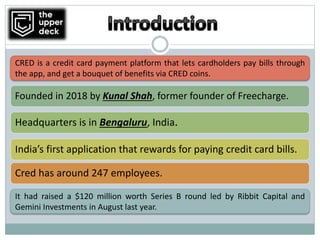

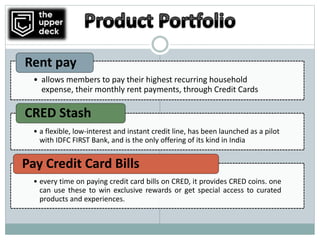

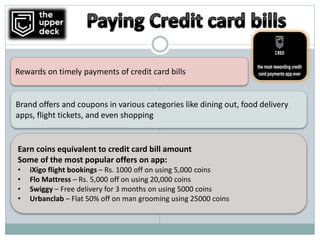

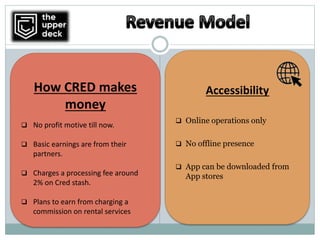

Cred, founded in 2018 by Kunal Shah, is a Bengaluru-based platform that allows users to pay their credit card bills and earn rewards in the form of cred coins. It has recently launched a pilot offering for paying rent with credit cards and a low-interest credit line in partnership with IDFC First Bank. Despite challenges like a competitive market and one-time monetization strategies, Cred is focusing on building a customer community and planning future services to sustain growth.