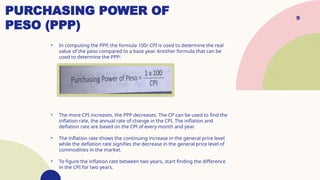

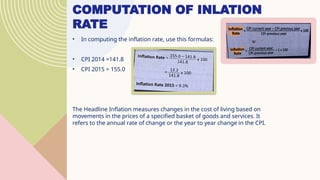

The document discusses inflation, its causes, and its effects on various economic sectors, emphasizing that it is a persistent problem affecting both consumers and producers. It explains different types of inflation such as cost-push and demand-pull, and outlines how inflation impacts people, including those with fixed incomes and debtors. Additionally, the document covers methods for measuring inflation, including the Consumer Price Index (CPI) and measures the government can take to combat inflation.