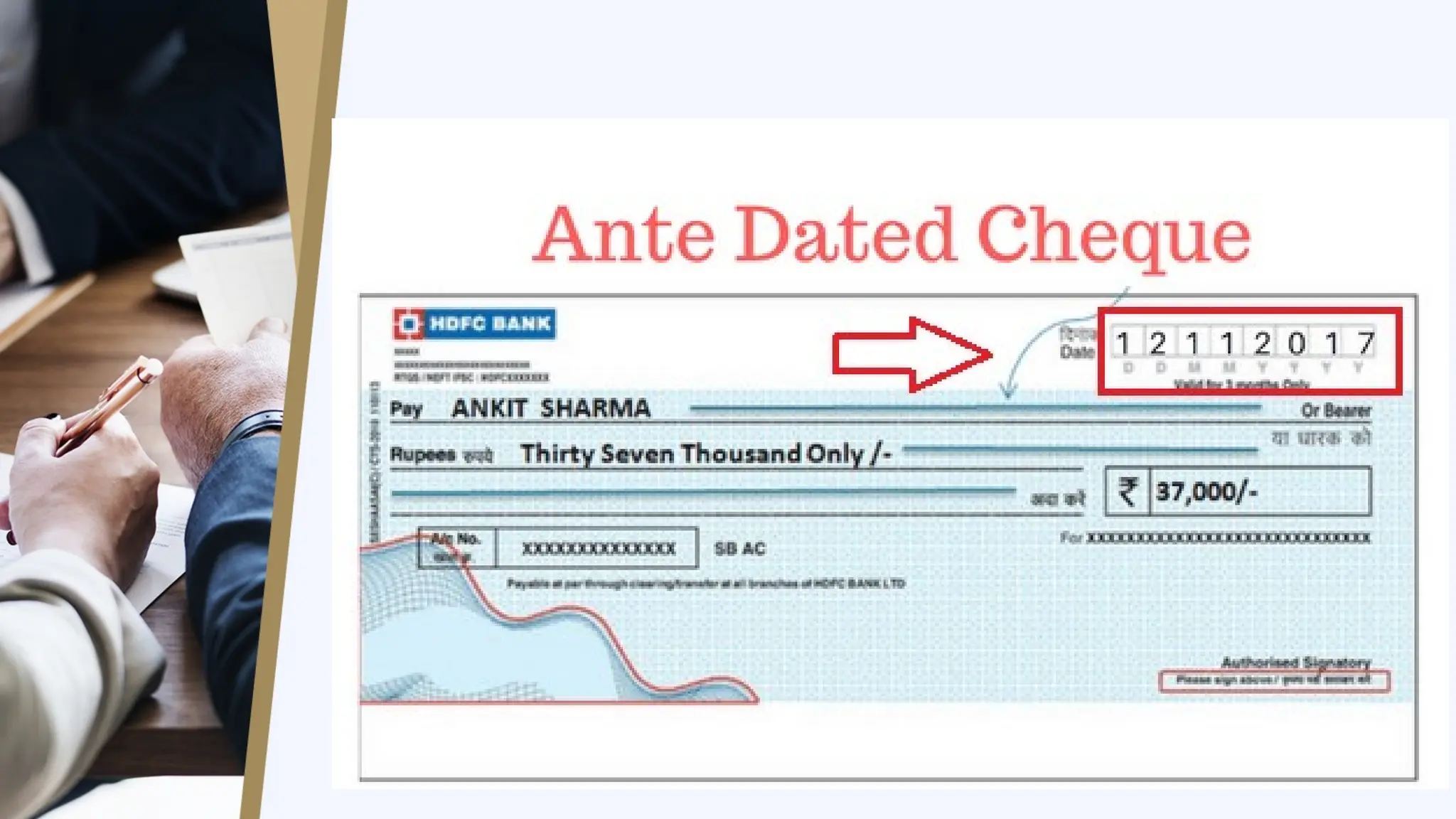

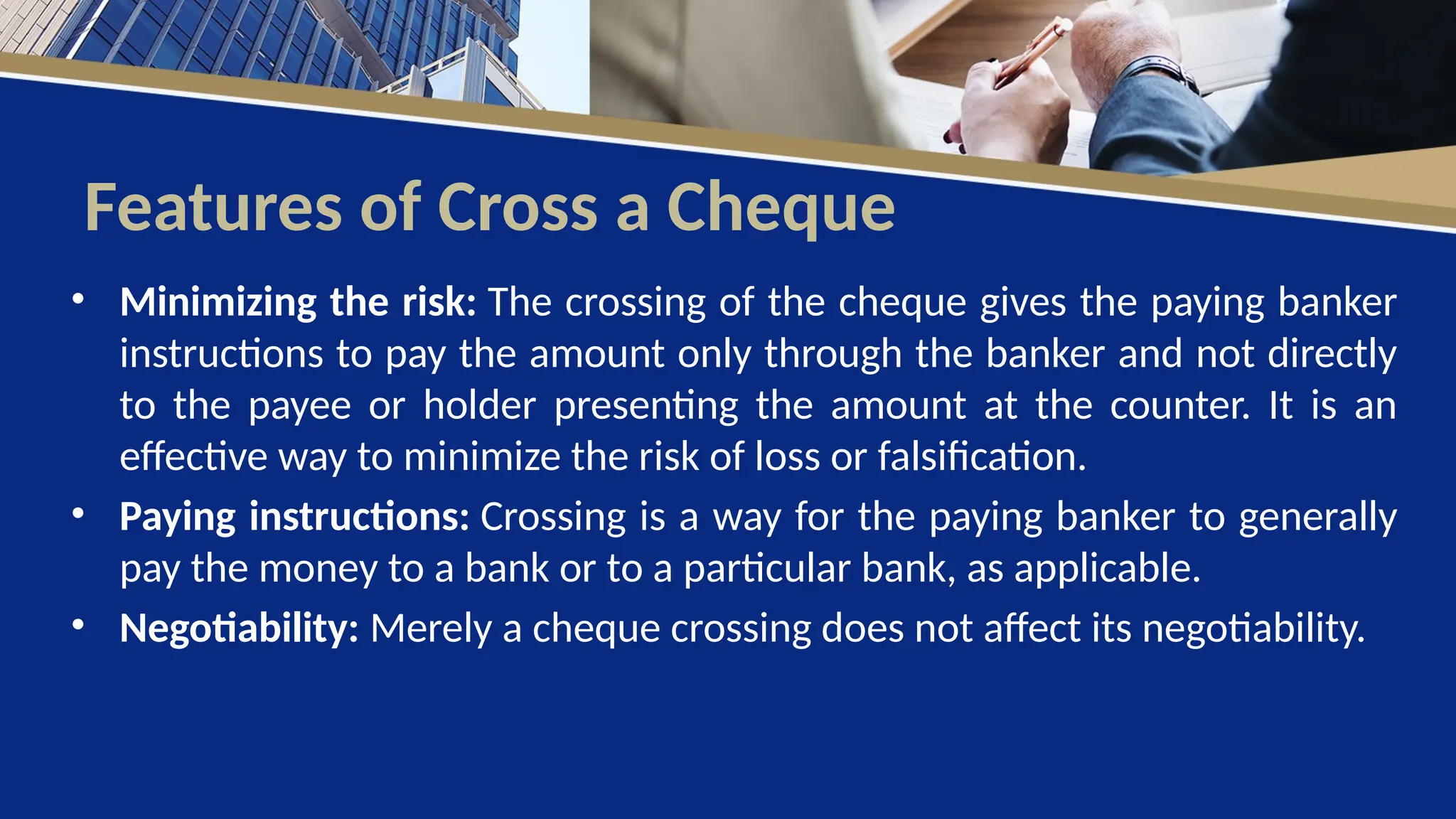

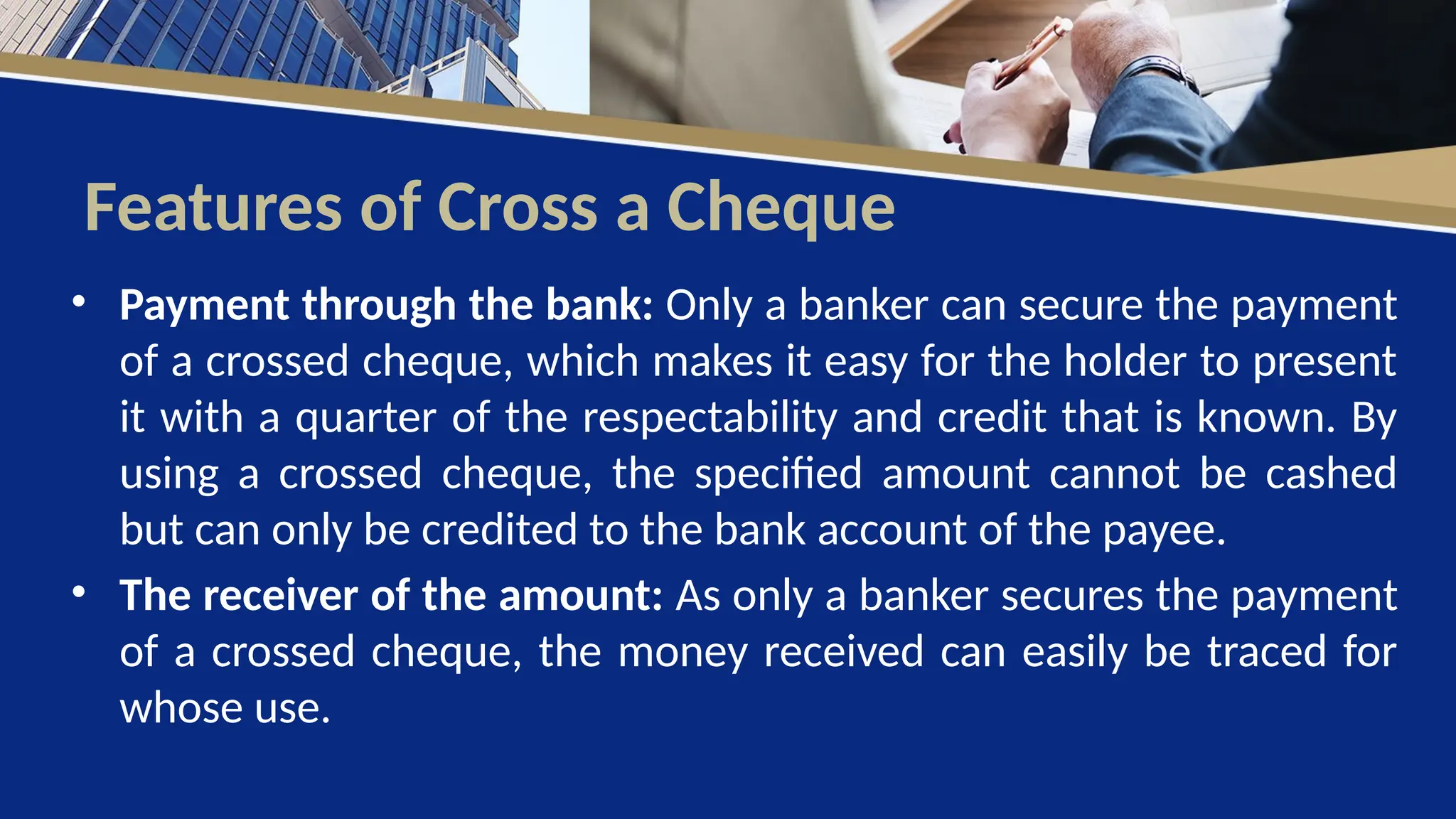

