COST OF CAPITAL.pptx

•Download as PPTX, PDF•

0 likes•155 views

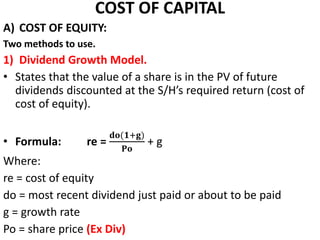

This document discusses methods for calculating the cost of capital, including: 1) Cost of equity using the dividend growth model and CAPM. Examples are provided to illustrate calculations. 2) Cost of debt including preferences shares, bonds, loans, and convertibles. Total market value of debt is also addressed. 3) A worked example is provided to calculate the weighted average cost of capital (WACC) for a company using calculated costs of equity and debt.

Report

Share

Report

Share

Recommended

Grp15 country risk analysis

Country risk analysis involves assessing the potential risks and rewards of doing business in a country. Country risk represents the potentially adverse impact of a country's environment on a firm's cash flows. Country risk analysis can be used to monitor risk in countries where a firm operates, screen countries to avoid excessive risk, and improve long-term investment and financing decisions. Key factors in country risk analysis include political, financial, economic, and other country-specific conditions. Firms use various quantitative and qualitative techniques to evaluate and compare country risks.

Foreign exchange risk and exposure

Foreign exchange risk and exposure refer to how changes in exchange rates can affect the value of a firm's assets, liabilities, and profits. Exposure is the sensitivity of a firm's value to exchange rate changes, while risk is the variability of a firm's value due to uncertain exchange rate changes. There are three main types of exposures - transaction, translation, and economic. Firms can use hedging strategies like forward contracts and options to manage their foreign exchange risk and exposure by locking in exchange rates for future transactions.

interest rate parity

This document discusses interest rate parity theory. It begins by defining spot and forward rates. Spot rates are prices for immediate settlement, while forward rates refer to rates for future currency delivery adjusted for cost of carry. Interest rate parity theory states that interest rate differentials between currencies will be reflected in forward premiums or discounts. The theory prevents arbitrage opportunities by making returns equal whether investing domestically or abroad when measured in the home currency. The document provides an example of covered and uncovered interest rate parity. Covered parity involves hedging exchange rate risk while uncovered parity does not. Empirical evidence shows uncovered parity often fails while covered parity generally holds for major currencies over short time horizons.

Foreign exchange risk

This document discusses foreign exchange risk and its management. It defines foreign exchange risk as the risk of an investment's value changing due to currency fluctuations. It identifies the main types of foreign exchange risk as transaction risk, translation risk, and economic risk. Transaction risk arises from currency movements between the signing and execution of contracts. Translation risk occurs when consolidating financial statements in different currencies. Economic risk affects the long-term expected profits and wealth of a company due to currency changes. The document outlines various hedging strategies to manage these risks, including the use of forwards, futures, and money markets.

Foreign exchange rates & quotes

There are two types of foreign exchange quotations: European and American. European quotations give the price of a currency in terms of units of another currency, while American quotations give the price in terms of dollars per unit of another currency. Direct quotes give the home currency price per unit of foreign currency, while indirect quotes give the opposite. Cross rates can be calculated using exchange rates between two currencies and a third currency. The TT buying rate is used for clean inward or outward remittances, while the bill buying rate factors in exchange and forward margins to account for delays in collection. The bill selling rate adds an exchange margin to the base rate to cover document handling costs.

Forecasting Exchange Rates

here we are trying to explain how firms can benefit from forecasting exchange rate, to describe common technique that used to forecast, how to evaluate forecasting performance

Foreign exchange market

The foreign exchange market is the largest financial market in the world, with over $4 trillion traded daily. It allows currencies to be exchanged between countries, facilitating international trade and investment. The market involves commercial banks, central banks, brokers, and other entities buying and selling currencies constantly. The most heavily traded currencies are the US dollar, euro, Japanese yen, British pound, and Australian dollar. Participants trade in spot markets for immediate exchange or forward markets for future delivery. Factors like economic performance, interest rates, trade balances, and political events influence exchange rates between currencies.

7 Introduction to forward contracts

The document discusses forward contracts and compares them to futures contracts. It notes that both specify a commitment to deliver an asset at a specified price, with the seller committing to deliver and the buyer committing to receive. For forwards, default risk lies with the counterparties rather than a clearinghouse. Features like standardization, tradability and liquidity differ between forwards and futures. The document also provides examples of how profits and losses are calculated for forward contracts and foreign exchange contracts.

Recommended

Grp15 country risk analysis

Country risk analysis involves assessing the potential risks and rewards of doing business in a country. Country risk represents the potentially adverse impact of a country's environment on a firm's cash flows. Country risk analysis can be used to monitor risk in countries where a firm operates, screen countries to avoid excessive risk, and improve long-term investment and financing decisions. Key factors in country risk analysis include political, financial, economic, and other country-specific conditions. Firms use various quantitative and qualitative techniques to evaluate and compare country risks.

Foreign exchange risk and exposure

Foreign exchange risk and exposure refer to how changes in exchange rates can affect the value of a firm's assets, liabilities, and profits. Exposure is the sensitivity of a firm's value to exchange rate changes, while risk is the variability of a firm's value due to uncertain exchange rate changes. There are three main types of exposures - transaction, translation, and economic. Firms can use hedging strategies like forward contracts and options to manage their foreign exchange risk and exposure by locking in exchange rates for future transactions.

interest rate parity

This document discusses interest rate parity theory. It begins by defining spot and forward rates. Spot rates are prices for immediate settlement, while forward rates refer to rates for future currency delivery adjusted for cost of carry. Interest rate parity theory states that interest rate differentials between currencies will be reflected in forward premiums or discounts. The theory prevents arbitrage opportunities by making returns equal whether investing domestically or abroad when measured in the home currency. The document provides an example of covered and uncovered interest rate parity. Covered parity involves hedging exchange rate risk while uncovered parity does not. Empirical evidence shows uncovered parity often fails while covered parity generally holds for major currencies over short time horizons.

Foreign exchange risk

This document discusses foreign exchange risk and its management. It defines foreign exchange risk as the risk of an investment's value changing due to currency fluctuations. It identifies the main types of foreign exchange risk as transaction risk, translation risk, and economic risk. Transaction risk arises from currency movements between the signing and execution of contracts. Translation risk occurs when consolidating financial statements in different currencies. Economic risk affects the long-term expected profits and wealth of a company due to currency changes. The document outlines various hedging strategies to manage these risks, including the use of forwards, futures, and money markets.

Foreign exchange rates & quotes

There are two types of foreign exchange quotations: European and American. European quotations give the price of a currency in terms of units of another currency, while American quotations give the price in terms of dollars per unit of another currency. Direct quotes give the home currency price per unit of foreign currency, while indirect quotes give the opposite. Cross rates can be calculated using exchange rates between two currencies and a third currency. The TT buying rate is used for clean inward or outward remittances, while the bill buying rate factors in exchange and forward margins to account for delays in collection. The bill selling rate adds an exchange margin to the base rate to cover document handling costs.

