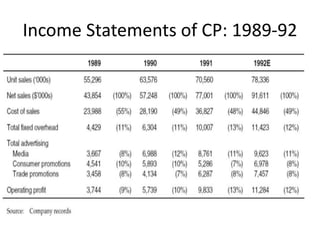

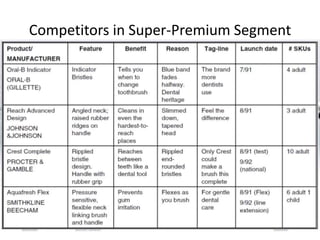

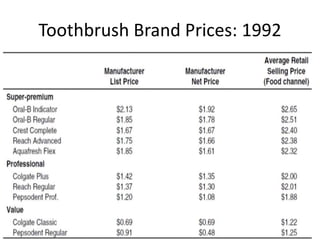

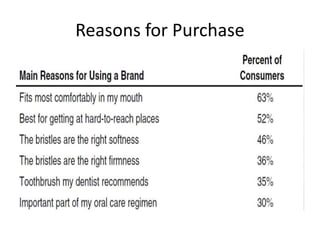

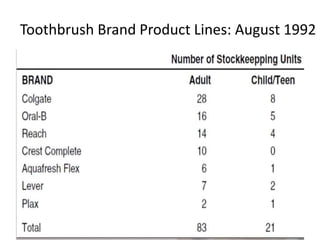

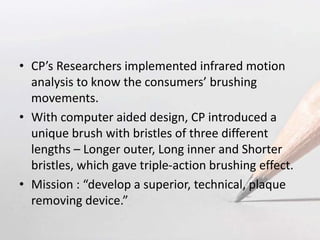

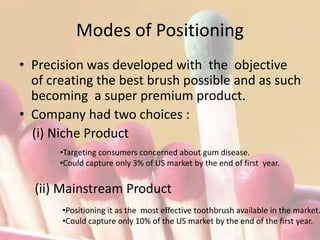

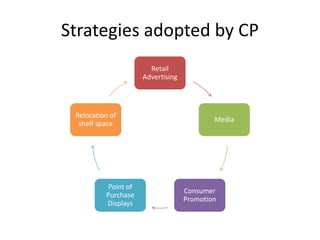

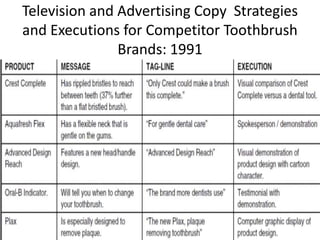

Colgate-Palmolive, founded in 1806, is a leader in consumer goods with significant sales in household and personal care products, and is launching the Colgate Precision toothbrush as part of their oral care division. The company has positioned the Precision toothbrush as a technologically advanced product while conducting market research to inform branding strategies amid competitive pressures. Key recommendations include initially positioning the toothbrush as a niche product to capture a specific market segment, followed by expansion to a mainstream audience to increase returns.