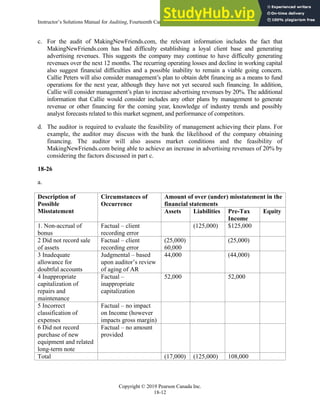

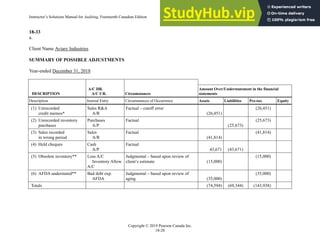

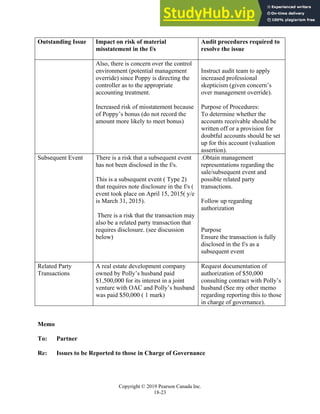

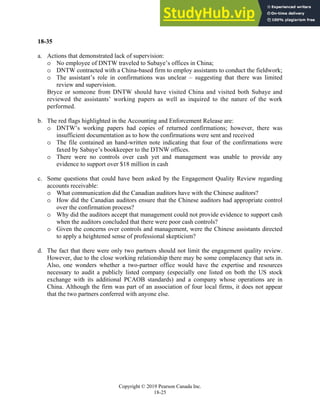

The document discusses completing the audit process. It includes concept check questions about identifying contingent liabilities, reviewing legal expenses, and identifying subsequent events. It also discusses management and auditor responsibilities regarding the going concern assumption. Key audit procedures mentioned include examining legal expenses, reviewing subsequent internal statements and board minutes, and assessing whether sufficient evidence was collected based on identified risks. The purpose of the engagement quality review and items that must be communicated to the audit committee are also summarized.