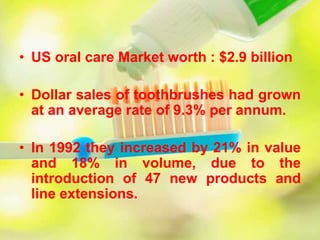

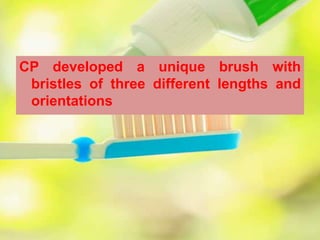

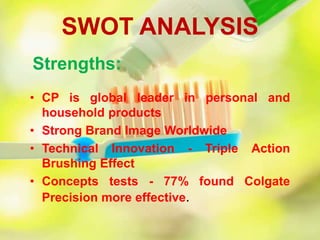

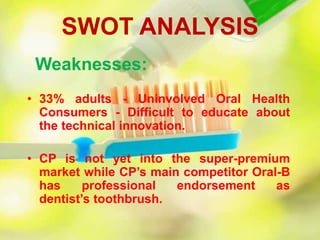

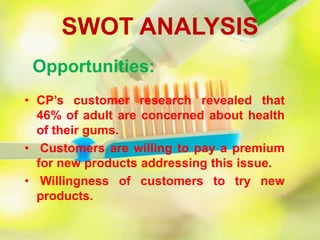

The document provides an overview of Colgate-Palmolive's performance and strategic insights in the toothbrush market, noting total sales of $6.06 billion and a focus on innovative products addressing gum health. It highlights the company's positioning and branding strategies while analyzing competition and consumer behavior, leading to recommendations for mainstream positioning of their precision toothbrush. A SWOT analysis outlines strengths, weaknesses, opportunities, and threats, emphasizing the need for a targeted approach to expand market presence.