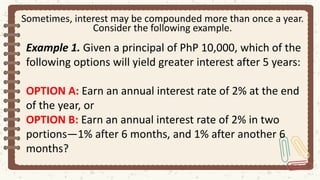

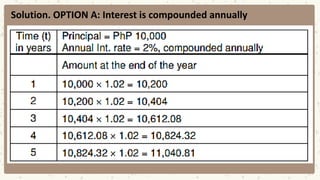

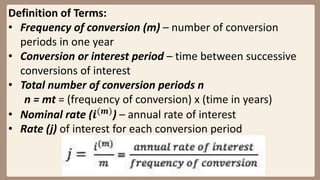

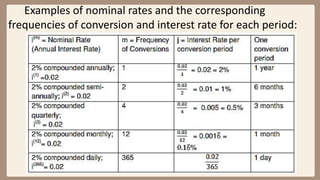

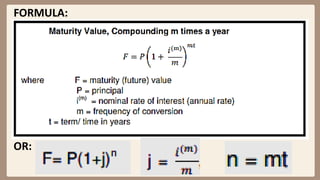

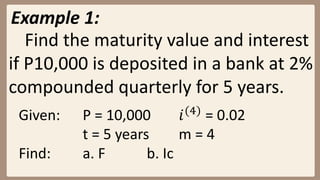

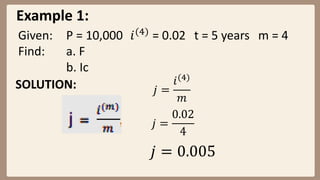

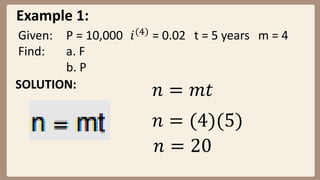

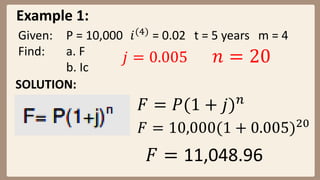

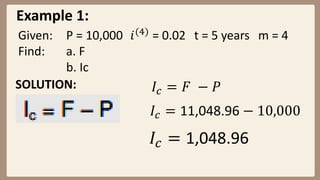

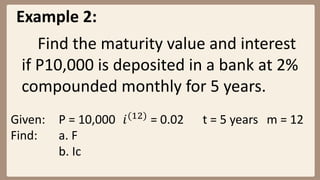

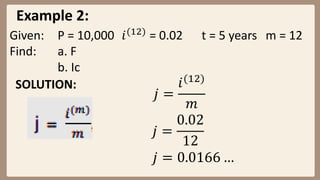

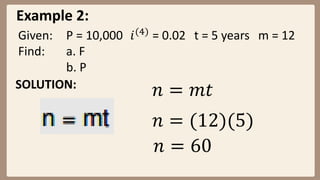

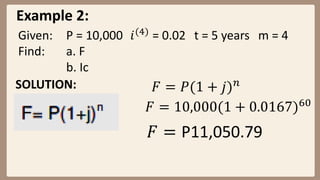

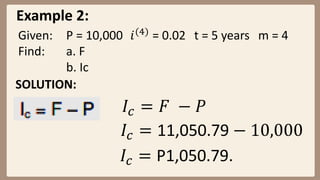

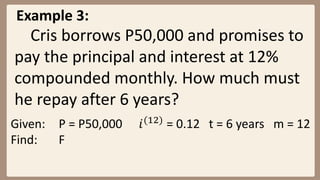

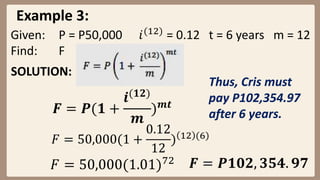

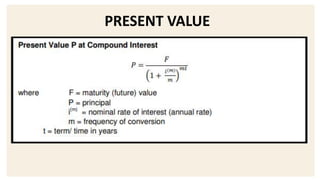

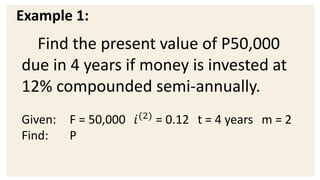

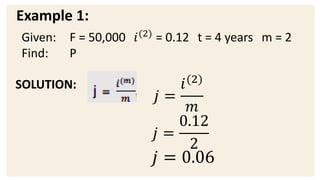

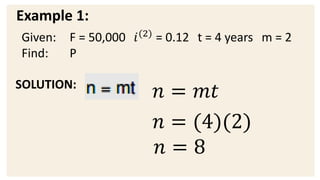

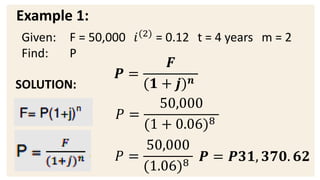

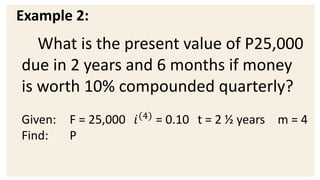

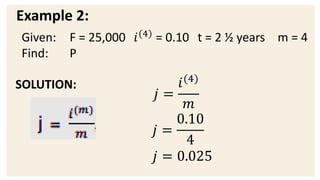

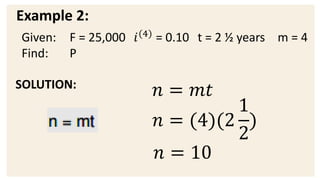

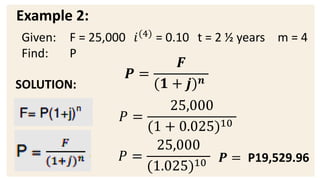

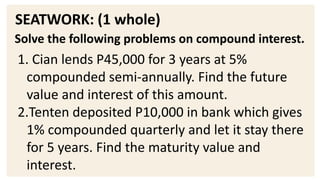

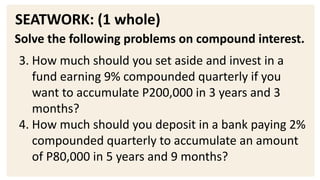

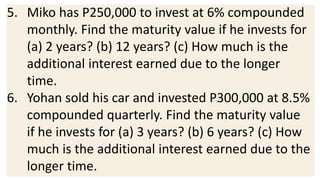

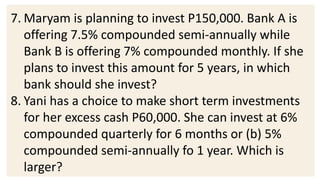

This document provides examples and explanations for computing compound interest when it is compounded more than once per year. It defines key terms like nominal interest rate, frequency of conversion, and interest rate per conversion period. Examples are provided to demonstrate calculating maturity value, interest, and present value for principal amounts compounded quarterly, semi-annually, and monthly over various time periods. Practice problems at the end involve using the concepts and formulas taught to solve for unknown values in compound interest scenarios.