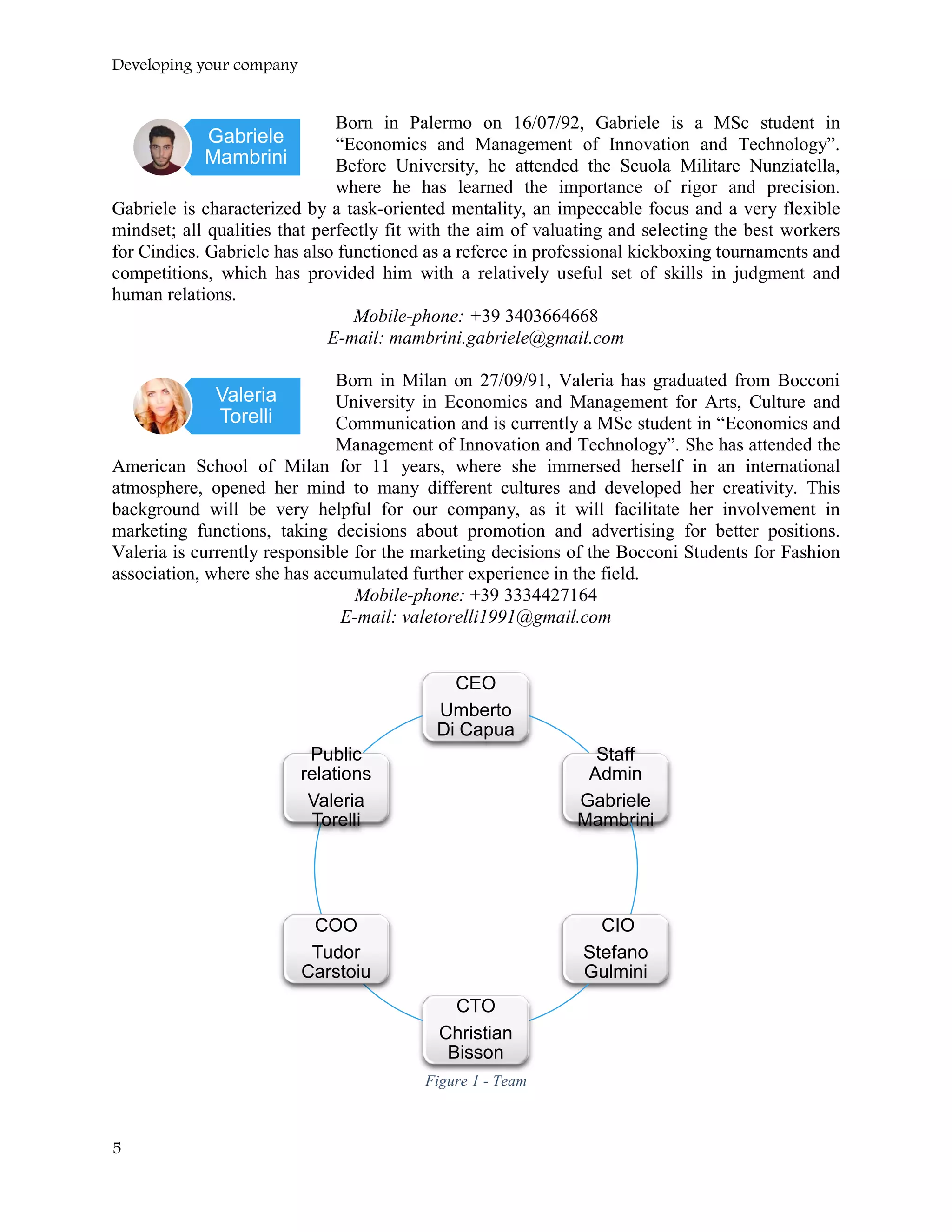

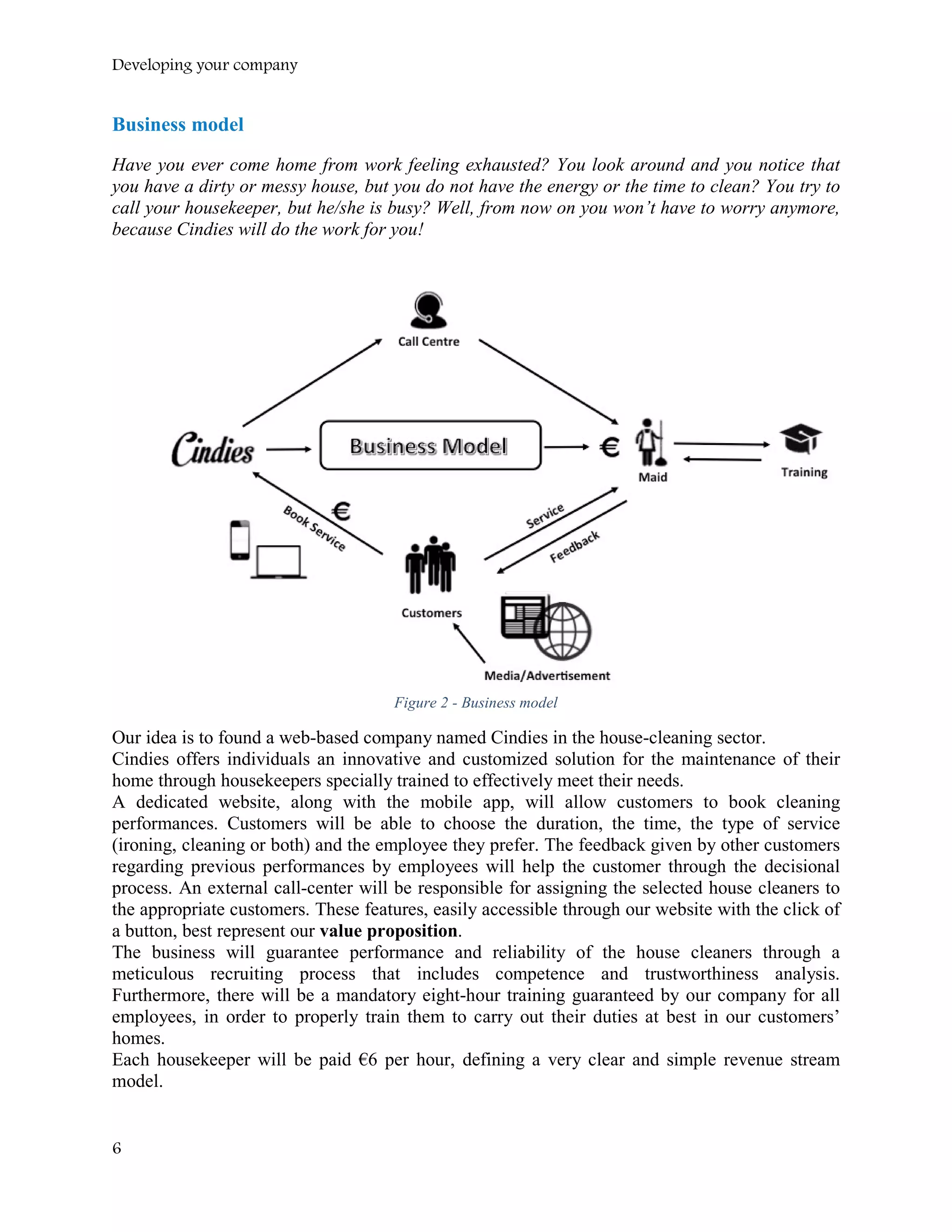

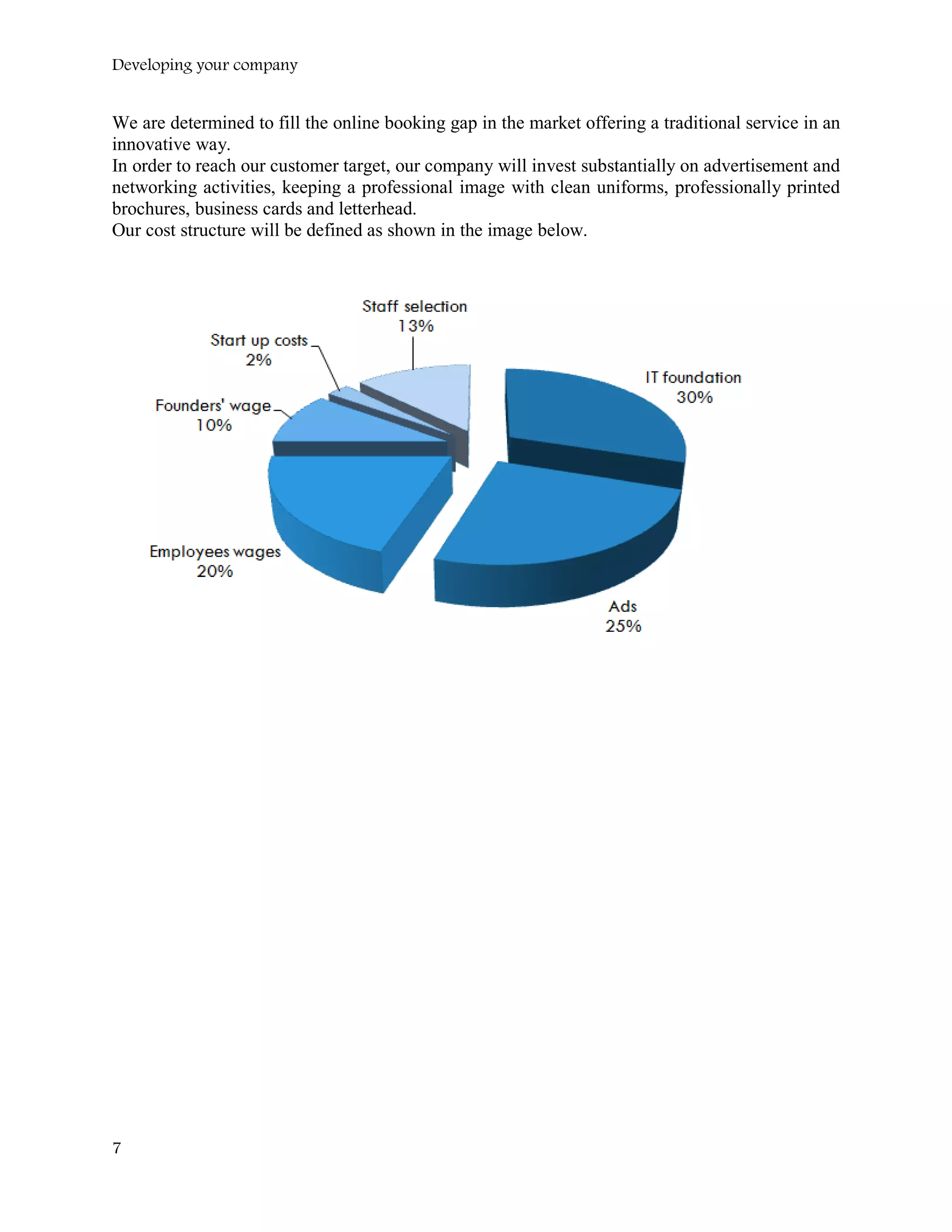

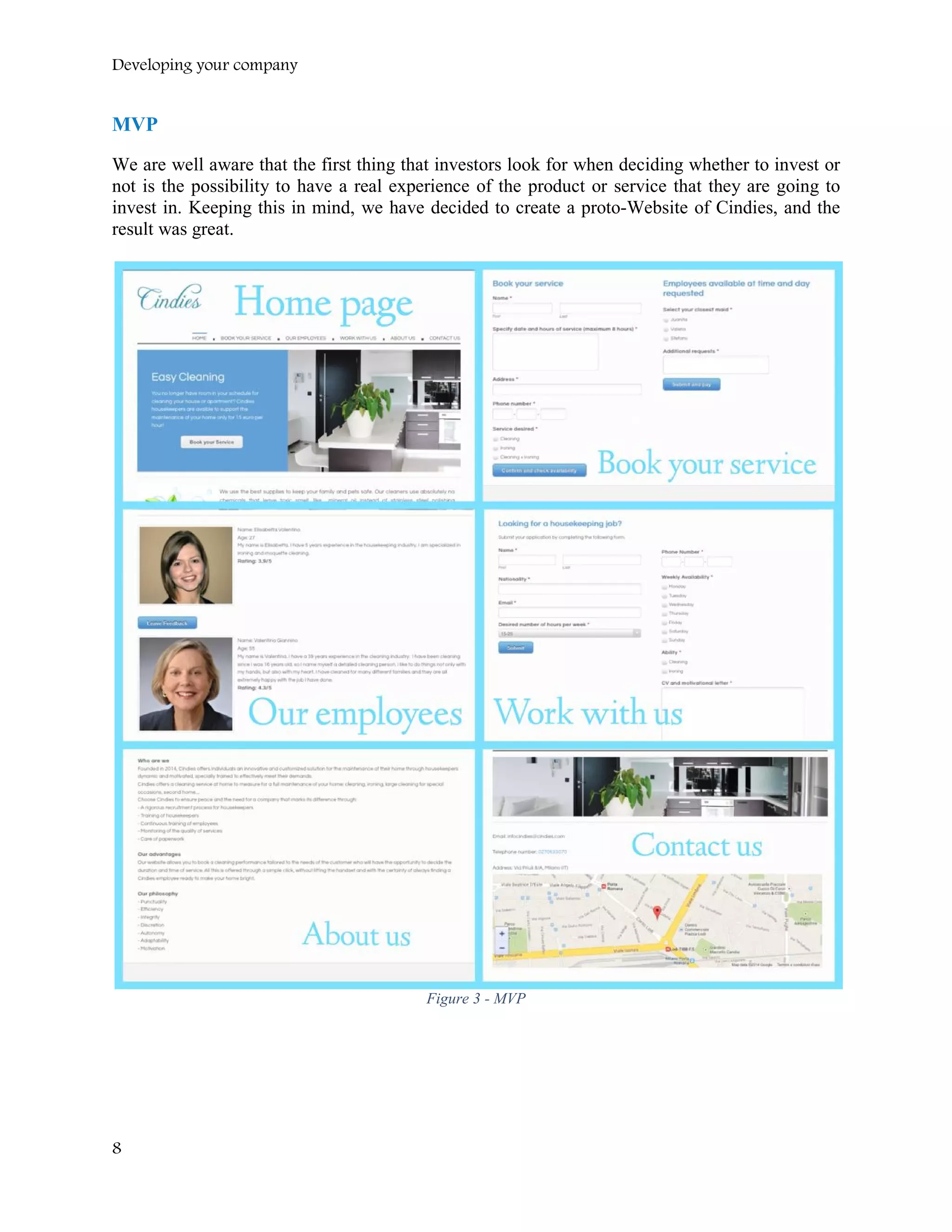

