This document discusses different types of business organizations:

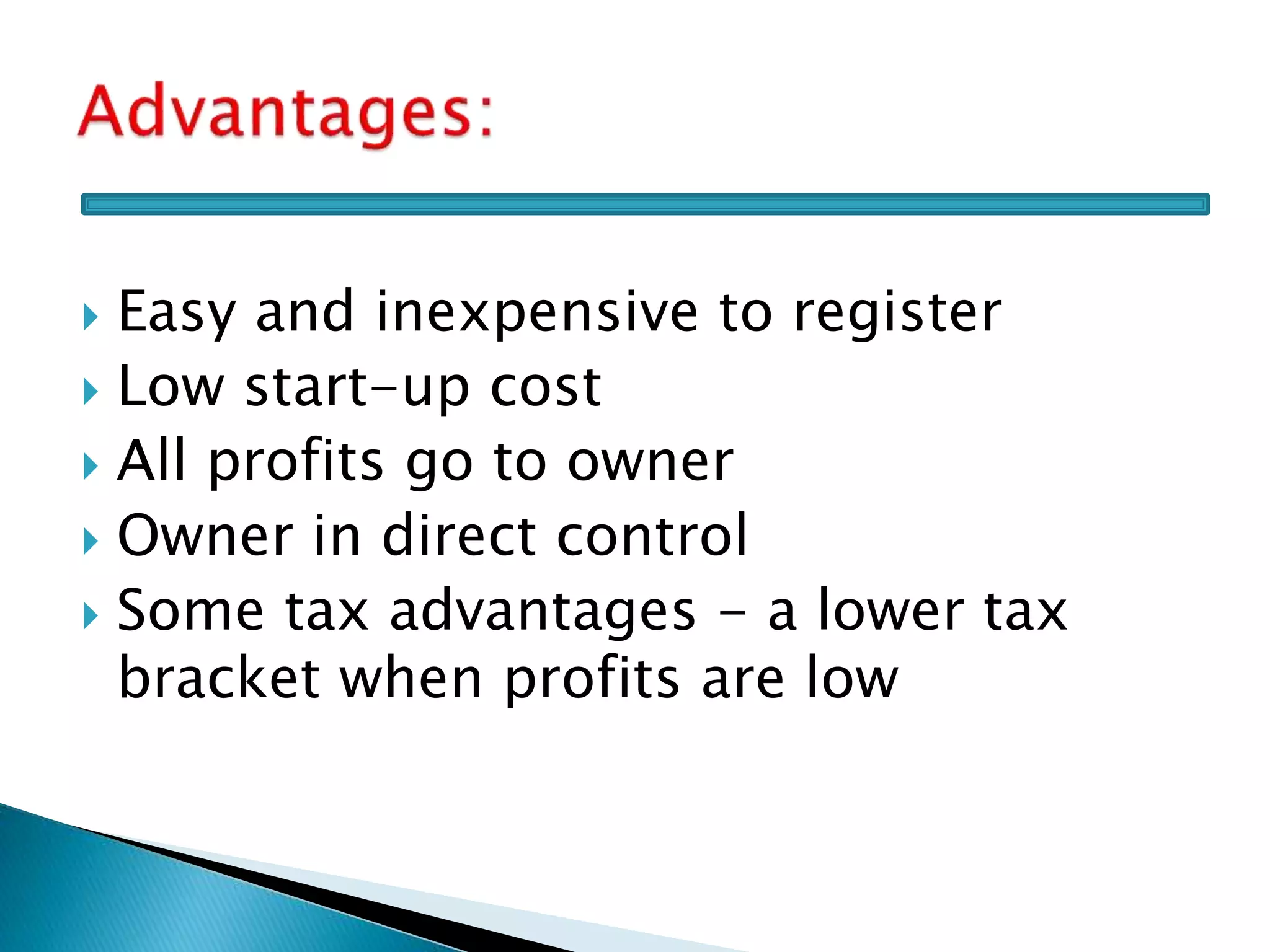

1. Sole proprietorship - Owned and run by one individual who has unlimited liability but full control. Low start-up costs but income is taxed personally.

