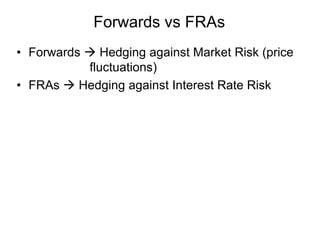

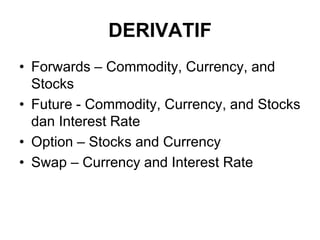

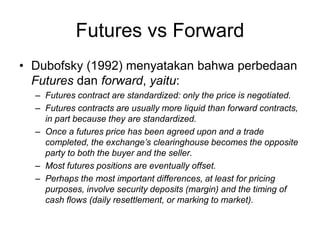

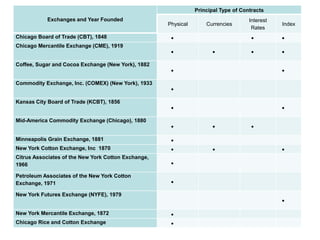

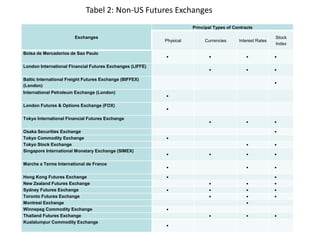

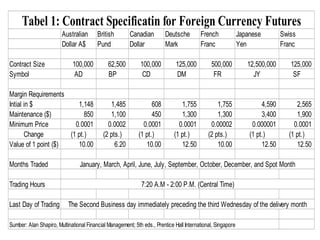

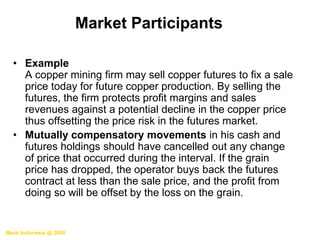

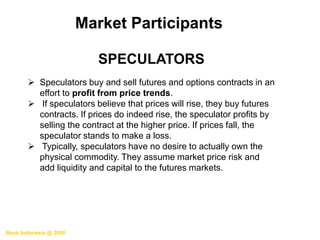

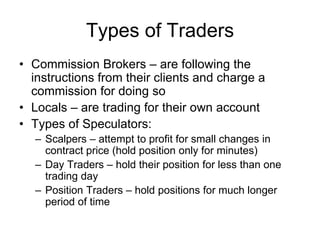

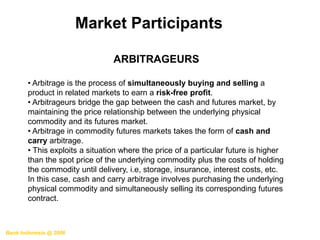

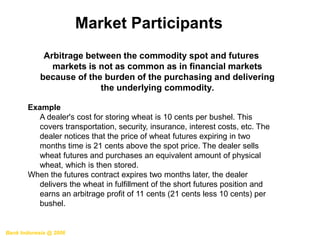

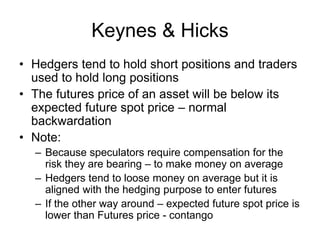

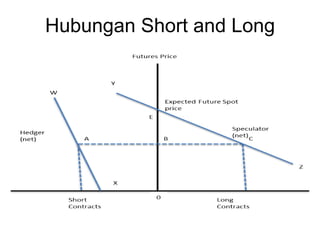

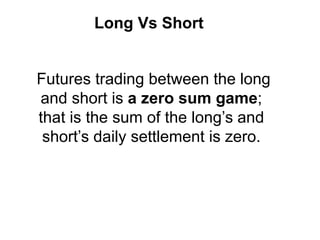

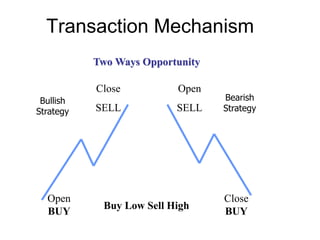

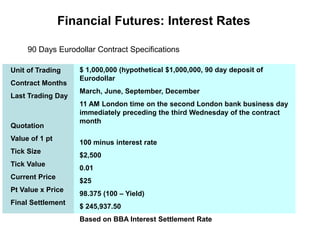

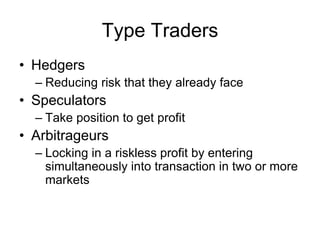

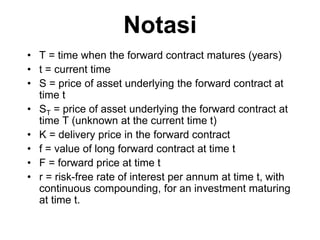

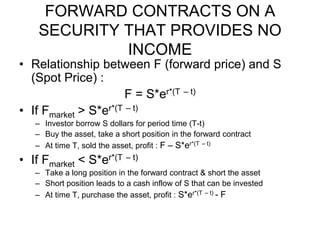

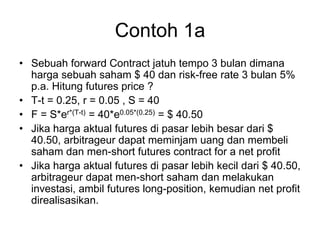

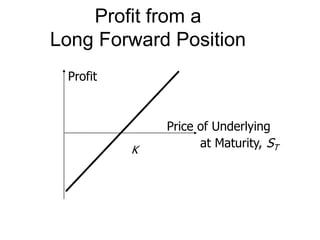

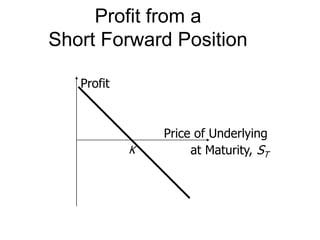

This document discusses forwards and futures contracts. It defines forwards as agreements between two parties to buy or sell an asset at a specific price and date without standardized terms or regulation. Futures, on the other hand, are standardized contracts traded on exchanges, with clearinghouses that act as intermediaries and mark positions to market daily. The document provides examples of different derivative