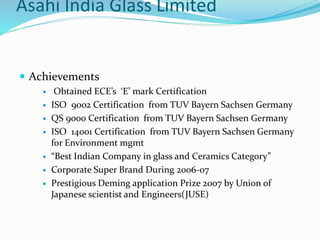

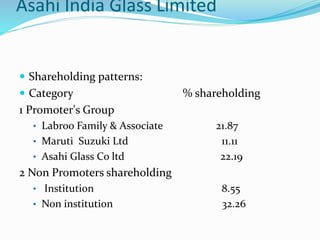

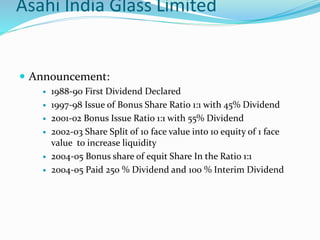

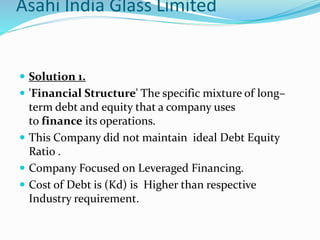

This document provides information about Asahi India Glass Limited, the largest integrated glass company in India. It produces automotive safety glass, float glass, and architectural processed glass. Its major customers include automotive companies like Maruti Suzuki, Mahindra and Mahindra, and Toyota. The company has received several certifications for quality and environmental management. It has experienced growth through share offerings and dividends. However, its high debt-equity ratio of 8.53 compared to the industry ratio of 1.77 made it vulnerable when the rupee depreciated against the dollar during the global financial crisis.