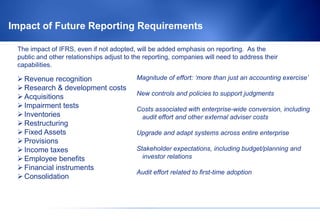

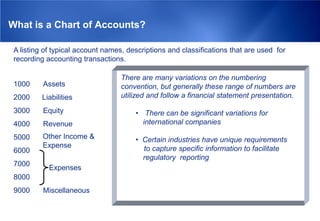

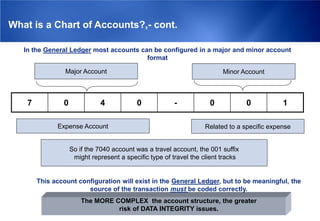

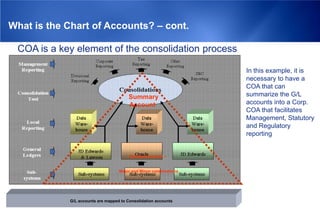

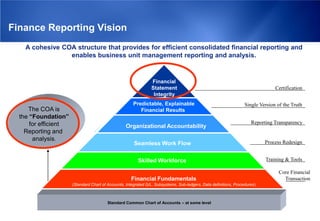

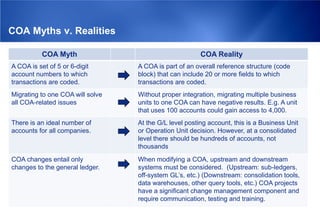

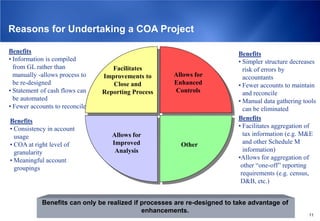

This document discusses considerations for a company's chart of accounts (COA). It notes that companies face issues like disparate systems, multiple general ledgers, and difficulties with reporting. A COA project can help address these issues by standardizing the account structure and reference data. The document outlines how future reporting requirements, myths versus realities about COAs, and reasons for undertaking a COA project, such as improved analysis, data requests, and controls.