types and exchanges, and discusses key differences between forwards and futures regarding standardization, liquidity, counterparty risk, and other factors. It also outlines the roles that hedgers, speculators, and arbitrageurs play in the futures markets.

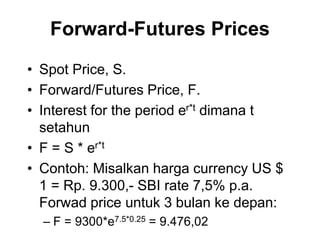

![Pricing of Financial Futures

(example: Currency)

Forward price is an unbiased predictor of spot

exchange rate in the future (so does Futures)

Futures are priced very similarly to Forward

contracts

Based on Interest Rate Parity Theory (High

Interest Rate Currency will appreciate against Low

Interest Rate Currency)

Ft ($/i) = So ($/i) [(1+Rus)/(1+Ri)] t

Ft = Futures Price, So = Spot Price, Rus = I/R

USD, Ri = I/R Currency i](https://image.slidesharecdn.com/forwardandfuture-adlerforbbj-150114214854-conversion-gate01/85/Forward-and-Futures-38-320.jpg)

![Example: Bunga USD 5% p.a. – Bunga IDR 10% p.a.

Kurs USD/IDR tgl.3/9/2006: 10,200

Forward Rate untuk 6 bulan (jatuh tempo 3/3/2007)

adalah: 10,200 x [(1+10%)^6 / (1+5%)^6]

= 10,200 x [(1.0083)^6 / (1.0042)^6]

= 10,200 x 1.024749

= 10,452.43

Forward Price (for FX rate)

t

t

USD/IDRUSD/IDR

)r(1

)r(1

)(rateSpot)(rateForward

USD

IDR

](https://image.slidesharecdn.com/forwardandfuture-adlerforbbj-150114214854-conversion-gate01/85/Forward-and-Futures-59-320.jpg)