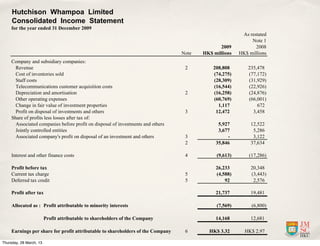

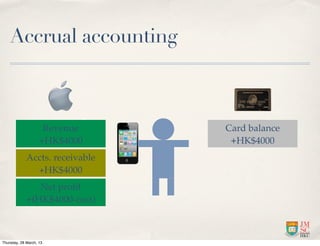

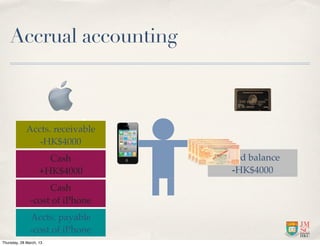

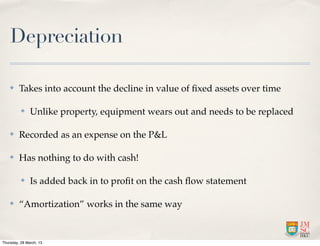

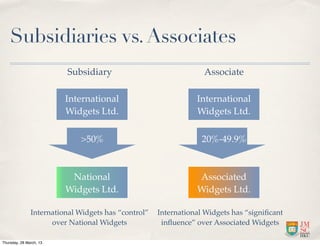

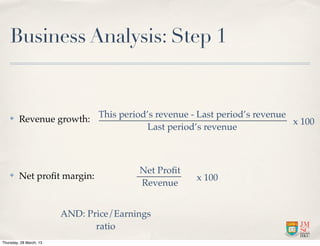

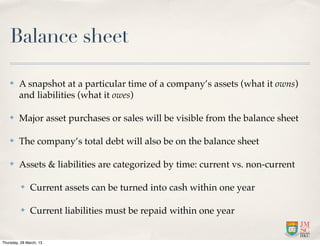

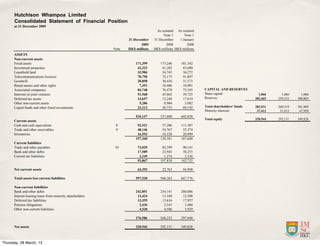

The document provides an overview of analyzing corporate profit and loss statements. It discusses key components of a P&L statement such as revenue, expenses, profit, earnings per share, and how it shows the path from revenue to net profit. It also discusses interpreting P&L statements, including checking footnotes and understanding the treatment of items like depreciation, subsidiaries versus associates, and minority interests. An example P&L statement is then presented for Hutchison Whampoa Limited to demonstrate these concepts.