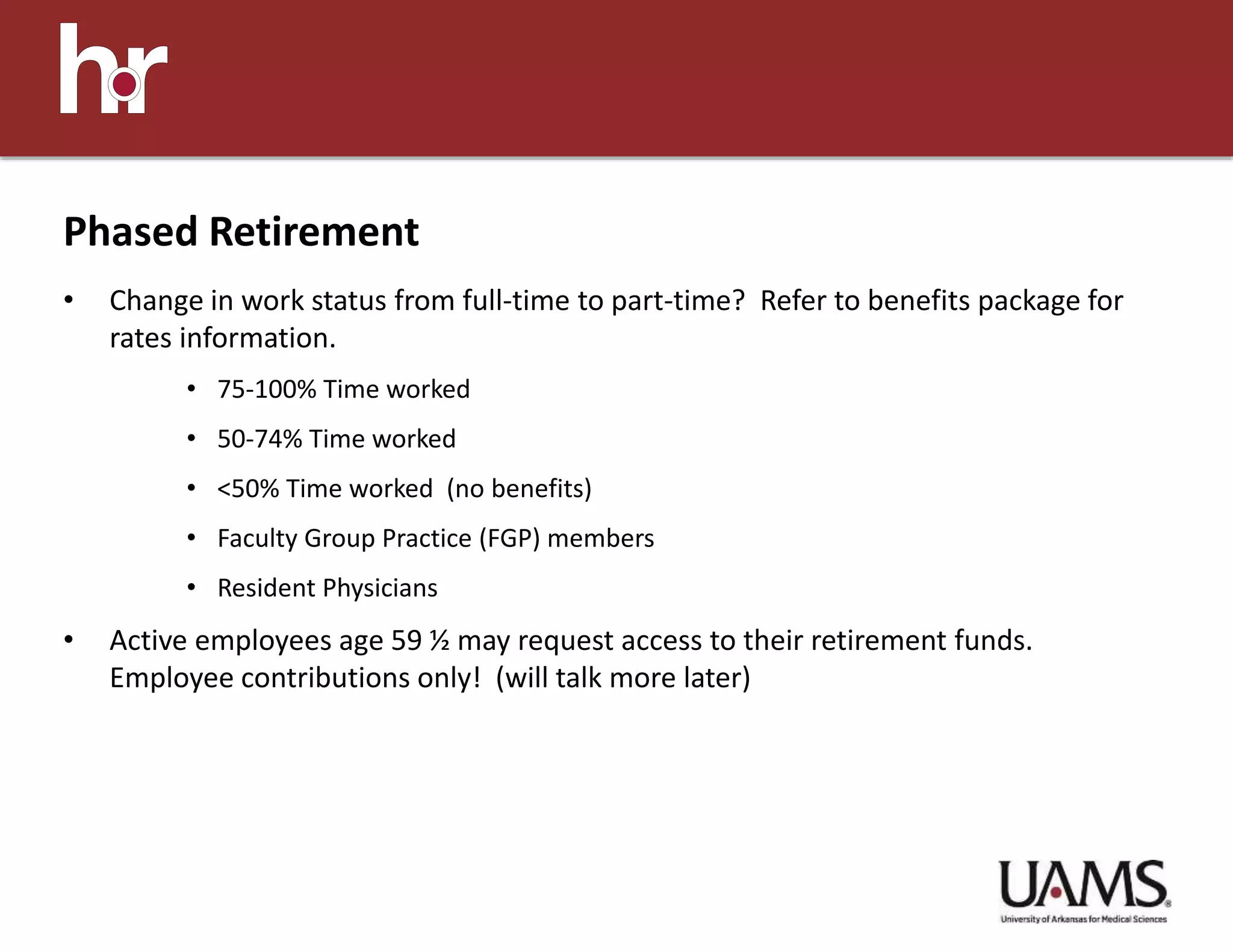

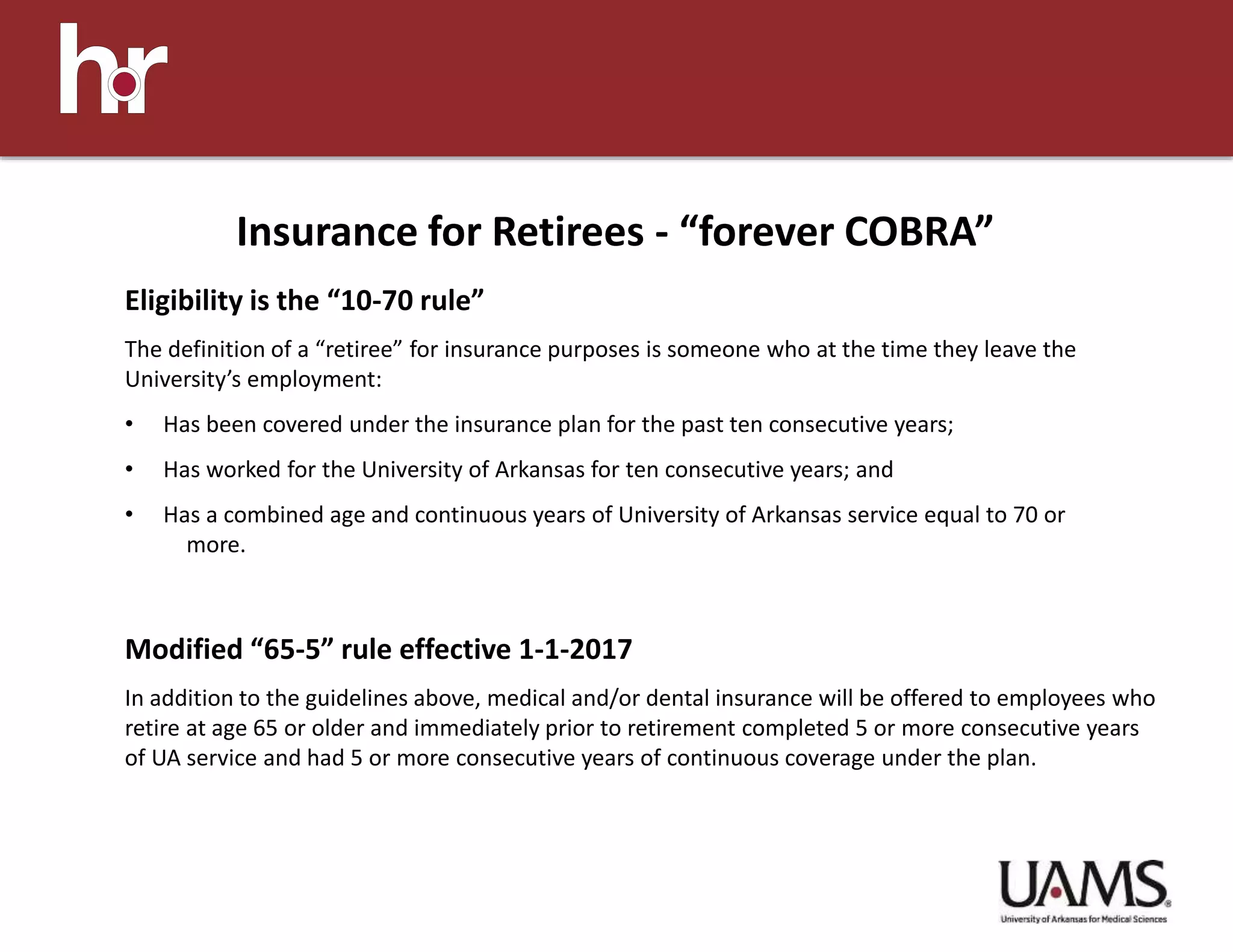

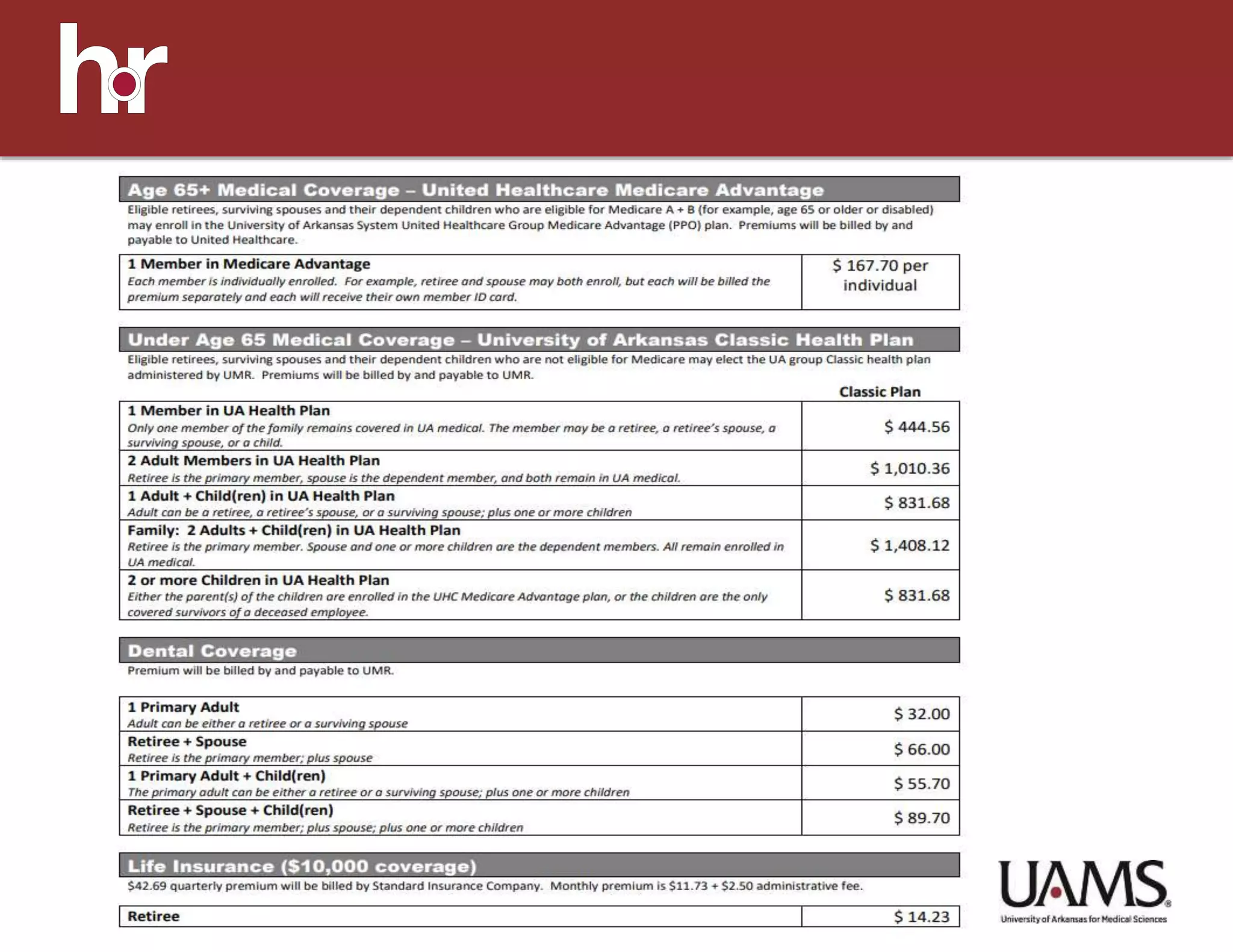