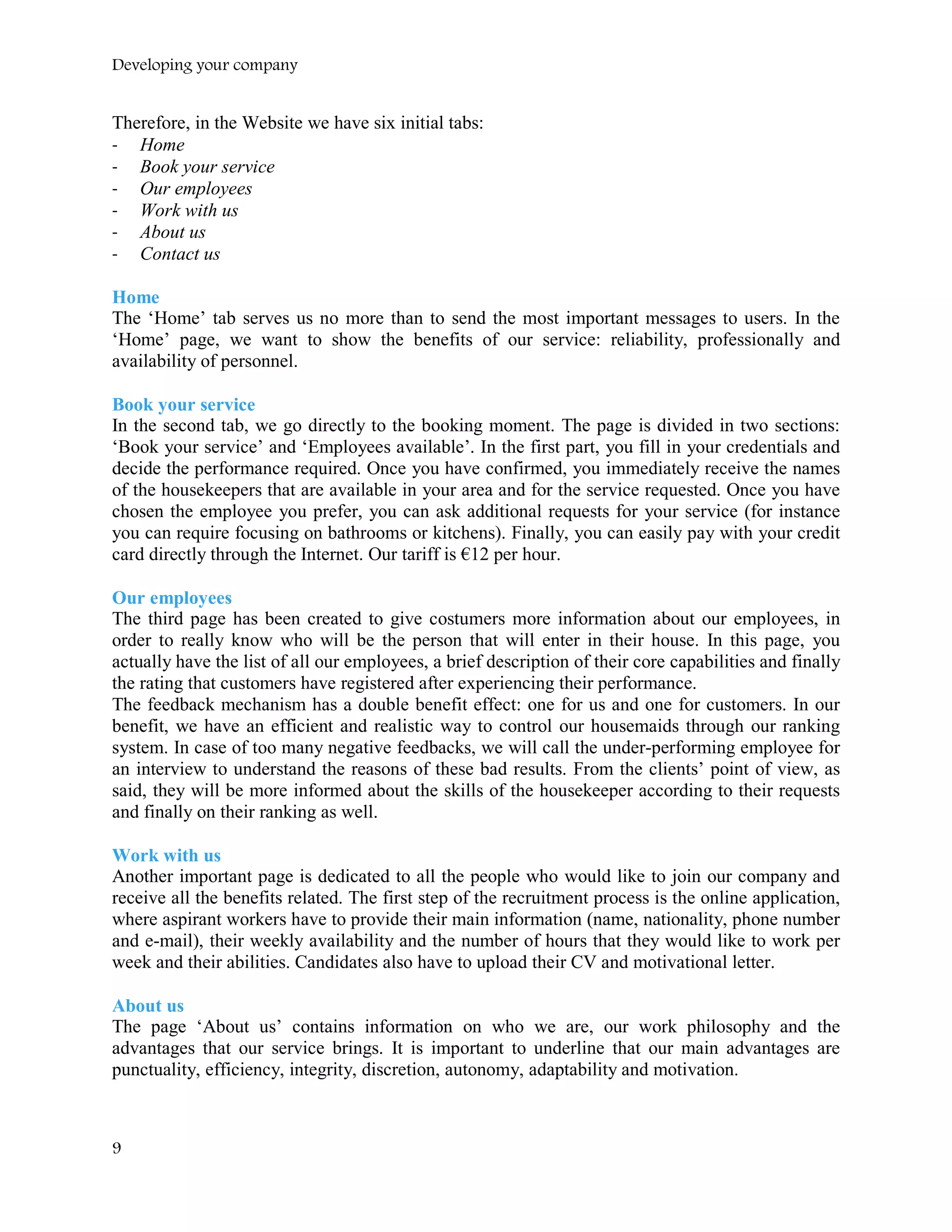

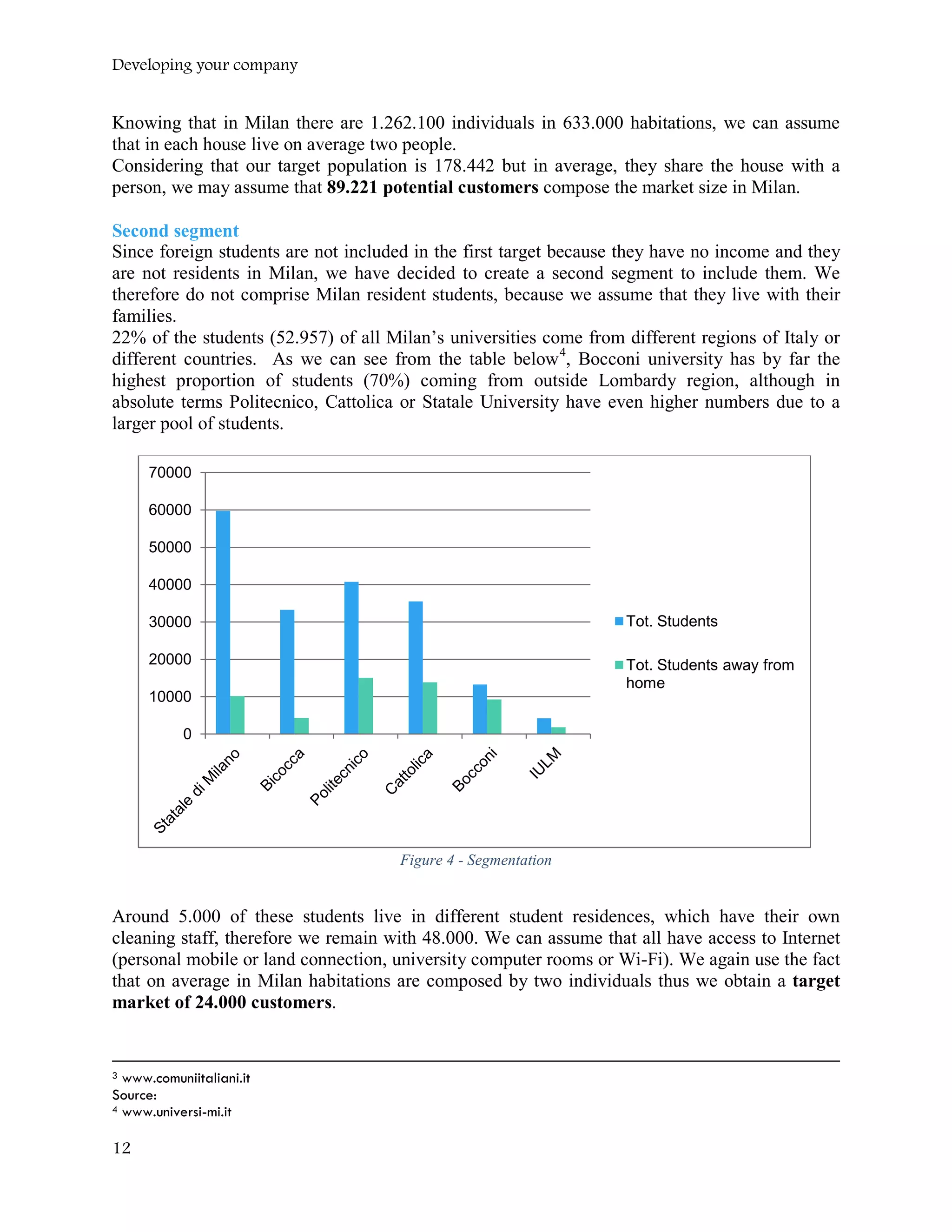

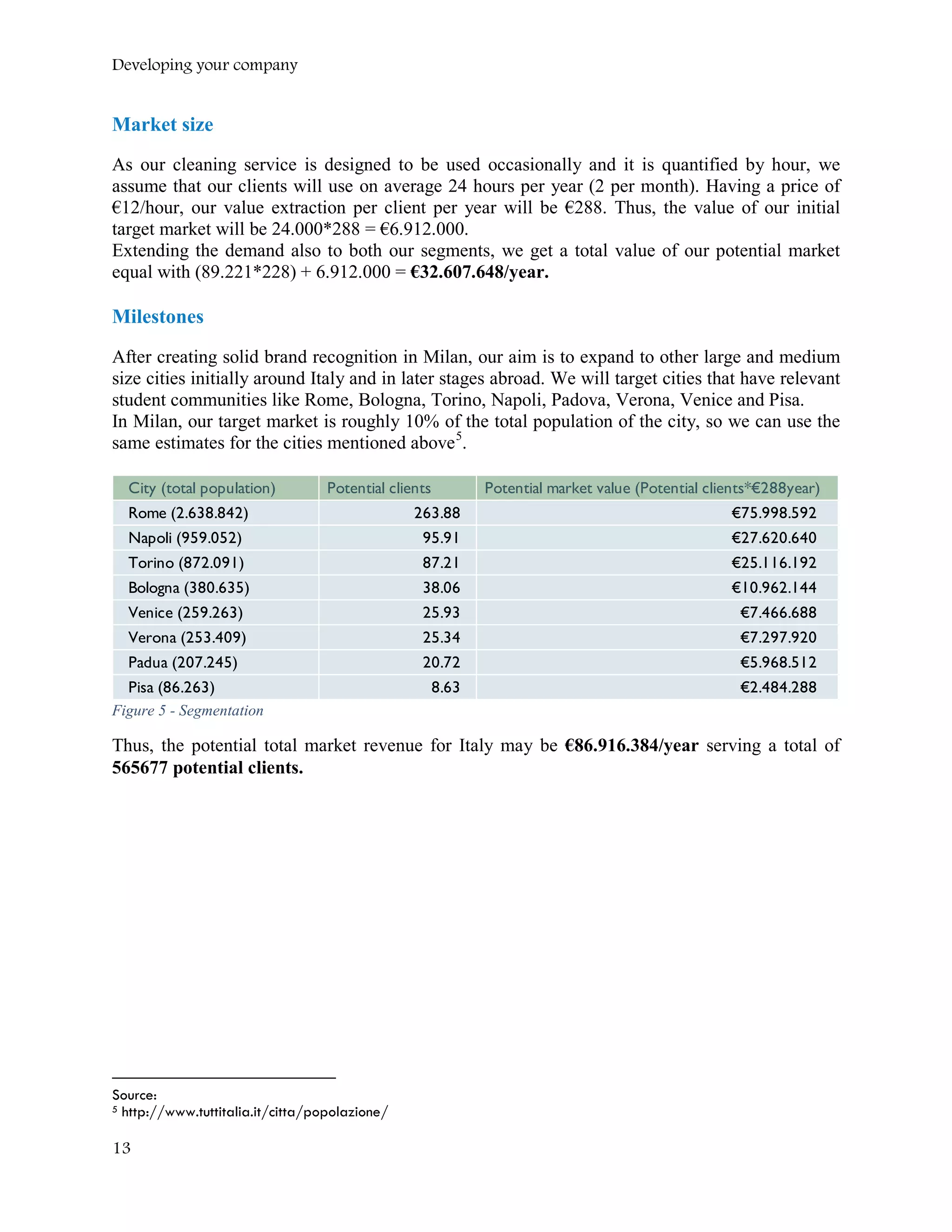