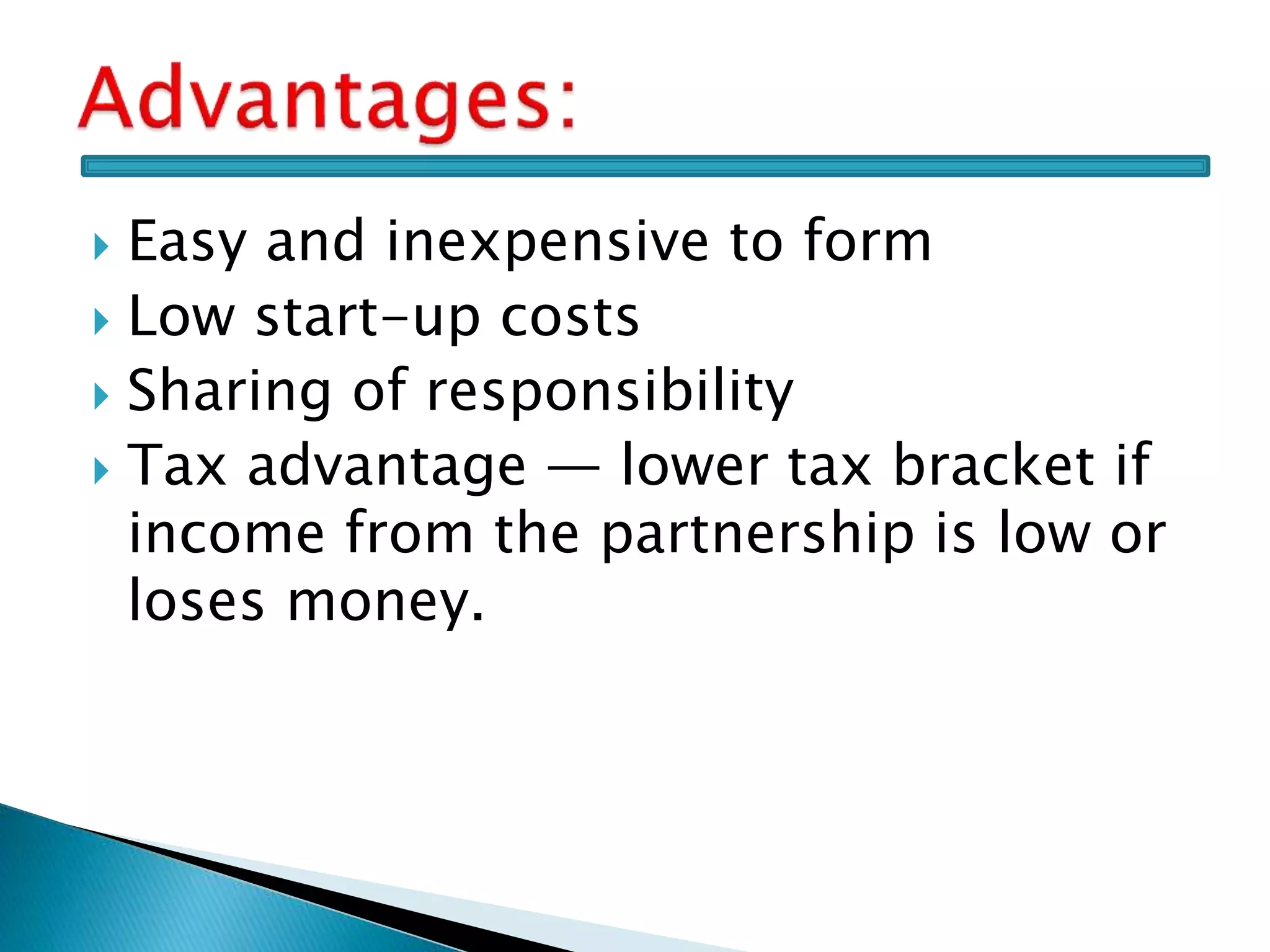

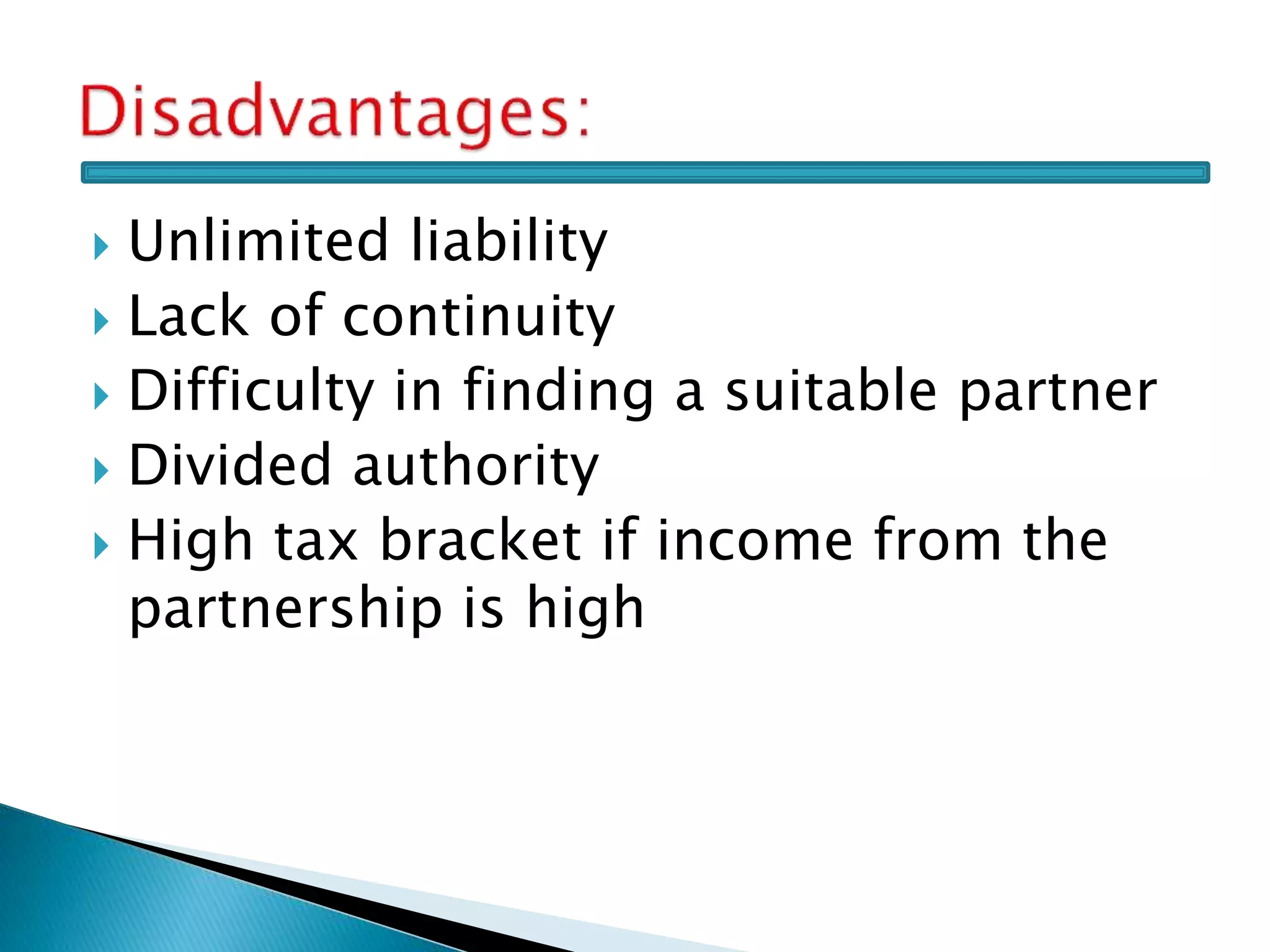

2. Partnership - Owned and run by two or more individuals who share profits/losses. Types include general, limited, and joint venture partnerships. Partners have unlimited liability but easy to form.

