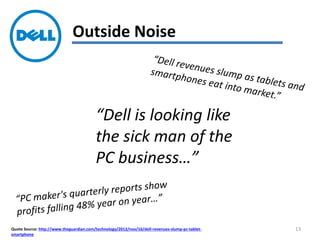

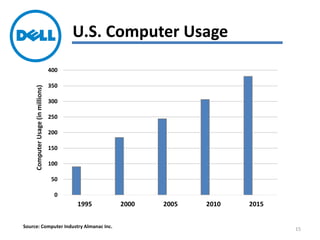

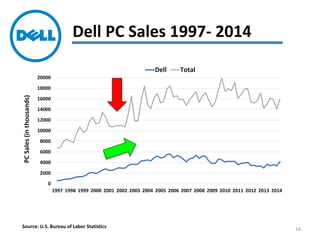

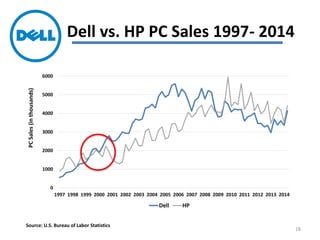

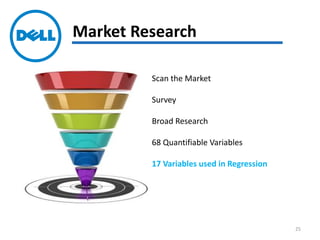

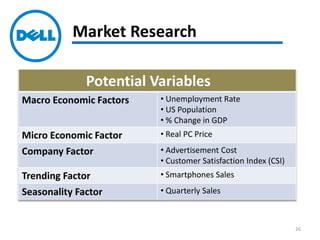

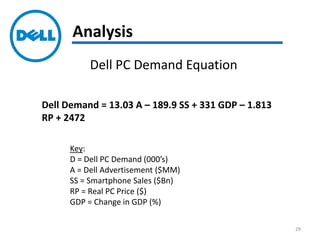

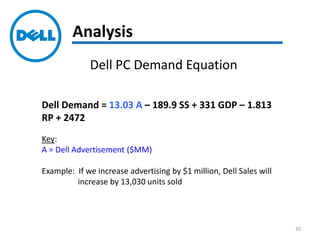

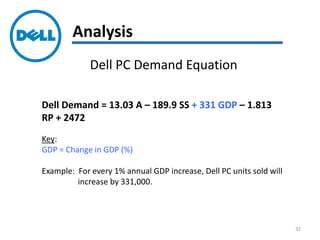

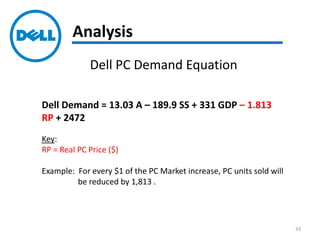

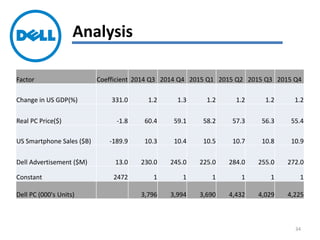

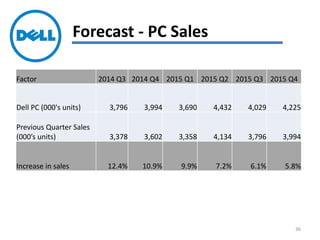

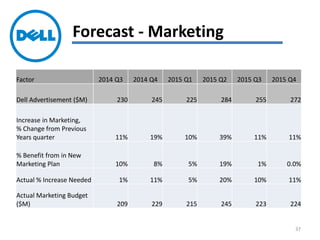

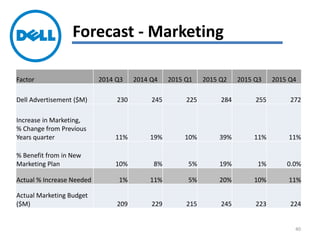

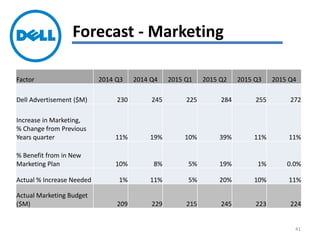

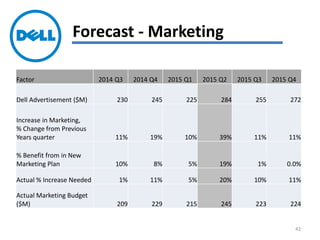

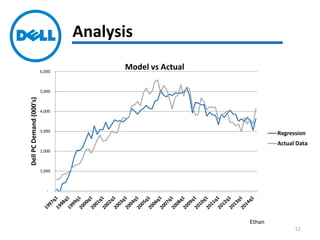

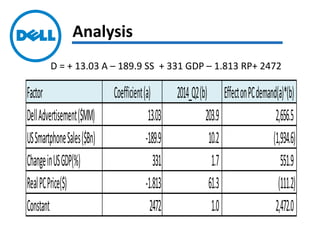

The document presents a comprehensive analysis of the demand for personal computers in the U.S., covering industry trends, data collection, and forecasts. It emphasizes Dell's market position and factors affecting PC sales, including advertising and smartphone sales. Additionally, it provides detailed regression analysis on the impact of macroeconomic and microeconomic factors on Dell's demand projections.