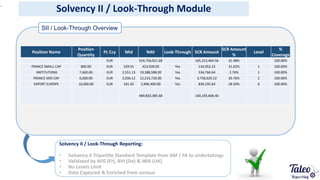

The document discusses regulatory reporting services for financial institutions. It focuses on TALEO Reporting software which helps clients comply with various regulations through modules that handle different reporting needs such as AIFMD, FATCA/CRS, Solvency II, EMIR, MiFID II, and PRIIPs. The software connects client data to regulatory calculation methods, analyzes results for consistency, and generates reports in required formats like XML and XBRL.

![Solvency II Module

Controls Features : EIOPA & BR Controls

Controls are Mandatory to

guarantee Accurate Reporting:

• Already all EIOPA

Controls are

implemented (148 B.

Rules)

• Additional BR are

being implemented and

can be extended upon

request

ID Rule Assertion InstitutionType ReportingType Frequency

CAS 1 S.02.01.03.R0500C0010=Sum(S.02.02.01.R0100C0050[CUR]) S.02.01.b.A30 = Sum(S.02.02.b.A7A[CUR]) Solo SolvencyIIReporting Annual

CAS 2 S.02.01.03.R0900C0010=Sum(S.02.02.01.R0200C0050[CUR]) S.02.01.b.L25A = Sum(S.02.02.b.A15[CUR]) Solo SolvencyIIReporting Annual

CAS 3 S.02.01.03.R0070C0010=Sum(S.02.02.01.R0020C0050[CUR]) S.02.01.b.A4 = Sum(S.02.02.b.A3[CUR]) Solo SolvencyIIReporting Annual

CAS 4 S.02.01.03.R0060C0010+S.02.01.03.R0420C0010+S.02.01.03.R0240C0010+S.02.01.03.R0250C0010+S.02.01.03.R0260C0010=Sum(S.02.02.01.R0030C0050[CUR])S.02.01.b.A3+S.02.01.b.A27 + S.02.01.b.A14A + S.02.01.b.A14B + S.02.01.b.A14BC = Sum(S.02.02.b.A4[CUR])Solo SolvencyIIReporting Annual

CAS 5 S.02.01.03.R0220C0010=Sum(S.02.02.01.R0040C0050[CUR]) S.02.01.b.A12 = Sum(S.02.02.b.A5[CUR]) Solo SolvencyIIReporting Annual

CAS 6 S.02.01.03.R0270C0010=Sum(S.02.02.01.R0050C0050[CUR]) S.02.01.b.A16 = Sum(S.02.02.b.A5A[CUR]) Solo SolvencyIIReporting Annual

CAS 7 S.02.01.03.R0360C0010+S.02.01.03.R0370C0010+S.02.01.03.R0380C0010=Sum(S.02.02.01.R0060C0050[CUR])S.02.01.b.A13+S.02.01.b.A21+S.02.01.b.A20 = Sum(S.02.02.b.A6[CUR])Solo SolvencyIIReporting Annual

CAS 8 S.02.01.03.R0030C0010+S.02.01.03.R0040C0010+S.02.01.03.R0050C0010+S.02.01.03.R0390C0010+S.02.01.03.R0430C0010+S.02.01.03.R0400C0010+S.02.01.03.R0410C0010=Sum(S.02.02.01.R0070C0050[CUR])S.02.01.b.A2+S.02.01.b.A26+S.02.01.b.A25B+S.02.01.b.A23+S.02.01.b.A29 + S.02.01.b.A28A + S.02.01.b.A28B = Sum(S.02.02.b.A7[CUR])Solo SolvencyIIReporting Annual

CAS 9 S.02.01.03.R0520C0010+S.02.01.03.R0560C0010+S.02.01.03.R0610C0010+S.02.01.03.R0650C0010=Sum(S.02.02.01.R0110C0050[CUR])S.02.01.b.L1+S.02.01.b.L4+S.02.01.b.L6B+S.02.01.b.L7 = Sum(S.02.02.b.A8[CUR])Solo SolvencyIIReporting Annual

CAS 10 S.02.01.03.R0690C0010=Sum(S.02.02.01.R0120C0050[CUR]) S.02.01.b.L10 = Sum(S.02.02.b.A9[CUR]) Solo SolvencyIIReporting Annual

CAS 11 S.02.01.03.R0770C0010+S.02.01.03.R0820C0010+S.02.01.03.R0830C0010=Sum(S.02.02.01.R0130C0050[CUR])S.02.01.b.L13+S.02.01.b.L15A+S.02.01.b.L15B = Sum(S.02.02.b.A10[CUR])Solo SolvencyIIReporting Annual

CAS 12 S.02.01.03.R0790C0010=Sum(S.02.02.01.R0140C0050[CUR]) S.02.01.b.L16 = Sum(S.02.02.b.A11[CUR]) Solo SolvencyIIReporting Annual

CAS 13 S.02.01.03.R0800C0010+S.02.01.03.R0810C0010=Sum(S.02.02.01.R0150C0050[CUR])S.02.01.b.L19+S.02.01.b.L20 = Sum(S.02.02.b.A12[CUR])Solo SolvencyIIReporting Annual

CAS 14 S.02.01.03.R0740C0010=Sum(S.02.02.01.R0160C0050[CUR]) S.02.01.b.L23 = Sum(S.02.02.b.A13[CUR]) Solo SolvencyIIReporting Annual