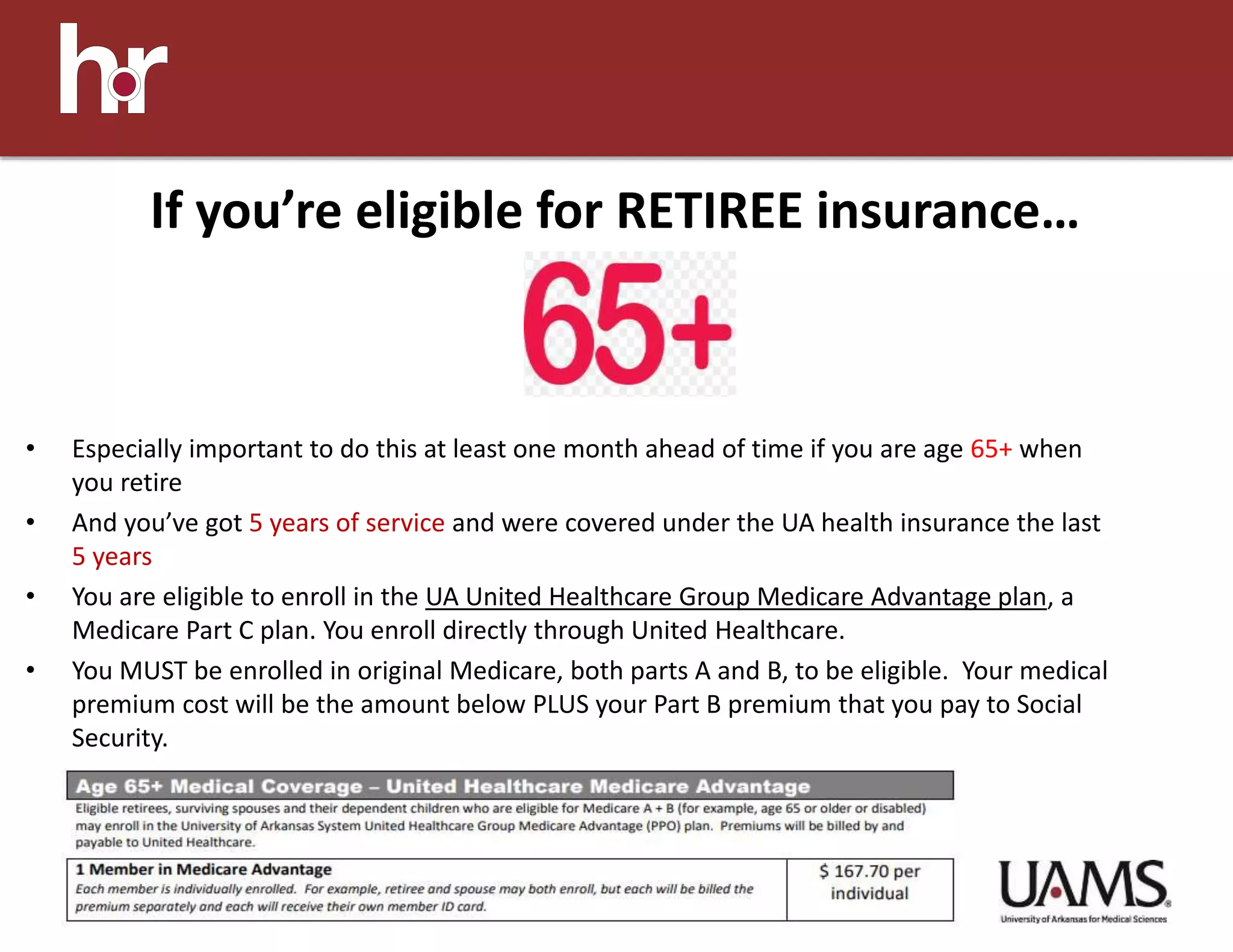

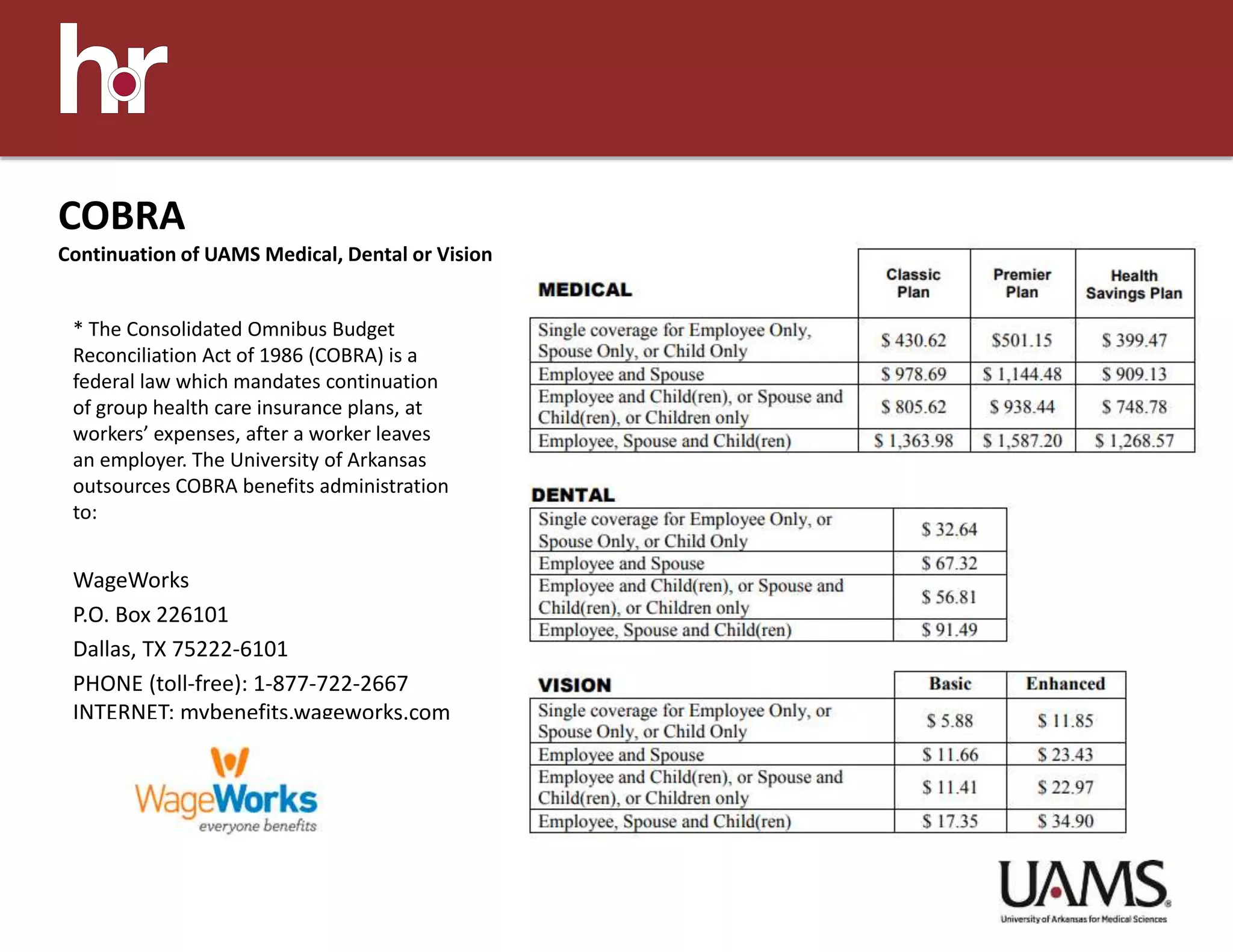