Forecasting Exchange Rates

here we are trying to explain how firms can benefit from forecasting exchange rate, to describe common technique that used to forecast, how to evaluate forecasting performance

Foreign exchange market

The foreign exchange market is the largest financial market in the world, with over $4 trillion traded daily. It allows currencies to be exchanged between countries, facilitating international trade and investment. The market involves commercial banks, central banks, brokers, and other entities buying and selling currencies constantly. The most heavily traded currencies are the US dollar, euro, Japanese yen, British pound, and Australian dollar. Participants trade in spot markets for immediate exchange or forward markets for future delivery. Factors like economic performance, interest rates, trade balances, and political events influence exchange rates between currencies.

7 Introduction to forward contracts

The document discusses forward contracts and compares them to futures contracts. It notes that both specify a commitment to deliver an asset at a specified price, with the seller committing to deliver and the buyer committing to receive. For forwards, default risk lies with the counterparties rather than a clearinghouse. Features like standardization, tradability and liquidity differ between forwards and futures. The document also provides examples of how profits and losses are calculated for forward contracts and foreign exchange contracts.

Factors affecting call and put option prices

The document outlines 6 primary factors that affect call and put option prices: 1) the underlying price, 2) expected volatility, 3) strike price, 4) time until expiration, 5) interest rates, and 6) dividends. Option prices increase or decrease based on whether the underlying price, expected volatility, time until expiration, and interest rates increase or decrease. Option prices also increase if the strike price is further in or out of the money and if dividends rise or fall.

Interest rate swap

This document discusses interest rate swaps. It defines an interest rate swap as an agreement to exchange interest rate payments, with one leg fixed and the other floating. Common types include paying fixed rate interest to receive floating, and vice versa. Interest rate swaps are used to hedge against rising or falling interest rates by transforming fixed deposits/borrowings to floating, or floating to fixed. Examples show how swaps can benefit entities by reducing income/funding costs if rates move in the desired direction.

management of foreign exchange and risk management

This document discusses various techniques for managing foreign exchange risk and exposure. It begins by defining foreign exchange exposure and risk for business firms engaged in international business. It then discusses managing transaction risk through hedging techniques like forward hedges, money market hedges, option market hedges, and future hedges. It also discusses internal risk management techniques used by multinational companies like netting, matching, leading and lagging, and pricing policies. Finally, it discusses managing operating risk and translation exposure.

Swaps (derivatives)

A swap is an agreement between two parties to exchange cash flows over a period of time, where at least one cash flow is determined by a variable such as interest rate, foreign exchange rate, or equity price. The most common type is an interest rate swap, where parties exchange interest payments on a notional principal amount at fixed and floating rates. Swaps allow users to align the risk characteristics of their assets and liabilities.

Forecasting exchange rates 1

The document discusses exchange rate forecasting. Exchange rate forecasting is done by calculating the value of one currency relative to others over time. Various theories can be used for predictions, but no model is perfect. Exchange rate forecasts are required by multinational corporations, governments, financial institutions, and brokers. Fundamental analysis considers long-term economic factors, while technical analysis charts patterns in investor sentiment. Models for predicting exchange rates and prices include the random walk approach, uncovered interest rate parity, purchasing power parity, and theories related to interest rates, inflation, and investor psychology.

International cash management

This chapter discusses international cash management for multi-national corporations. It covers analyzing cash flows from the perspective of subsidiaries and the parent company. Techniques for optimizing cash flows include accelerating cash inflows, minimizing currency conversion costs, and managing inter-subsidiary transfers. Complications can arise from government restrictions, banking systems, and company characteristics. The chapter also discusses investing excess cash across currencies and managing risks through hedging strategies.

Foreign exchange exposure PPT

Foreign exchange exposure is the risk associated with activities involving currencies other than a firm's home currency. It is the risk that foreign currencies may fluctuate in a way that financially harms the firm. There are three main types of foreign exchange exposure: transaction, economic, and translation. Firms can assess and manage their exposures through hedging strategies like financial contracts and operational techniques. Whether to hedge depends on factors like a firm's currency forecasts and focus on its core business versus currency speculation.

Stock and derivatives market in india

The document provides information about stock markets, stocks, stock exchanges, and derivatives markets. It discusses:

1) What a stock market and equity market are, how stocks are listed and traded on exchanges.

2) What stocks are and how companies raise money by issuing shares.

3) Details on some major Indian stock exchanges like BSE and NSE, their locations and roles.

4) Concepts related to stock trading like brokers, demat accounts, stock market crashes.

5) An overview of derivatives markets, different types of derivatives like forwards, futures, options, swaps, and assets they are based on.

Fimmda

1) FIMMDA is an association of commercial banks, financial institutions and primary dealers incorporated in 1998 as a voluntary market body for the bond, money and derivatives markets in India.

2) It has a large membership base including all major public and private sector banks, financial institutions, insurance companies and primary dealers.

3) One of FIMMDA's key roles is to publish reference rates for various money market instruments and yield curves for pricing government securities to bring standardization and transparency to fixed income markets in India.

Forecasting Exchange Rates

This document discusses why MNCs forecast exchange rates and different techniques for doing so. MNCs need to forecast exchange rates for hedging decisions, short-term financing, investments, capital budgeting, earnings assessments, and long-term financing. Exchange rate forecasts help MNCs determine things like whether to hedge currency risk, which currency to borrow in, and whether to remit foreign subsidiary earnings. There are four main categories of forecasting techniques: technical analysis of historical exchange rate data, fundamental analysis of economic factors affecting exchange rates, market-based analysis using current spot or forward rates, and subjective assessments.

Unit 5 Forex Risk Management

This presentation covers foreign exchange risk definition, types, management and measurement. Hedging tools and techniques; both internal and external are also discussed.

Interest rate parity (Global Finance)

Interest rate parity is a theory stating that the interest rate differential between two countries should equal the forward exchange rate premium or discount relative to the spot exchange rate. This establishes a break-even condition where returns on domestic and foreign currency investments are equal after accounting for exchange risk. If interest rate parity is violated, an arbitrage opportunity exists where investors can borrow, invest, and exchange currencies to earn risk-free profits. Kim Deal, a European portfolio manager, should choose to invest in 1-year Japanese yen deposits covered by a 1-year forward contract to hedge exchange risk, as this option provides the highest euro return of €352,005 compared to €352,000 from euro deposits.

Foreign exchange exposure & risk mannagement1

This document discusses various methods for managing foreign exchange risk exposure, including transaction exposure and economic exposure. It defines transaction exposure as the uncertain value of known foreign currency cash flows, and economic exposure as the uncertain value of uncertain foreign currency cash flows. The document also discusses hedging techniques for transaction exposure, such as futures contracts, forwards, money market hedges and options. Long-term hedging techniques include long-term forwards, currency swaps and parallel loans.

