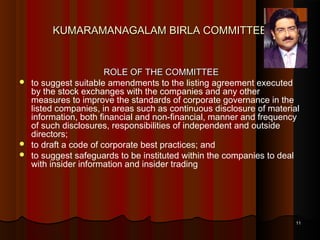

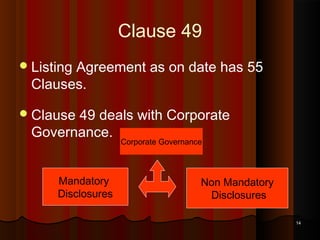

The document provides an overview of corporate governance in India. It defines corporate governance as ethics that govern how a company is directed and controlled. The Securities and Exchange Board of India (SEBI) mandates corporate governance requirements for listed companies through a clause in the listing agreement. SEBI introduced corporate governance reforms in the late 1990s in response to several stock market scams to improve transparency, minimize losses to stakeholders and restore investor confidence. Key committees like the Kumaramangalam Birla Committee and Narayana Murthy Committee have reviewed corporate governance standards and made recommendations to further improve practices for boards of directors, audit committees, disclosures and compliance.