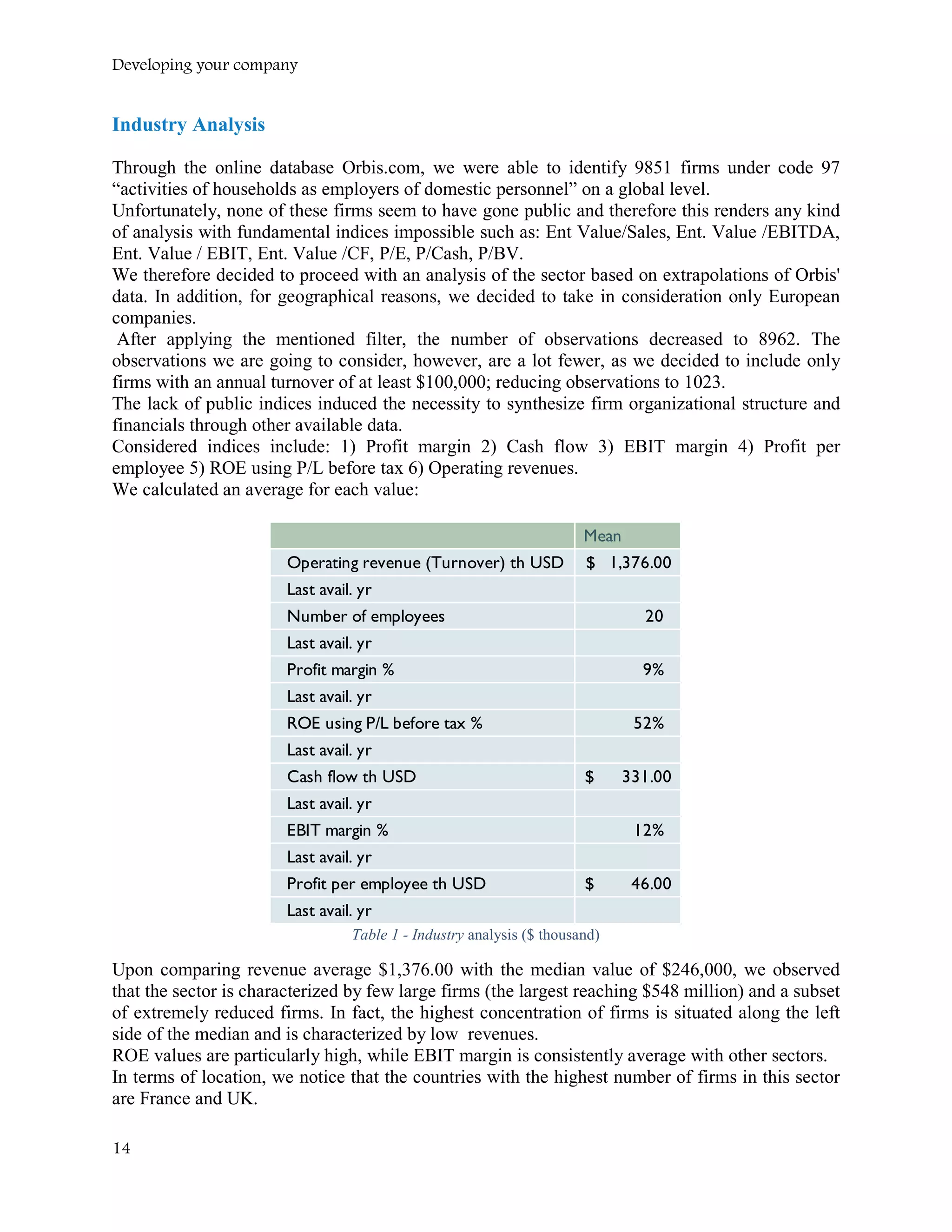

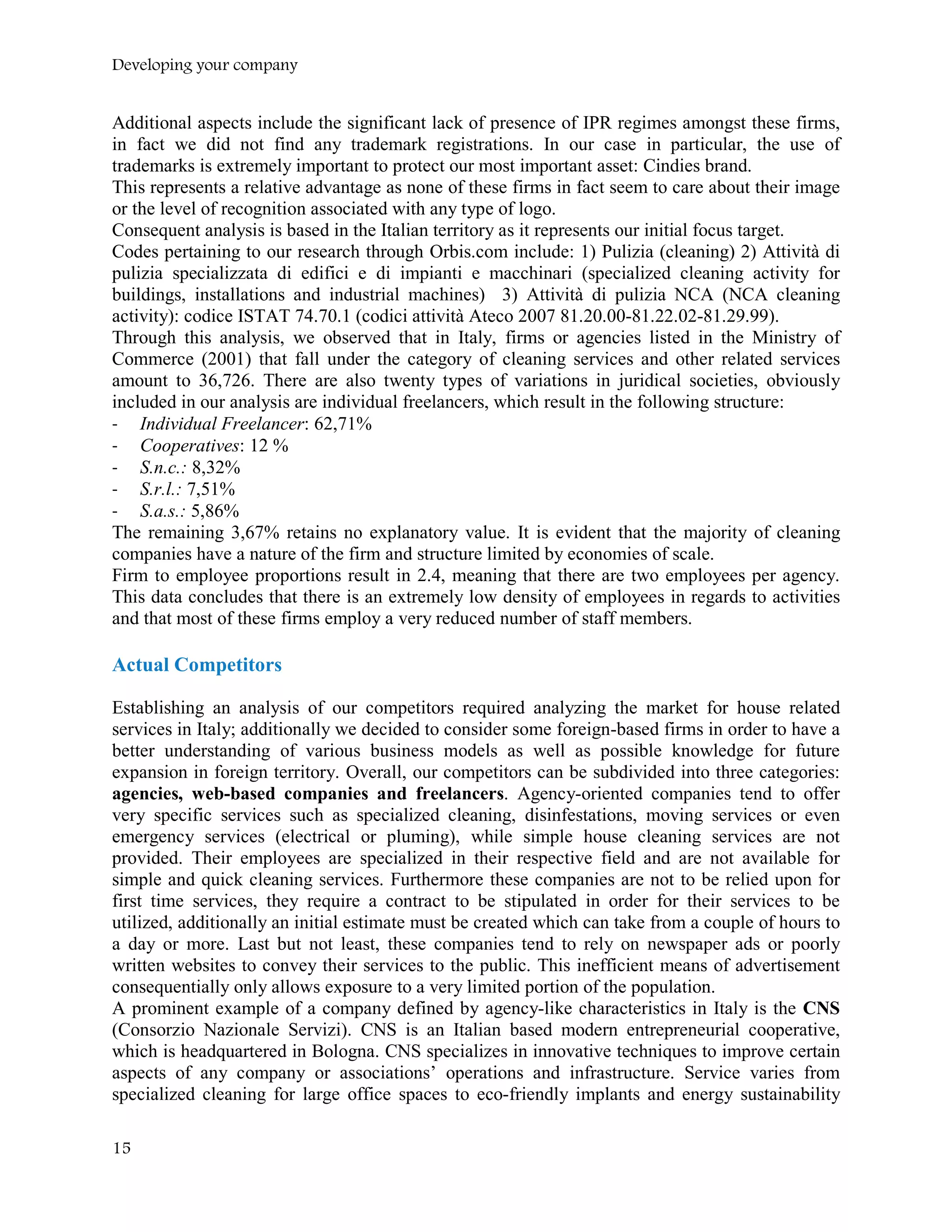

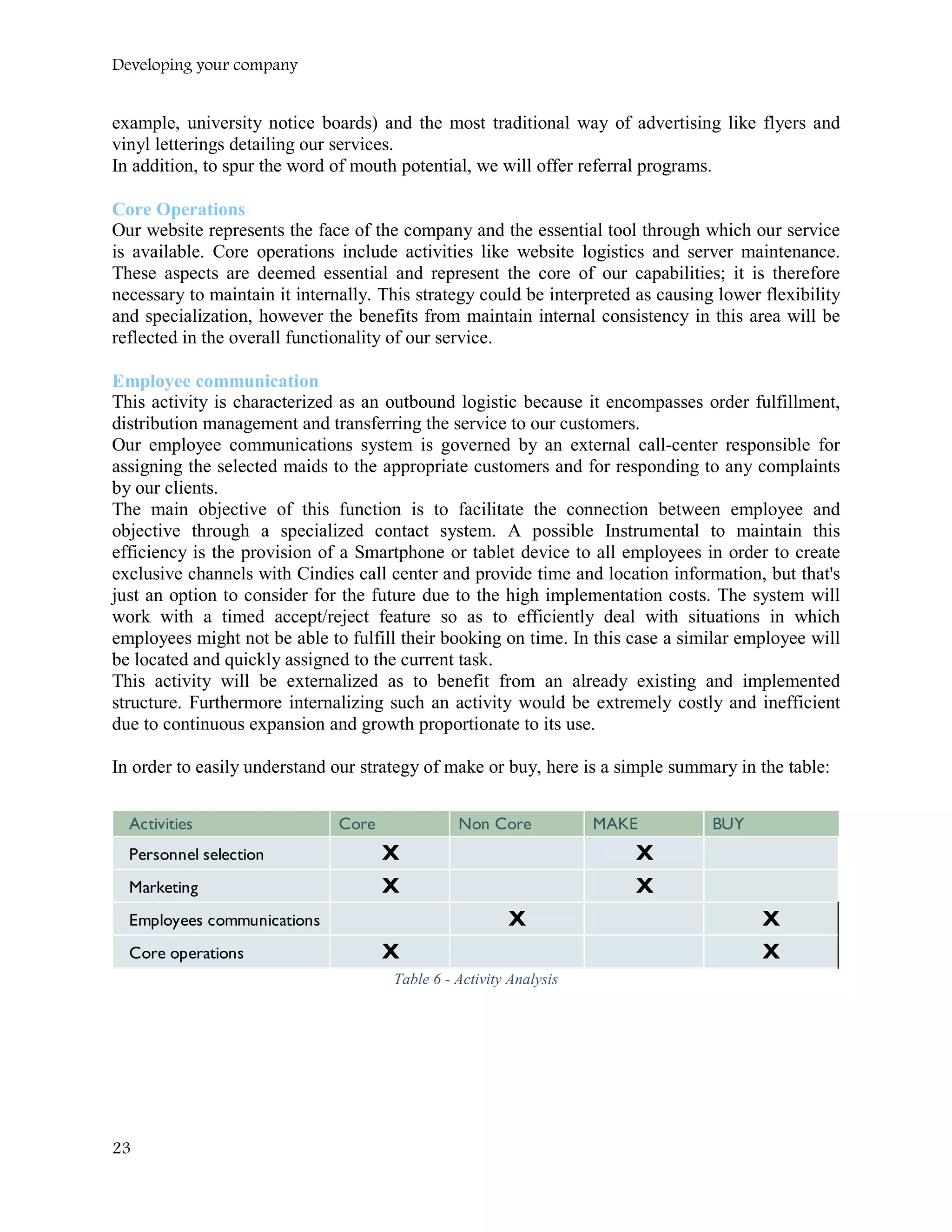

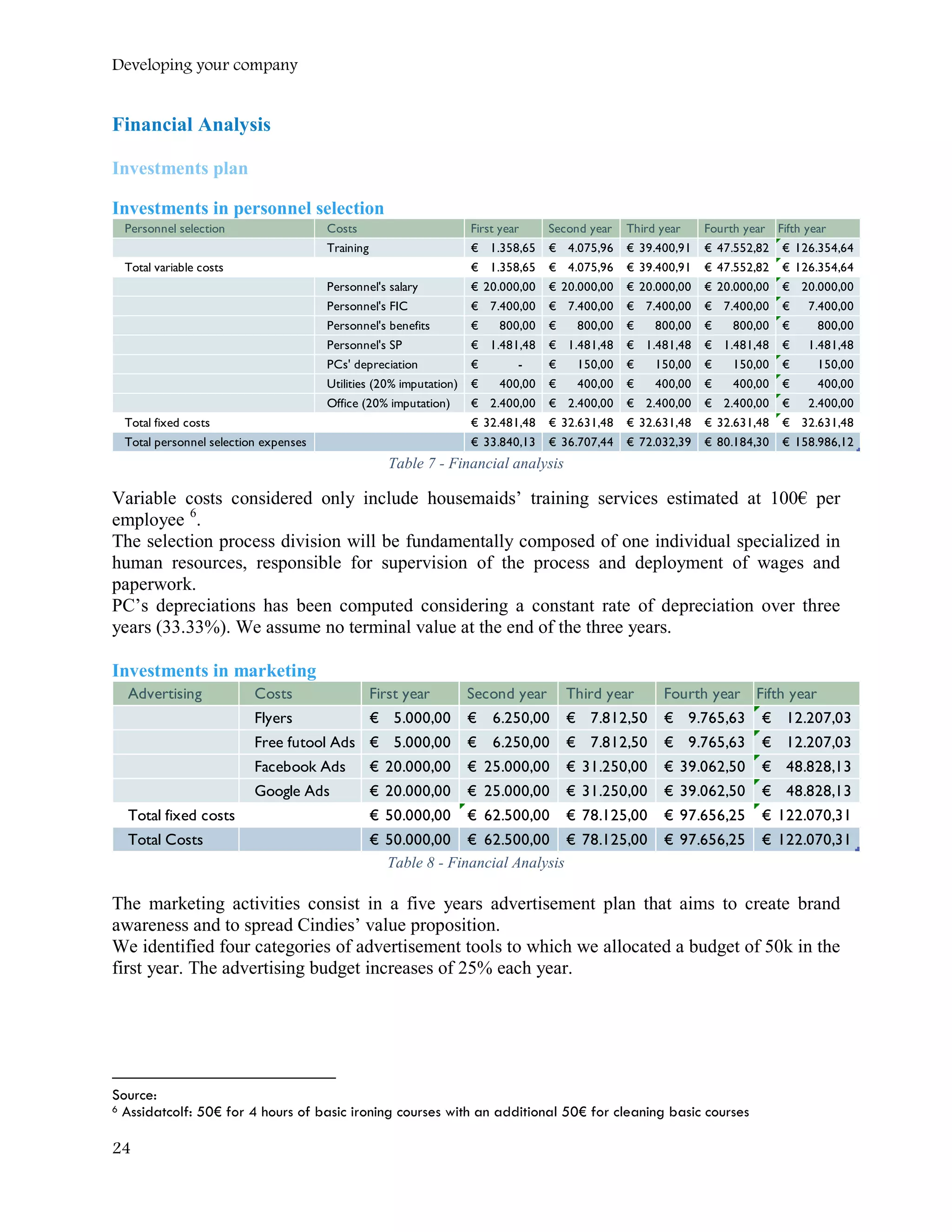

