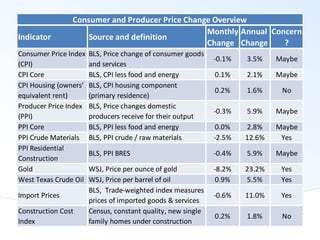

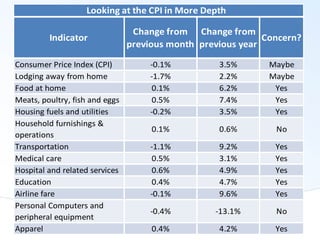

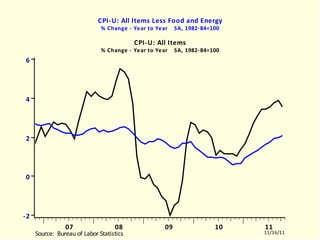

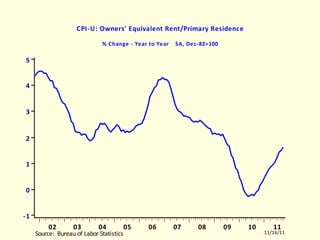

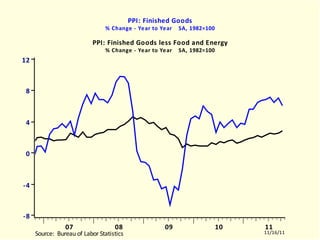

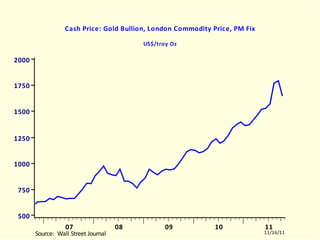

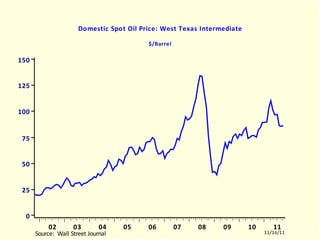

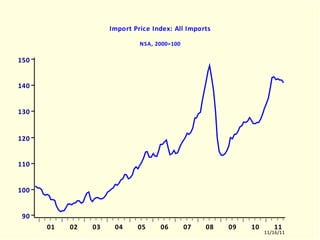

- Inflation moderated or declined in October for measures like the consumer price index, gold prices, and producer price indexes, though prices remain higher than a year ago.

- While overall and core consumer prices remain within the Fed's target range of 1-2% and 2-4% respectively, they are approaching the upper bounds.

- The relaxation in price growth in October means the Fed will likely continue its low-rate policy committed through mid-2013.