Forward Rate Agreement ppt

1) Forward-forward contracts guarantee a certain interest rate on an investment or loan that begins on a future forward date and ends later.

2) Forward rate agreements (FRAs) are similar to forward contracts where two parties agree on a borrowing rate for a future period and the difference between the agreed rate and actual rate is settled at maturity.

3) Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date, with standardized terms, and can be settled through physical delivery or cash.

Currency Exchange Risk

This document discusses currency exchange risk and how international marketers manage it. It provides an overview of currency risk and exchange rates. Currency risk occurs when companies have assets or operations across borders or loans in foreign currencies. Exchange rates determine the value of one currency relative to another. The document then discusses sources of exchange rate risk, how the foreign exchange market works, factors that influence exchange rates, and strategies international marketers can use to manage currency risk such as hedging and adjusting prices.

Binomial Option pricing

The document introduces the binomial option pricing model, which values options by allowing the underlying asset price to move up or down by a set percentage at each time period. It assumes two possible prices, constant interest rates over the life of the option, and perfect markets. The model is then demonstrated by calculating the possible up and down prices of a stock and related call option values at the next time period, given inputs like the current stock price, interest rates, and strike price.

Financial arbitrage

Financial arbitrage involves taking advantage of temporary price differences between the same or similar financial assets traded in different markets. It allows investors to buy assets in a market where the price is low and immediately sell them in another market where the price is higher, thereby locking in a risk-free profit. Arbitrage is possible when the same asset trades at different prices in different markets, when an asset's future price is inconsistent with its present value, or when two identical assets trade at different prices. The practice of arbitrage tends to drive prices between markets to convergence.

CURRENCY SWAP & INTREST RATE SWAP

A currency swap involves the exchange of principal and interest payments in one currency for the same in another currency at fixed intervals over the contract period. In a currency swap, counterparties can choose to exchange principal at the start and end of the swap or just exchange interest payments. An interest rate swap is an agreement where one party pays a fixed interest rate on a loan while receiving a floating rate, or vice versa, from the other party in order to reduce exposure to interest rate fluctuations. Common types of interest rate swaps include fixed to floating, floating to fixed, and float to float (basis) swaps. Swaps allow parties to achieve their desired interest rate exposure and are customized over-the-counter agreements.

Forex accounts. interbank quotations, interbank deals

1) The document discusses various types of foreign currency accounts like Nostro, Vostro, and Loro accounts that banks maintain with each other.

2) It explains key concepts like two-way quotations in the interbank market, direct and indirect currency quotations, and American and European quotation styles.

3) Interbank deals refer to foreign exchange transactions between banks, including cover deals to hedge customer transactions and trading to profit from expected exchange rate changes. Swap deals involve simultaneously buying and selling the same currency for different maturities.

Fundamentals of foreign exchange market

The document provides an overview of the foreign exchange market. It discusses that the foreign exchange market allows for the exchange of one country's currency for another and determines exchange rates. It operates as an over-the-counter, decentralized global market open 24 hours. Major players include banks, corporations, central banks, speculators, and arbitrageurs. Common transaction types are spots, forwards, and swaps. Factors like interest rates, inflation, economic growth, and political stability influence exchange rates.

Cost of Capital.pptx

How to determine a firm’s cost of equity capital, How to determine a firm’s cost of debt, How to determine a firm’s overall cost of capital, How to correctly include flotation costs in capital budgeting projects, Some of the pitfalls associated with a firm’s overall

cost of capital & what to do about them

COST OF EQUITY

The document discusses the cost of capital and various methods for calculating it. It defines cost of capital as the required return on funds provided by creditors and shareholders. It then covers the cost of debt, cost of equity using the dividend growth model and CAPM, weighted average cost of capital (WACC), weighted average cost of equity (WACE), and differences between cost of equity and cost of debt. The cost of capital is important for investment decisions, capital structure, performance evaluation, and dividend policy.

More Related Content

What's hot

Factors affecting call and put option prices

The document outlines 6 primary factors that affect call and put option prices: 1) the underlying price, 2) expected volatility, 3) strike price, 4) time until expiration, 5) interest rates, and 6) dividends. Option prices increase or decrease based on whether the underlying price, expected volatility, time until expiration, and interest rates increase or decrease. Option prices also increase if the strike price is further in or out of the money and if dividends rise or fall.

Interest rate swap

This document discusses interest rate swaps. It defines an interest rate swap as an agreement to exchange interest rate payments, with one leg fixed and the other floating. Common types include paying fixed rate interest to receive floating, and vice versa. Interest rate swaps are used to hedge against rising or falling interest rates by transforming fixed deposits/borrowings to floating, or floating to fixed. Examples show how swaps can benefit entities by reducing income/funding costs if rates move in the desired direction.

management of foreign exchange and risk management

This document discusses various techniques for managing foreign exchange risk and exposure. It begins by defining foreign exchange exposure and risk for business firms engaged in international business. It then discusses managing transaction risk through hedging techniques like forward hedges, money market hedges, option market hedges, and future hedges. It also discusses internal risk management techniques used by multinational companies like netting, matching, leading and lagging, and pricing policies. Finally, it discusses managing operating risk and translation exposure.

Swaps (derivatives)

A swap is an agreement between two parties to exchange cash flows over a period of time, where at least one cash flow is determined by a variable such as interest rate, foreign exchange rate, or equity price. The most common type is an interest rate swap, where parties exchange interest payments on a notional principal amount at fixed and floating rates. Swaps allow users to align the risk characteristics of their assets and liabilities.

Forecasting exchange rates 1

The document discusses exchange rate forecasting. Exchange rate forecasting is done by calculating the value of one currency relative to others over time. Various theories can be used for predictions, but no model is perfect. Exchange rate forecasts are required by multinational corporations, governments, financial institutions, and brokers. Fundamental analysis considers long-term economic factors, while technical analysis charts patterns in investor sentiment. Models for predicting exchange rates and prices include the random walk approach, uncovered interest rate parity, purchasing power parity, and theories related to interest rates, inflation, and investor psychology.

International cash management

This chapter discusses international cash management for multi-national corporations. It covers analyzing cash flows from the perspective of subsidiaries and the parent company. Techniques for optimizing cash flows include accelerating cash inflows, minimizing currency conversion costs, and managing inter-subsidiary transfers. Complications can arise from government restrictions, banking systems, and company characteristics. The chapter also discusses investing excess cash across currencies and managing risks through hedging strategies.

Foreign exchange exposure PPT

Foreign exchange exposure is the risk associated with activities involving currencies other than a firm's home currency. It is the risk that foreign currencies may fluctuate in a way that financially harms the firm. There are three main types of foreign exchange exposure: transaction, economic, and translation. Firms can assess and manage their exposures through hedging strategies like financial contracts and operational techniques. Whether to hedge depends on factors like a firm's currency forecasts and focus on its core business versus currency speculation.

Stock and derivatives market in india

The document provides information about stock markets, stocks, stock exchanges, and derivatives markets. It discusses:

1) What a stock market and equity market are, how stocks are listed and traded on exchanges.

