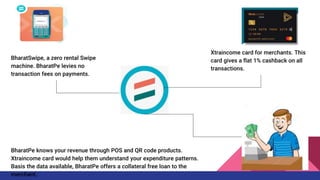

BharatPe, founded by Ashneer Grover and Shashvat Nakrani, quickly attracted over 1.5 million merchants by offering a universal QR code without charging fees. Its growth was fueled by a strong focus on retail transactions, strategic marketing, and partnership with renowned cricketers for brand promotion. Despite challenges, such as the COVID-19 pandemic, BharatPe became India's third-largest P2M payment app and continues to target ambitious growth in its loan book.