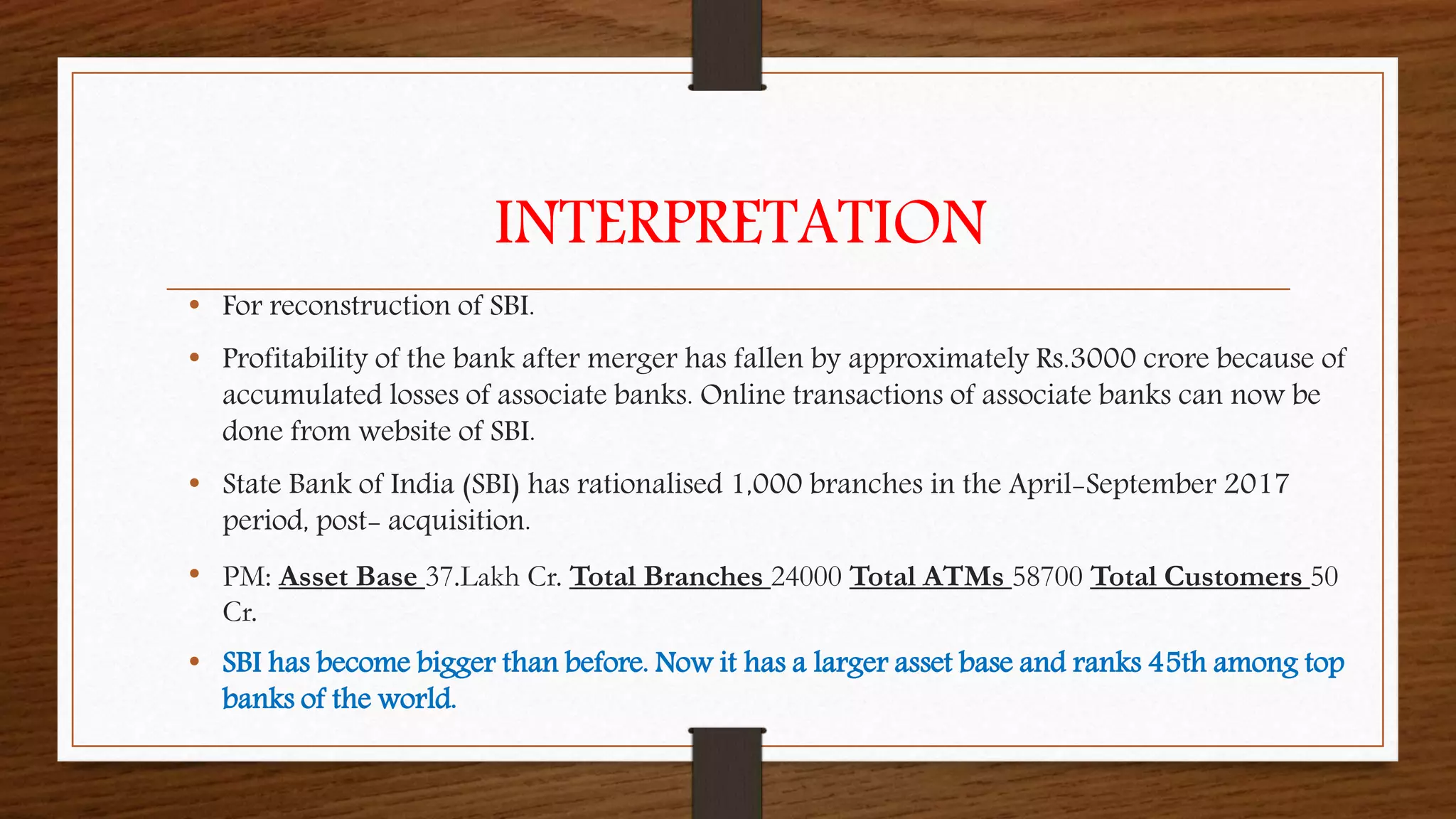

The document discusses bank mergers, defining them as the unification of two banking institutions into one. It provides examples such as the SBI merger with its five associate banks and examines the impact on profitability and operational efficiency. The document also outlines the pros and cons of mergers, along with suggestions for improving merger outcomes.