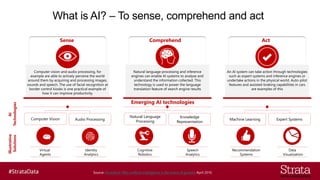

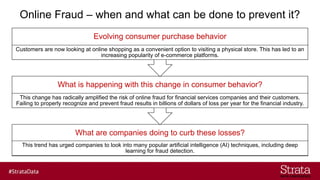

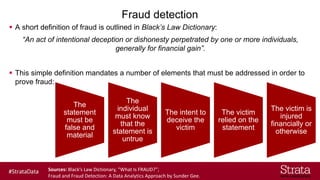

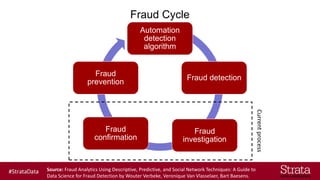

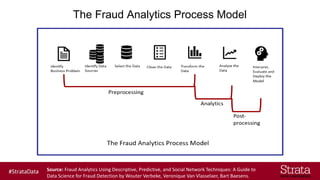

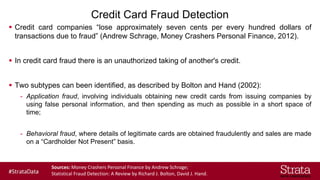

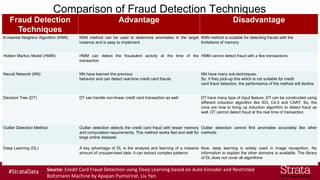

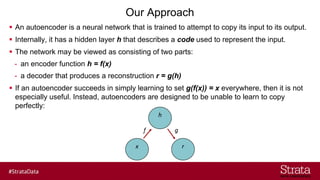

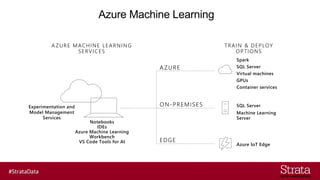

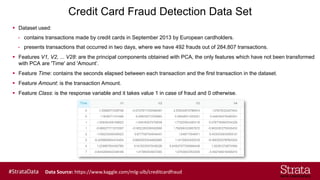

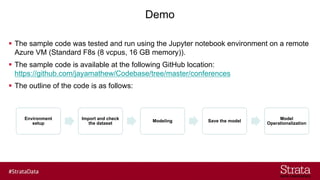

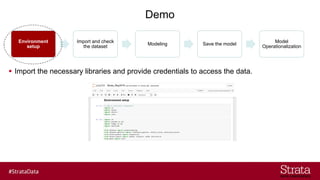

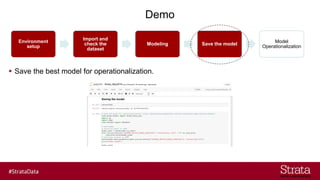

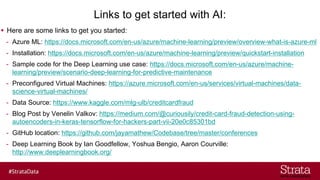

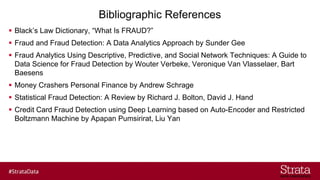

The document discusses the use of deep learning models for fraud detection in financial services, particularly focusing on credit card fraud. It outlines various fraud detection techniques, such as autoencoders, and their advantages and disadvantages, while urging companies to adopt artificial intelligence due to growing online consumer behavior and associated fraud risks. Additionally, it provides information about a dataset used for fraud detection modeling and links to resources for further exploration of AI technologies.