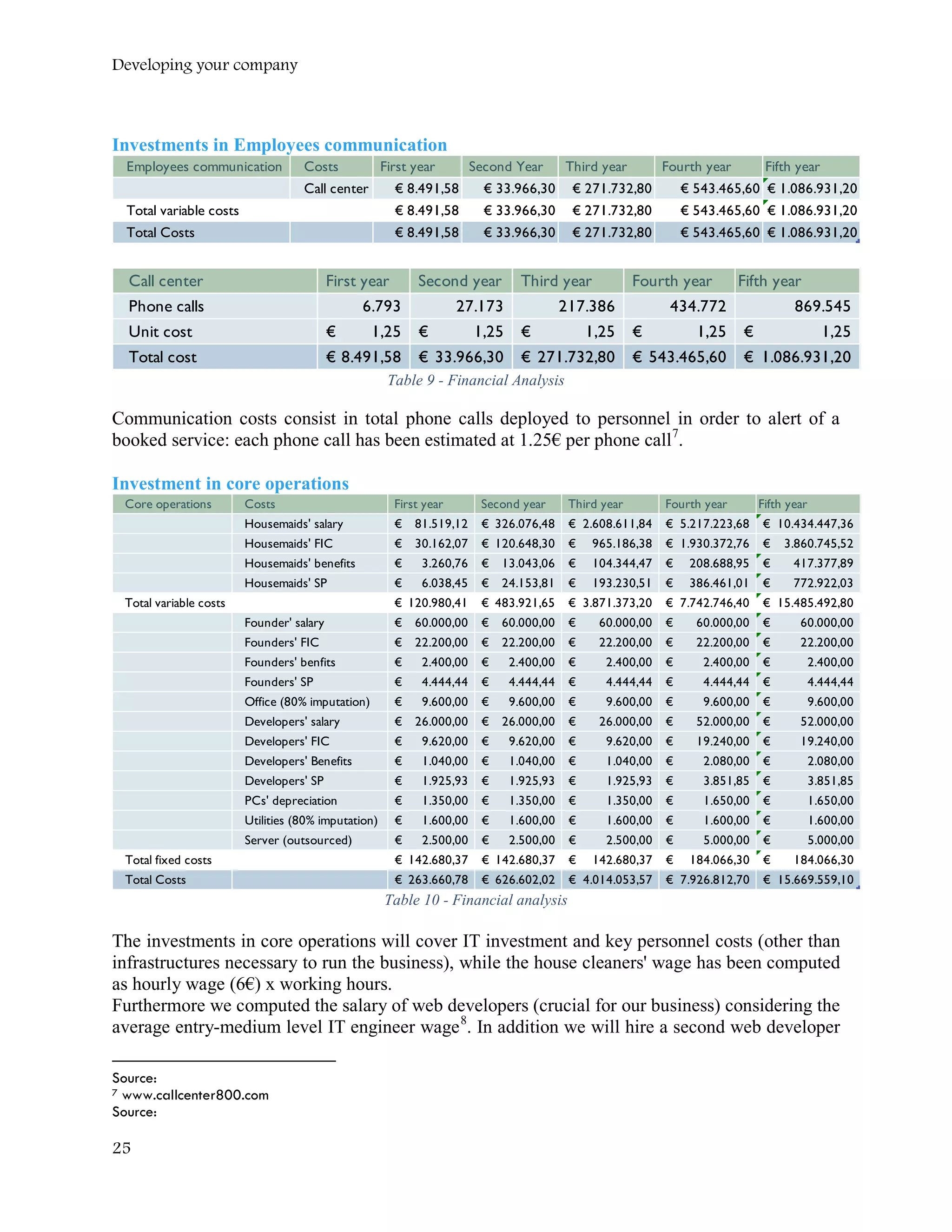

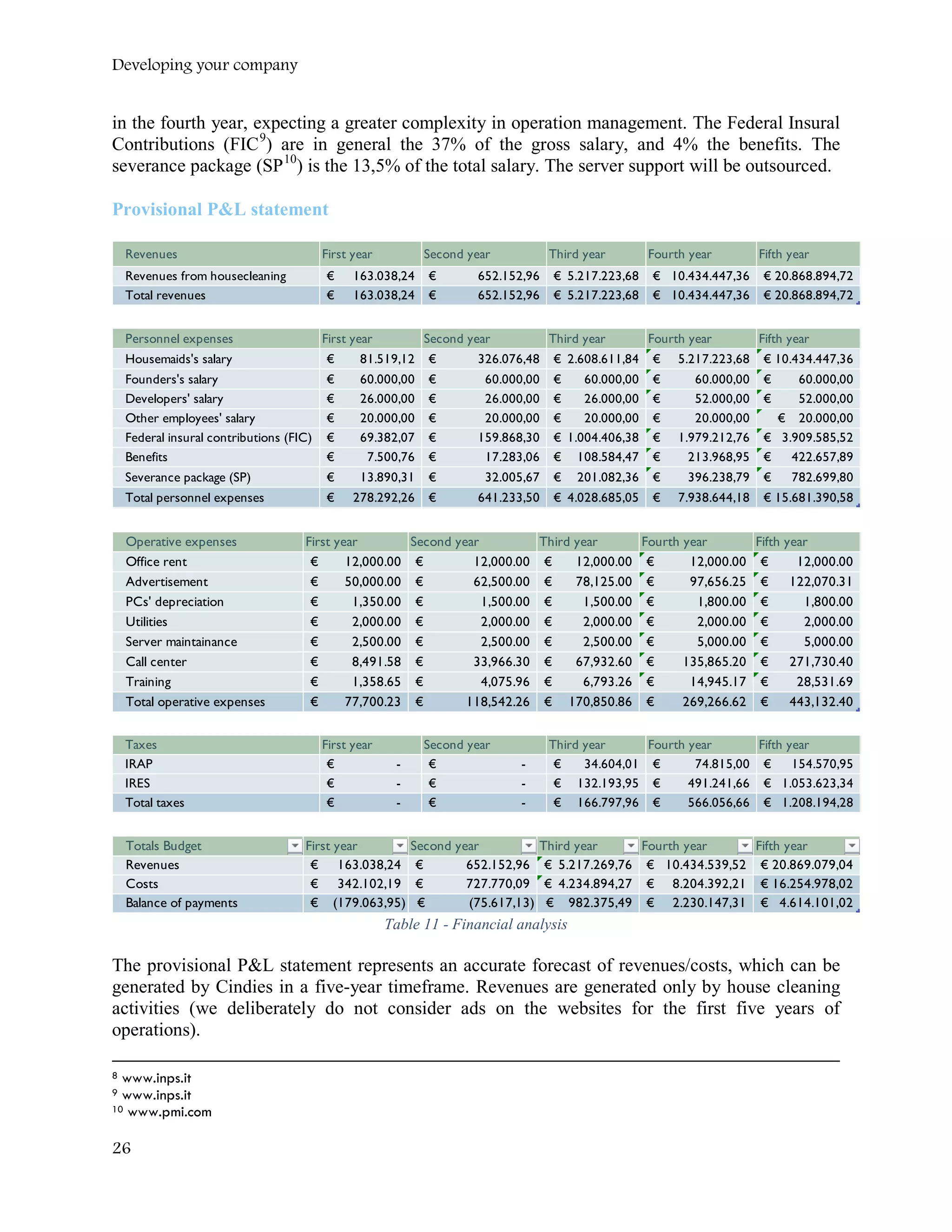

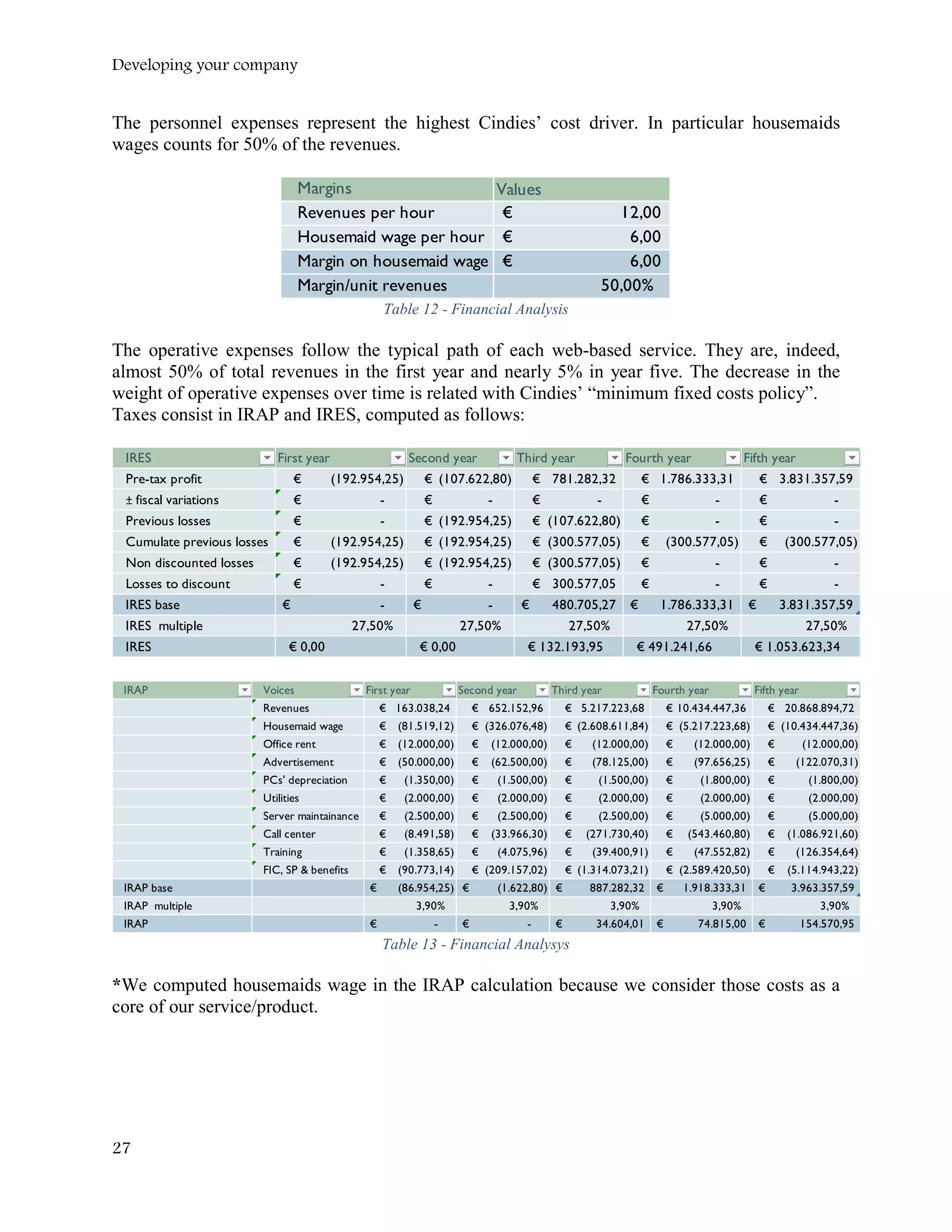

