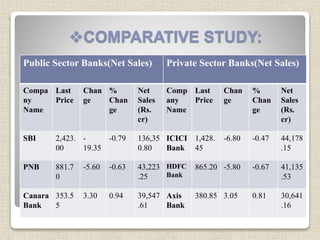

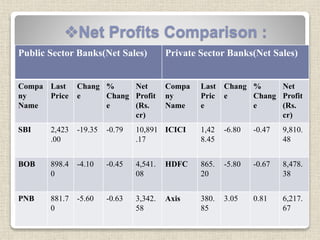

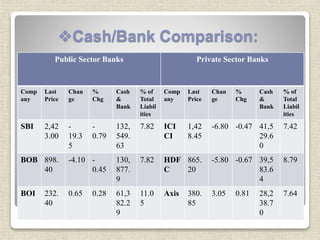

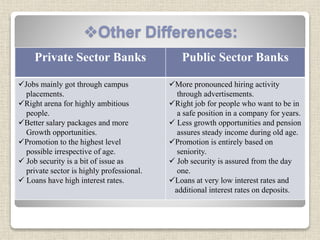

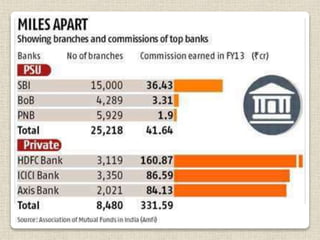

This presentation compares private sector banks and public sector banks in India. Private sector banks have grown faster since liberalization using newer technology, innovations, and tools. They offer higher salaries and more growth opportunities but less job security. Public sector banks provide more job security from the start with promotions based on seniority, but offer fewer growth opportunities and lower salaries. They provide loans at lower interest rates than private banks. The presentation includes comparative data on net sales and profits of major private and public banks.

![PUBLIC SECTOR BANKS :

Public Sector Banks (PSBs) are banks where a majority

stake (i.e. morethan 50%) is held by a government.

The shares of these banks are listed on stock exchanges.

There are a total of 27 PSBs in India [19 Nationalised

banks + 6 State bank

group (SBI + 5 associates) + 1 IDBI bank (Other Public

Sector-Indian Bank) = 26 PSBs + 1 recent Bhartiya

Mahila Bank].](https://image.slidesharecdn.com/apresentationonca-181103054546/85/corporate-accounting-4-320.jpg)