The document discusses various aspects of business finance including:

- Sources of finance for businesses including internal sources like retained profits and external sources like bank loans. New businesses find it difficult to access finance due to high risk.

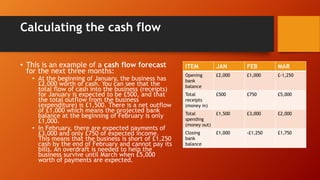

- Financial records that businesses keep like profit and loss statements, balance sheets, and cash flow forecasts to monitor performance and ensure solvency. Maintaining adequate working capital is important for businesses to pay debts.

- The concepts of revenue, costs, profits and losses. Break-even analysis can help businesses determine the minimum level of sales or output needed to cover total costs. Cash flow must be carefully managed to avoid insolvency.