CAS 15 S.02.01.03.R0750C0010+S.02.01.03.R0760C0010+S.02.01.03.R0780C0010+S.02.01.03.R0840C0010+S.02.01.03.R0880C0010+S.02.01.03.R0870C0010+S.02.01.03.R0860C0010=Sum(S.02.02.01.R0170C0050[CUR])S.02.01.b.L18+S.02.01.b.L22+S.02.01.b.L17+S.02.01.b.L15C+S.02.01.b.L25+S.02.01.b.L26+S.02.01.b.L15D = Sum(S.02.02.b.A14[CUR])Solo SolvencyIIReporting Annual

CAS 16 S.02.01.03.R0290C0010=S.17.01.01.R0330C0050+S.17.01.01.R0330C0060+S.17.01.01.R0330C0070+S.17.01.01.R0330C0080+S.17.01.01.R0330C0090+S.17.01.01.R0330C0100+S.17.01.01.R0330C0110+S.17.01.01.R0330C0120+S.17.01.01.R0330C0130+S.02.01.b.A17 = S.17.01.b.D27+S.17.01.b.E27+S.17.01.b.F27+S.17.01.b.G27+S.17.01.b.H27+S.17.01.b.I27+S.17.01.b.J27+S.17.01.b.K27+S.17.01.b.L27+S.17.01.b.N27+S.17.01.b.O27+S.Solo SolvencyIIReporting Annual

CAS 17 S.02.01.03.R0300C0010=S.17.01.01.R0330C0020+S.17.01.01.R0330C0030+S.17.01.01.R0330C0040+S.17.01.01.R0330C0140S.02.01.b.A18 = S.17.01.b.A27+S.17.01.b.B27+S.17.01.b.C27+S.17.01.b.M27Solo SolvencyIIReporting Annual

CAS 18 S.02.01.03.R0320C0010=S.12.01.01.R0080C0170+S.12.01.01.R0080C0180+S.12.01.01.R0080C0190+S.12.01.01.R0080C0200S.02.01.b.A18A = Sum(S.12.01.b.C10…C13) Solo SolvencyIIReporting Annual

CAS 19 S.02.01.03.R0330C0010=S.12.01.01.R0080C0020+S.12.01.01.R0080C0070+S.12.01.01.R0080C0080+S.12.01.01.R0080C0090+S.12.01.01.R0080C0100S.02.01.b.A19 = S.12.01.b.C1+S.12.01.b.C4+S.12.01.b.C5+S.12.01.b.C6+S.12.01.b.C7Solo SolvencyIIReporting Annual

CAS 20 S.02.01.03.R0340C0010=S.12.01.01.R0080C0040+S.12.01.01.R0080C0050S.02.01.b.A19A = S.12.01.b.C2 + S.12.01.b.C3 Solo SolvencyIIReporting Annual

CAS 21 S.02.01.03.R0530C0010=S.17.01.01.R0010C0050+S.17.01.01.R0010C0060+S.17.01.01.R0010C0070+S.17.01.01.R0010C0080+S.17.01.01.R0010C0090+S.17.01.01.R0010C0100+S.17.01.01.R0010C0110+S.17.01.01.R0010C0120+S.17.01.01.R0010C0130+S.02.01.b.L1A = S.17.01.b.D1+S.17.01.b.E1+S.17.01.b.F1+S.17.01.b.G1+S.17.01.b.H1+S.17.01.b.I1+S.17.01.b.J1+S.17.01.b.K1+S.17.01.b.L1+S.17.01.b.N1+S.17.01.b.O1+S.17.01.b.P1Solo SolvencyIIReporting Annual

CAS 22 S.02.01.03.R0540C0010=S.17.01.01.R0260C0050+S.17.01.01.R0260C0060+S.17.01.01.R0260C0070+S.17.01.01.R0260C0080+S.17.01.01.R0260C0090+S.17.01.01.R0260C0100+S.17.01.01.R0260C0110+S.17.01.01.R0260C0120+S.17.01.01.R0260C0130+S.02.01.b.L2 = S.17.01.b.D23+S.17.01.b.E23+S.17.01.b.F23+S.17.01.b.G23+S.17.01.b.H23+S.17.01.b.I23+S.17.01.b.J23+S.17.01.b.K23+S.17.01.b.L23+S.17.01.b.N23+S.17.01.b.O23+S.1Solo SolvencyIIReporting Annual

CAS 23 S.02.01.03.R0550C0010=S.17.01.01.R0280C0050+S.17.01.01.R0280C0060+S.17.01.01.R0280C0070+S.17.01.01.R0280C0080+S.17.01.01.R0280C0090+S.17.01.01.R0280C0100+S.17.01.01.R0280C0110+S.17.01.01.R0280C0120+S.17.01.01.R0280C0130+S.02.01.b.L3 = S.17.01.b.D25+S.17.01.b.E25+S.17.01.b.F25+S.17.01.b.G25+S.17.01.b.H25+S.17.01.b.I25+S.17.01.b.J25+S.17.01.b.K25+S.17.01.b.L25+S.17.01.b.N25+S.17.01.b.O25+S.1Solo SolvencyIIReporting Annual](https://image.slidesharecdn.com/69e49b91-9273-4fa4-98a6-8bf60369e2d4-160817121740/85/TALEO_Reporting_Global_VF-28-320.jpg)