2) What stocks are and how companies raise money by issuing shares.

3) Details on some major Indian stock exchanges like BSE and NSE, their locations and roles.

4) Concepts related to stock trading like brokers, demat accounts, stock market crashes.

5) An overview of derivatives markets, different types of derivatives like forwards, futures, options, swaps, and assets they are based on.

Fimmda

1) FIMMDA is an association of commercial banks, financial institutions and primary dealers incorporated in 1998 as a voluntary market body for the bond, money and derivatives markets in India.

2) It has a large membership base including all major public and private sector banks, financial institutions, insurance companies and primary dealers.

3) One of FIMMDA's key roles is to publish reference rates for various money market instruments and yield curves for pricing government securities to bring standardization and transparency to fixed income markets in India.

Forecasting Exchange Rates

This document discusses why MNCs forecast exchange rates and different techniques for doing so. MNCs need to forecast exchange rates for hedging decisions, short-term financing, investments, capital budgeting, earnings assessments, and long-term financing. Exchange rate forecasts help MNCs determine things like whether to hedge currency risk, which currency to borrow in, and whether to remit foreign subsidiary earnings. There are four main categories of forecasting techniques: technical analysis of historical exchange rate data, fundamental analysis of economic factors affecting exchange rates, market-based analysis using current spot or forward rates, and subjective assessments.

Unit 5 Forex Risk Management

This presentation covers foreign exchange risk definition, types, management and measurement. Hedging tools and techniques; both internal and external are also discussed.

Interest rate parity (Global Finance)

Interest rate parity is a theory stating that the interest rate differential between two countries should equal the forward exchange rate premium or discount relative to the spot exchange rate. This establishes a break-even condition where returns on domestic and foreign currency investments are equal after accounting for exchange risk. If interest rate parity is violated, an arbitrage opportunity exists where investors can borrow, invest, and exchange currencies to earn risk-free profits. Kim Deal, a European portfolio manager, should choose to invest in 1-year Japanese yen deposits covered by a 1-year forward contract to hedge exchange risk, as this option provides the highest euro return of €352,005 compared to €352,000 from euro deposits.

Foreign exchange exposure & risk mannagement1

This document discusses various methods for managing foreign exchange risk exposure, including transaction exposure and economic exposure. It defines transaction exposure as the uncertain value of known foreign currency cash flows, and economic exposure as the uncertain value of uncertain foreign currency cash flows. The document also discusses hedging techniques for transaction exposure, such as futures contracts, forwards, money market hedges and options. Long-term hedging techniques include long-term forwards, currency swaps and parallel loans.

Forward Rate Agreement ppt

1) Forward-forward contracts guarantee a certain interest rate on an investment or loan that begins on a future forward date and ends later.

2) Forward rate agreements (FRAs) are similar to forward contracts where two parties agree on a borrowing rate for a future period and the difference between the agreed rate and actual rate is settled at maturity.

3) Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date, with standardized terms, and can be settled through physical delivery or cash.

Currency Exchange Risk

This document discusses currency exchange risk and how international marketers manage it. It provides an overview of currency risk and exchange rates. Currency risk occurs when companies have assets or operations across borders or loans in foreign currencies. Exchange rates determine the value of one currency relative to another. The document then discusses sources of exchange rate risk, how the foreign exchange market works, factors that influence exchange rates, and strategies international marketers can use to manage currency risk such as hedging and adjusting prices.

Binomial Option pricing

The document introduces the binomial option pricing model, which values options by allowing the underlying asset price to move up or down by a set percentage at each time period. It assumes two possible prices, constant interest rates over the life of the option, and perfect markets. The model is then demonstrated by calculating the possible up and down prices of a stock and related call option values at the next time period, given inputs like the current stock price, interest rates, and strike price.

Financial arbitrage

Financial arbitrage involves taking advantage of temporary price differences between the same or similar financial assets traded in different markets. It allows investors to buy assets in a market where the price is low and immediately sell them in another market where the price is higher, thereby locking in a risk-free profit. Arbitrage is possible when the same asset trades at different prices in different markets, when an asset's future price is inconsistent with its present value, or when two identical assets trade at different prices. The practice of arbitrage tends to drive prices between markets to convergence.

CURRENCY SWAP & INTREST RATE SWAP

A currency swap involves the exchange of principal and interest payments in one currency for the same in another currency at fixed intervals over the contract period. In a currency swap, counterparties can choose to exchange principal at the start and end of the swap or just exchange interest payments. An interest rate swap is an agreement where one party pays a fixed interest rate on a loan while receiving a floating rate, or vice versa, from the other party in order to reduce exposure to interest rate fluctuations. Common types of interest rate swaps include fixed to floating, floating to fixed, and float to float (basis) swaps. Swaps allow parties to achieve their desired interest rate exposure and are customized over-the-counter agreements.

Forex accounts. interbank quotations, interbank deals

1) The document discusses various types of foreign currency accounts like Nostro, Vostro, and Loro accounts that banks maintain with each other.

2) It explains key concepts like two-way quotations in the interbank market, direct and indirect currency quotations, and American and European quotation styles.

3) Interbank deals refer to foreign exchange transactions between banks, including cover deals to hedge customer transactions and trading to profit from expected exchange rate changes. Swap deals involve simultaneously buying and selling the same currency for different maturities.

Fundamentals of foreign exchange market

The document provides an overview of the foreign exchange market. It discusses that the foreign exchange market allows for the exchange of one country's currency for another and determines exchange rates. It operates as an over-the-counter, decentralized global market open 24 hours. Major players include banks, corporations, central banks, speculators, and arbitrageurs. Common transaction types are spots, forwards, and swaps. Factors like interest rates, inflation, economic growth, and political stability influence exchange rates.

What's hot (20)

management of foreign exchange and risk management

management of foreign exchange and risk management

Forex accounts. interbank quotations, interbank deals

Forex accounts. interbank quotations, interbank deals

Similar to COST OF CAPITAL.pptx

Cost of Capital.pptx

How to determine a firm’s cost of equity capital, How to determine a firm’s cost of debt, How to determine a firm’s overall cost of capital, How to correctly include flotation costs in capital budgeting projects, Some of the pitfalls associated with a firm’s overall

cost of capital & what to do about them

COST OF EQUITY

The document discusses the cost of capital and various methods for calculating it. It defines cost of capital as the required return on funds provided by creditors and shareholders. It then covers the cost of debt, cost of equity using the dividend growth model and CAPM, weighted average cost of capital (WACC), weighted average cost of equity (WACE), and differences between cost of equity and cost of debt. The cost of capital is important for investment decisions, capital structure, performance evaluation, and dividend policy.

Financial Management Lecture 9 NUML Capital Structure

- Titan Mining's capital structure consists of common stock valued at $256M, preferred stock valued at $33.5M, and bonds valued at $91M, for a total firm value of $380.5M.

- The weights of each component are: common equity is 67.28%, preferred equity is 8.80%, and debt is 23.92%.

