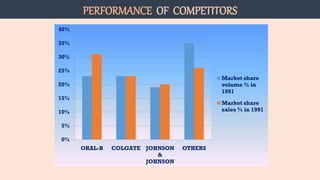

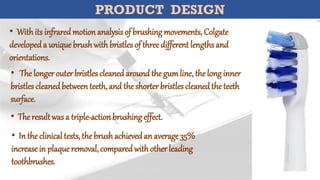

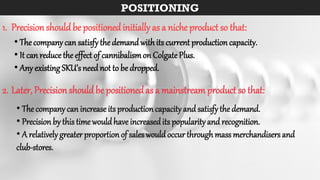

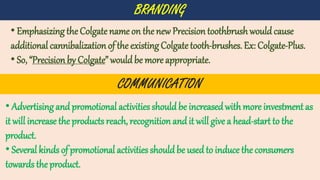

Colgate-Palmolive was planning to launch its new Precision toothbrush in 1992. It analyzed positioning the brush as either a niche product targeting gum health or mainstream. Research found the unique three-bristle design removed more plaque but consumers needed education on its benefits. It was recommended to initially position Precision niche and emphasize its brand to limit cannibalizing Colgate Plus, then transition to mainstream. Advertising and promotions like dentist sampling, buy-one-get-one offers, and combo packs with toothpaste were advised to increase recognition and sales.