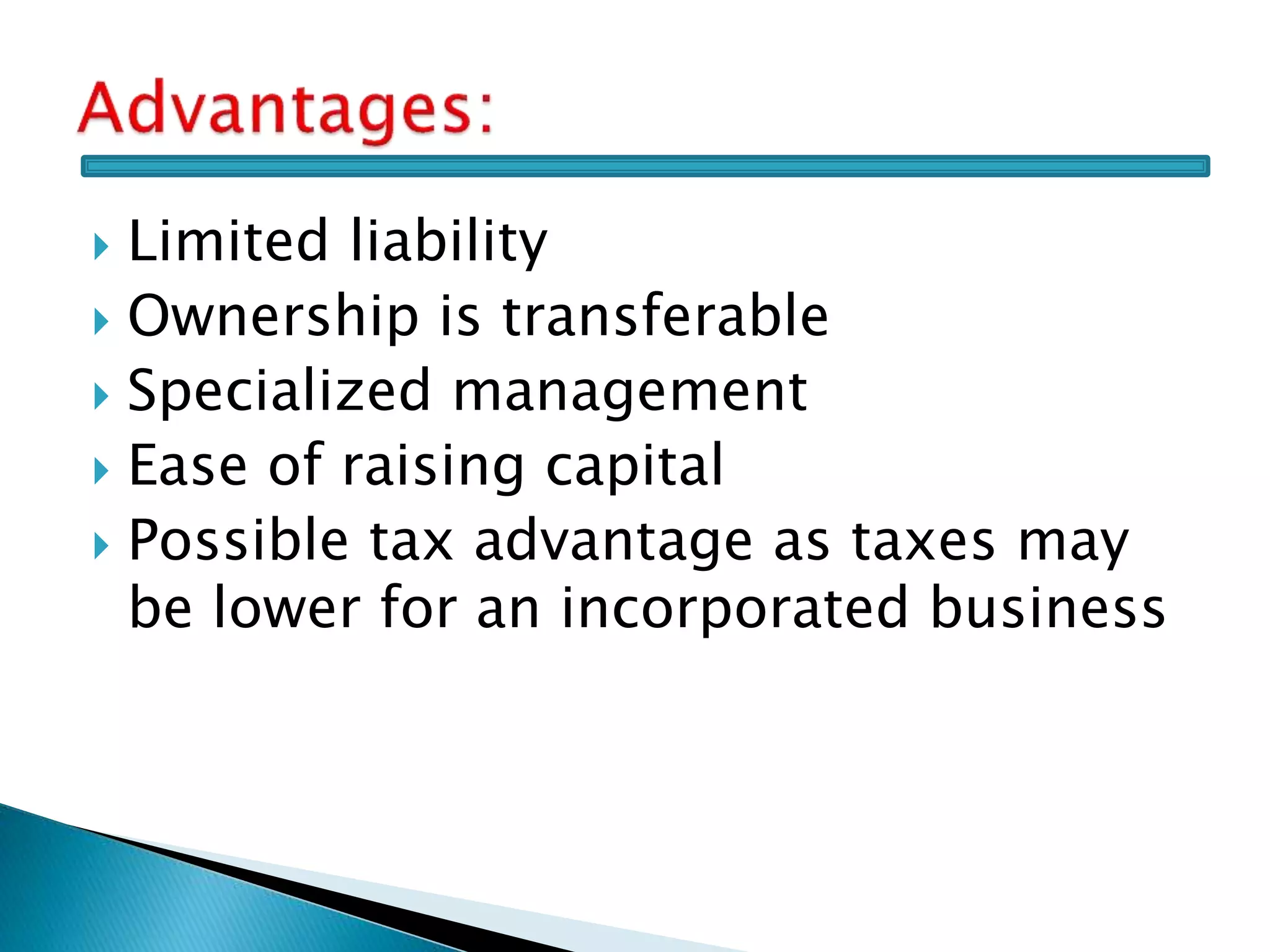

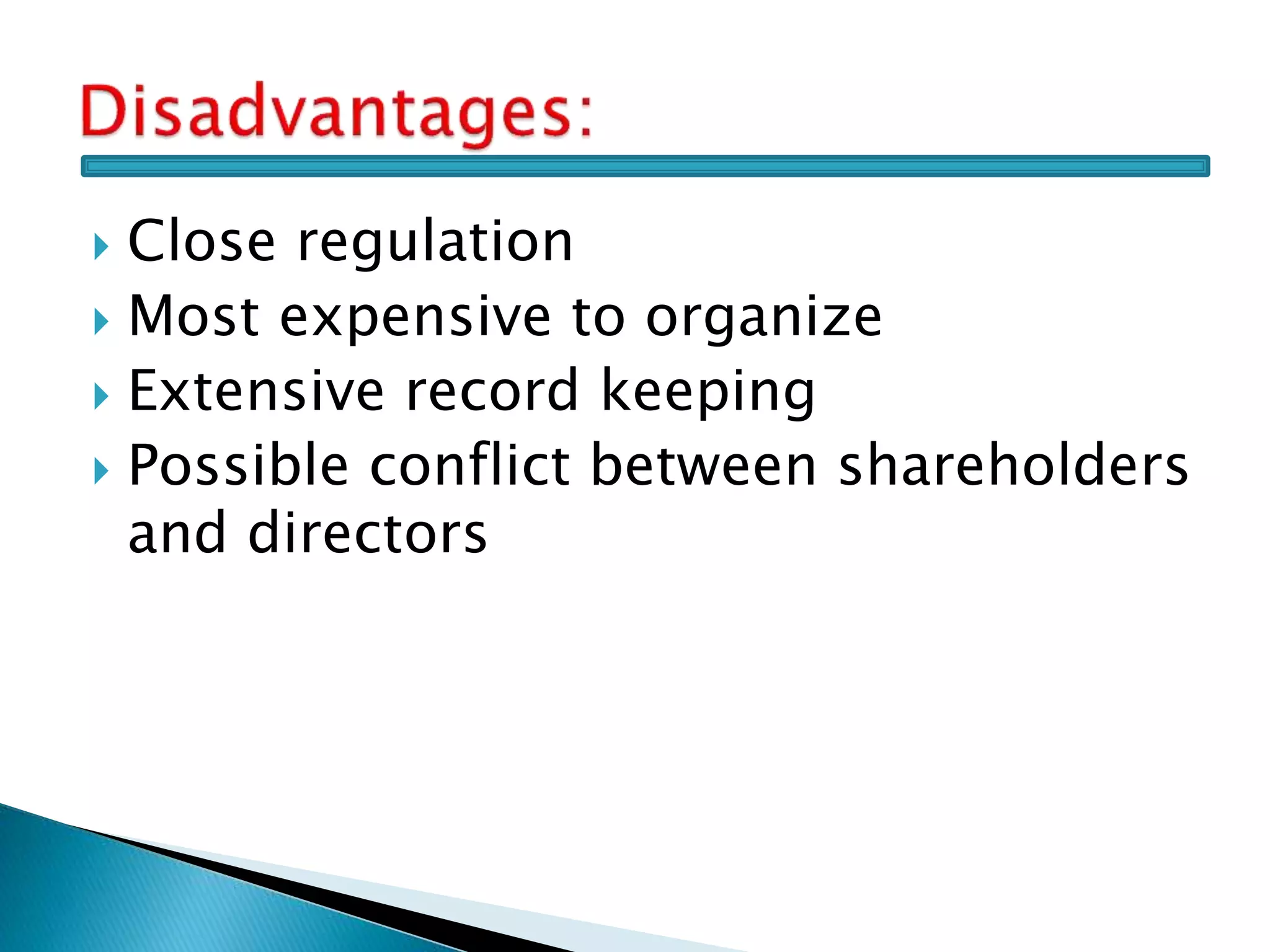

3. Corporation - A separate legal entity from its owners with transferable ownership. Limited liability but more regulation and expensive to organize than other structures.

