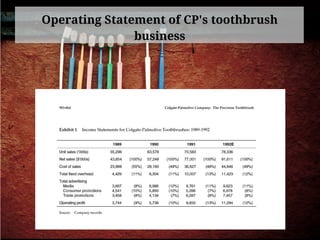

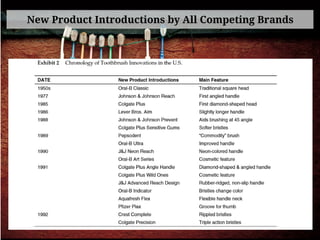

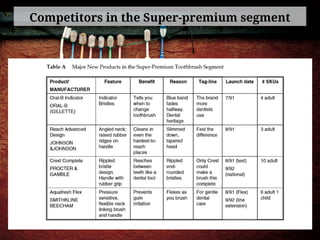

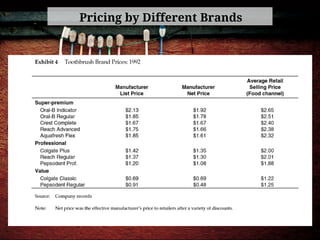

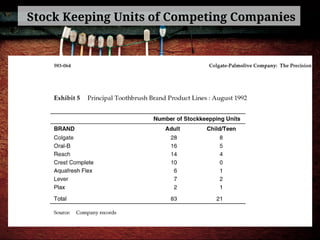

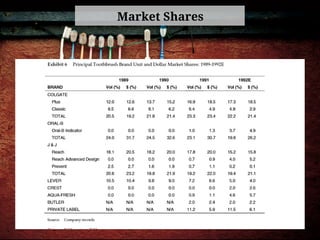

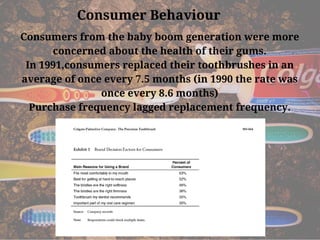

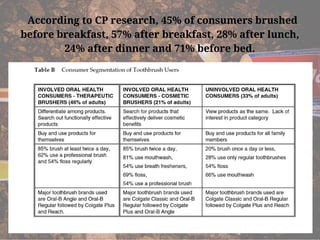

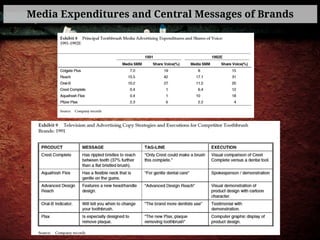

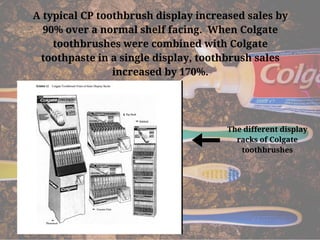

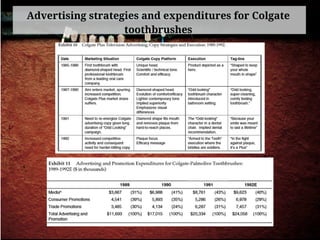

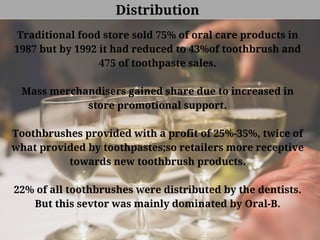

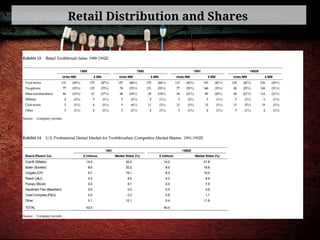

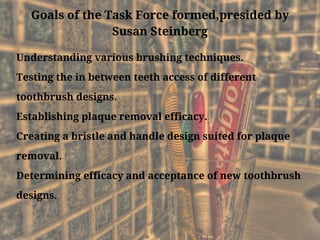

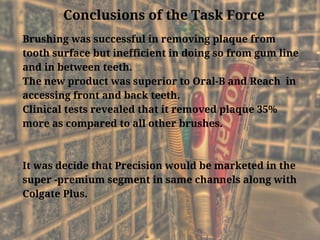

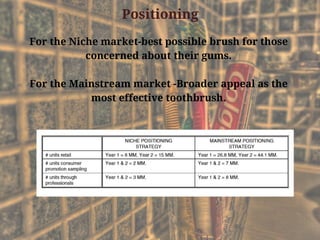

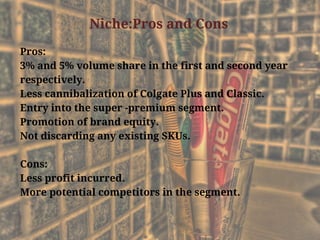

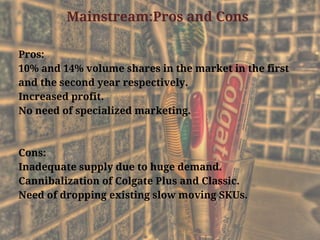

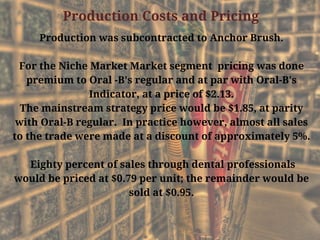

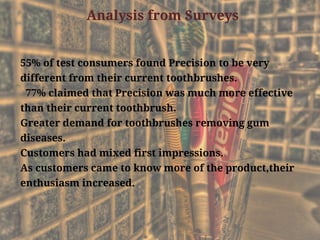

The case discusses Colgate-Palmolive's strategy for launching the Precision toothbrush in the highly competitive U.S. market in 1992, highlighting the need for effective positioning, branding, and marketing strategies. Despite being a technical innovation with superior plaque removal efficacy, the product faced challenges due to competition and consumer behavior trends. The case emphasizes the importance of targeted communication and promotional strategies to establish brand equity and market share in both niche and mainstream segments.