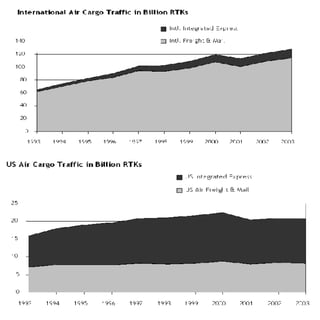

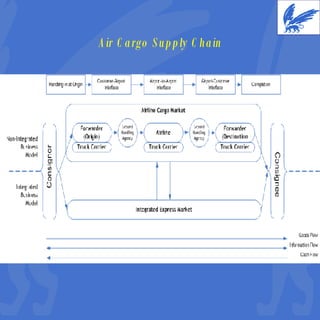

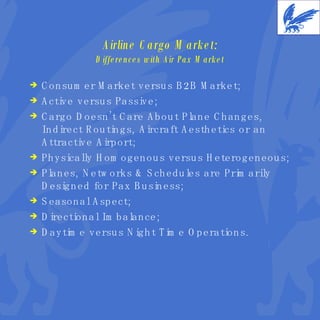

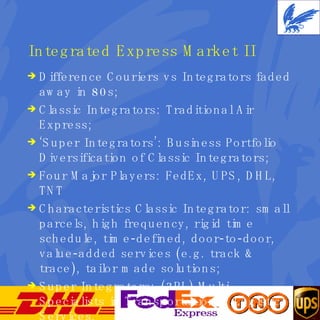

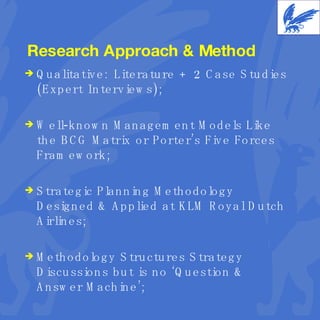

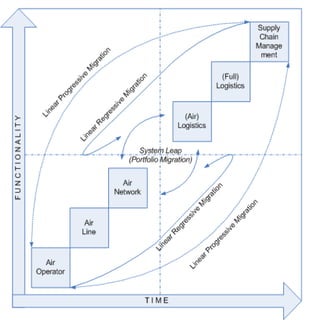

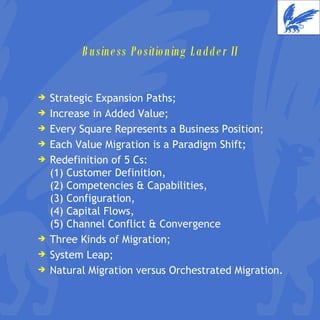

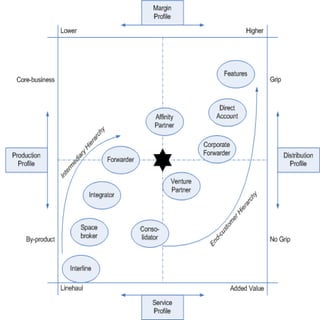

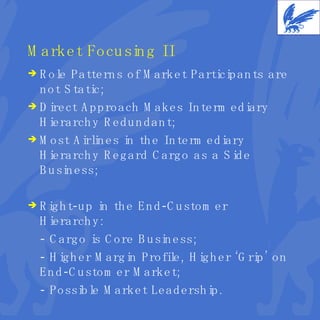

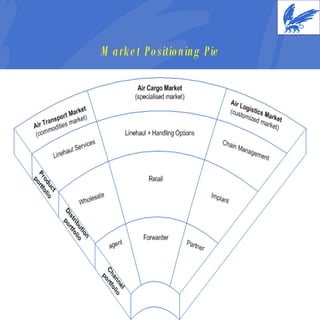

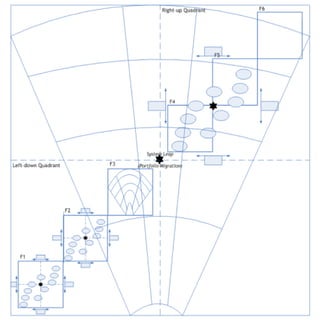

This document presents a qualitative analysis of competition between airlines and integrated express companies in the air cargo industry. It introduces the air cargo industry and supply chain. It then describes differences between the airline cargo market and integrated express market. The document also outlines a strategic planning methodology used to analyze business positioning, customer relationship management, and commercial distribution to frame the complex air cargo industry. While the main research question about which sector is losing the battle cannot be definitively answered, some conclusions are that integrated express players have a more solutions-oriented approach while airlines prefer expanding scale over scope.

![By: Willem-Jan Zondag MSc [email_address] ‘ Competing for Air Cargo’ “A Qualitative Analysis of Competition in the Air Cargo Industry” July 1 st 2006: Presentation GARS Amsterdam](https://image.slidesharecdn.com/competing-for-air-cargo-1196895628178859-5/75/Competing-For-Air-Cargo-1-2048.jpg)