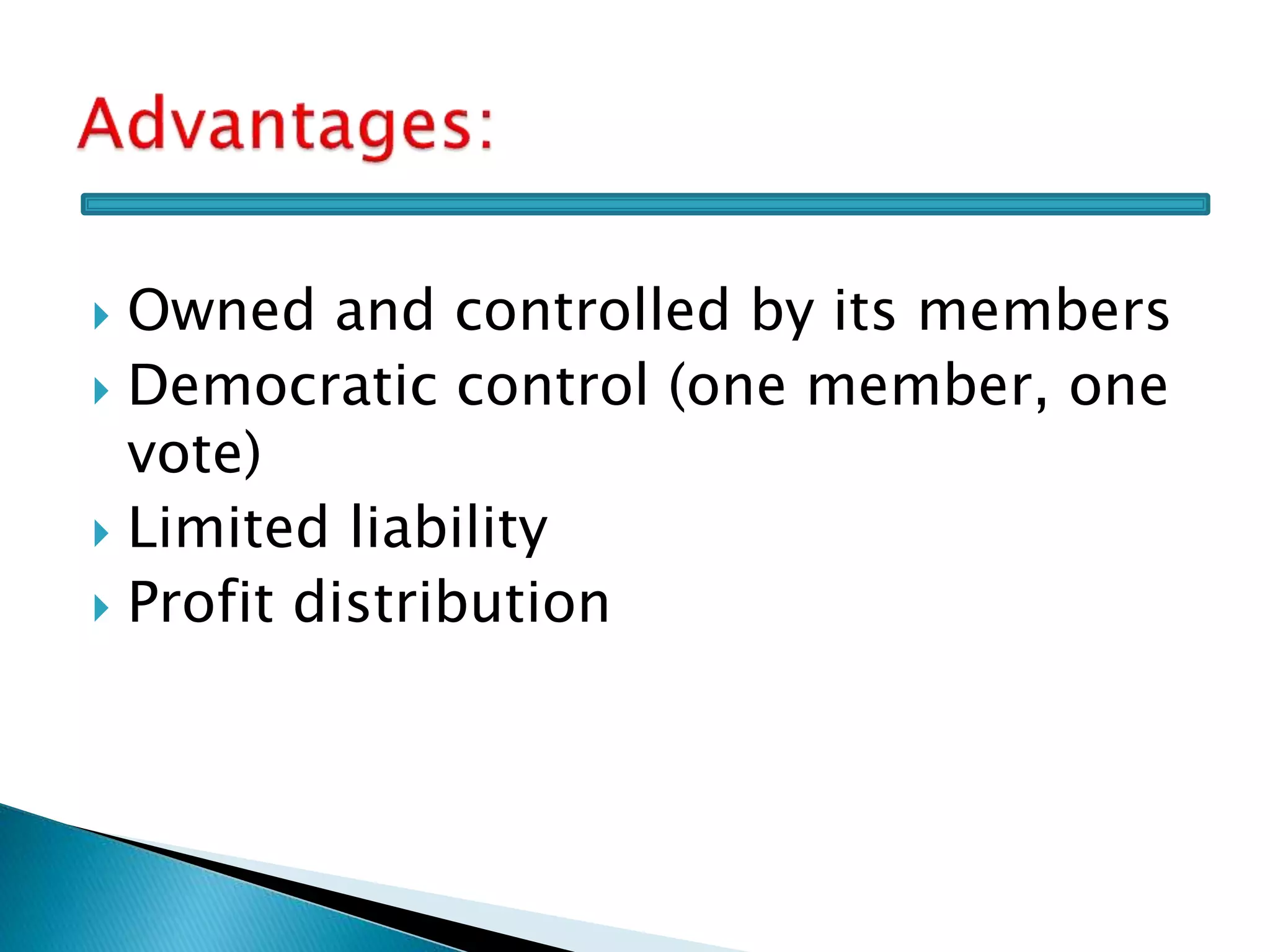

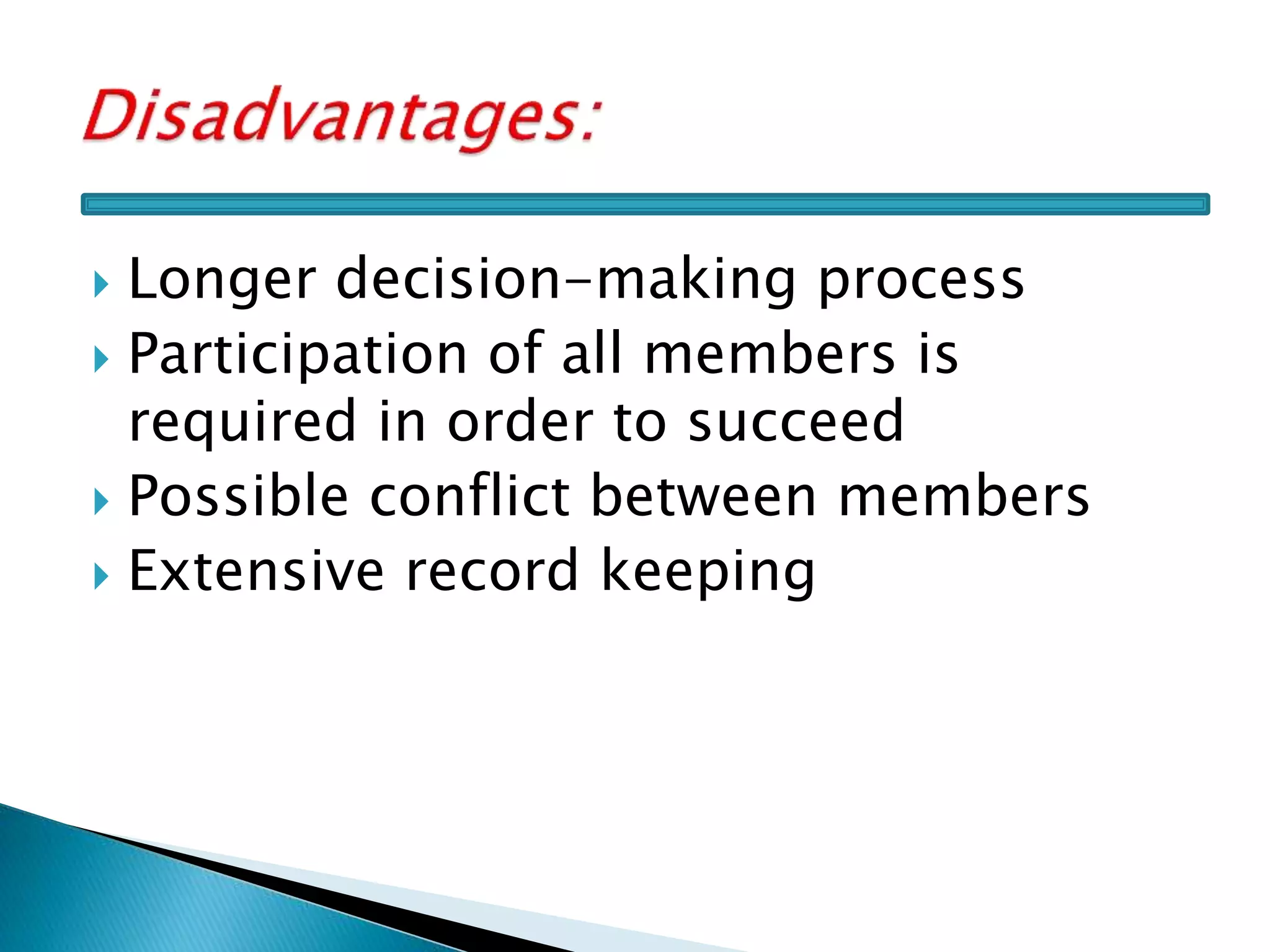

4. Cooperative - Owned and controlled by members who voluntarily join to achieve a common social or economic goal. Democratic control