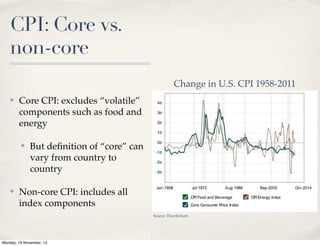

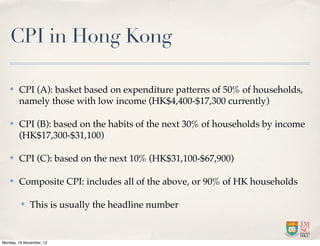

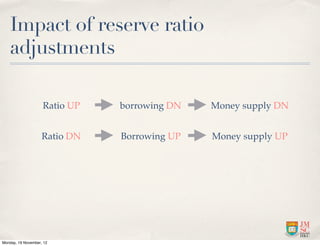

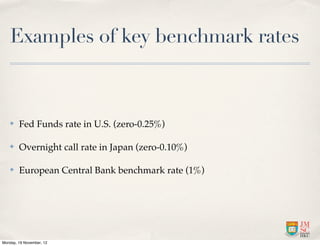

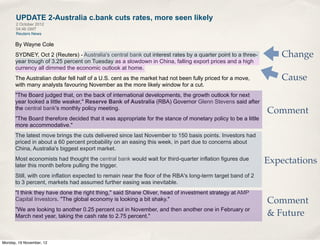

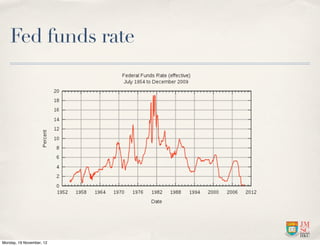

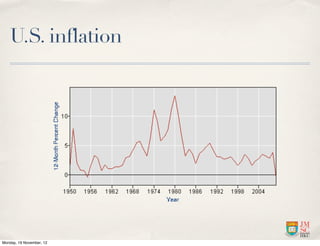

The document discusses key economic indicators such as GDP, CPI, unemployment rates, and confidence indexes. It explains how governments and central banks use tools like fiscal policy, monetary policy, interest rates, and reserve ratios to influence economic goals of steady growth, low unemployment, and stable prices. Specific indicators covered in depth include CPI, which can have issues due to arbitrary baselines and basket changes over time, and unemployment rates, which don't include discouraged workers.