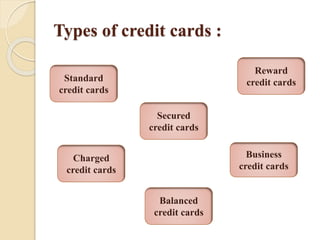

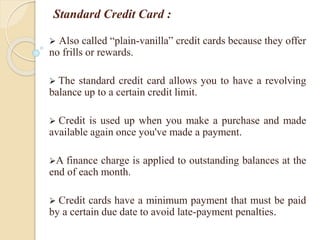

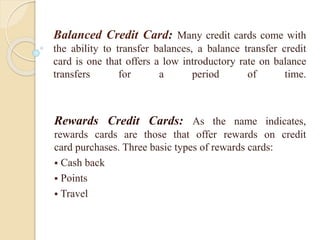

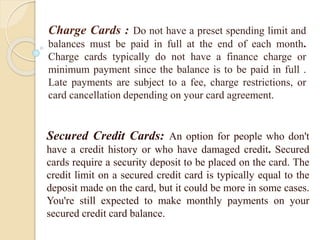

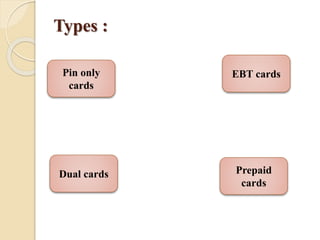

The document provides an overview of consumer credit, defining it as money, goods, or services provided without immediate payment. It discusses the costs associated with credit, different types of consumer credit including installment and revolving open-end credit, and details various types of credit and debit cards, such as standard, secured, and rewards credit cards. Additionally, it highlights the functions of debit cards and their categories including pin-only, dual-use, and prepaid cards.