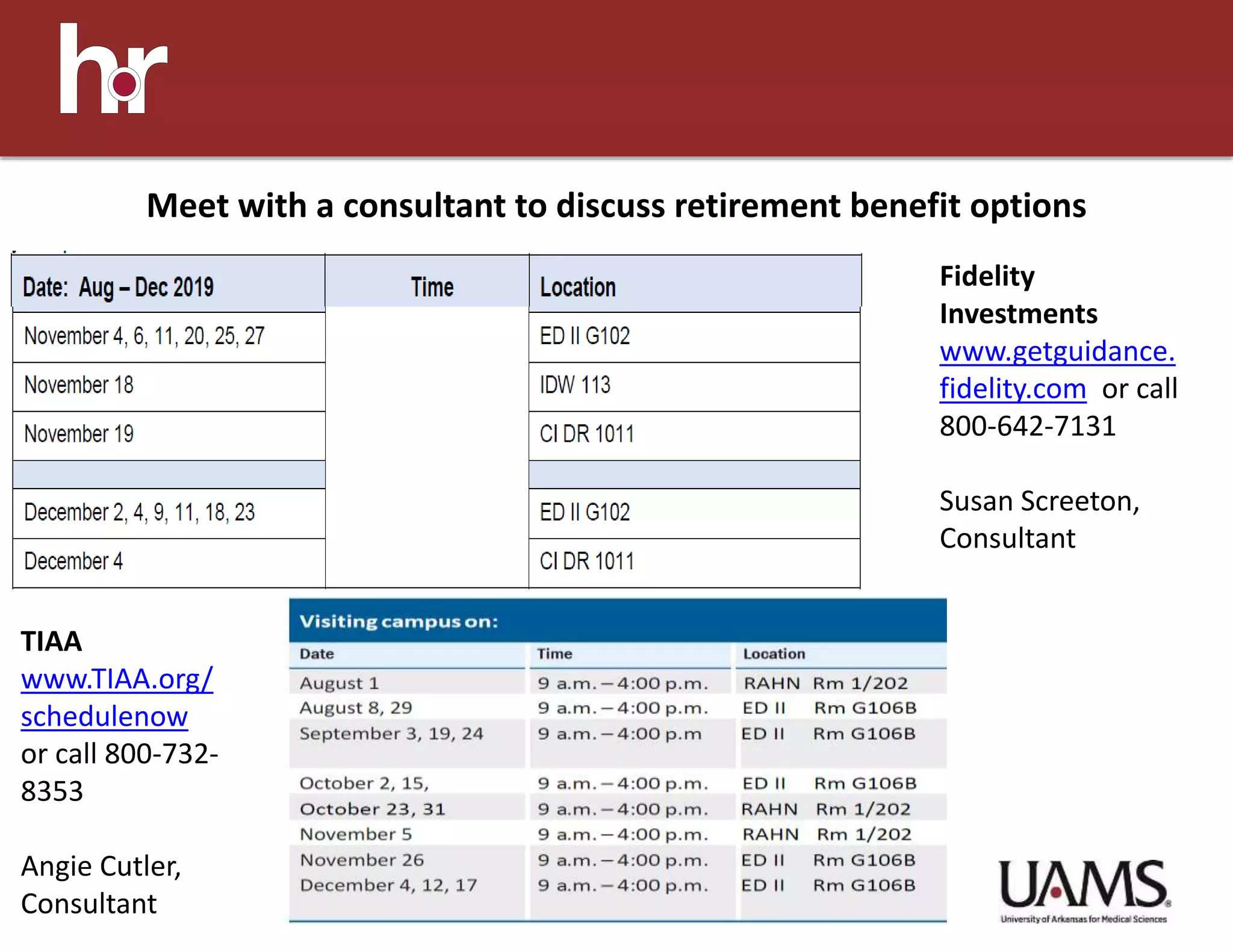

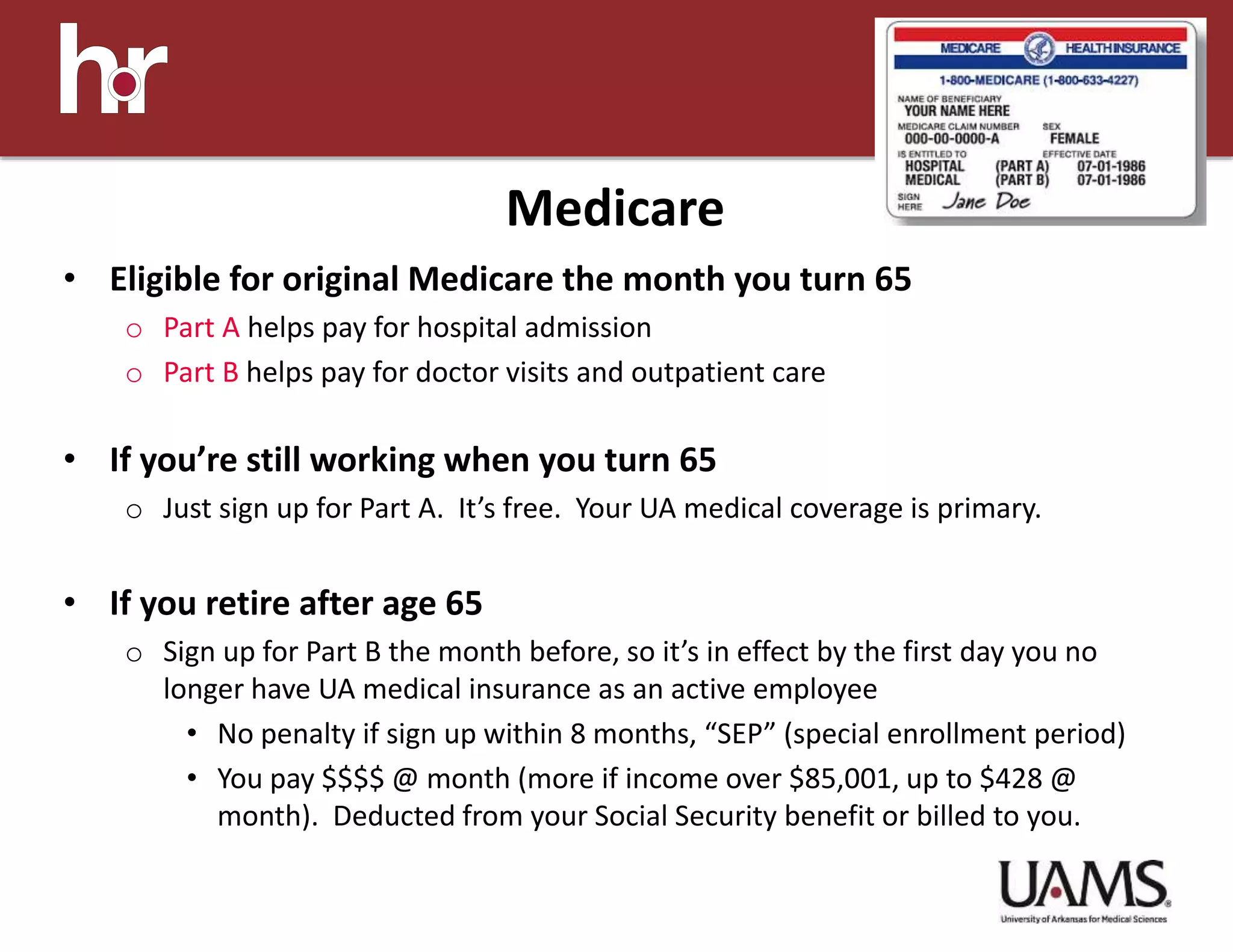

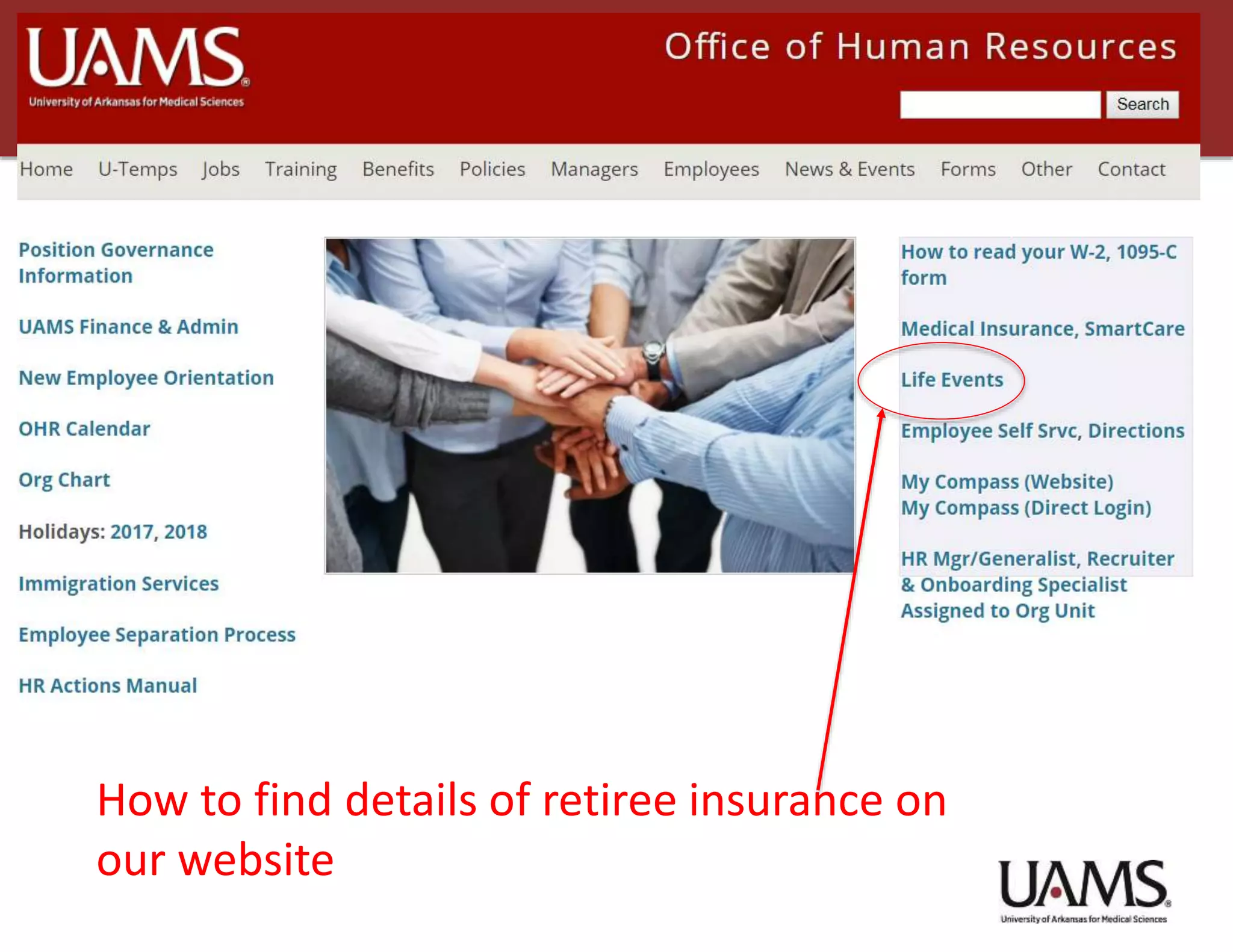