- Using these weights and the costs of 13.47% for equity, 8.96% for preferred stock, and 6.62% for debt, the weighted average cost of capital (WACC) is calculated to be 13.47%.

adavanced financial management materials

This document discusses the cost of capital and capital structure. It begins by defining cost of capital as the minimum rate of return a company must earn on its investments to maintain the market value of the firm. It then discusses the significance of calculating the cost of capital and the different types of capital including debt, preferred shares, common equity, and retained earnings. Formulas are provided for calculating the cost of each type of capital. The weighted average cost of capital is defined as the blended cost of all sources of capital weighted by their proportions in the total capital structure. Several problems are provided as examples of calculating the costs of different types of capital.

Chapter 2_FIN3004_2022 new (1).pdf

This document provides an overview of capital structure. It defines sources of capital including equity and debt capital. It discusses the costs of equity, debt, and preferred shares. It introduces the weighted average cost of capital (WACC) and how it is used to determine a firm's target capital structure. The document also covers financial leverage and how it impacts earnings per share, return on equity, and risk. Break-even analysis and operating leverage are also summarized.

Anıl Sural - WACC Calculation

1) The CFO provided information on the firm's capital structure, bond yields, stock prices, tax rates, and growth expectations to estimate the WACC.

2) The costs of debt, preferred stock, and retained earnings were calculated using the bond yield, dividend yield, CAPM, and DCF approaches.

3) The WACC was estimated to be 7.58% using a 40% weight on debt at 3.6%, 10% weight on preferred stock at 7.4%, and 50% weight on retained earnings at 10.08%.

Chapter 3 Cost of Capital.pptx

This document discusses the cost of capital, which is the rate of return a firm must earn on investments to maintain its market value and attract funds. It is affected by business risk, financial risk, and after-tax costs. There are four basic sources of long-term capital: long-term debt, preferred stock, common stock, and retained earnings. The cost of each is calculated differently based on factors like interest rates, dividends, and valuation models. The weighted average cost of capital combines the costs of each source based on their relative weights and represents the overall expected cost of funds for a firm.

Cost of capital

- Cost of capital is the minimum rate of return expected by investors to compensate for the risk of investing in a company. It includes the cost of different sources of financing like debt, preferred stock, common stock, and retained earnings.

- The weighted average cost of capital (WACC) is calculated by weighting the cost of each individual source of capital according to its proportion of total capital structure. WACC is used to evaluate whether potential projects or investments will increase shareholder value.

- Case studies are provided to demonstrate calculating WACC using different capital structures, costs of individual sources, tax rates, and market values. WACC is recalculated based on changes to financing decisions and market conditions.

Stock valuation

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement – stocks that are judged undervalued (with respect to their theoretical value) are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will, on the whole, rise in value, while overvalued stocks will, on the whole, fall.

Weighted Average Cost of Capital

The document discusses the components of the cost of capital, including debt, preferred stock, and common equity. It provides methods for calculating the costs of each component, such as using bond yields for the cost of debt. The weighted average cost of capital (WACC) is calculated using the costs of each component weighted by the target capital structure weights. Factors that influence the WACC include market conditions, the firm's capital structure and investment policy. The document also discusses approaches for adjusting the cost of capital for divisions or projects based on their specific risks.

14123 cost of capitalnew (2)

- The cost of capital is the minimum required rate of return for a project given its riskiness, while the firm's cost of capital is the weighted average required return across all projects.

- The cost of capital is used for investment decisions, debt policy design, and evaluating management performance.

- It represents the expected return forgone by investing in a project rather than the next best alternative of similar risk. Various capital sources have different costs depending on their risk.

- The weighted average cost of capital (WACC) is calculated by weighting the costs of different capital sources by their proportion of the total capital structure.

capital asset pricing model for calculating cost of capital for risk for risk...

capital asset pricing model for calculating cost of capital for risk for risk...University of Balochistan

cost of capital, beta, risk, risky project,weighted average cost of capital, market efficiency, semi-efficient market, weak efficient marketCost of capital

The cost of capital is the minimum rate of return that a firm must earn on its investments to maintain its market value. It refers to the weighted average of the costs of a firm's various capital components, such as debt, preferred stock, common stock, and any retained earnings. The cost of each capital component depends on its risk level and the rates of return that suppliers of capital expect given the risk. The overall cost of capital is calculated as a weighted average of the costs of the individual capital components.

BlueBookAcademy.com - Value companies using Discounted Cash Flow Valuation

The document outlines the steps to build a discounted cash flow (DCF) valuation model. It includes: 1) forecasting historical performance and future cash flows, 2) calculating the terminal value, 3) determining the weighted average cost of capital (WACC) discount rate, and 4) discounting the forecasted cash flows and terminal value to calculate the firm's value. An example DCF model is provided with assumptions and valuation results. Pros, cons, and best practices of DCF modeling are also discussed.

Week2.pdf

This document discusses stock valuation using the Gordon Growth Model. It begins by introducing the Gordon Growth Model, which values a stock based on discounting the dividends that are distributed to shareholders. It then provides assumptions of the model, such as the business being stable and experiencing steady growth. The document also discusses estimating free cash flow to equity and financial leverage. It provides an example analysis of stock valuation for Consolidated Edison using the Gordon Growth Model.

Dividend policy

This document discusses dividend decision and theories. It defines dividends as the portion of profits distributed to shareholders. There are different types of dividends such as interim, final, stock, and scrip dividends. Dividend decision is influenced by legal provisions and is treated as a financing decision aimed at wealth maximization. The document discusses various dividend theories including the residual dividend policy, Modigliani-Miller's irrelevance theory, Walter's model, Gordon's model, and their underlying assumptions. It also covers factors influencing dividend policy and different approaches a company can take to its dividend policy.

Slide 1 12-1Cost of CapitalSlide 2.docx

Slide 1

12-1

Cost of Capital

Slide 2

12-2

Key Concepts and Skills

• Know how to determine:

– A firm’s cost of equity capital

– A firm’s cost of debt

– A firm’s overall cost of capital

• Understand pitfalls of overall cost of

capital and how to manage them

From our modules on capital budgeting, we learn that the discount rate, or required return, on an investment

is a critical input. However, we haven’t discussed how to come up with that particular number. This module

brings together many of our earlier discussions dealing with stocks and bonds, capital budgeting, and risk

and return. Our goal is to illustrate how firms go about determining the required return on a proposed

investment. Understanding required returns is important to everyone because all proposed projects must

offer returns in excess of their required returns to be acceptable.

In this module, we learn how to compute a firm’s cost of capital and find out what it means to the firm and

its investors. We will also learn when to use the firm’s cost of capital and, perhaps more important, when

not to use it.

