This document discusses various cost accounting concepts including:

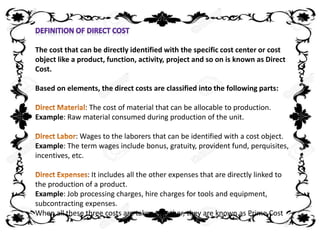

- Direct costs which include materials, labor, and other costs directly linked to production.

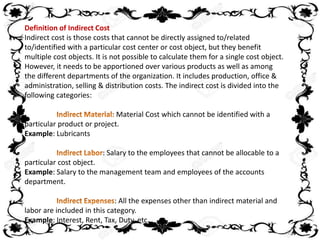

- Indirect costs which cannot be directly assigned to a cost object but benefit multiple objects, including indirect materials, labor, and other expenses.

- Fixed costs which do not change with production volume, variable costs which are directly proportional to production, and mixed costs with both fixed and variable components.

- Overhead which includes costs that cannot be directly attributed to a specific activity like accounting, rent, and utilities.

- The breakeven point where sales exactly cover expenses and is calculated using fixed costs, variable costs, and selling price.