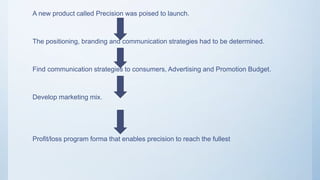

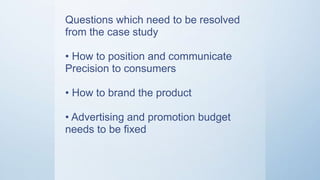

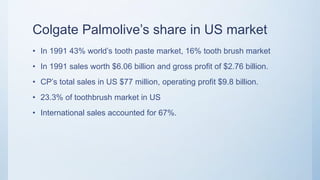

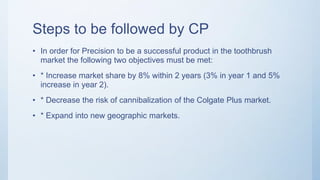

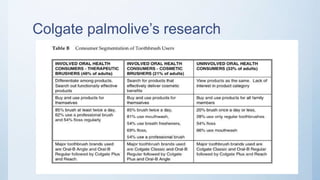

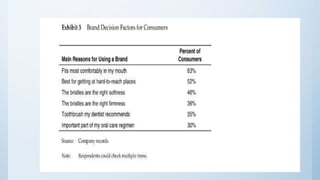

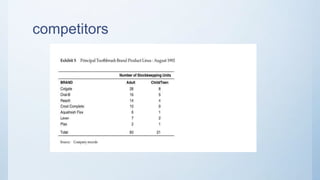

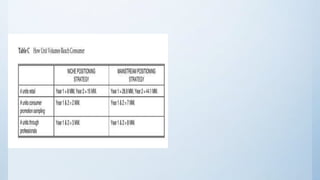

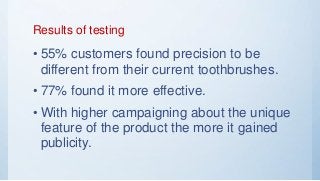

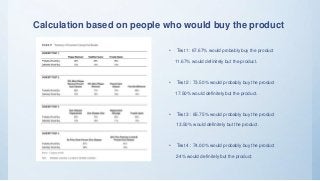

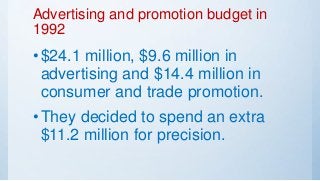

Colgate-Palmolive was developing a new toothbrush called Precision to target dental plaque removal. Research found adults were concerned about gum health and willing to pay more for products that fit their mouths well and removed plaque effectively. Tests showed Precision removed 35% more plaque than competitors. The case analyzed niche versus mainstream positioning and recommended a niche strategy with promotional advertising to emphasize Precision's clinical benefits. Precision was projected to lose $1.4 million in year 1 but gain $7.4 million in year 2 under this positioning.