Why is it important? A good estimate is required for:

• good capital budgeting decisions—neither the NPV rule nor the IRR rule can be implemented without

knowledge of the appropriate discount rate

• financing decisions—the optimal/target capital structure minimizes the cost of capital

• operating decisions—cost of capital is used by regulatory agencies in order to determine the “fair”

return in some regulated industries (e.g. utilities)

Slide 3

12-3

Chapter Outline

• The Cost of Capital: Some Preliminaries

• The Cost of Equity (RE)

• The Costs of Debt (RD) and Preferred Stock (RP)

• The Weighted Average Cost of Capital (WACC)

• Divisional and Project Costs of Capital

Slide 4

12-4

Cost of Capital Basics

• The cost to a firm for capital funding = the

return to the providers of those funds

– The return earned on assets depends on the

risk of those assets

– A firm’s cost of capital indicates how the

market views the risk of the firm’s assets

– A firm must earn at least the required return to

compensate investors for the financing they

have provided

– The required return is the same as the

appropriate discount rate

Cost of capital, required return, and appropriate discount rate are different phrases that all refer to the

opportunity cost of using capital in one way as opposed to alternative financial market investments of the

same systematic risk.

• Required return is from an investor’s point of view.

• Cost of capital is the same return from the firm’s point of view.

• Appropriate discount rate is the same return used in a PV calculation.

Slide 5

12-5

Cost of Equity

• The cost of equity is the return required by

equity investors given the risk of the cash

flows from the firm

• Two major methods for determining the

cost of equity

▪Dividend growth model

▪SML .

Capital structure theories.pptx

The document discusses various capital structure theories including the net income approach, traditional approach, and irrelevance theories like the net operating income approach and MM approach. It provides definitions of key terms like capital structure and optimal capital structure. It also lists the assumptions and formulas used in different theories. Several factors that determine a firm's capital structure are outlined along with examples of calculating a firm's value and WACC under different approaches.

Costofcapital 100114234212-phpapp02

The document discusses the cost of capital, which is the rate of return a firm must earn on its investments to maintain its market value and attract funds. It defines the key components that make up the cost of capital, including the cost of long-term debt, preferred stock, common stock equity, and retained earnings. It also discusses how to calculate the weighted average cost of capital (WACC) by weighting the cost of each capital component by its proportion in the firm's target capital structure. The document provides examples to demonstrate how to calculate the various costs and the WACC.

Similar to COST OF CAPITAL.pptx (20)

Financial Management Lecture 9 NUML Capital Structure

Financial Management Lecture 9 NUML Capital Structure

capital asset pricing model for calculating cost of capital for risk for risk...

capital asset pricing model for calculating cost of capital for risk for risk...

BlueBookAcademy.com - Value companies using Discounted Cash Flow Valuation

BlueBookAcademy.com - Value companies using Discounted Cash Flow Valuation

Recently uploaded

一比一原版(OP毕业证)奥塔哥理工学院毕业证成绩单如何办理

OP毕业证【微信95270640】《如何办理奥塔哥理工学院毕业证认证》【办证Q微信95270640】《奥塔哥理工学院文凭毕业证制作》《OP学历学位证书哪里买》办理奥塔哥理工学院学位证书扫描件、办理奥塔哥理工学院雅思证书!

国际留学归国服务中心《如何办奥塔哥理工学院毕业证认证》《OP学位证书扫描件哪里买》实体公司,注册经营,行业标杆,精益求精!

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到奥塔哥理工学院奥塔哥理工学院毕业证学位证;

3、不清楚流程以及材料该如何准备奥塔哥理工学院奥塔哥理工学院毕业证学位证;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★奥塔哥理工学院奥塔哥理工学院毕业证学位证毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查奥塔哥理工学院奥塔哥理工学院毕业证学位证】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助奥塔哥理工学院同学朋友

你做代理,可以拯救奥塔哥理工学院失足青年

你做代理,可以挽救奥塔哥理工学院一个个人才

你做代理,你将是别人人生奥塔哥理工学院的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会顿时留恋起家乡的小河潺潺活水清凉无比日子就这样孤寂而快乐地过着寂寞之余山娃最神往最开心就是晚上无论多晚多累父亲总要携山娃出去兜风逛夜市流光溢彩人潮涌动的都市夜生活总让山娃目不暇接惊叹不已父亲老问山娃想买什么想吃什么山娃知道父亲赚钱很辛苦除了书籍和文具山娃啥也不要能牵着父亲的手满城闲逛他已心满意足了父亲连挑了三套童装叫山娃试穿山娃有点不想父亲说城里不比乡下要穿得漂漂亮亮爸怎么不穿得漂亮望着父亲山娃可

EV Charging at Multifamily Properties by Kevin Donnelly

Kevin Donnelly gave this presentation at the Forth Addressing The Challenges of Charging at Multi-Family Housing webinar on June 11, 2024.

Skoda Octavia Rs for Sale Perth | Skoda Perth

The Octavia range embodies the design trend of the Škoda brand: a fusion of

aesthetics, safety and practicality. Whether you see the car as a whole or step

closer and explore its unique features, the Octavia range radiates with the

harmony of functionality and emotion

Hand Gesture Control Robotic Arm using image processing.pptx

Hand Gesture Control Robotic Arm using image processing

What do the symbols on vehicle dashboard mean?

Ever been troubled by the blinking sign and didn’t know what to do?

Here’s a handy guide to dashboard symbols so that you’ll never be confused again!

Save them for later and save the trouble!

一比一原版(Columbia文凭证书)哥伦比亚大学毕业证如何办理

一模一样【微信:176555708】【(Columbia文凭证书)哥伦比亚大学毕业证成绩单Offer】【微信:176555708】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:176555708】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:176555708】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

What Could Be Behind Your Mercedes Sprinter's Power Loss on Uphill Roads

Unlock the secrets behind your Mercedes Sprinter's uphill power loss with our comprehensive presentation. From fuel filter blockages to turbocharger troubles, we uncover the culprits and empower you to reclaim your vehicle's peak performance. Conquer every ascent with confidence and ensure a thrilling journey every time.

Digital Fleet Management - Why Your Business Need It?

Fleet management these days is next to impossible without connected vehicle solutions. Why? Well, fleet trackers and accompanying connected vehicle management solutions tend to offer quite a few hard-to-ignore benefits to fleet managers and businesses alike. Let’s check them out!

AadiShakti Projects ( Asp Cranes ) Raipur

Welcome to ASP Cranes, your trusted partner for crane solutions in Raipur, Chhattisgarh! With years of experience and a commitment to excellence, we offer a comprehensive range of crane services tailored to meet your lifting and material handling needs.

At ASP Cranes, we understand the importance of reliable and efficient crane operations in various industries, from construction and manufacturing to logistics and infrastructure development. That's why we strive to deliver top-notch solutions that enhance productivity, safety, and cost-effectiveness for our clients.

Our services include:

Crane Rental: Whether you need a crawler crane for heavy lifting or a hydraulic crane for versatile operations, we have a diverse fleet of well-maintained cranes available for rent. Our rental options are flexible and can be customized to suit your project requirements.

Crane Sales: Looking to invest in a crane for your business? We offer a wide selection of new and used cranes from leading manufacturers, ensuring you find the perfect equipment to match your needs and budget.

