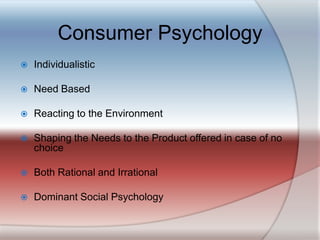

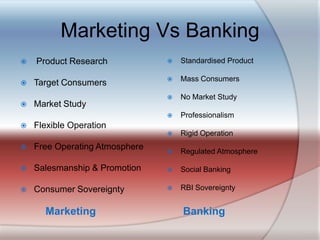

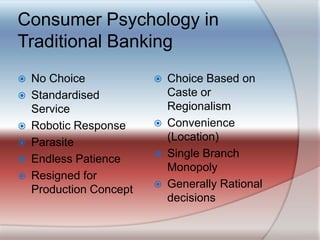

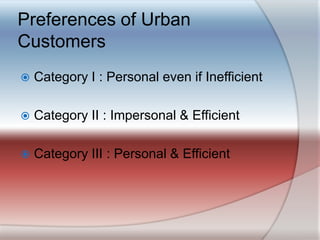

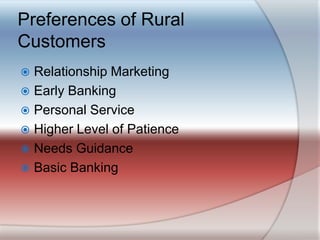

The document discusses the interplay between consumer psychology and the marketing of banking products, highlighting how individual needs and societal factors influence banking decisions. It contrasts traditional banking approaches with new trends emphasizing customer segmentation and relationship marketing, addressing the roles of technology and risk management in modern banking. Additionally, it stresses the importance of aligning banking products with consumer requirements and improving customer service through deeper engagement and understanding.