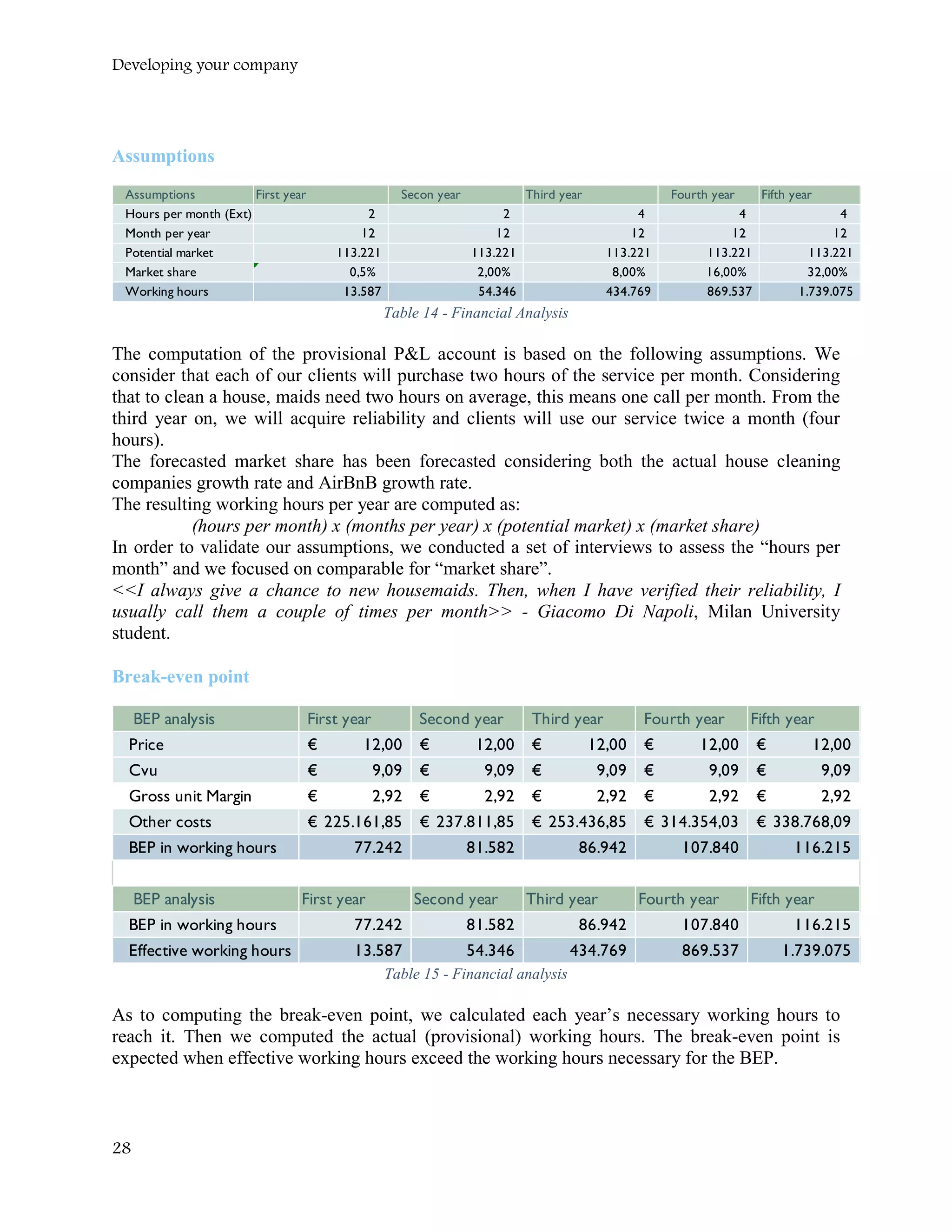

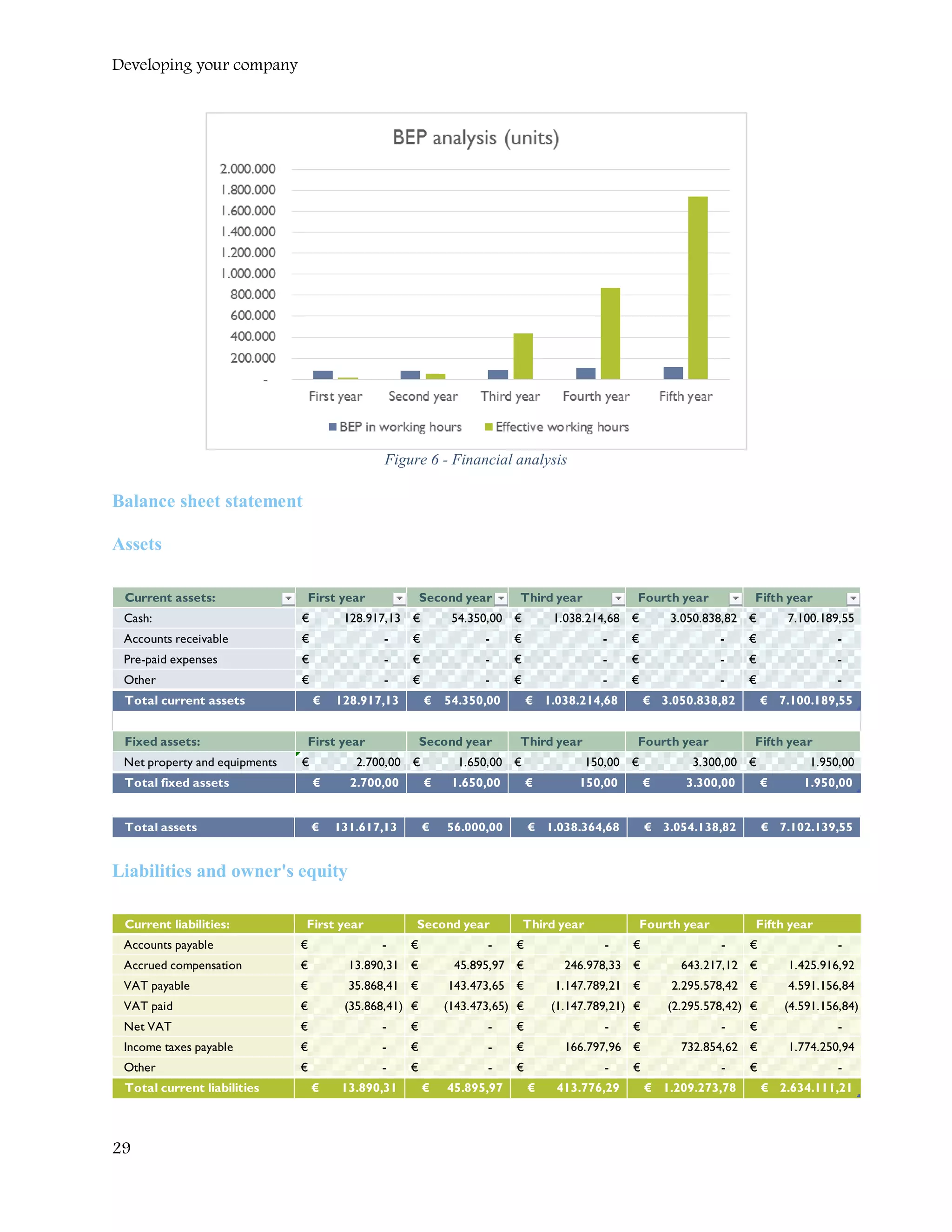

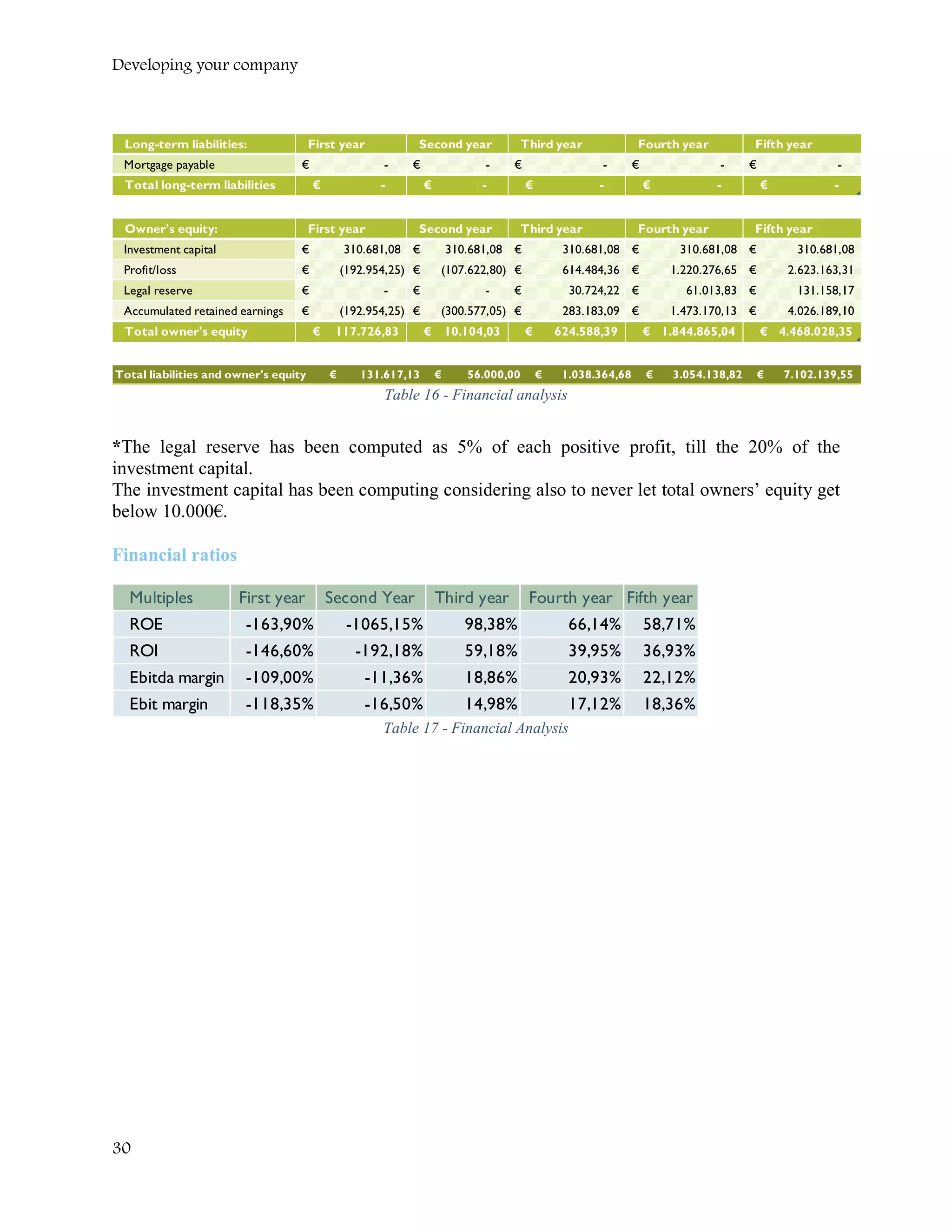

Cindies is seeking funding to launch an online house cleaning service business in Milan, Italy. Their business model involves customers booking cleaners through a user-friendly website and mobile app. The team has developed an MVP website to demonstrate the concept. Their target customers are students and young professionals in Milan who need occasional cleaning help. They estimate their total addressable market in Milan is approximately 113,000 potential customers.