Crane Maintenance and Repair: To ensure optimal performance and safety, regular maintenance and timely repairs are essential for cranes. Our team of skilled technicians provides comprehensive maintenance and repair services to keep your equipment running smoothly and minimize downtime.

Crane Operator Training: Proper training is crucial for safe and efficient crane operation. We offer specialized training programs conducted by certified instructors to equip operators with the skills and knowledge they need to handle cranes effectively.

Custom Solutions: We understand that every project is unique, which is why we offer custom crane solutions tailored to your specific requirements. Whether you need modifications, attachments, or specialized equipment, we can design and implement solutions that meet your needs.

At ASP Cranes, customer satisfaction is our top priority. We are dedicated to delivering reliable, cost-effective, and innovative crane solutions that exceed expectations. Contact us today to learn more about our services and how we can support your project in Raipur, Chhattisgarh, and beyond. Let ASP Cranes be your trusted partner for all your crane needs!

一比一原版(WashU文凭证书)圣路易斯华盛顿大学毕业证如何办理

一模一样【微信:176555708】【(WashU文凭证书)圣路易斯华盛顿大学毕业证成绩单Offer】【微信:176555708】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:176555708】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:176555708】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

一比一原版(AIS毕业证)奥克兰商学院毕业证成绩单如何办理

AIS毕业证【微信95270640】《如何办理AIS毕业证奥克兰商学院文凭学历》【Q微信95270640】《奥克兰商学院文凭学历证书》《奥克兰商学院毕业证书与成绩单样本图片》毕业证书补办 Fake Degree做学费单《毕业证明信-推荐信》成绩单,录取通知书,Offer,在读证明,雅思托福成绩单,真实大使馆教育部认证,回国人员证明,留信网认证。网上存档永久可查!

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到奥克兰商学院奥克兰商学院毕业证学历书;

3、不清楚流程以及材料该如何准备奥克兰商学院奥克兰商学院毕业证学历书;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★奥克兰商学院奥克兰商学院毕业证学历书毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查奥克兰商学院奥克兰商学院毕业证学历书】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助奥克兰商学院同学朋友

你做代理,可以拯救奥克兰商学院失足青年

你做代理,可以挽救奥克兰商学院一个个人才

你做代理,你将是别人人生奥克兰商学院的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会的笑连连说记得记得但别忘了拿奖状进城啊考试一结束山娃就迫不及待地给父亲挂电话:爸我拿奖了三好学生接我进城吧父亲果然没有食言第二天就请假回家接山娃离开爷爷奶奶的那一刻山娃又伤心得泪如雨下宛如军人奔赴前线般难舍和悲壮卧空调大巴挤长蛇列车山娃发现车上挤满了叽叽喳喳的同龄人皆一脸惊喜地四处瞅山娃不认识他们也无暇去套近乎一味地跟着父亲昼夜兼程第二天凌晨就辗转到了父亲的城哇父亲的城真的好大好美哟走出广州火车方

快速办理(napier毕业证书)英国龙比亚大学毕业证在读证明一模一样

学校原件一模一样【微信:741003700 】《(napier毕业证书)英国龙比亚大学毕业证》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Here's Why Every Semi-Truck Should Have ELDs

Implementing ELDs or Electronic Logging Devices is slowly but surely becoming the norm in fleet management. Why? Well, integrating ELDs and associated connected vehicle solutions like fleet tracking devices lets businesses and their in-house fleet managers reap several benefits. Check out the post below to learn more.

原版制作(Exeter毕业证书)埃克塞特大学毕业证完成信一模一样

学校原件一模一样【微信:741003700 】《(Exeter毕业证书)埃克塞特大学毕业证》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Recently uploaded (20)

EV Charging at Multifamily Properties by Kevin Donnelly

EV Charging at Multifamily Properties by Kevin Donnelly

Manual despiece Yamaha fuera de borda pc_e40x_02.pdf

Manual despiece Yamaha fuera de borda pc_e40x_02.pdf

Hand Gesture Control Robotic Arm using image processing.pptx

Hand Gesture Control Robotic Arm using image processing.pptx

53286592-Global-Entrepreneurship-and-the-Successful-Growth-Strategies-of-Earl...

53286592-Global-Entrepreneurship-and-the-Successful-Growth-Strategies-of-Earl...

What Could Be Behind Your Mercedes Sprinter's Power Loss on Uphill Roads

What Could Be Behind Your Mercedes Sprinter's Power Loss on Uphill Roads

Digital Fleet Management - Why Your Business Need It?

Digital Fleet Management - Why Your Business Need It?

final-slide-deck-ACURE-AQ-December-1-webinar-2022.pdf

final-slide-deck-ACURE-AQ-December-1-webinar-2022.pdf

Globalfleet - global fleet survey 2021 full results

Globalfleet - global fleet survey 2021 full results

COST OF CAPITAL.pptx

- 1. COST OF CAPITAL A) COST OF EQUITY: Two methods to use. 1) Dividend Growth Model. • States that the value of a share is in the PV of future dividends discounted at the S/H’s required return (cost of cost of equity). • Formula: re = 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g Where: re = cost of equity do = most recent dividend just paid or about to be paid g = growth rate Po = share price (Ex Div)

- 2. Cost of Equity Cont’d. •Example 1: •Co. B has just paid a div of 9c. Dividends are expected to grow at a rate of 6% pa in the future and the current share price is $1.85. Calculate the cost of equity. •Example 2. •JP Co will pay a Div of 20c in the near future. The current share price is $1.55 and the Dividends are expected to grow at 7% pa. Calculate the cost of equity.

- 3. Estimating g. • Two methods i) Past Dividend Growth (growth formula). Assumption here is that past growth will continue into the future. Growth formula; g = 𝒏−𝟏 𝒎𝒐𝒔𝒕 𝒓𝒆𝒄𝒆𝒏𝒕 𝑫𝒊𝒗 𝑬𝒂𝒓𝒍𝒊𝒆𝒔𝒕 𝑫𝒊𝒗 - 1 (%) Where n = number of years. Example 3: Dividend paid in the recent years are as follows: 2007 14.8c 2008 15.2c 2009 16.8c 2010 18.6C Calculate the average annual growth rate.

- 4. Estimating g Cont’d • ii) Gordon Growth Approximation. •Formula; g = bre. Where; b = proportion of profits retained re = cost of equity. NB: If the cost of equity is not known, then use some given measure of accounting return. Example 4: Co. A has a share price of $4 and is about to pay a dividend of 30c per share. The rate of return on reinvested funds is 14% and the company has a pay out ratio of 30%. Estimate growth (g) and calculate the cost of equity.

- 5. Cost of Equity Cont’d •2) The CAPM •The Background of the CAPM is the Portfolio Theory (PT). •The PT considers Total Risk. •Whenever an investment is done, there is a risk that the actual return will be different from the expected return. •Investors take this risk into account when they decide on the return they wish to receive from making the investment. •The CAPM is a method of calculating the return required based on the assessment of the risk.

