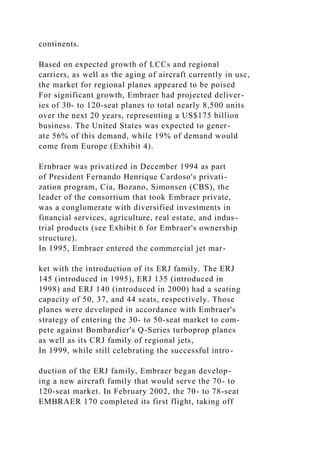

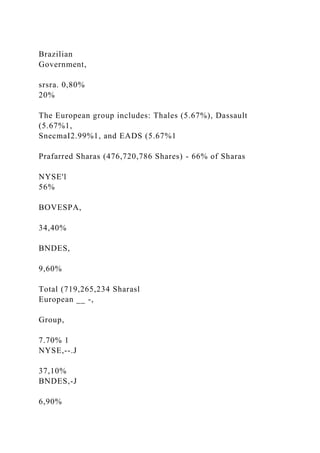

The document discusses the evolution of the airline industry, highlighting the rise of Embraer as a significant player in the regional aircraft market following deregulation in the U.S. in 1978. It details the competition between major, regional, and low-cost carriers, emphasizing how regional airlines adopted efficient technologies like regional jets to meet market demands. The document also notes market conditions post-911 and outlines the restructuring within the commercial aircraft industry, projecting significant growth for regional jets in the coming years.

![a basis for cla . . BUSiness Administration. It was written ns

h dll f ss dl~Cusslonrather than to illustrate effective or

Ineffective

o~ Vilr~~n~~ a~m1lli~ative situation. COPyright e 2007 by the

University

reserved ~o = en . hoo! Foundation, Charlottesville. VA. All

rights

N'f}{m~ifrilisap"b',f. ca,~les,Send an e-mail

[email protected]:!enpublishing.com.

lCalOlllllayberep_" ...~ d i d

in a spreudsheel Of tran' . ''''''1/(=, slore III a retrteval system,

lise

mechanical pha; ,. Smmed '? any form or by any means-

setectranic.

of the Dard~1IS'f''',P~1II8, rt~ordmg, or otherwise-without Ihe

permission

100 roundarlOll.

C382

Embreer: Shaking Up the Aircraft Manufacturing Market 63

CASE 25 , Ernbraer: Shaking Up the Aircraft Manufacturing

Market C383

outofunderutilized airports in those markets, the LLCs

were able to keep a low profile. The largest LCCs were

already operating nonstop transcontinental flights.

Contrary to the major airlines' hub-and-spoke sys-

tem, LCCs generally operated a point-to-point route

system. This feature was credited in the air carrier](https://image.slidesharecdn.com/internationalbusinessstrategy-221122044852-1cb4ecd4/85/International-Business-Strategy-62-docx-4-320.jpg)

![Most importantly, given Botelho's expectations of

rivals' future competitive moves, what should Embraer

do next to protect its position and influence its com.

petitors' actions?

Endnotes

I. "Air Transponation," Encyclopedia of Global Industries.

online edition, Thomson Gale, 2005. Reproduced in Business

and Company Resource Center (Michigan: Gale Group. 2005).

http://galeneLgalegroup.com/servletlBCRC.

2. "Air TranspOrtation," Encyclopedia of Gtobal tndustries,

Gale Research International Ltd. Pub ID: GE66 (1 December

2002). '

3. AV,ailable seal miles (ASM) measure available passenger

capacity.

4. "Airli~e,lndust]'Y: A Business in Transition," Optimizing Air

Travel MIni-Conference Presentation Boston Massachusets,

24 March 2004. "

_______________________________ U:.-P...:S_i_n_ln.;d .;ia_-

_A_Package Deal? 7§

/I'S challenging. Bill UPS is all about global trade. Global

Trade is going to

pull us out of this recession.

-UPS CEO SCOTT DAVIS IN A 2009 CNBC INTERVIEW

Marne L. Arthaud·Day

Kansas State University](https://image.slidesharecdn.com/internationalbusinessstrategy-221122044852-1cb4ecd4/85/International-Business-Strategy-62-docx-36-320.jpg)