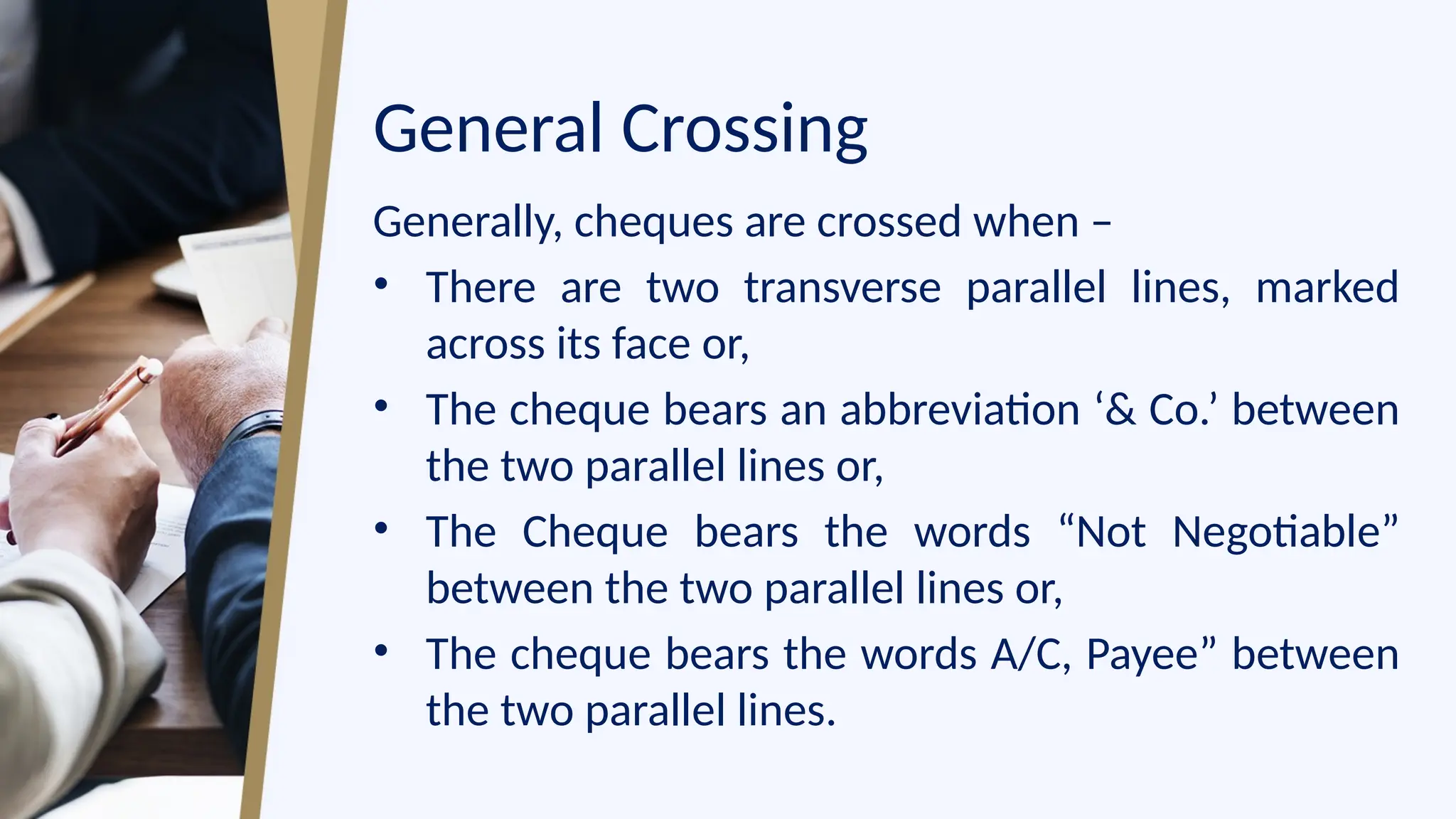

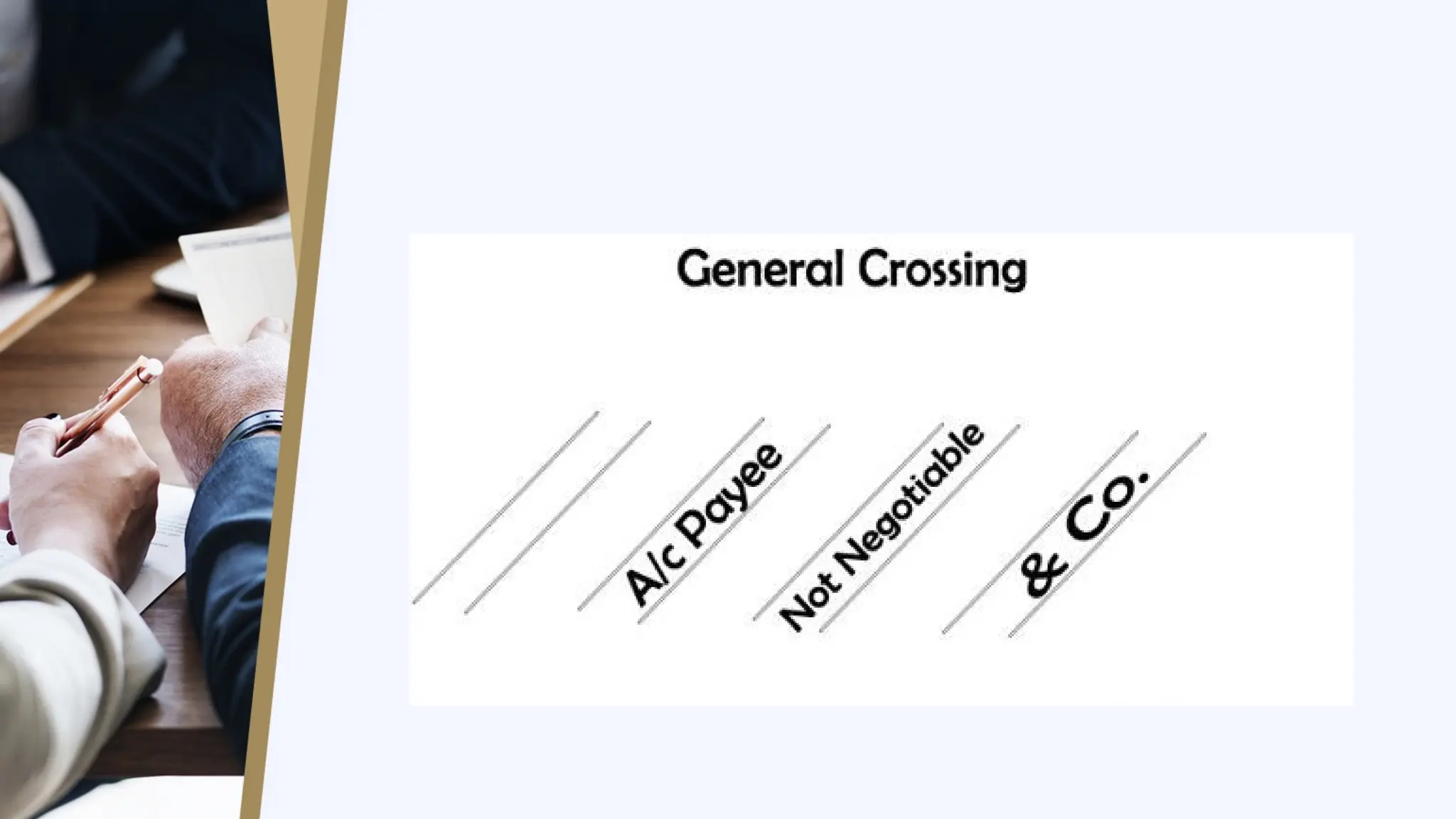

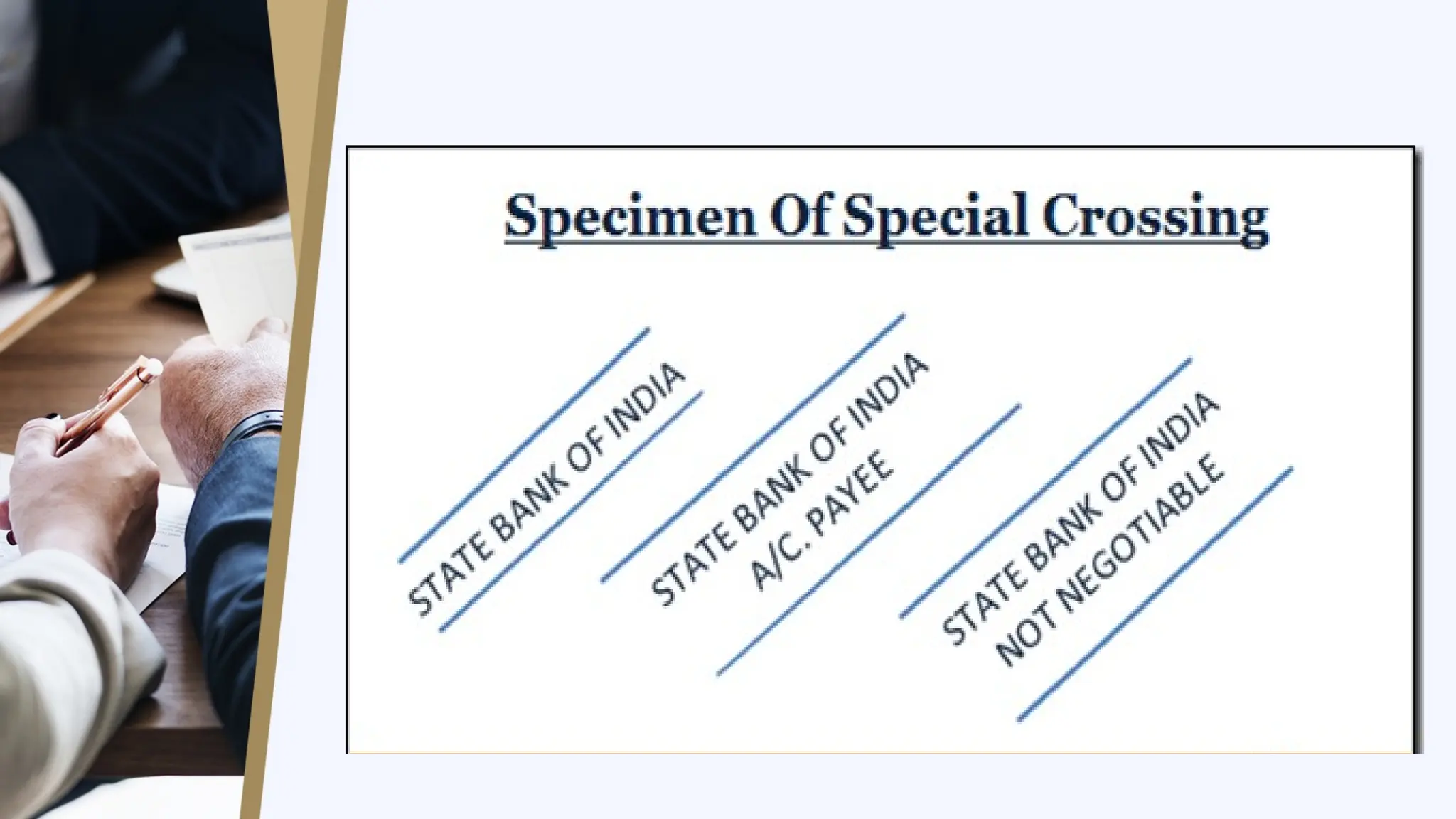

The document provides an extensive overview of banking laws related to cheques, detailing their features, parties involved, types, and reasons for dishonor. Key elements include the roles of drawer, drawee, and payee, as well as the various types of cheques such as bearer, order, and crossed cheques. Additionally, it covers the laws governing endorsements, including the different types and rules for validity, alongside information on electronic cheques and their importance.