- 6. Cont’d •Total Risk= Systematic + Unsystematic Risk •Investors create a portfolio of different investments to reduce the risk. •The amount of risk reduced depends on the Correlation Coefficient between the investments. •If the correlation is high, there is little risk reduction and V/V (give E.gs).

- 7. What Type of Risk is Reduced/diversified? Types of Risks: •Unsystematic Risk. •Also called specific Risk or diversifiable risk, this is the risk specific/unique to the company, investment or segment. •It is caused by factors specific to the particular company/investment/segment e.g strikes in universities, in cement industry… •This risk can be diversified away or reduced by diversifying.

- 8. Systematic Risk •Is the risk of the entire system/market as a whole. •Caused by factors which impact on the whole market e.g inflation rates, unemployment rates, oil prices, exchange rates. •These factors affect every body in the market although differently. •This risk cannot be diversified away.

- 9. What Risk is Reduced. Unsystematic Risk Total Risk Systematic Risk Number of investments/shares

- 10. CAPM •CAPM assumes that investors are rational and so well diversified. •Required Return = Rf + Average Systematic Risk •Average Systematic Risk = E(Rm) – Rf •Problem: Some Co.s suffer more systematic Risk than others and so, companies don’t get the same risk premium. •Therefore, we need to measure this systematic risk for the different companies or investments. •This is done by use of an index called beta (β). •CAPM formula: E(ri) = Rf + βi(E(Rm) – Rf)

- 11. CAPM CONT’D • Example 5. •Company B has a beta of 1.25. The return on government guilt is 5% while return on the market is 11%. •Calculate the cost of equity. • Example 6. Risk on government security = 4%, Equity risk premium = 5% and the beta value of Roy Co = 1.2 •Calculate the cost of Equity. •Total MV of Equity = Share Price (ex div) x Total no. of shares.

- 12. Cost of Debt. •1) Preference Shares: •Cost of pref. shares – Use DGM but g = 0 (since there is no growth). •Total MV – same of ordinary share i.e Price x number of shares. • Using DGM, rd= 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g •Since g =0, rd = do Po x 100% • Example7. Co D. has 7% $1 irredeemable shares which currently trade at $1.23. •Calculate the cost of preference shares.

- 13. Cont’d • True Debt (Preference shares is not true debt) •1) Bonds/loan Stock. •These are long-term debts •Key features: •Assume $100 nominal/face/par value. •Interest is fixed on the date of issue. •Bonds may be issued or redeemed at a premium or at a discount to par value. •Bonds may be convertible into shares. •Bonds may be redeemable or irredeemable. •Market Value of the bond will vary over time •Key note: If Market interest rates rise the value of the bond will fall and V/V. (why?)

- 14. Cont’d •2) Irredeemable Debt/Bond. •Has no specific redemption/maturity date. •Borrower pays interest but provides no information on principle payment •In many cases, the principle may never be paid •Cost of the debt: (we need 2 things) i) Cost (Post-tax) = 𝐢(𝟏−𝐓) Po x100% Where, i = annual interest on the bond in $s. Po = Current value/price of the bond. (Ex-interest)

- 15. Cont’d •Example 8. •TK Co has irredeemable loan notes of 8% which are currently trading at $79. The total book value of the loan is $80m. Corporation Tax is 28%. Calculate the Post-tax cost of the loan notes. ii) We also need Total Market Value of the Loan. Total MV = Total book value x Po 𝟏𝟎𝟎 Example 9. •Calculate the total MV in example 8 above.

- 16. Cont’d •3) Redeemable Debt: 1) Post-tax cost = IRR of the cash flows from the company’s point of view. 2) Total MV = Like irredeemable debt. Example 10. TK company has issued 9% debentures which are due to be redeemable at par in 6 years. The debentures have a current market value of $102. Corporation Tax is 30%. Calculate the post tax cost of these redeemable debentures.

- 17. Cont’d • Solution: (IRR – use 5%, 10% or 15% or less than 5%) 5% PV 10% PV Cash flows df/af df/af To Total MV (102) 1 (102) 1 (102) T1-6 Interest saved =100*9%*(1-t) 100*.09*.7 = 6.3 5.076 32. 4.355 27.4 T6 Redemption Value = 100 0.746 74.6 0.564 56.4 NPV 4.6 (18.2) Cost =IRR = 5 + 𝟒.𝟔 𝟒.𝟔+𝟏𝟖.𝟐 (5) = 6%

- 18. Cont’d • Solution: • Cost =IRR = 5 + 𝟒.𝟔 𝟒.𝟔+𝟏𝟖.𝟐 (5) = 6% • 4) Convertible Bonds This is like Redeemable debt but the redemption value is higher of; i) cash redemption value ii) Forecast value if converted. Assignment: A company has convertible loan notes in issue which have a coupon rate of 7% and are currently trading at $90. The bonds are redeemable at a premium of 10% in 4 years. Alternatively each loan note is convertible into 20 shares. The shares are currently trading at $4.70 and are expected to grow in value at 5% pa. Corporation tax is 30%. Calculate the post-tax cost of these convertible loan notes.

- 19. Cont’d •4- Non Tradable Debt: •i) Bank Loan/Overdraft i) Post-tax cost = %ge rate charged by the bank x(1-T) ii) Total MV – Use book Value. Example 11. AB Company has a fixed rate bank loan on which it is charged 8% pa. Corporation tax is 30%. Calculate the post-tax cost of the loan. 5.6%

- 20. Cont’d •WACC Example. •XYZ Co has $ 3m of 25c ordinary shares which are trading at $1.70 each. A dividend of 10c is due to be paid soon. The company also has $9m par value of 11% irredeemable bonds. These bonds are currently trading at $105. The company has an accounting return of 9% and retains 60% of its available profits . Corporation Tax is 28%. Calculate the WACC for the company.

- 21. Cont’d • Solution. a) Cost of Equity – DGM. g not given - to be estimated. g = bre, (b = proportion retained, re = cost of equity) re = 𝐝𝐨(𝟏+𝐠) 𝐏𝐨 + g g= 0.6x0.09 = 5.4% re = 𝟏𝟎(𝟏+.𝟎𝟓𝟒) 𝟏𝟔𝟎 + 0.054 = 12% b) Cost of the 11% irredeemable debt. Post – tax cost = 𝐢(𝟏−𝐓) Po x100% = 𝟏𝟏 (𝟏−𝟎.𝟐𝟖) 105 x100% = 7.5%

- 22. Cont’d •Total Market values. Equity: Ex Dive price = 170 – 10 = 160c Number of shares = 3,000,000/ 0.25 = 12,000,000 shares Total MV = 1.6*12,000,000 = 19,200,000 Debt: Total MV = Book value x Po 𝟏𝟎𝟎 = 9,000,000*105 𝟏𝟎𝟎 = 9,450,000 Total MV (‘000) = 19,200 + 9,450 = 28,650 WACC = ( 19,200 28,650 x 12%) + ( 9,450 28,650 x 7.5%) = 10.5%

- 23. •END