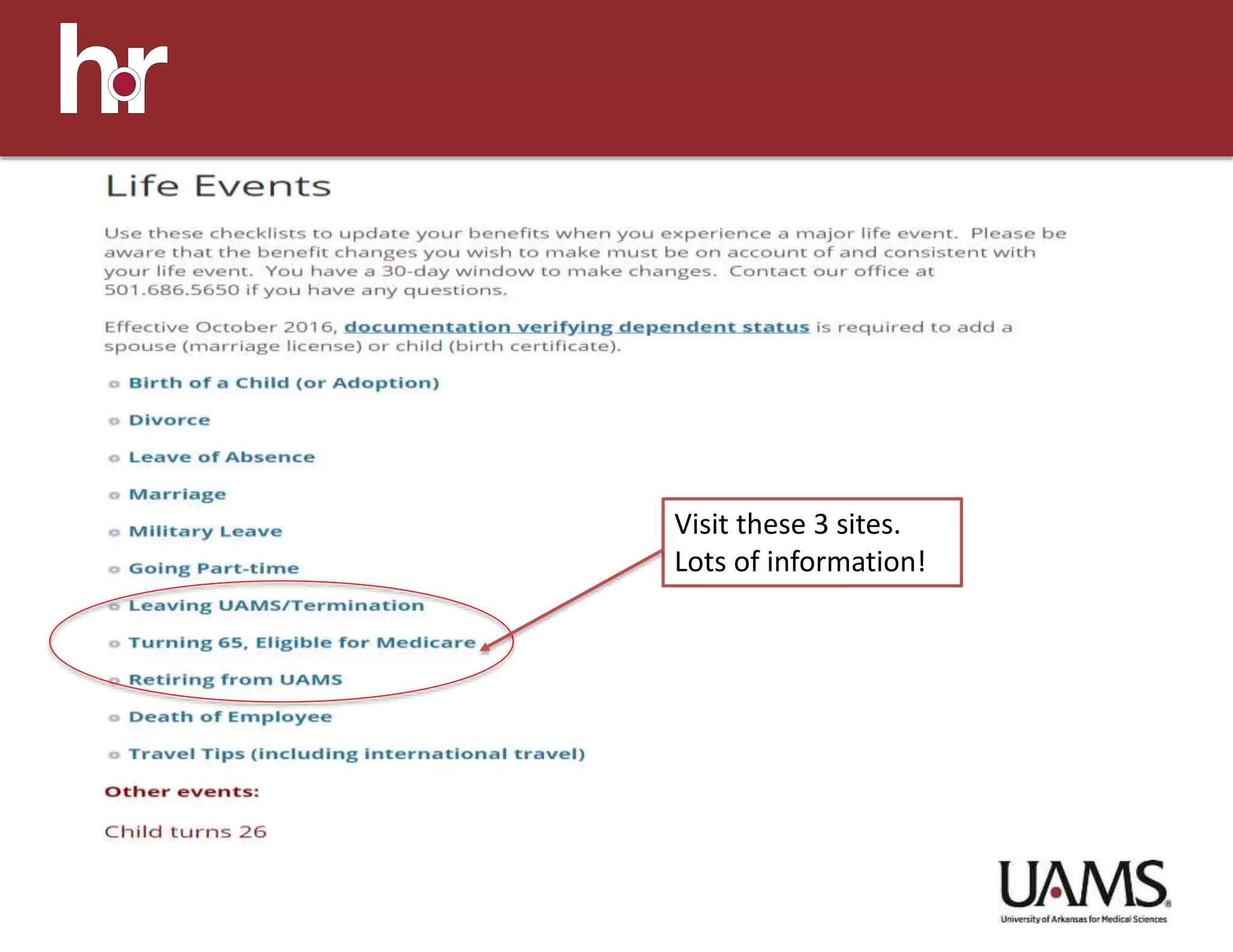

The document provides information for UAMS employees preparing for retirement, including notifying HR of retirement plans, benefits after leaving employment such as health insurance and access to retirement savings, applying for Medicare and Social Security, and considerations for long-term care insurance and savings. Employees are instructed to schedule meetings with benefits consultants to discuss retirement options from various retirement plans and health insurance offerings.